We’re thrilled to announce this week’s exclusive with Paige Finn, Syndicate Lead, author (Seed to Harvest) and operator (Developer Success Engineer @ WorkOS)! Paige has taken the venture & startup ecosystem by storm, deploying over a quarter of a million dollars for her syndicate in the first two months and authoring countless VC articles that have gone viral! An investor, author & community builder, we sat down to talk shop about all things cap table related, including:

- 👁👄👁 and the power of community

- How she creates ‘approachable’ venture capital content ✍️

- The biggest challenges GenZ founders are tackling 🌍

- Cap table advice & tips ⼏

- The state of venture capital in 2030 🔮

TCT: How did you start out with regards to your career?

Managing rappers didn’t work out. I’m like 85% kidding — but I’ve always had a love for music. When I was younger, I could never afford to go to as many shows as I wanted to. So, I realized if you interviewed artists, you got a press pass to the show. I got great at cold emailing managers & in college, I was interviewing a couple artists a week at shows. I think I have some minor hearing damage — but I have some amazing memories.

Turns out cold emailing & interviewing people are very transferable to lots of different industries — and I started emailing a lot of founders to hear about the companies they were building. I was fascinated — I got a front row seat to the future they were creating from their visions. There was so much playfulness and malleability in the way they melded narratives, products, business models and I was hooked on learning more.

I got involved in SDSU’s Lavin entrepreneurship program, and joined our first venture capital investment competition team. After we took second place to the reigning national champs, I got recruited by a $400m b2b saas growth equity firm in town. I learned a lot there — cold calling, retention analysis, meeting other investors, LP relationships.

Often being the only woman in the room inspired me to be more public about what I was learning and build a community on Twitter — and also contributed to my ten year goal of helping 1000 people write their first angel checks, 500 organize their first syndicate, and seeding 100 emerging managers, especially underrepresented folks.

You’re writing an illustrated children's book for adults on how venture capital works. Can you tell us more about the inspiration behind this, and your goals for publishing this?

Shortly after I spoke on a panel with him, my friend Nikhil wrote one on medical trials. Hilariously, I retweeted his announcement and was basically like — I’m doing the same for venture capital, dm me your email if you want the first draft. The punchline was — there was no first draft.

The morning I was supposed to send the draft out, I woke up at 3am with this bingo moment of the analogy of farmers, wrote ten pages, and received feedback from ~80 people from long time investors, to high school friends, to my mom. I repeated that a couple of times, launched a gofundme, raised over $5,000 to self-publish & now my youngest brother is working on the illustrations (my stick figures weren’t going to cut it). Text “seed” to +1 (858) 203-2966 for pre-sale and launch updates!

My inspiration started in necessity (not having a short, easy to understand primer about venture) and has evolved into an effort to inspire the next generation of investors. Representation matters, so we’re making the illustrations as inclusive as possible. I would be lying if I said I don’t tear up a bit when investors remark on how glad they are that their little girls will have a book where they can see themselves represented.

You were a part of 👁👄👁 (“it is what it is”) movement last year, sweeping VC twitter by storm, hyping a private beta of an unnamed product, which then led to 30k+ people signing up for “early access” within 2 days, which was then was used to help raise $200k+ for charitable foundations. At what point did you realize this was bigger than a funny TikTok trend? What role does hype and community play in launching a product, and what have you learned from that experience?

We were all just vibing online for a while, posting memes — and I think when we started to get some VCs dm’ing us about investing that we realized we should divert the attention into a more worthwhile cause — organizations supporting black lives. I think the funniest part is — our team actually designed a really thoughtful social app in Figma and definitely could have raised millions of dollars. Andrew Chen (jokingly?) offered me a Series A term sheet in a hundred-person Clubhouse room at one point. And we turned it all down to make a point about the exclusivity of tech & the importance of including and amplifying diverse voices within tech and vc.

Community is part of my core thesis while investing, and my experience in EyeMouthEye strengthened that belief. I learned so much about the impact that a small group of people online can have when they are vocal and aligned on specific things — whether that’s memes or social issues.

My friend Gaby wrote a great piece on this here.

You recently announced that you’ll be joining the newest cohort of angels at OnDeck, congratulations! What does this program entail and what are you most excited about?

Thank you — yeah, I feel really lucky that Erik Torenberg invited me to join ODA. It’s an eight-week cohort program with angels. I’m most excited about meeting the other fellows, learning others’ due diligence processes & their paths to conviction with an investment.

