Hey everyone!

Today, we're excited to launch our report on Klarna: The $31B Snapchat of Personal Banking. We’d love for you to read it and let us know what you think.

Klarna is the world’s leading Buy-Now-Pay-Later (“BNPL”) provider, with $53B of GMV in 2020 to AfterPay’s $11B and Affirm’s $4.6B. And after raising at a $31B valuation earlier this year, they have regained their title as Europe’s most valuable company.

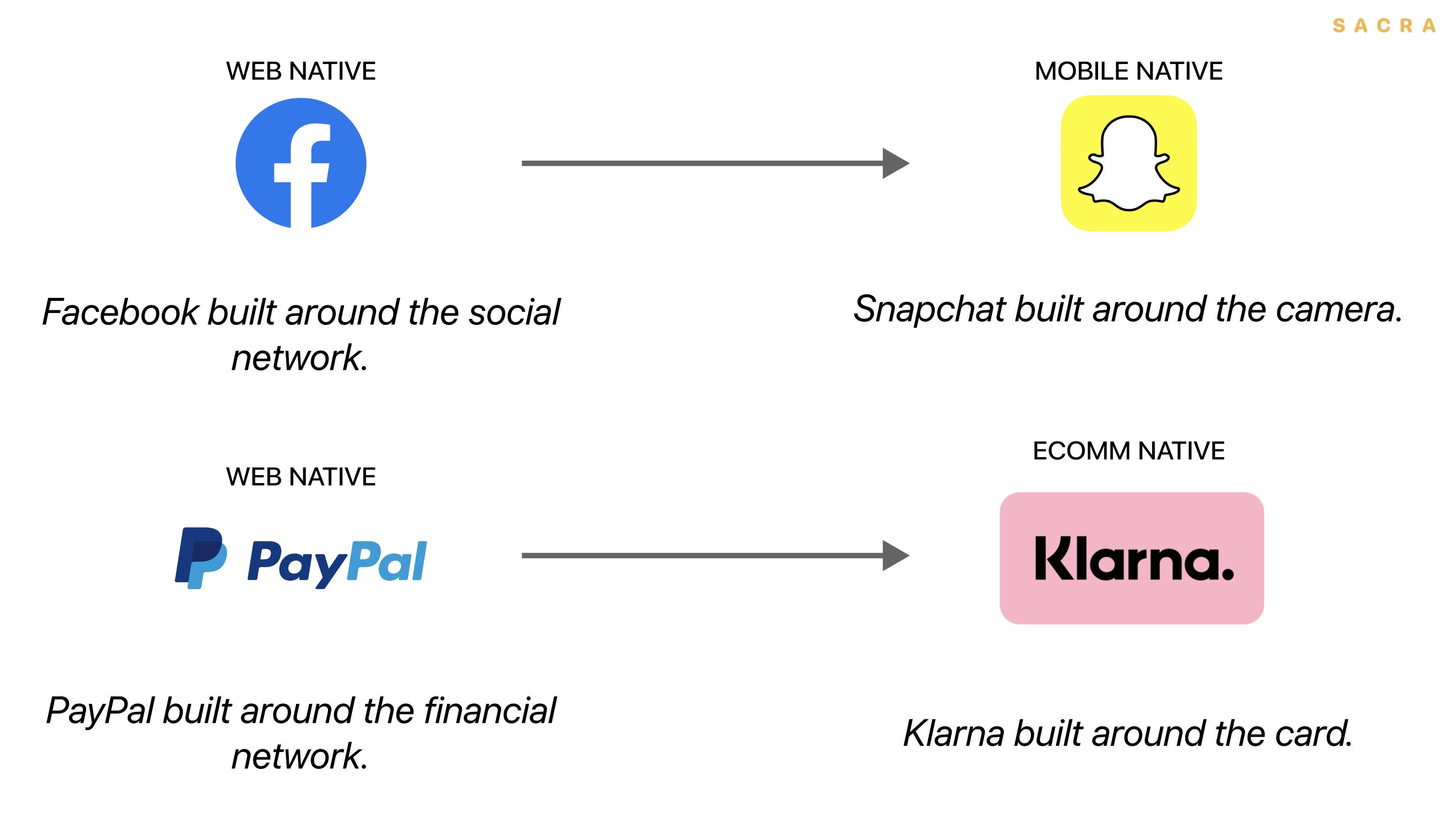

The U.S, which saw $750B in ecommerce spending last year, is the natural next step for Klarna to maintain its growth. But to win the U.S, Klarna will need to unseat PayPal, a behemoth with 54% retailer market share, 350M+ user accounts, a $300B+ market cap, and as of last year, their own BNPL program.

Some key points from our report:

- In Klarna’s home markets, BNPL is replacing credit cards and driving increased frequency of usage. 23% of all ecommerce transactions in Sweden use BNPL, and Klarna cohorts buy more every year: 10x in year 2, 14x in year 3, and 20x in year 7, with the earliest adopters buying as often as 27x per year.

- However, the BNPL space is becoming increasingly crowded. Two quarters after launching their own BNPL product, PayPal has surpassed Afterpay and Affirm—scale-wise, 54% of websites accept PayPal, compared with only 1.2% for Klarna.

- To overcome the competitive pressure, Klarna is repositioning itself from B2B to direct-to-consumer (“D2C”). With their brand, investment in product, and alignment with ecommerce, Klarna aims to become a destination app for Gen Z and millennials and become the default consumer e-commerce portal.

Check out the report for our full analysis, and let us know what you think!

Nan