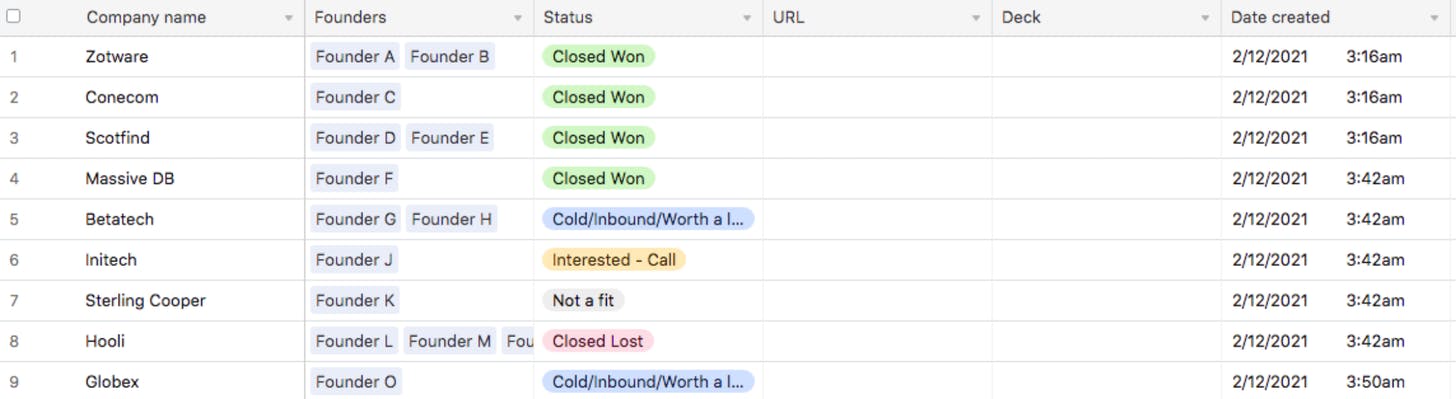

Today we launched The Startup Liquidity Database to highlight which startups allow employees to sell their stock. To build this, we surveyed 100+ employees at growth-stage, VC-backed companies about whether their company lets them sell their stock.

Equity is an integral part of total compensation for startup workers. It can be a life-changing source of wealth creation for many people, especially those that work at companies that go public or get acquired.

However, companies are waiting longer than ever to go public. Because of this, in some instances, employees may want to sell some of their stock. On the buy-side, investors are eager to provide liquidity, but there are some catches.

The path to liquidity for most employees has several hurdles:

- Stock option exercise can be expensive and have meaningful tax implications far before a liquidity event. As a result, many people never exercise their stock options in the first place.

- Talking about selling your stock with your current or former privately-held employer is taboo and can be uncomfortable.

- Companies generally have rights of first refusal (ROFRs) that allow them to block sales of stock to unauthorized parties.

- And, in certain cases, stock transfer restrictions make the sale of the stock without company consent nearly impossible.

We built this database because we want to normalize talking about employee liquidity and to help employees make informed career decisions.

Equity without liquidity is only paper wealth. Right now, only a handful of late-stage private companies offer some form of recurring liquidity to employees as a benefit. In the future, we think pairing equity with liquidity will become table stakes for companies Series B and beyond.

Let us know what you think by replying to this email or on Twitter!

Thanks,

Walter, Jan, Nan, and Conor