You run a syndicate, investing in early stage-stage product led growth founders, and have deployed over a quarter of a million dollars in the first two months of organizing 🤯. You note that all of your deal flow is inbound from “approachable venture capital content on Twitter”. How do you approach creating venture content? Where do you get your weekly inspiration for creating this new content?

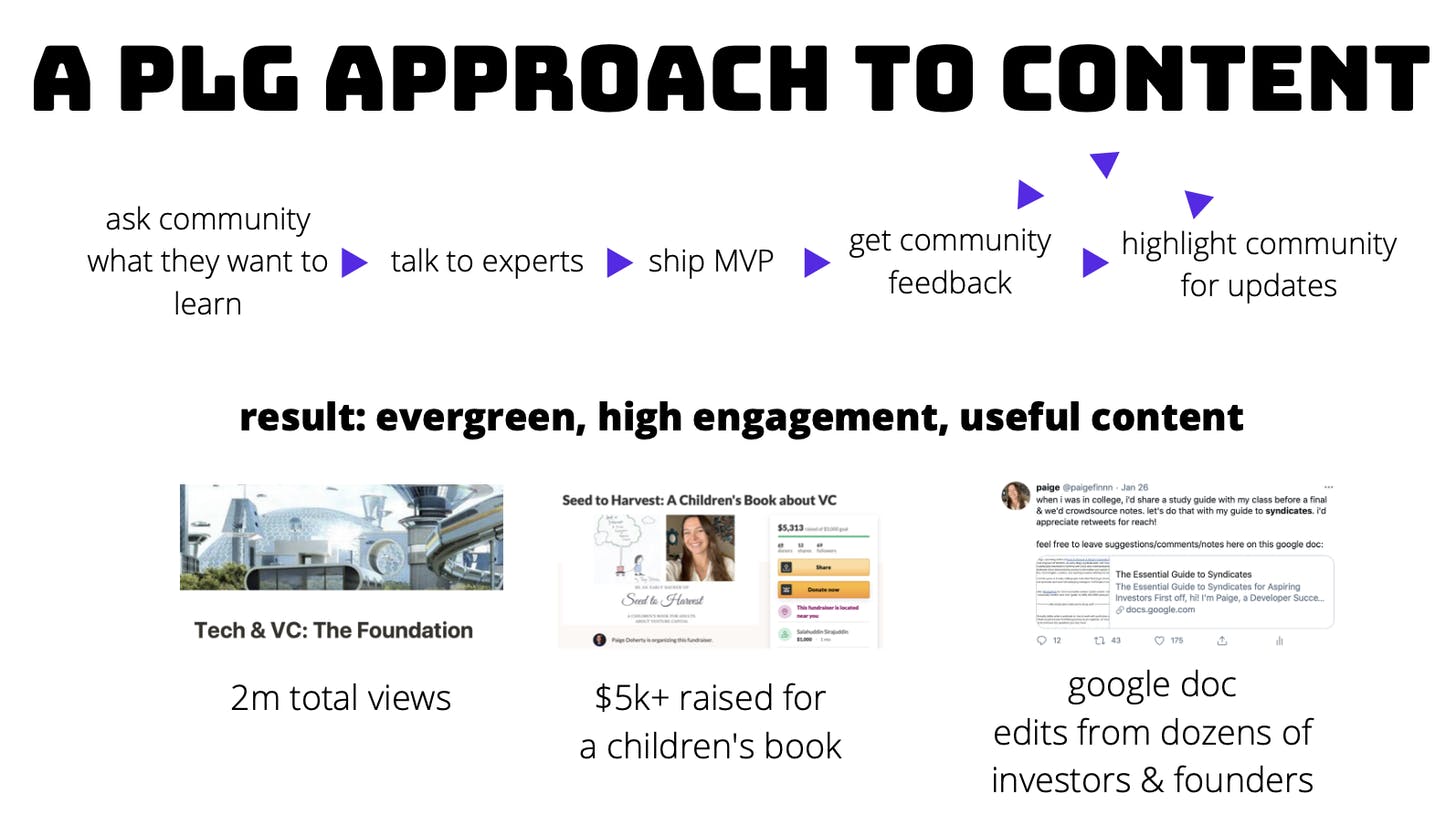

A lot of things I write about are things people consider “dumb questions.” In school, I studied computer science — and I asked a lot of dumb questions. People after class would tell me they were afraid to look dumb, but they also had those questions. I think the same is true in venture, so I write answers to a lot of those “dumb questions,” which are often about implicit norms. Here’s what my writing process looks like(I follow my own thesis of product led growth):

You’ve co-invested with funds like the Accel & KP scout funds, a partner at Bessemer, and operator angels like Sahil Lavingia. How did you build this network, and how long did it take to generate dealflow?

