Hi everyone 👋

Sign Up Today!

To get these right in your inbox

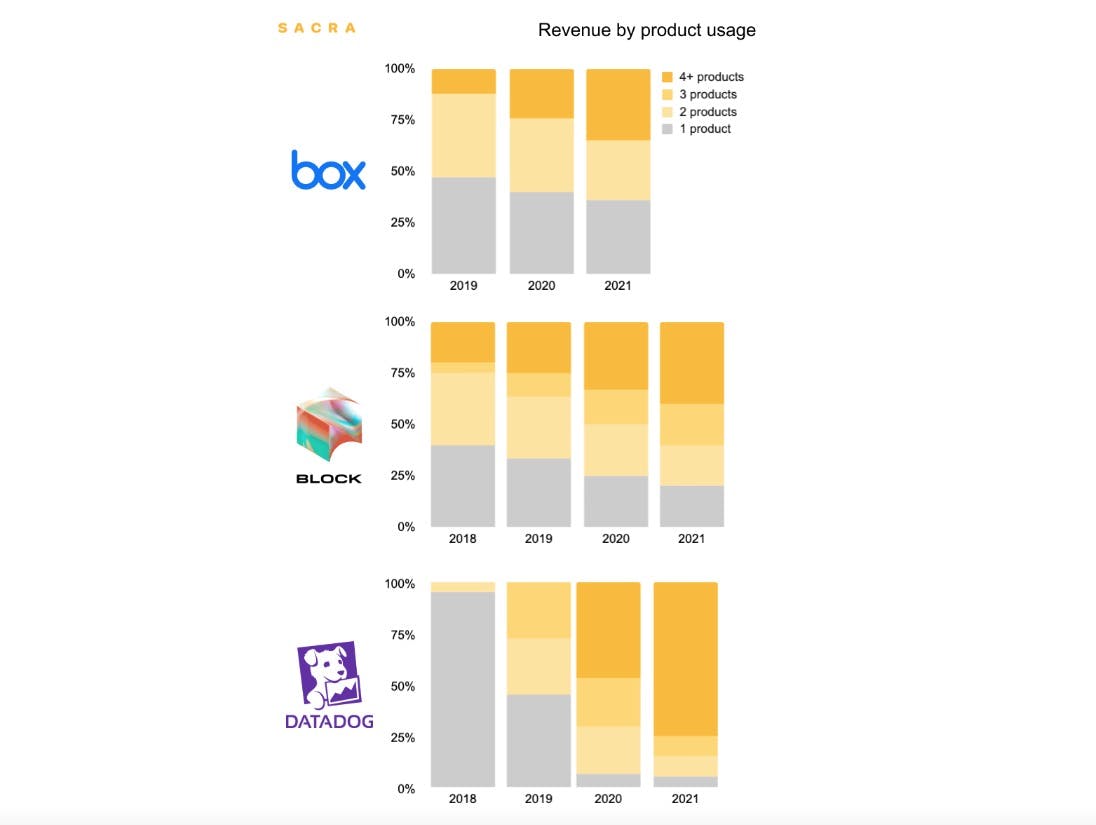

Box passed $300M ARR through its 2015 IPO as a single-product company. Later that year, Box went multiproduct, and they would go on to launch enterprise solutions for data governance (Box Governance), encryption key management (Box KeySafe), security (Box Shield), and workflow automation (Box Relay).

Today, only 36% of Box’s revenue comes from customers of its core product alone. Roughly 64% of revenue comes from multi-product customers, and 35% comes from its enterprise bundle of 3+ products, up 3x from 12% two years ago.

Going multiproduct has become critical to driving and extending SaaS growth at scale, particularly when growing upmarket to serve complex enterprise-scale business problems. The same dynamics are playing out across SaaS companies like Block, Datadog, Monday.com, and Elastic as multiproduct customers increasingly eat up the revenue mix.

Two private companies that have raised up rounds and defied The Great Regression to the Mean of 2022 are Rippling ($12B) and Ramp ($8B). Both of them not only went multiproduct, but did so from day 1. Parker Conrad calls Rippling a “Compound Startup”, which combines a set of related point solution systems into one coherent product to solve a much larger problem for businesses.

Compound startups bring together:

- the pricing advantage of bundling: maximizing revenue on the bundle of SKUs with cost savings on any individual SKU

- the familiar & integrated UX of all-in-one software: one piece of software to manage and use

- the tech stack of a platform: every point solution in the bundle shares the same underlying infrastructure

Rippling combines ADP ($90B) with payroll, Workday ($40B) with talent, Okta ($10B) with single sign-on, and Jamf ($3B) with device management, all built on its employee data platform.

Ramp brings together American Express ($120B) with their corporate card, Bill.com ($10B) with B2B payments, TripActions ($7B) with corporate travel, and Expensify ($2B) with expense management, all built on its transaction data platform.

Peak idealism for the "consumerization of the enterprise" died when Microsoft Teams crushed Slack with its bundle and Salesforce subsumed it into its bundle.

In 2022, repeat founders like Conrad (Rippling and previously Zenefits) and Eric Glyman (Ramp and previously Paribus) are taking second and third stabs at building in the same space, with accumulated knowledge and vision for building “fat” startups—not lean startups—raising several millions to build multiple parallel products from the earliest stages of their companies.

Jan & team

The multiproduct generation

For more on the rising crop of startups raising big rounds and going multiproduct from the beginning, check out our interviews with:

- Karim Atiyeh, Co-Founder and CTO of Ramp: $200M Series C from Founders Fund to rebuild the back-office around the corporate card

- Product manager at Canva: $200M from T. Rowe Price to disrupt the traditional productivity suite based on Microsoft Office and Google Workspace

- Dan Westgarth, COO of Deel: $425M Series D from Coatue to build an all-in-one hiring platform for global businesses

If you have other companies you’d like to learn more about, let us know what they are by replying to this email.

New & upcoming interviews

Reply to this email to offer questions you’d like us to ask upcoming interviewees, request specific interviewees and offer feedback.

New

- Taimur Abdaal, Co-Founder and CEO of Causal: $19.5M Series A from Accel to build a horizontal modeling platform using FP&A as a wedge

- Paul Gambill, Co-Founder and CEO of Nori: $7M Series A from M13 to rebuild the carbon offset market with token-based incentives

- Justin Intal, Co-Founder and CEO at Forage: Seed from Y Combinator to help online grocery and ultrafast delivery grow volume by accepting online EBT

- Taylor Edgerton, Business Development & Expansion at Nature’s Fynd: $350M Series C from SoftBank Vision Fund to use fungi to build a sustainable alternative to dairy and meat

Upcoming

- James Borow, Co-Founder and CEO of Trust: $25M Debt Round from Upper90—talking to learn more about the intersection of corporate cards and spend management ala Ramp and Brex

- Patrick Coleman, VP of Growth at Replit: $80M Series B from Coatue—talking to learn more about the evolution of cloud IDEs and the Jamstack

New company pages

Here are the company profiles we added last week:

- Bolt Threads: $123M Series D from Baillie Gifford and Fidelity to turn mycelium into mass-produced fashion

Reply to this email to let us know what other companies you’d like us to cover.