This month, we’re celebrating our 1 year anniversary of launching TCT. It’s amazing to see how far we’ve come from a year, and how excited we are for the future of TCT and Sacra.

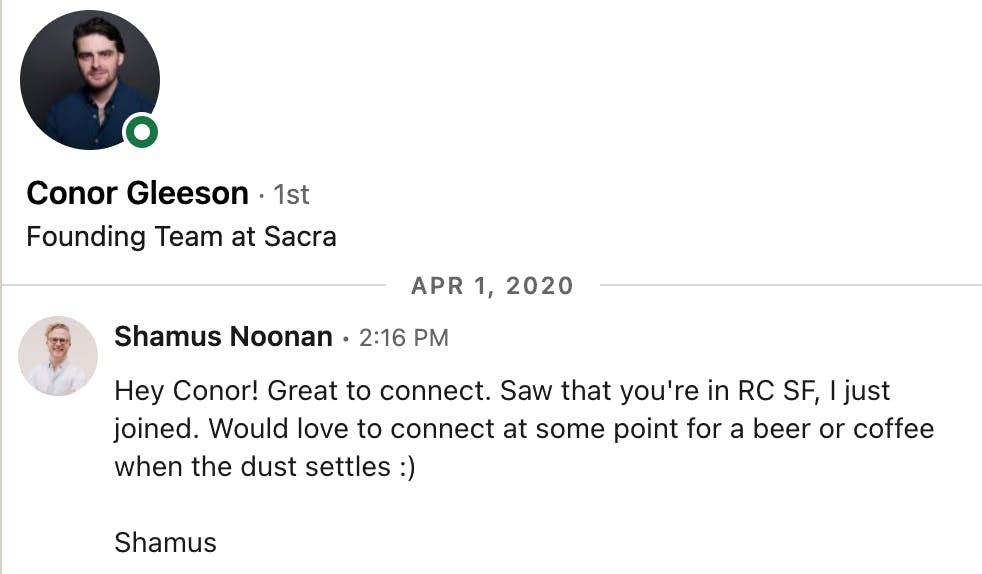

the original note behind TCT founders Conor & Shamus meeting:

To celebrate our 1 year anniversary, we’re sharing our 10 most popular pieces. We’d love your feedback on how we can improve, so please let us know here.

What you can expect from us moving forward: we’re doubling down on our content and finding new ways of engaging with our community and audience. There will be more exclusive’s, more in-depth research reports, and more ways to connect with each other.

And lastly, a huge thank you to all of our subscribers - we wouldn’t be here without you.

Enjoy.

-Conor, Shamus & the Sacra team

10. Gaby Goldberg, Analyst @ Bessemer Venture Partners

What’s your secret for getting on the cap table?

A great piece of advice I got a few years ago to be well-lopsided, meaning you’re well-rounded but have a competitive edge in a certain area, or something that makes you stand out. That can manifest as a specific industry focus or a particular skill you can offer to founders. For me, I like to spend my time focusing on consumer software businesses, and my favorite stage has been helping a product achieve its first 10,000 users.

On a personal level, I fell in love with venture because I loved the relationships I was building with founders and investors across all industries, geographies, and stages. At the end of the day, I want to be on the cap table if I truly love the founder and her vision for the company. If I can build trust with a founder and show up for both the highs and the lows, then I’m off to a pretty good start.

9. Shomik Ghosh, Principal @ boldstart ventures

As an angel investor, what's your secret for getting on the cap table?

Again, for me, I've mostly backed close friends who I've known for a long time. However, when I have angel invested in others, it's normally because I've been an avid user of the product or have some sort of expertise or passion about that area. This visibly comes through in the interactions with the founders. When that is the case, the founders themselves also get caught up in the energy and want to work with you. So regardless, even if it's an oversubscribed round, they'll make sure to find room for you since they know you are going to be a huge champion of the product. The other way to go about it is to be close friends with other angels that you respect. Hopefully, they know your areas of competency well and will tap you on the shoulder when they find an investment that would be a good fit.

8. Amplifying Black Voices in VC & Startups

Resources for Black Founders & Operators

- A16Z Talent X Opportunity Fund

- The Black Founder List (US-Based, Venture-Backed)

- BLCK VC - Bringing Together Black VC's and founders.

- Backstage Capital - Backstage Capital has invested over $7M in more than 130 companies led by underrepresented founders.

- DivInc - bridging the gap between underrepresented entrepreneurs and the resources they need to build profitable, high-growth companies,

- Fearless Fund - Fearless Fund invests in women of color led businesses seeking pre-seed, seed level, or series A financing.

