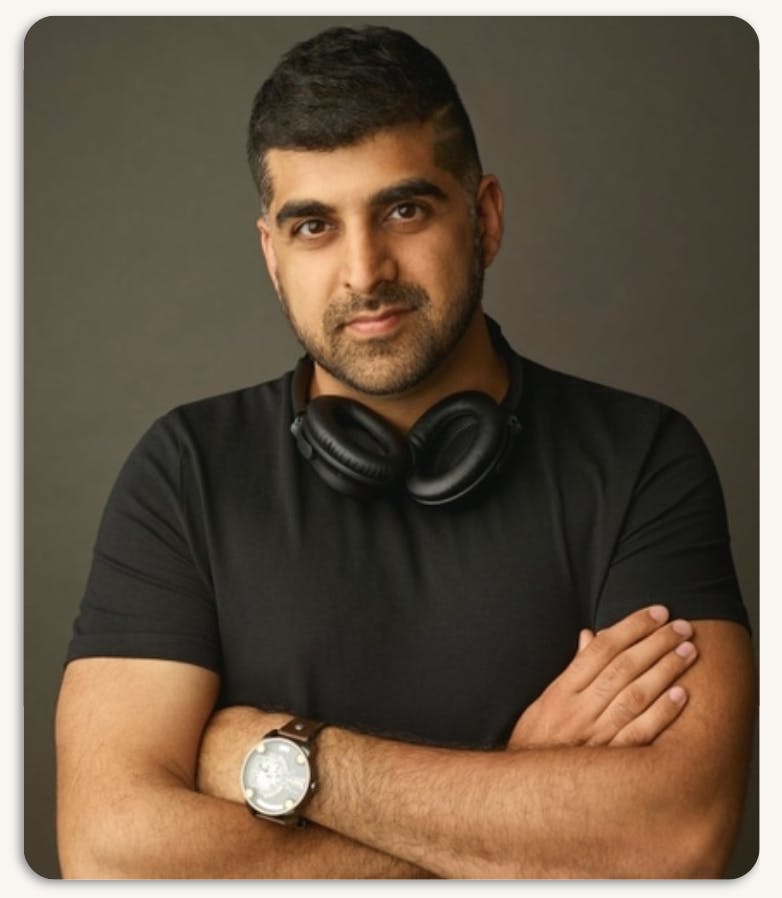

We’re thrilled to announce this week’s exclusive with Shaan Puri, serial entrepreneur, angel investor and GP! Shaan sold his last startup to Twitch and is currently the co-host of My First Million podcast and GP of All Access rolling fund, which invests ~3m/year into startups around the globe. Shaan is best known for taking complicated business ideas, breaking them down and making it simple for people to understand. We had to pleasure to sit down to talk all things cap table related, including:

- The LPs behind his new rolling fund 😲

- His first 100x 🚀

- The framework he uses to vet founders 👁

- Cap table tips and tricks ⼏

- The next unbundling trend 💰

TCT: You launched “All-Access-Fund” Rolling Fund on AngelList in September of 2020 and have since invested in a handful of startups. You’re now 6 months in — what’s been the biggest surprises/challenges of being a first time fund manager?

More money, more problems!

When you have more capital to deploy, investing takes more time and getting into deals is harder because your check size is bigger. That’s honestly been the biggest challenge so far.

The biggest surprise is how much LP interest there is to be in my fund. We hit the 99 investor limit and the fund is now ~$4m/year!

How would you describe your relationship with LP’s and how often do you lean on them for helping support your portfolio of companies you invest in?

Our relationship is surprising. Most people assume I raised the fund from my network in Silicon Valley.

But in reality, I raised the fund ONLY from people who follow me on Twitter or my podcast. So even though we have 99 investors, I have never met any of them in real life, and didn’t call/pitch anyone on Zoom. The entire relationship is built from trust of them reading/listening to my content for years. So they know how my brain works and my track record (lucky for me!).

I update the LP’s monthly about deals we’re doing — and if they have a way to help the companies, they email me saying “oh that thing you asked for, I have an intro for the company.”

What’s the most competitive (funding) round you’ve gotten into, and how did you go about winning over the founder(s)?

