Hi everyone 👋

Sign Up Today!

To get these right in your inbox

TL;DR: We did a report on Flexport—check it out here.

Key points from our report on Flexport:

- Flexport found initial product-market fit with its Uber/Postmates-style order tracking dashboard for global shippers. Behind their digital dashboard, Flexport—like other freight forwarders—still does a lot of manual work to move cargo around the world.

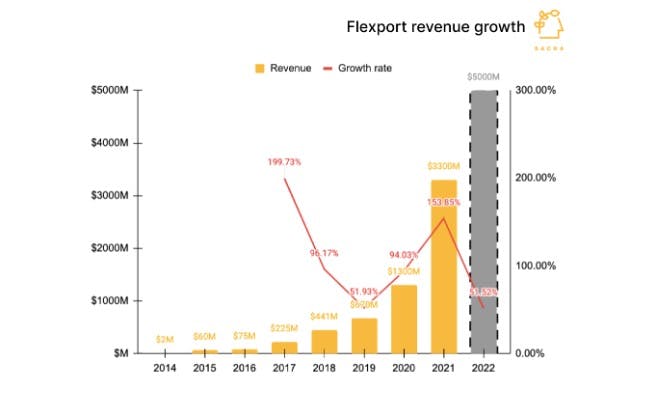

- Flexport did $3.3B gross revenue in 2021, up 146% from 2020 ($1.3B). Compare to the biggest freight forwarders like DSV ($29B, up 59%) and Kuehne + Nagel ($35B, up 65%).

- In 2021, Flexport recorded 20% gross margin ($660M) after paying out the asset owners (Maersk, etc) and 1% net margin. Flexport’s gross margin compares to 21.5% for DSV, 27.8% for Expeditors, and 31.4% for Kuehne + Nagel. Typical net margins hover around 3-8% in freight forwarding.

- Flexport is now the 21st biggest freight forwarder in revenue terms with about 0.3% in total market share. The 6 largest freight forwarders comprise a third of the $140B market for freight forwarding.

- We project 51% year-over-year growth for about $5B in gross revenue in 2022. Shipping volumes have slowed down due to decelerating growth and lower consumer spend as well as retail inventories that have been rebuilt following supply chain disruptions of 2020-21. Volume growth is a function of GDP and global trade, which is expected to grow at ~5% and face some protectionist headwinds.

- Since Flexport launched, the logistics space has undergone a wider digital transformation. Freight forwarding incumbents like K+N have built out their own digital front-ends, while other SaaS platforms like Project44 (raised $817.5M) and Forto ($593.4M) have launched to bring supply chain visibility and tracking to retailers.

