If the 2010’s will be remembered as the decade of publications, the 2020’s will be the decade of creators.

In fact, digital content creation is expected to reach $43 billion by 2026, up from $12 billion in 2017 (Global Digital Content Creation Forecast 2018-2026), ushering in a new era of content creators.

While content creators are getting smarter about the content they create, the distribution channels are still not fully defined. Social media has exposed vulnerabilities around privacy and security (How the Trump administration could ban TikTok) and traditional publication models are not cost effective for creators.

This brings us to this week's exclusive on Substackand their bet on the future of how creators and readers will interact with each other.

Background:

Chris Best knows the importance behind mass communication.

As CTO and Co-Founder of the messenger app Kik (which claimed 300m registered users in 2016), Best noted that the most impactful thing he learned while making a messenger app is that how you structure how individuals interact can change the entire outcome of any kind of social system. Kik made it easy for users to interact with each other by removing friction and allowing individuals to connect with each other. Through the 2010’s, social media pushed the limits for how individuals could connect with each other and consume content. With the rise of algorithmic feeds, users began to see more content that wasn’t relevant to them but was high performing based in the eyes of publishers, who focus on metrics like clicks and impressions. While publishers flourished, users consumed algorithm-driven content. That’s why Best teamed up with Kik colleagues Jairaj Sethi and Hamish McKenzie to launch Substack in 2017. Their core belief is “what you read matters and good writing is valuable”. They wanted to help great writers regenerate revenue lost to the social media giants.

“We created Substack to change the incentives for writers, so they could get paid by their readers instead of advertisers. We wanted to flip the attention economy on its head.” - Hamish McKenzie, The Geyser, 2017

With nearly 4b active email users in the world (compared to 3.5b social media users), the Substack team believed email newsletters would be the best launch point for distribution.

Writers can sign up for free on Substack and use simple drag and drop templates to get a newsletter up and running in hours, if not minutes. Users can build their own audience or bring them over through their own email list.

Bill Bishop, who writes the Sinocism China newsletter, was Substack’s first publisher in 2017. Originally intended as a passion project, Sinocism China recently surpassed 80k subscribers.

Substack continued to gain users before incubating at Y Combinator in 2018 (W18 batch), boasting 7,000 users paying an average of $70/year at the time. They continued to grow, helping newsletters gain paid subscriptions, taking 10% from each paid subscription fee.

It then sparked the interest of Andreessen Horowitz, who led their $15.3 million Series A in July of 2019. A16’s Andrew Chen joined the Board of Directors and is also an avid Substack blogger. This plays nicely into A16’s thesis around the future of work and the Passion Economy:

“Substack has come along at a pivotal time in the history of mass communication — what we believe is the golden age of new media. What we love most about this age is that it can free many creatives, from all kinds of backgrounds, to pursue the type of creative work they love, and on their own terms. - Substack by Andrew Chen”

Since COVID-19 hit in March of 2020, Substack has seen a 30% increase in monthly website visits, surpassing 5.5m monthly website visits (Source: SimilarWeb, June 2020). They’ve also seen a spike in readers and writers:

“Readership and writership has doubled in the first three months of the coronavirus pandemic” - Chris Best, Protocol June 2020

Substack is helping democratize access to the tools writers need to create content and making it easier for readers to subscribe to it. They believe this type of direct news subscription business could be much larger than the newspaper industry. Their growth over the last few years has proven this.

As avid users (Why we switched to Substack), we’re excited to watch Substack evolve and grow in this new era of media.

Who’s on the Cap Table?

Series A:

- Andreessen Horowitz (Andrew Chen)

- Y Combinator

Seed:

- UpHonest Capital (Wei Guo)

- Kenji Niwa

- FundersClub

- Wei Guo

- Garage Capital

- The Chernin Group

- Brad Flora

- VentureSouq (Sonia Gokhale, Suneel Gokhale)

- Justin Waldron

- Emmett Shear

- ZhenFund

- Y Combinator

The Cap Table Opportunity: whether you’re looking to launch a newsletter or invest in the next Substack, here are the rising Email Newsletter platforms we’re watching:

Revue: founded in 2015, Revue is easy to use tool which includes a suite of editing tools and intended for writers and publishers. It’s free up to 50 subscribers and then charges a variable fee based on audience size ($5/month up to 200, $8/month up to 750 and so on). Boasting 60k+ customers, Revue is profitable and continues to grow.

Funding: €400,000 Angel round in December of 2016.

Why we like it: boasting 60k+ customers, Revue is profitable and continues to grow, seeing a 10% monthly website visits growth while staying lean (6 employees listed on LinkedIn)

Ghost: founded in 2013 after a successful Kickstarter campaign, Ghost is a non-profit organization focused on professional publishing. Plans start at $29/month (flat fee regardless of revenues) and they boast 2m+ installs to date.

