‘Many Are Called, But Few Are Chosen’

No, we’re not talking about admission to Clubhouse in this week’s exclusive.

We’re talking about perhaps the best-kept secret in VC.

The man behind fintech Unicorn Carta’s near $500mm in venture funding raised.

Teetotaler; faintly-Scottish-brogued Brexiteer; family man; lover of a tall glass of milk -

this week’s issue is about none other than Sumeet Gajri.

At Carta, Sumeet wore many hats; strategy operator, LP, principal investor, and advisor. One might go as far as to call him the Chief Fundraising Officer for the Silicon Valley firm.

Perhaps due to the overwhelming stack of hats, Sumeet is also famous for only ever wearing one shirt. (hint: it’s not a black turtleneck.)

Sumeet (right) in his fundraising uniform. source: Twitter

Sumeet’s classic attire is a purple and neon green Nike t-shirt with the scripture phrase, “Many Are Called, Few Are Chosen”, a cheeky nod to King James of Los Angeles himself, as well as a verse from The Book of Matthew 22:14 from the bible.

A self-described believer (and Lakers fan), the phrase emboldened across his barreled chest, much like the man, is an enigma.

In this week’s exclusive, we’ll explore his background, successes at Carta, and what’s next for Sumeet.

Background

Enter Sumeet.

Founder and GP of Original Capital and scout for Sequoia, Sumeet’s pièce de résistance to date has been shepherding Carta, the Silicon Valley darling helmed by Henry Ward, through several monster rounds of financing.

According to his LinkedIn, Sumeet’s story begins with humble origins.

From 1999-2009 in Cranhill, an inner-city housing district in the northeast of Glasgow, Scotland, Sumeet worked as an assistant at his father’s shop.

“[I] [w]as taught the two most important lessons of my professional career - perseverance, and gratitude - by the best boss I will ever have, my Dad.”

From there, Sumeet went on to college at NYU in New York City, studying economics and political science.

Sumeet hardly followed a traditional path into VC. Instead of exiting a company as a founder or early employee, or being independently wealthy, he came across a unique opportunity with a growth equity shop who was willing to give him a shot.

Sumeet cut his teeth in VC in New York, at a firm who would sponsor his visa during the height of the financial crisis to help him stay in the United States.

These experiences would culminate, by way of grit, good fortune, and good timing, with Sumeet becoming Carta’s (then known as eShares) Chief of Staff, reporting directly to the CEO, Henry Ward.

The ‘Beginning of the Beginning’

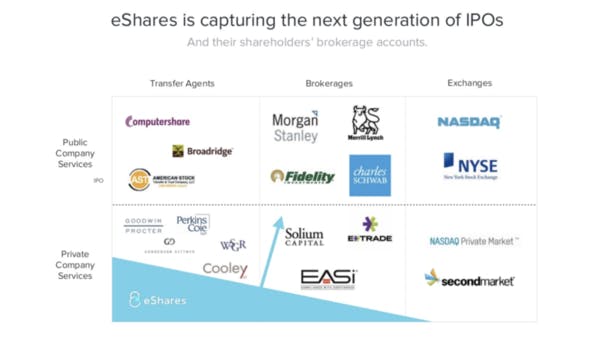

‘In 2014, a friend shared a deck with me from a small company in Mountain View called eShares Inc. The deck opened by posing a simple question: “What is eShares?”.

I did not have to wait long for the answer. On the next slide, there was a diagram that represented one of the most audacious visions I had encountered in my short career as a tech investor.

In a single slide, Henry Ward had succinctly laid out a multi-decade roadmap that called for financial infrastructure in the US to be rebuilt bottoms up starting in the private markets.’

-Original capital blog post

Fast forward six years and that vision would unfold into one of the most legendary silicon valley unicorns of our time.

From Carta's pitch deck to investors; Circa 2014

Next Chapter

In March 2020, Sumeet stepped away from Carta to focus on his personal portfolio of investments.

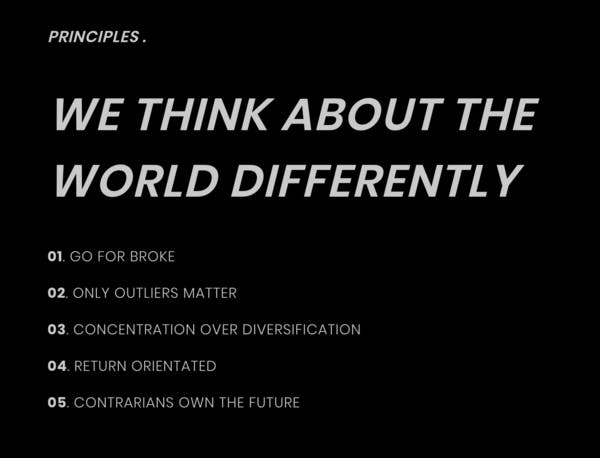

Original Capital is, in a sense, the anti-VC; bucking diversification as one of its’ core investment theses.

