Hi everyone 👋

Sign Up Today!

To get these right in your inbox

There's a battle raging between internet-native companies with neither a physical footprint nor physical products and the local governments bleeding revenue that want to tax them—creating massive tailwinds behind back-office software that abstracts away local boundaries while keeping your company in compliance.

In 2011, when Gusto set out to automate domestic US payroll, co-founder Joshua Reeves analogized abstracting away local law to how webmail services abstracted away email protocols: "If you use Gmail," he said, "You don’t have to know how SMTP and IMAP work." It would take Gusto 4 years to break into all 50 states.

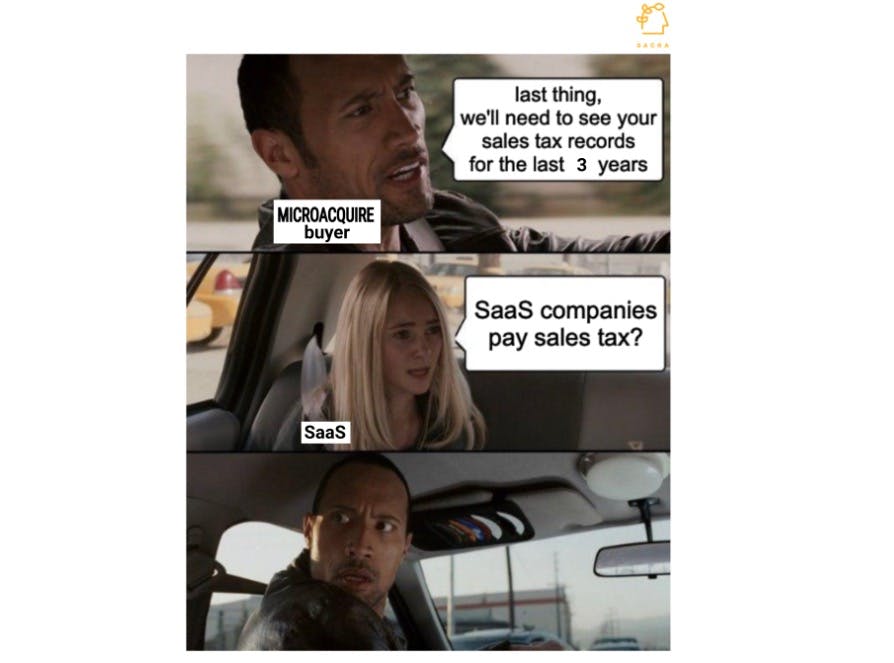

Sales tax is an emerging battleground between internet-native companies and local governments. Since 2018, SaaS companies—which collectively did $140B in sales worldwide in 2021—have been subject to sales tax in much of the United States. Concepts like "economic nexus" mean that wherever you do business or hire employees, states and even individual cities have a hook into forcing you to pay sales tax.

To learn more about the problem of sales tax in SaaS and the space missed by incumbent tax software like Avalara ($AVLR), we talked to Michelle Valentine, the CEO of Sequoia-backed SaaS sales tax software Anrok. Key learnings:

Of the 45 states that impose sales taxes in the U.S., all have now enacted remote seller laws. These remote seller laws impact online businesses in particular, and about half of these jurisdictions tax software. This means that, if you're a finance leader at a SaaS company, you now have to monitor sales across all the different states in the U.S., comparing the revenue or the number of transactions you’re making in that state against the state-specific revenue thresholds... [Often] the obligation to remit tax happens on the first sale, regardless of whether you have a physical presence or other form of nexus there or not. (link)

[Legacy solutions] are hard to integrate. They need user configuration to make sure they capture the edge cases for software... Home rule cities are a good concrete example... [The home rule city of Chicago] taxes software, but the state does not... [the data model needs] to treat these cities as a first-class entity [and] calculate and collect sales tax correctly in these jurisdictions. (link)

The typical SaaS startup is selling in over a dozen states in the U.S., and they could be audited by several states in a given year. That's a big time and possibly monetary cost to manage retrospectively. And when you're not collecting and remitting sales tax, you're accruing interest and penalties on top of the sales tax that you would otherwise collect from the customer. It's much cheaper and easier to comply when you start selling in a state from the get-go, rather than to try to catch up later. (link)