Funding: $7.3m (crowdfunding)

Why we like it: $2.3m run rate, 5k+ customers, 23% monthly visits growth, and a 3.77% net churn (metrics are public). As they state on their website “we appeal to users and not shareholders”, a slogan you don’t see on most venture backed companies homepage.

Buttondown: founded in 2017, Buttondown is a small, elegant tool for producing newsletters. They don’t charge writers until they reach 1,000 subscribers, which then kicks into a $5/month, per thousand subscribers after that.

Funding: N/A

Why we like it: their editorial assistance checks for typos, broken links or malformed images (we could use this at the Cap Table : )), and is designed for individual users rather than big companies. They’re also lean and efficient (you can see their public running costs here).

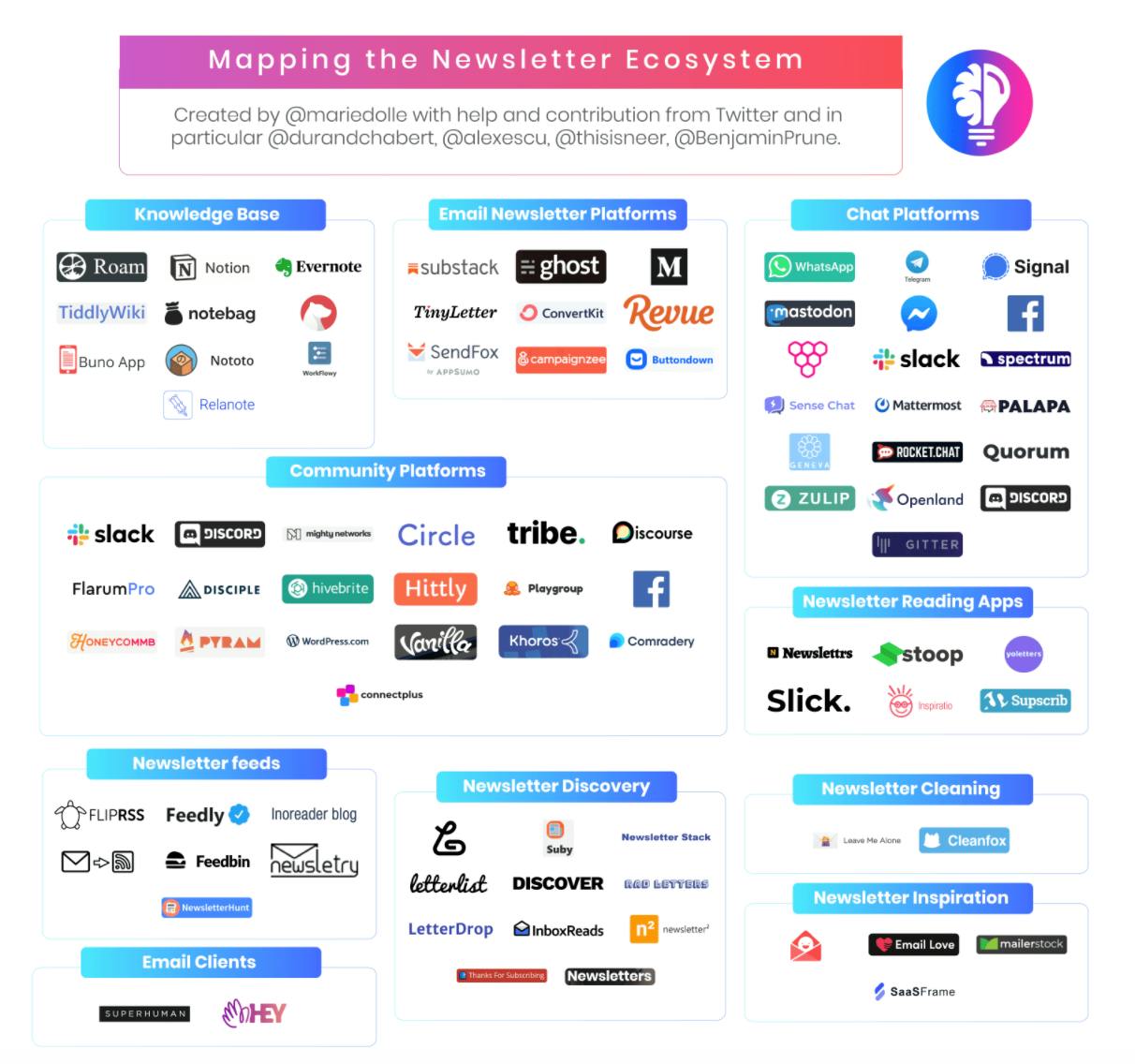

Still looking for more Cap Table opportunities? Check out the newsletter ecosystem:

Sign Up Today!