In fact, here are his investment theses per the website:

Not your typical '1/10 will do' VC source: www.originalcapital.com

How many VCs are truly “return-oriented”? The average VC fund returns about 20% net of fees to investors and allocates risk across tens, hundreds, and in the case of the Sequoias and A16Zs of the world, thousands of bets.

Sumeet only wants winners.

Will that mean he has plenty of doubters? Initially, probably yes.

But what if he gets it right?

Is the paradigm of ‘throwing enough at a wall to see what sticks’ truly a good business model?

The best operators, VCs, LPs, and fund managers, have a hard time repeating outsized successes, and historically rely on a few home runs per fund to make up for a lot of losing investments.

Is the Man in the Purple Shirt on to something?

Only time will tell, but until then, we will be watching closely as Sumeet’s next chapter unfolds.

That’s all for now, stay tuned for next week’s exclusive.

Data Sources: LinkedIn, Crunchbase, AngelList, www.originalcapital.com

The Cap Table is a resource to help you get, and stay, on the capitalization table.

What did we miss? Email us at hello@thecaptable.com

Check out Harry Stebbings 20VC podcast episode with Sumeet:

What twitter is saying about Sumeet:

Good Luck Sumeet! You gave this wall street trader a new lease on life. We will be watching and cheering from the sidelines.

— PatrickArmstrong,CFA (@NYSE70) May 2, 2020

— Zibbie Nwokah (@zibigem) May 2, 2020

Nobody has made a bigger impact to @cartainc over the last few years than @S27G_ . What an incredible story and an even more incredible person. Super excited to be an LP in Original Capital 🚀🚀🚀🚀🚀

— Alessandro Chesser (@SandroChess) May 1, 2020

Thanks so much for this Ron, it was such a joy to have Sumeet on the show and so proud of the episode!

— Harry Stebbings (@HarryStebbings) January 19, 2020

TCT Tip of the Week

Founders: beware of the “Option Pool Shuffle”.

Definition: Anywhere between 13%-20% of unallocated employee stock options can be added (in advance) before the VC writes the check in your next round.

What does this mean? In the event of a sale, unallocated option pool shares will be distributed pro-rata, meaning, some of that money will go right back into investor’s (already deep) pockets. Some call this a “backdoor” way of increasing ownership while trying to come off as a pro-company investor.

Takeaway: seriouslyseriously consider how much equity you’ll be allocating each and every round and avoid any unnecessary dilution. If you plan on having a large pool of shares, have a proper allocation plan.

Notable Deals 5/1-5/8

Deal of the Week: despite financial market volatility, Robinhood nabs $280mm Series F, bringing their total funding to $1.2bn

Today we’re announcing a $280M Series F funding. Amid challenging times, we’re humbled that people are using Robinhood to build their financial future, and we look forward to continuing to serve our customers. https://t.co/yZigUw6JxO

— Robinhood (@RobinhoodApp) May 4, 2020

Staring at digital screens hurts your eyes. Our Blue Light glasses help. Click here to learn how Felix Gray’s designer eyewear means healthier eyes. Shop now!

Seed Rounds

- theklicker raises $10,000,000 led by Joseph Creig | theklicker is an online platform that provides online directory which compares price of mobile from different websites.

- FXWEALTH raises $10,000,000| FxWealth is an American Leading & Awarded Finance & Real Estate Service Provider across the Globe.

- Adfone raises $7,500,000 led by James Perry | Savings and rewards technology provider

- STILT raises $7,500,000 | Stilt financial technology company located in San Francisco.

- First Dollar raises $5,000,000 led by Next Coast Ventures | First Dollar is a healthcare savings platform.

- LifePod Solutions raises $5,000,000 led by Winter Street Ventures | LifePod Solutions is provides proactive voice and connected services to support those with chronic health conditions.

Series A

- Sidewalk Infrastructure Partners raises $400,000,000 led by Alphabet, Ontario Teachers’ Pension Plan | Sidewalk Infrastructure Partners applies innovative technology to urban infrastructure systems.

- Ventus Therapeutics raises $60,000,000 led by Versant Ventures | Ventus Therapeutics is a biopharmaceutical company developing novel small molecule medicines that target the innate immune system

- KlearNow raises $16,000,000 led by GreatPoint Ventures | KlearNow is the first on-demand transparent customs clearance platform connecting Importers, Brokers and Transporters.