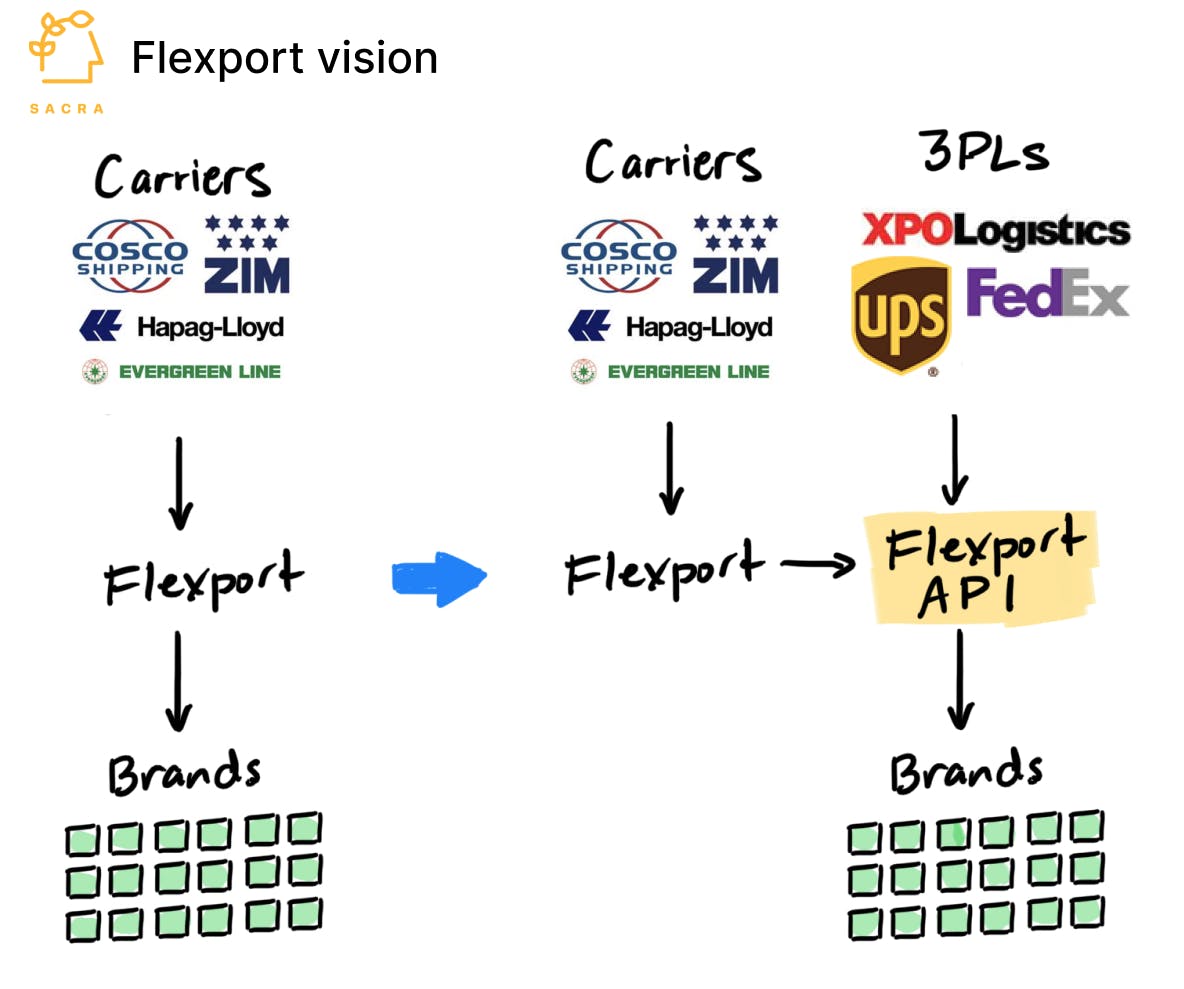

- Flexport’s ultimate vision is to build a standardized data protocol for asset owners and shippers. If merchants and asset owners could communicate via API instead of via freight forwarders, it would enable more efficient matching of demand and supply, allowing merchants big and small to sell cheaper products and provide better selection with faster shipping.

It’s fitting that Flexport’s new CEO will be Dave Clark, previously the head of global consumer at Amazon.

Just as Amazon evolved from an online retailer into a utility for demand generation and fulfillment for all merchants, Flexport wants to evolve from a freight forwarder into the end-to-end digital infrastructure connecting asset owners (like ocean carriers, e.g. Maersk) with warehouses, factories, and ecommerce brands.

For more on Flexport, check out the full report here.

