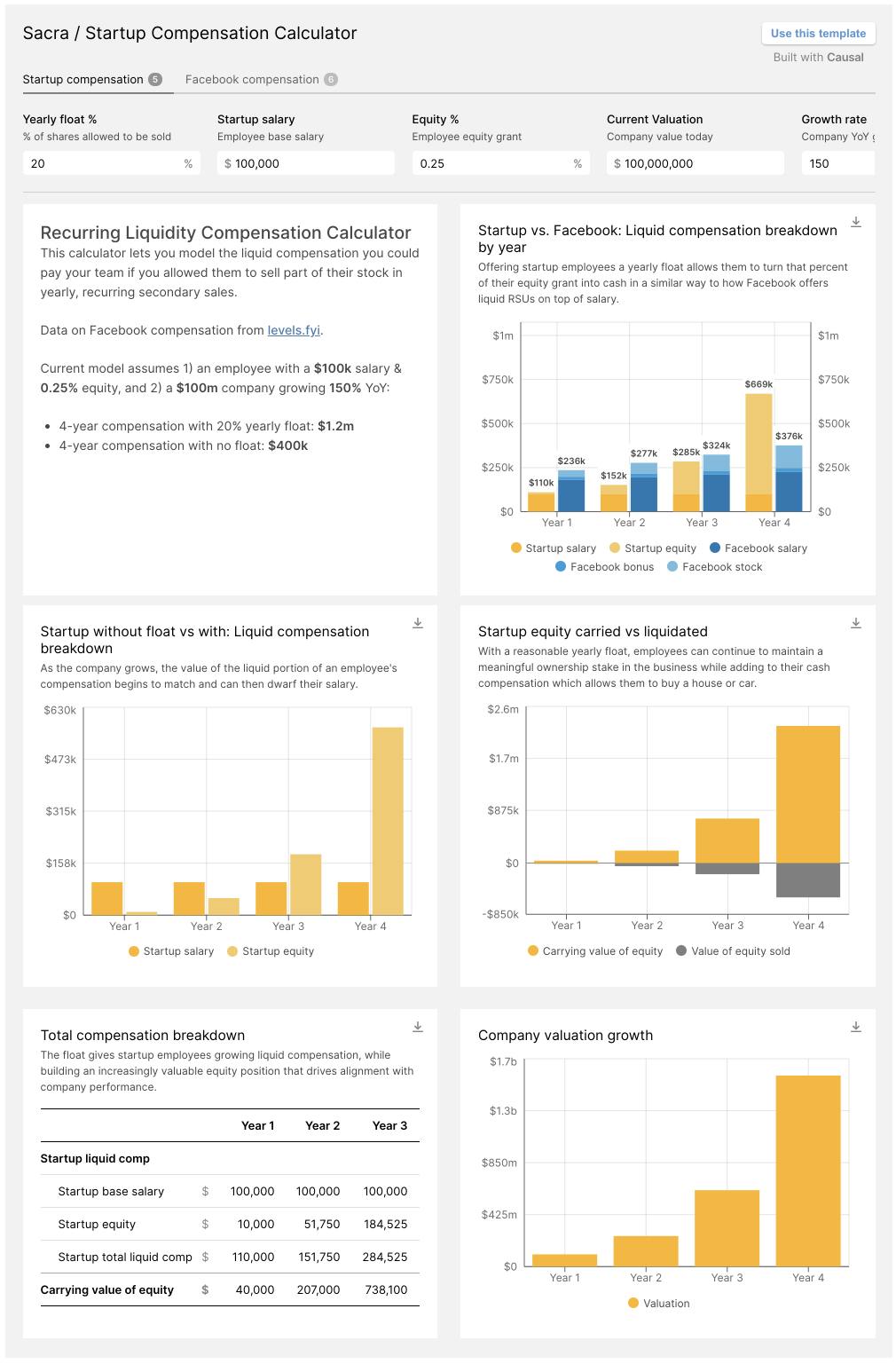

Today, we're launching our startup liquidity calculator that shows what happens when you offer your employees recurring liquidity—you can offer liquid compensation competitive with Facebook while giving the upside of a high growth company.

Our calculator shows the power in offering liquidity as the flip side to equity:

- How 150% year-over-year growth and 20% yearly float can make a Series B startup’s liquid compensation comparable to that of a Facebook E4

- Why faster growth rates mean that the liquid equity portion of a startup employee’s compensation starts small but can hit 2-3x salary by year 4

- How a 10% increase in float can reduce your startup compensation's total time-to-upside by a year

Today, a handful of late-stage private companies offer some form of recurring liquidity to employees. As more startups learn how liquidity can help them compete on compensation with the best-paying public companies, we believe offering it will become table stakes—all the way down to Series B.

Check out our recurring liquidity calculator and you’ll see why.

Let us know what you think by replying to this email.

Thanks!