Probably Gagan (Biyani)’s new ed tech company. He’s a serial founder, big silicon valley network, and his last ed tech company is worth $3B+. So there was a lot of demand to get into the round. I got in because I have a big audience that I could launch a course to, so I offered to be an “investor” and a “user” whereas most investors could only do the first part. I’ve found that it’s important to be a user of the product and not just an investor and believer.

You’re the Co-Host of My First Million podcast, which does 4M+ downloads per year and you also have your own newsletter with 19k subscribers. Where do you find the inspiration for content on a daily basis?

I basically just lurk the internet.

Twitter, Reddit, YouTube… and go down rabbit holes. Sometimes the result is really interesting topics or findings and then I keep digging deeper, sometimes tweeting things out to get feedback from our audience as well. Basically, I just follow my curiosity, and then I share the most interesting bits on the pod(cast) and see what type of traction it has and follow it from there.

Let’s talk about deal flow. What percentage of your deal flow is referrals, cold inbounds, etc?

So far, it’s been roughly:

- 30% of deals were cold outreach (I liked the product, reached out to founder)

- 30% were referrals from other investors

- 40% were scouted by my lead scout (Zach)

Sign Up Today!

To get these right in your inbox

You’re a big proponent of frameworks (your New Year's Resolutions framework, for example). What type of framework do you use for vetting founders?

While I’m sure this is similar to others, I want to make sure of the following:

- Are they committed?

- Are they relentless?

- Do they know what the hell they are talking about?

- Do they learn quickly?

- Have they done anything before?

- Do I want to spend time with them?

- Are they rational about the problem?

- Are they irrational and ambitious about the solution?

What was your first 100x/10x and how did you get into that deal?

Lambda school was my first. I got into the deal as a scout for my friend. I was thinking of doing a startup like that myself... and then saw lambda school already in motion, doing it even better than I had imagined. So I called Austen, learned about the business, and asked to invest. Then I convinced my friend who I was scouting for to invest in it and split the upside.

How do you stay organized with your angel investments (managing notes and SAFEs pipeline, etc)? What does your personal tech stack look like?

I use Google sheets and AngelList for the backend and that’s mostly it! I like to keep it simple.

You’re currently leading Product, Mobile Gaming & Emerging Markets as a Senior Director at Twitch (via Bebo acquisition). How do you allocate time between your operating role and investing?

I don’t actively try to invest.

I just read a lot and meet a lot of people — and when I see something that I think can be big, I try to invest, so it’s not necessarily a split of “I spent XX hours investing” per week, but rather on an opportunistic mindset and trying to grow my network week over week.

You’ve stated that angel investing should be more accessible to the public. What needs to happen to make this a reality?

I think someone needs to build a startup index fund. So you can invest and get access to like 300 or 500 new startups a year without being a picker. To me, this would be a great opportunity to allow the masses to invest more in the private markets.

What’s the next “unbundling” trend we’ll see?

I think we’ve started to see this but the unbundling of money, specifically crypto, is going to one worth watching over the coming years!

What’s your secret for getting on the cap table?

Show real interest when you talk to the founder. Know your shit. Start helping ASAP and have a unique asset other investors can’t offer (eg. in my case, a big audience..and knowledge about building big audiences)

What’s your biggest cap table “mistake”? (alternative: What's your biggest miss (a company you saw but passed on)?)

I’d say my biggest mistake was not putting more money into dukaan even though I saw it… and I wanted to lead the whole round myself. I ended up investing $20k but I wish I would have been $2m!

What are you passionate about outside of work?

Becoming mentally fit. Being able to master your mind & mood is a huge focus of mine and I’m constantly working on it every day.

For more insights into startups, angel investing, and new business ideas, follow Shaan on Twitter (@ShaanVP)!

Deal News This Week:

Seed

- ActZero.ai: $40,000,000 led by Point72 Ventures. ActZero.ai is a software development company that builds an AI-driven security platform.

- Bedrock Ocean Exploration: $8,000,000 led by Eniac Ventures. Developing robotics, autonomy, and software to explore, map, and classify the entirety of Earth's oceans.

- Populus: $5,000,000. Populus is a platform for cities to manage the future of mobility.

- Calixa: $4,250,000 led by Kleiner Perkins. Calixa unifies customer data and customer tooling into one, easy-to-use product so that you can manage all your customers in one place.

- Refraction AI: $4,200,000 led by Pillar VC. Refraction AI is a robot delivery startup offering food delivery service from restaurants to customers through its self-driving robot REV-1.