Just vibing online, making transparent content, helping other people. It took me a year to build a community of 10k incredible founders & investors, but I’ve been talking with founders & investors for the past four years.

You’re a Developer Success Engineer at WorkOS, a Seed stage Developer API. As someone who constantly vets startups for your syndicate, how do you decide on being an operator vs. investor in a startup? What framework would you recommend to others vetting a startup they would like to work at?

I love working with early stage founders & Michael pitched me on exactly that when I joined WorkOS. We make APIs for single sign on & directory sync, so you don’t have to build all the fragmented IT stuff when you’re selling to large enterprises. It’s like Stripe but for infrastructure. I honestly put on my investor cap when evaluating companies to join — the most valuable investment you can make is your time.

What tools do you use to stay organized for your syndicate and deal flow? (pipeline, notes, SAFE’s, etc.)

Notion for a list of investors and founders, Texts.com & Superhuman for managing inbound twitter dms / emails / texts etc, Assure for the backend. Working on incorporating clay.run, airtable, close, and notion fully!

What’s the best pitch deck you’ve seen recently, and what made it stand out? Emojis or no emojis?

Not that I’m biased, but I’m pretty proud of our LP deck. Lots of bright colors & bold fonts.

You're intentional about making your deals accessible to and working with first time angels. What advice do you have for first-time angel investors?

So first, a disclaimer: angel investing is really risky — definitely make sure you're making sound financial decisions with 401ks / savings and that you can afford to lose the money you'll invest in start-ups.

The hardest bridge to cross is never writing that first check, it’s identifying as an investor. I think my advice is you should start to see yourself as an investor, weave it into your narrative, before you write a check. You start by helping founders with intros & strategic advising. You’ll find someone you have table thumping enthusiasm for one day, and I’d advise you follow your gut there.

Write an investment memo highlighting the top three highlights & risks, as well as how they’ll be handling the risks & share with some friends who have already made angel investments. Based on this feedback, write a check (or if you don’t have the money, try organizing a syndicate).

Sign Up Today!

To get these right in your inbox

What are the biggest problems and markets Gen Z founders are passionate about solving in 2021 and beyond?

GenZ’s have an incredibly high bullsh*t detector. We grew up on the internet, we understand how to organize en masse, we understand that people are behind software. We’re also some of the loneliest and have the highest rates of mental health issues.

Mental health and wellness are huge markets I’m passionate about exploring, as well as the creator infrastructure — supporting people to do what they love!

I think play is going to be a huge theme going forward — there’s a certain tongue in cheek vibe that I think we’ll see pop up more in marketing and product especially.

What are you passionate about outside of work?

My family, friends, and health! I’m a plant mom, I love to read (Mari Andrews is one of my faves), I’m getting back into surfing. I live in San Diego, so of course — long walks on the beach.

What’s your secret for getting on the cap table?

Empathy, positivity, and transparency go a lot further than people think. Also, there’s not many other 22 year old women investing — I think that’s refreshing for a lot of founders to see one of their peers on the other side of the table.

On the flip, what’s your biggest cap table “mistake”?

I will let you know in 7 to 10 years ;)

What advice would you give to other Gen Z’s looking to get into venture capital?

The game is long, and we’ve got so much time to learn. Send lots of cold emails and DMs — infinite upside & no downside. Build a network of your peers — we’re all here to help. Meagan Loyst is doing a lot of great things with the GenZ VC community.

The year is 2030. What’s the state of venture capital?

Community-driven & collaborative. Lots of super angels, syndicates, rolling funds.

Democratized. I honestly have hella beef with the accredited investor definition, so hopefully that’s expanded far past what it is today. I think we’ll see a much more diverse group of funders - based more off of us raising our own funds than it is taking a traditional route.

Follow Paige on Twitter (@paigefinnn) for more insights on venture capital, angel investing & startups!