- Harlem Capital - focused on investing in minority and women founders in the United States.

- ⚡️ Ultimate list of Professional Online Communities - via Complish

7. Ryan Denehy, founder & CEO of Electric

What advice would you give to first-time angel investors?

Just don’t do it unless you really have money that you are OK with never seeing again.

Learning money. I got lucky and had two big returns very quickly but that is atypical.

Do it for the right reasons, making money only comes into the picture after you get good at it (or lucky), and in most cases both take time.

6. Polina Marinova on the future of media

How do you go about selecting people for ‘The Profile’?

I look for three key things: 1) the subject has to be interesting and multi-layered; 2) an interesting narrative that allows the reader to learn from the person’s successes and missteps; 3) the story has to grab you immediately with an intriguing lead.

The best profiles are typically those that showcase the various layers of a person and allow you to learn something about them and from them. So I’m very much drawn to complicated characters that don’t have the stereotypical career path. A great profile also allows you to visualize the person by describing in detail their mannerisms and quirks that make them them.

5. Substack and the Rise of Content Creators

“Substack has come along at a pivotal time in the history of mass communication — what we believe is the golden age of new media. What we love most about this age is that it can free many creatives, from all kinds of backgrounds, to pursue the type of creative work they love, and on their own terms. - Substack by Andrew Chen”

4. Jonathan Abrams: founder of of Friendster, Nuzzel and now GP at 8-Bit Capital

What's your secret for getting on the cap table?

Even before we could write bigger checks via 8-Bit Capital, entrepreneurs wanted us on their cap table for our advice or our name. We’re able to get on the cap table for several reasons, including: our relationships, our experience as operators, our empathy with founders, and our track record as mentors.

3. Stephanie Friedman: angel investor, advisor & board member

What’s your secret for getting on the cap table?

- Have specific areas / topics where you can be actually helpful to the CEO

- Take the time to understand a bit more about the situation the company is currently in before you give advice - so that the advice is actually useful and timely

- Willing to be very operational and concrete in your advice

- Having specific experience in the areas that this company is trying to accomplish (e.g. having scaled from $0-50MM, having sold to developers, having build an inbound or enterprise sales team)

I usually invest in companies when I really like, and respect the founder(s) and find myself looking forward to spending time helping their company grow.

2. Let’s talk about SAFEs

For Investors & Angels:

Safes can offer angels and VCs anti-dilution protection before converting into equity. SAFEs also offer the option to convert to equity if the startup gets acquired before a natural conversion, such as a change of control provision.

1. Allison Barr Allen, co-founder @ Fast

What's your secret for getting on the cap table?

It's all about showing up and reaching out to founders and companies you're interested in to show them how you can bring value. Don't be afraid to ask for meetings with people – building relationships and your personal network is one of the most important aspects of investing and fundraising.

Sign Up Today!

To get these right in your inbox

Deal News 3/20-3/26

Seed

- Nebula Microsystems Inc.: $15,000,000 led by Morningside Group. Nebula Microsystems Inc’s mission is to deliver intelligent and high-performance Analog Products for a wide variety.

- Price.com: $10,000,000 led by Ricky Caplin. Price.com develops a money savings platform used for comparison shopping, cashback, coupons, price history, and price alerts.

- Gro: $7,100,000 led by Framework Ventures, Galaxy Digital, Northzone. Gro develops protocols or autonomous programs designed for a simple and friendly DeFi experience.

- Leeway: $4,200,000 led by henQ. Leeway helps companies reduce the time spent on contract management and gives them more control and visibility over legal and financial risks.

- Kintent: $4,000,000 led by Tola Capital. Kintent provides backend as a service to mobile app developers.

Series A

- HYCU: $87,500,000 led by Bain Capital Ventures. HYCU provides application focused data protection and monitoring software to support hyperconverged datacenters.

- Fortis Therapeutics: $40,000,000 led by Fulcrum 2020, Myeloma Investment Fund. Fortis Therapeutics is an immuno-oncology biotech focused on developing new antibody drug conjugate therapies against CD46.

- Outpace Bio: $30,000,000 led by Artis Ventures (AV), Lyell Immunopharma. Outpace Bio is a biotechnology company that creates smart cell therapies aimed at improving efficacy and safety.

- ZeroAvia: $24,300,000 led by British Airways, Horizons Ventures. ZeroAvia is building the World's first practical zero emission aviation powertrain, based on hydrogen fuel cells.