To get these right in your inbox

Deal News 7/4 - 7/10

Seed

- Second Front Systems raises $6,000,000 led by Artis Ventures (AV) | Second Front Systems is a developer of cybersecurity products for the U.S. federal government.

- Quaestor raises $5,800,000 led by 8VC | Quaestor is an automated data platform that enables financial transparency between startups and investors.

- Teal raises $5,000,000led by Flybridge | Teal helps people navigate change and drive their career with confidence and purpose.

- Nomad Homes raises $4,000,000 led by Comcast Ventures | Nomad Homes is digital platform that uses technology to help people in Europe and the Middle East to buy and finance homes.

- Icon Savings Plan raises $3,200,000 led by Tom Blaisdell | Icon is a portable retirement savings plan company that simplifies retirement benefits for employers.

- Popshop Live raises $3,000,000 led by Abstract Ventures, Floodgate | Popshop Live is a mobile live streaming marketplace where talented individuals can create and host their own shopping channel.

- CALA raises $3,000,000 led by Maersk Growth, Real Ventures | CALA is a marketplace that provides retail infrastructure for influencers and fashion brands to design and launch their own fashion brands.

- Parade raises $3,000,000 led by Vice Ventures | Parade is an underwear company that creates designer and eco-friendly fabrics undergarments.

- Grow Credit raises $2,250,000 led by Mucker Capital | Grow Credit helps consumers with no or thin credit files establish or build credit for free using their subscription accounts.

- MonkeyLearn raises $2,225,000 led by Bling Capital, Uncork Capital | MonkeyLearn is a Text Analysis platform with Machine Learning to automate business workflows and save hours of manual data processing.

- Replenysh raises $2,000,000 led by 122WEST VENTURES, Floodgate, Kindred Ventures | Replenish builds the operating system of material recovery.

Series A

- Tranquis Therapeutics raises $30,000,000 led by Remiges Ventures, SR One | Tranquil Therapeutics is focused on the discovery and development of therapies to treat neurodegenerative and aging-related diseases.

- Inimmune raises $22,000,000 led by Two Bear Capital | Inimmune is focused on the discovery and development of novel immunotherapeutics for an array of disease areas.

- Liquid Wire raises $10,000,000 led by Deerfield Management | Liquid Wire produces a unique eutectic metal gel that can be patterned into conductive traces that can stretch, bend.

- SetSail raises $7,000,000 led by Wing Venture Capital | SetSail is an AI-powered sales insights and incentives platform that supercharges sales performance by rewarding what matters.

- Verikai raises $6,000,000 led by ManchesterStory Group | Verikai is an insurance technology company leveraging alternative data and machine learning to help insurers improve underwriting.

Series B

- VelosBio raises $137,000,000 led by Matrix Capital Management, Surveyor Capital | VelosBio operates is an owner and operator of a biotechnology company intended to provide cancer research.

- Vor Biopharma raises $110,000,000 led by RA Capital Management | Vor Biopharma is an immuno-oncology company developing novel therapies with broad potential for treating cancer.

- Growers Edge raises $40,000,000 led by Cox Enterprises, S2G Ventures, Skyline Global Partners | Growers Edge provides farmers with income assurance through data-driven financial technology products, solutions, and tools.

- Kindbody raises $32,000,000 led by Perceptive Advisors | Kindbody is a health and technology company providing fertility, gynecology, and family-building care.

- Truepill raises $25,000,000 | Truepill is a B2B pharmacy fulfillment service that provides a pharmacy API and fulfillment of medications.

- Chainalysis raises $13,000,000 led by Ribbit Capital, Sound Ventures | Chainalysis is a blockchain analysis company providing data and analysis to government agencies, exchanges, and financial institutions.

Series C

- Perfect Day raises $160,000,000 led by Canada Pension Plan Investment Board | Perfect Day produces animal-free dairy proteins that are nutritionally identical to proteins from cows milk.

- Kernel raises $53,000,000 led by General Catalyst | Kernel is a neuroscience company that specializes in developing brain-recording technologies.

- LogDNA raises $25,000,000 led by Emergence | LogDNA offers a log management solution that provides DevOps teams an aggregation of all their system and application logs on one platform.

Series D

- Doctor On Demand raises $75,000,000 led by General Atlantic | Doctor On Demand is a mobile app that provides on-demand and scheduled visits with U.S.-licensed health care providers.

- OwnBackup raises $50,000,000 led by Insight Partners | OwnBackup provides backup and recovery solutions for companies that use Salesforce.

- Natron Energy raises $35,000,000 led by ABB Technology Ventures, NanoDimension, Volta Energy Technologies | Natron Energy is an energy storage company that develops a high power, long cycle life, and low-cost battery technology.

Sources: Crunchbase, Twitter, LinkedIn.