Hi everyone 👋

Sign Up Today!

To get these right in your inbox

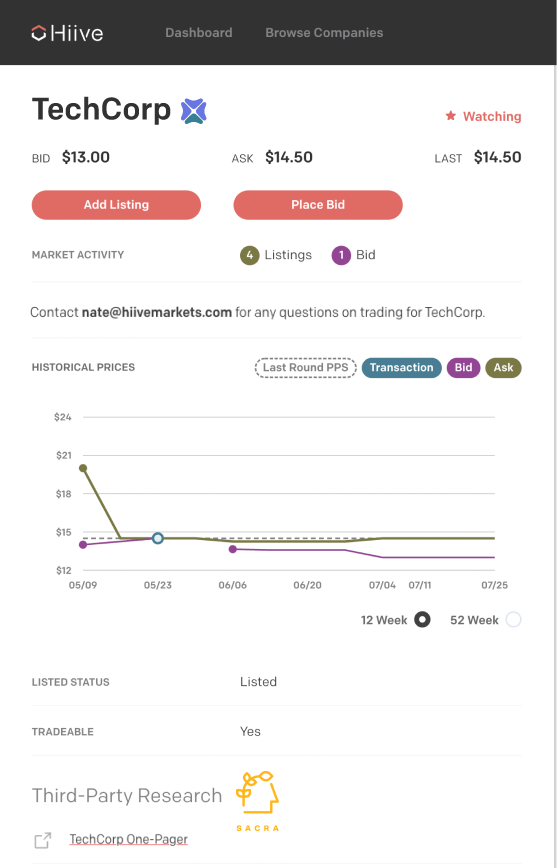

We’re excited to announce our partnership with Hiive, which is embedding Sacra research directly into their marketplace for buying and selling private company stock.

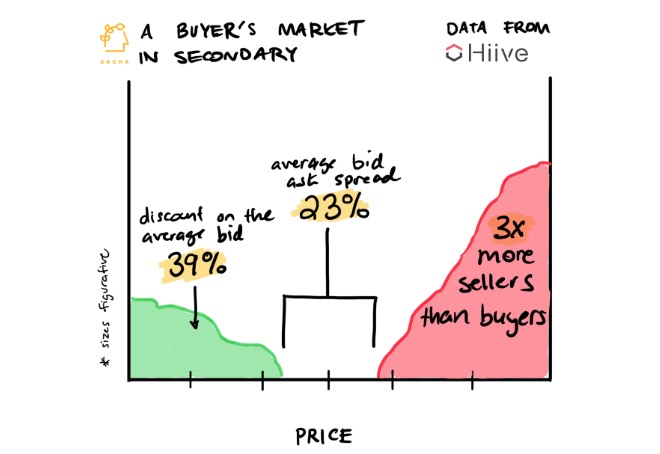

Over the last several months, public market turmoil has created a dislocation between the buy side and sell side in secondary markets.

We’ve seen buyers looking for steep discounts in line with public market valuation changes, while sellers insist on selling at the last round’s price.

- It’s a buyer’s market: Sellers outnumber buyers by more than 3 to 1.

- Buyers and sellers are far apart: The bid/ask spread between buyers and sellers of private stock has hovered around 23% for the last 3 months

- Buyers are asking for big discounts: The average bid has come in at around a 39% discount to the last round’s price

This dislocation has meant that transactions have been slow to clear. That’s why we believe Hiive’s mission of bringing transparency to pricing is so important, and why we’re so excited about our partnership with them.

WIth visibility into the live bids and asks in an open order book, buyers and sellers of private stock on Hiive can better find the price point where transactions will clear.

With Sacra research on the platform, investors can learn about companies from a bottom-up point of view and better understand the opportunity behind the price.

To learn more about how investors are pricing private companies today, and to get more data on the secondary markets for private stock, check out Hiive and sign up to get started.