- KUDO: $21,000,000 led by Felicis Ventures. Cloud-based Collaboration in Multiple Languages.

Series B

- Pyxis Oncology: $152,000,000 led by Arix Bioscience, RTW Investments LLC. Pyxis Oncology is a developer of antibody therapeutics intended to promote the body's immune response to cancer.

- Entrada Therapeutics: $116,000,000 led by Wellington Management. Entrada Therapeutics is a developer of novel therapeutics intended to treat devastating diseases.

- Scribe Therapeutics: $100,000,000 led by Avoro Capital Advisors, Avoro Ventures. Scribe Therapeutics is a biotech company that develops and engineers new therapeutics based on CRISPR molecules.

- Immune-Onc Therapeutics: $73,000,000 led by Oceanpine Capital. Immune-Onc Therapeutics is a newly established biopharmaceutical company that develops therapeutic antibodies for cancer treatment.

- Substack: $65,000,000 led by Andreessen Horowitz. Substack is a subscription-based newsletter publishing platform for independent writers.

- UnitedMasters: $50,000,000 led by Apple. UnitedMasters gives musicians an alternative to exploitative record label deals.

- Cresta: $50,000,000 led by Sequoia Capital. Cresta leverages artificial intelligence to help sales and service agents improve the quality of their customer service.

- Holler: $36,000,000 led by CityRock Venture Partners, NGM Ventures. Holler is a Conversational Media company, focused on the creation and delivery of content that helps peer-to-peer messages be more engaging and effective.

- Ethic: $29,000,000 led by Oak HC/FT. Ethic operates as a tech-driven asset manager that powers the creation of investment portfolios.

Series C

- HighRadius: $300,000,000 led by D1 Capital Partners, Tiger Global Management. HighRadius is a SaaS company that develops an artificial intelligence-based order-to-cash and treasury management software.

- Cityblock Health: $192,000,000 led by Tiger Global Management. Cityblock Health is a tech-driven healthcare provider for those in underserved communities.

- Omega Therapeutics: $126,000,000 led by Flagship Pioneering. Omega is a Biotechnology Company.

- BrightInsight: $101,000,000 led by General Catalyst. BrightInsight offers a global regulated digital health platform for biopharma and medtech.

- Cameo: $100,000,000 led by e.ventures. Cameo is a marketplace where fans can book personalized video shoutouts from their favorite people.

- Manticore Games: $100,000,000 led by XN. Manticore Games develops Core, a platform to build, share, and play online games.

- Rightway Healthcare: $100,000,000 led by Khosla Ventures. Rightway Healthcare is a health technology company that focuses on care navigation and pharmacy services tools.

- Capitolis: $90,000,000 led by Andreessen Horowitz. Capitolis is a technology provider addressing capital market constraints in equities and foreign exchange.

- Stord: $65,000,000 led by Bond. Stord provides cloud supply chain warehousing services to brands who seek visibility and control over their inventory.

- Zoomin Software: $52,000,000 led by General Atlantic. Zoomin Software helps companies manage their technical content such as user guides, manuals, and community discussions.

Series D

- Fetch Rewards: $210,000,000 led by SoftBank Vision Fund. Fetch Rewards is a mobile shopping platform that rewards shoppers for buying the brands they love.

- Crossover Health: $168,000,000 led by Deerfield Management. Crossover Health designs and delivers membership based primary health and secondary care services to self insured employers.

- Uniphore: $140,000,000 led by Sorenson Capital. Uniphore offers an AI-based conversational service automation platform that changes the way enterprises engage with their customers.

- 6sense: $125,000,000 led by D1 Capital Partners. The 6sense Account Engagement Platform helps B2B organizations achieve predictable revenue growth by putting the power of AI, big data, and machine learning behind every member of the revenue team.

- Tomorrow.io: $77,000,000 led by Stonecourt Capital. Tomorrow.io is a weather intelligence platform that provides real-time weather forecasts.

- Ecovative Design: $60,000,000 led by Viking Global Investors. Ecovative Design is a biomaterials company focused on the development of innovative materials from natural growth processes.

Series E

- Tonal: $250,000,000 led by Dragoneer Investment Group. Tonal is a smart home gym that uses artificial intelligence and coaching to provide strength training.

- Harry's: $155,000,000 led by Bain Capital, Macquarie Capital. Harry is a developer of an online platform used to sell shaving equipment and accessories for men.

Sources: Crunchbase, LinkedIn, Twitter.