Series A

- Advise Insurance: $100,000,000 led by Oak HC/FT. Advise Insurance is a Medicare concierge agency that focuses on serving seniors within their community.

- ixLayer: $75,000,000 led by General Catalyst. ixLayer develops a telehealth platform that provides an infrastructure for payors, providers, and government partners to scale testing.

- MainStreet: $60,000,000 led by SignalFire. MainStreet is a financial platform that helps startups and small businesses discover and claim tax credits and government incentives.

- Vendr: $60,000,000 led by Tiger Global Management. Vendr empowers companies to purchase SaaS without friction.

- Pipe: $50,000,000 led by Next47, Raptor Group. Pipe operates a global trading platform for recurring revenue streams, connecting companies to institutional investors.

- Oishii Farm: $50,000,000 led by Mirai Creation Fund. Oishii Farm provides indoor vertical farming technology.

- Flatfile: $35,000,000 led by Scale Venture Partners. Flatfile provides software products that focus specifically on solving the problem of data onboarding.

- Wrapbook: $27,000,000 led by Andreessen Horowitz. Wrapbook provides digital profiles that facilitate onboarding, paying and insuring project workforces compliantly.

- Eco: $26,000,000 led by a16z crypto. Eco provides a digital global cryptocurrency platform that can be used as a payment tool for daily-use transactions.

Series B

- Valo Health: $110,000,000 led by Koch Disruptive Technologies. Valo Health uses human-centric data and machine learning-anchored computation to transform the drug discovery and development process.

- SeekOut: $65,000,000 led by Tiger Global Management. SeekOut gives companies a competitive edge in recruiting hard-to-find and diverse talent.

- Privacera: $50,000,000 led by Insight Partners. Privacera is a SaaS-based data security and governance platform that offers data sharing without compromising regulatory compliance.

- Tetrate: $40,000,000 led by Sapphire Ventures. Tetrate provides enterprise-ready service mesh for all workloads and all environments.

- Neeva: $40,000,000 led by Greylock, Sequoia Capital. Neeva is an ad-free, private search engine that helps its users find exactly what matters to them.

- Belong: $40,000,000 led by Battery Ventures. Belong is a residential network that vertically integrates all aspects of the home rental and home improvement process.

- Pico Interactive: $37,400,000 led by . Pico is a VR company committed to combining precision optics, immersive video and sound with fine industrial design.

- Tackle.io: $35,000,000 led by Andreessen Horowitz. Tackle.io operates as a cloud marketplace subscription platform that helps software providers generate revenue.

Series C

- Flutterwave: $170,000,000 led by Avenir Growth Capital, Tiger Global Management. Flutterwave is a fintech company that provides a payment infrastructure for global merchants and payment service providers.

- Zego: $150,000,000 led by DST Global. Zego is a commercial auto and ‘New Mobility' insurance provider, powering opportunities for modern business by saving time and money

- Corvus Insurance: $100,000,000 led by Insight Partners. Corvus Insurance provides AI-driven commercial insurance that empowers brokers and policyholders to predict and prevent risk.

- Centrical: $32,000,000 led by Intel Capital. Centrical employee engagement and performance management solutions help companies motivate employees to exceed their own KPIs.

Series D

- Forward: $225,000,000 led by Founders Fund, SoftBank Vision Fund. Forward is a startup redesigning the way healthcare is delivered using all the technologies such as sensors, mobile, and AI.

- Cedar: $200,000,000 led by Tiger Global Management. Cedar is a patient payment and engagement platform for hospitals, health systems, and medical groups that elevates the patient experience.

- M1 Finance: $75,000,000 led by Coatue. M1 Finance provides a free platform to enable people to manage and grow their money with control and automation.

- NuORDER: $45,000,000 led by Brighton Park Capital. NuORDER is a cloud & mobile B2B eCommerce platform empowering brands and retailers to streamline their business operations.

Series E

- Snyk: $300,000,000 led by Accel, Tiger Global Management. Snyk is a cybersecurity company that develops security analysis tools used to identify open-source vulnerabilities.

Series F

- WorkFusion: $220,000,000 led by Georgian. WorkFusion offers automation solutions to enterprises to help them reduce costs and up-skill workforces.

Sources: Crunchbase, Twitter, LinkedIn