Seed

- Auron Therapeutics: $12,750,000 led by Arkin Bio Ventures, Polaris Partners, Qiming Venture Partners USA. Auron aims to cure cancer therapeutics from cell killing to transformation of malignant cells into more normal functioning cells.

- Pinecone: $10,000,000 led by Wing Venture Capital. Pinecone is a database for machine learning applications. Build vector-based personalization, ranking, and search systems.

- Vessel: $8,000,000 led by Monogram Capital Partners. Vessel is an at-home wellness tracker that helps in accessing, understanding, and optimizing health and wellness from the comfort of home.

- mealco: $7,000,000 led by Rucker Park Capital. Mealco is a food-tech startup that offers delivery-native food brands.

- Unfolded: $6,000,000 led by S28 Capital. Unfolded offers location-based products and services from geospatial data visualization to data enrichment and analytics.

- Milo: $6,000,000 led by QED Investors. Milo is a financial technology company that is reimagining the way global consumers access credit and financial solutions.

- Abound: $6,000,000 led by Point72 Ventures. Abound is the independent benefits API for businesses that serve independent workers.

- Preemadonna: $5,600,000 led by Halogen Ventures. Preemadonna is the maker of Nailbot, a patented nail robot and intelligent manicure product line disrupting the $15B nail care industry.

- Ambulero: $5,500,000 led by Orphinic Scientific. Ambulero is a cell and gene therapy spin-out of the University of Miami focused on advancing new therapies to fight vascular disease.

- Hurdle: $5,000,000 led by .406 Ventures, Seae Ventures. Hurdle is an app that helps people find healthy ways to manage stress from all parts of life and create routines that promote wellness.

- Cellvie: $5,000,000 led by KIZOO Technology Capital. Cellvie develops cell-derived medicines, leveraging the therapeutic potential of mitochondria, the powerhouses of the cell.

- TalentHack: $4,700,000 led by Global Founders Capital. TalentHack is a health platform that connects directly with the fitness professionals and industry.

- Preciate: $4,600,000 led by Inspiration Ventures. Virtual socializing and recognition platform for businesses and teams.

- FINESSE: $4,200,000 led by . FINESSE is a fashion house that leverages AI on big data and community feedback to predict trends and optimize distribution.

- Bbot: $4,000,000 led by Rally Ventures. Bbot is a restaurant and hospitality tech startup dedicated to simplifying and improving the ordering and payment process.

- Gowalla: $4,000,000 led by GV, Spark Capital. Gowalla is an augmented reality social game.

- Goalsetter: $3,900,000 led by Astia. Goalsetter is a children and family finance app that provides a next-generation, education-first banking experience.

- Joshu: $3,700,000 led by Blumberg Capital. Joshu helps insurance carriers launch online distribution channels quickly and independently.

Series A

- Calendly: $350,000,000 led by OpenView. Calendly is an automated scheduling tool that takes the work out of connecting with others so that its users can accomplish more.

- Nuvalent: $50,000,000 led by . Nuvalent is a biotechnology company that develops targeted therapies for clinically proven kinase targets in cancer.

- SetSail: $26,000,000 led by Insight Partners. SetSail is an AI-powered platform that combines data and behavioral science to drive more revenue per sales rep.

- Calibrate: $22,500,000 led by Threshold. Calibrate is a digital metabolic health business that provides a virtual program for weight loss.

- SOMA Global: $22,500,000 led by Weatherford Capital. SOMA Global is a provider of cloud-native, modern public safety solutions focused on the public sector.

- Riverlane: $20,000,000 led by Amadeus Capital Partners, Draper Esprit. Riverlane builds ground-breaking software to unleash the power of quantum computers.

- Nirogy Therapeutics: $16,500,000 led by Sante Ventures, Sporos Bioventures. Nirogy Therapeutics is focusing on small-molecule drugs that target the solute carrier family of transporter proteins (SLCTs).

- Darwin Homes: $15,000,000 led by Canvas Ventures. Darwin Homes is the property management platform that elevates the rental experience for property owners and residents.

- Tealbook: $14,400,000 led by RTP Global. Tealbook is an enterprise software company providing data needed to make procurement decisions.

- Concert Health: $14,000,000 led by Vertical Venture Partners. Concert Health focuses on building an integrated behavioral health system.