- Knowde raises $14,000,000 led by Sequoia Capital | Knowde is the online marketing platform dedicated to chemicals and ingredients.

- Finite State raises $12,500,000 led by Energy Impact Partners | Finite State is the pioneer of IoT device intelligence.

- Peanut raises $12,000,000 led by EQT Ventures | Peanut is an online platform that provides a safe space for women to connect across fertility and motherhood.

- Jellyfish raises $12,000,000 led by Accel | Engineering Management Platform, helping engineering leaders focus teams on what matters most to the business and drive strategic decisions.

- Groove raises $12,000,000 led by Level Equity Management | Groove is a sales engagement platform that automates non-sales activities so that sales teams can spend time generating revenue.

- Hypersonix raises $11,500,000 led by Intel Capital | Hypersonix is an AI-backed autonomous analytics platform created to help businesses better analyze consumer commerce data.

- Workstream raises $10,000,000 led by Founders Fund | Workstream is an automated hiring platform for companies employing hourly workers.

- Postal.io raises $9,000,000 led by Mayfield Fund | Postal.io is a direct mail automation platform for sales and marketing teams.

- Treasury Prime raises $9,000,000 led by Amias Gerety, John C. Morris | Treasury Prime builds APIs that let both banks and their corporate customers automate their banking operations.

- Limbix raises $9,000,000 led by GSR Ventures | Limbix is a prescription digital therapeutics platform intended to provide mental health treatment for young people.

- Braid Health raises $9,000,000 led by Lux Capital | Braid Health is an artificial intelligence platform for the medical diagnostics industry.

- Emtrain raises $8,000,000 led by Education Growth Partners | Emtrain provides online education and guidance on HR and compliance topics.

- Qrvey raises $7,500,000 Qrvey simplifies business analytics on AWS and moves analytics beyond just visualizations to include your entire data pipeline.

- Monogram Health raises $7,000,000 led by Frist Cressey Ventures, Norwest Venture Partners | Monogram Health is leading Nephrologists to deliver transformative kidney care services.

- Hydrant raises $5,700,000 led by Coefficient Capital | Hydrant is a wellness brand company providing a balanced mix of electrolytes, minerals, and vitamins.

- TimeDoc Health raises $5,700,000 led by Vocap Investment Partners | TimeDoc helps healthcare organizations manage and coordinate care for their chronic disease patients.

- Alume Biosciences raises $5,500,000 | Alume Biosciences is a biotechnology company developing nerve-targeted pharmaceuticals for surgical and therapeutic use.

- Instabug raises $5,000,000 led by Accel | Instabug is a computer software company that offers services for mobile app developers to help them in testing their applications.

ProdPerfect is a platform that uses live traffic to automatically build, run, and maintain QA testing for web applications.

Series B

- ASAPP raises $185,000,000 | ASAPP is an artificial intelligence customer service software that helps call center agents work more efficiently.

- Covariant raises $40,000,000 led by Index Ventures, Radical Ventures | Covariant is a developer of artificial intelligence for robotics.

- Knock raises $12,000,000 led by Madrona Venture Group | Knock is a software-as-a-service platform that provides sales and marketing services for residential property management companies.

- VNDLY raises $8,500,000 led by Madrona Venture Group | VNDLY offers a vendor management SaaS platform that collaborates on the corporation’s contingent workforce needs.

Series C

- Bought By Many raises $97,566,439 led by FTV Capital | Bought By Many is an award-winning pet insurance provider that is disrupting insurance distribution.

- LetsGetChecked raises $71,000,000 led by HLM Venture Partners, Illumina Ventures | LetsGetChecked is an at-home health testing platform that connects customers to regulated laboratory testing.

Series D

- Grail raises $390,000,000 | Grail is developing a blood test that will help reveal cancers at their early stages.

- Cockroach Labs raises $86,600,000 led by Altimeter Capital, Bond | Cockroach Labs is the company behind CockroachDB, an open source, distributed SQL database.

- Dtex Systems raises $17,500,000 led by Northgate Capital | Dtex Systems utilizes user behavior intelligence to help enterprises detect cybersecurity threats without compromising privacy.

Series F

- Robinhood raises $280,000,000 led by Sequoia Capital | Robinhood is a stock brokerage that allows customers to buy and sell U.S. stocks, options, ETFs, and cryptocurrencies with zero commission.

Series H

- Pulmonx raises $66,000,000 led by Ally Bridge Group | Pulmonx provides minimally-invasive medical devices and technologies for the diagnosis and treatment of pulmonary disorders.