Hi everyone 👋

Sign Up Today!

To get these right in your inbox

TL;DR: We did a report on Gusto—check it out here. Sacra members can access our full revenue, growth, and comps dataset here.

Key points from our report on Gusto:

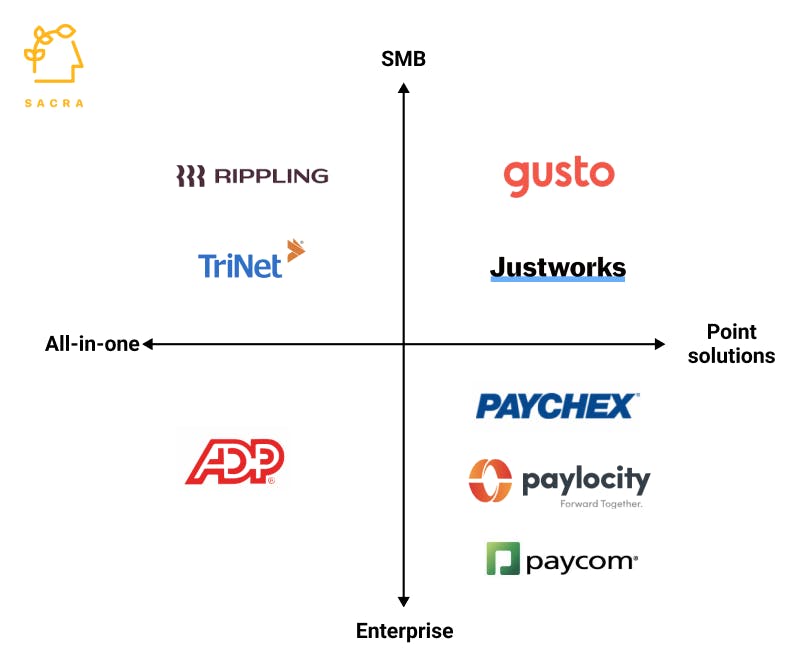

- Gusto found initial product-market fit replacing pen and paper payroll with an easy-to-use web portal for SMBs and their employees. With business models built around big companies, incumbents like ADP have remained upmarket, which has left many small businesses doing payroll by hand—today, about 30% of SMBs still run payroll themselves.

- Gusto did for domestic payroll what Avalara did for sales tax—abstract away state boundaries to make it possible for any company to hire employees anywhere. Gusto drives high margin subscription revenue from SMBs using its payroll/HR services and lower margin commission revenue from insurance carriers for selling medical/vision/dental/life insurance.

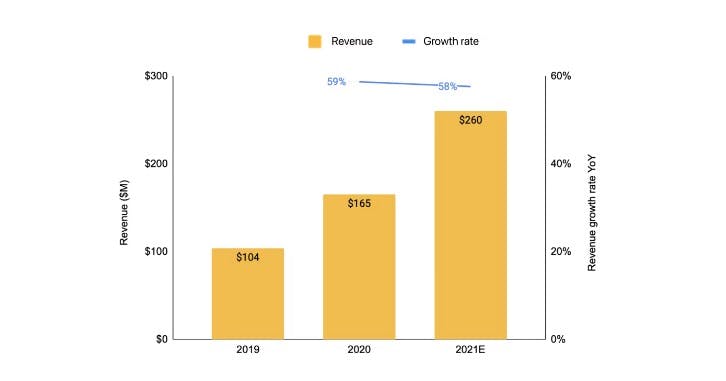

- Gusto did $260M in revenue in 2021, up 58% from 2020 ($165M), on about 200,000 SMB customers. Compare to the biggest payroll/HR providers like ADP ($15B revenue, +3% YoY) and TriNet ($4.5B revenue, +12% YoY) and private competitors like Rippling ($45M revenue, +170% YoY). (See model)

- Gusto raised at $9.5B and 36x revenue in 2021—public comps like TriNet (-17%) on payroll and Bill.com (-52%) on SMB back office are down since then. At the same time, private competitor Rippling raised an up round in 2022 at $11.25B at 170% YoY growth with an all-in-one platform that includes app and device management.

- Embedded payroll API companies like Check ($725M valuation) and Zeal ($65M) threaten to commodify payroll by bundling it into every vertical SaaS like ServiceTitan and Homebase. Vertical SaaS companies use these APIs to bundle high-retention payroll into their own platforms and give employees a more convenient experience.

- Global payroll companies like Deel ($12B) and Remote ($3B) replicate Gusto’s approach to abstracting away boundaries to hiring on a global scale—positioning themselves to eat up domestic payroll as a use case. While many of these companies started off focused on the international contractor hiring use case, they’ve since expanded to offering a one-stop-shop for payroll across contractors and employees and across global and domestic.

- Payroll is still a massive market with several $10B+ giants like ADP ($104B), Paychex ($48B), Paylocity ($14B)—and Gusto is still growing at 50%+ YoY. Gusto’s customer base is highly sticky: after a brief disruption due to COVID, 98% of Gusto’s 200,000+ SMB customers had resumed paying for the product by summer 2020.

- Gusto has an edge over Rippling with the core payroll function for SMBs—88% of Gusto reviewers on G2 are SMBs to only 43% for Rippling. Rippling has an edge with companies in the mid-market (51-1000 person) and companies that need extra features like device and app management.

- Since 2019, Gusto have launched an embedded payroll API, an employee wallet, and an earned wage access product. They’re pursuing a platform vision with impressive product velocity, expanding their TAM into financial services for employees.

For more on Gusto, check out the report here and download our revenue model here.

Jan & team

Related reading

For more, check out some of our other research on payroll:

- Justworks: The $2B PEO-as-a-service company that did $982M of gross revenue in 2021

- Dan Westgarth, COO of Deel: $425M Series D from Coatue to build an all-in-one global payroll platform

- Matt Redler, CEO of Panther: $2.5M Seed from Tribe Capital to build the Stripe for modern employer of record services

- Jeremy Zhang, CEO of Finch: $3.5M Seed from General Catalyst to build a universal API for HR and payroll

- Anthony Mironov, Co-Founder and CEO of Wingspan: $3.5M Seed from Grand Central Tech to solve mass contractor payments

- Hari Raghavan, CEO of AbstractOps: $7M Seed from Craft Ventures to build a COO in a box