- KeraCel: $14,000,000 led by Musashi Seimitsu Industry. KeraCel develops and manufactures solid-state lithium-ion batteries intended to store electricity efficiently.

- Raydiant: $13,000,000 led by 8VC, Atomic. Raydiant offers cloud-based digital signage technology to retail businesses and restaurants.

- Vectorized: $12,500,000 led by Lightspeed Venture Partners. Vectorized is the Intelligent Data API company.

- Phospholutions: $10,300,000 led by Continental Grain Company. Phospholutions is a State College, PA-based sustainable fertilizer startup.

Series B

- Fast: $102,000,000 led by Addition, Stripe. Fast is the home of Fast Checkout, bringing one-click buying to the entire internet (see TCT interview with Allison Barr Allen)

- Clubhouse: $100,000,000 led by Andreessen Horowitz. Clubhouse is an audio-based social app that allows users to spontaneously join group chats.

- TimelyMD: $60,000,000 led by JMI Equity. TimelyMD is the only all-in-one telehealth provider created for universities and colleges.

- Literati: $40,000,000 led by Felicis Ventures. Literati is a book subscription company that offers clubs for both kids and adults.

- Ocient: $40,000,000 led by Greycroft, OCA Ventures. Ocient is a startup building a near-real time database and data analytics platform for petabyte- to exabyte-scale data sets.

- Check Technologies: $35,000,000 led by . Check is a payroll infrastructure startup.

- Playvox: $25,000,000 led by Five Elms Capital. Playvox is a provider of quality assurance software for customer service.

- Span.IO: $20,000,000 led by Munich Re Ventures. Span.IO develops products to enable rapid adoption of renewable energy and deliver an intuitive interface for the home.

- Physna: $20,000,000 led by Sequoia Capital. Physna searches, compares and analyses 3D models. Physna also owns Thangs.com, the fastest-growing 3D community and first 3D search engine.

Series C

- Sidecar Health: $125,000,000 led by Drive Capital. Sidecar Health is an insurtech company that provides a personalized health insurance platform.

- Melio: $110,000,000 led by Coatue. Melio is a fintech company that gives small businesses a way to digitally manage their business-to-business payments and receivables.

- Albert: $100,000,000 led by General Atlantic. Albert is a financial technology company aiming to democratize money management by making financial advice accessible and affordable.

- TScan Therapeutics: $100,000,000 led by . TScan Therapeutics is a biopharmaceutical company focused on the development of immunotherapy treatments for cancer.

- Encodia: $75,000,000 led by Deerfield Management, Northpond Ventures. Encodia is a biotech company that develops the next generation of protein analysis tools.

- Booksy: $70,000,000 led by Cat Rock Capital. Booksy is an online platform for finding and booking beauty and wellness appointments.

- Pilot: $60,000,000 led by Sequoia Capital. Pilot offers the best bookkeeping, tax, and CFO services for growing businesses.

- FreeWire Technologies: $50,000,000 led by Riverstone Holdings. FreeWire Technologies is a provider of electric vehicle (EV) charging and power solutions.

- Sitetracker: $42,000,000 led by Energize Ventures, H.I.G. Growth Partners. Sitetracker is a SaaS platform for deploying, operating, and servicing critical infrastructure and technology.

- Airspace Technologies: $38,000,000 led by HarbourVest Partners, Telstra Ventures. Airspace Technologies is a technology enabled provider of time definite logistics.

- Roostify: $32,000,000 led by Ten Coves Capital. Roostify is a digital lending platform that connects customers and lenders to accelerate the home loan experience.

Series D

- OwnBackup: $167,500,000 led by Insight Partners, Salesforce Ventures, Sapphire Ventures. OwnBackup provides backup and recovery solutions for companies that use Salesforce.

Series E

- Lyra Health: $187,000,000 led by Addition. Lyra helps companies improve access to effective, high-quality mental health care for their employees.

- Bloomreach: $150,000,000 led by Sixth Street. Bloomreach is an API company that helps eCommerce customers create, personalize, and scale commerce experiences.

- Splashtop: $50,000,000 led by Sapphire Ventures. Splashtop is a provider of remote-desktop support software for business, MSPs, IT, helpdesks, and schools.

Series F

- Sila Nanotechnologies: $590,000,000 led by Coatue. Sila Nanotechnologies is a provider and manufacturer of revolutionary car batteries.

Sources: Crunchbase, Twitter, LinkedIn