Jan & team

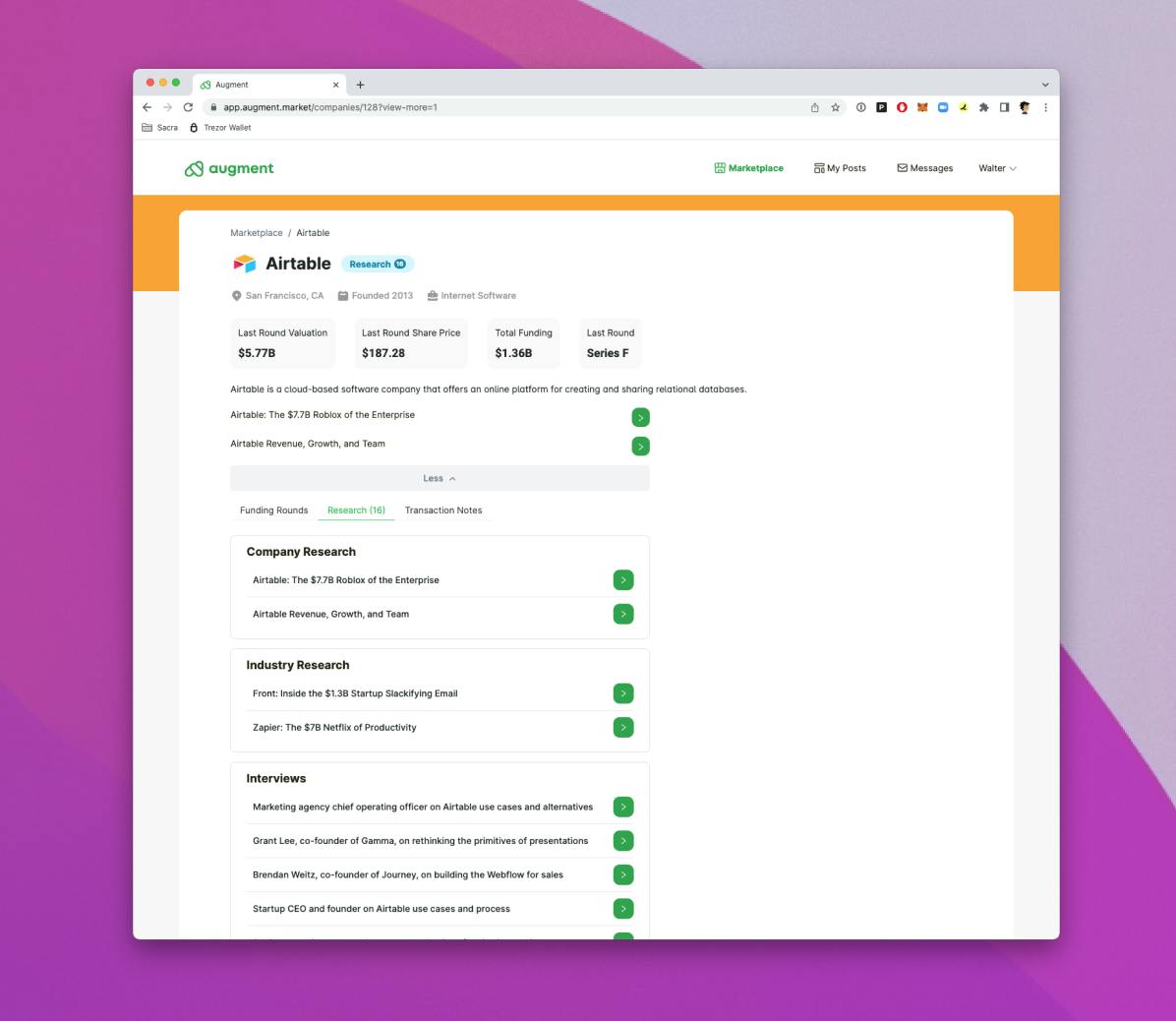

Product update: Sacra Documents API

We're building an API that lets you integrate our reports, interviews, and company profiles into your app experience.

If you’re an investing app, wealth management app or employee option exercise financing app, reply to this email to chat with us about it.

Event: CVEX investor Q&A

On Thursday (6/30) at 10am PT/1pm ET, join us for an investor Q&A with Chris Belew, co-founder and co-CEO at CVEX.

Over the last few years, we’ve seen platforms like Semper and CartaX emerge to help companies run end-to-end secondary programs for employees and investors.

CVEX is building the underlying matching engine technology to enable issuers, cap table businesses, and secondary brokers anywhere to spin up their own on-demand auctions for private company stock.

New interviews

Check out these new interviews on the platform. Reply to this email to offer questions you’d like us to ask upcoming interviewees, request specific interviewees and offer feedback.

- Jeremy Zhang, CEO of Finch: $3.5M Seed from General Catalyst to build a universal API for HR and payroll

- Jacob Wenger, Chief Product Officer at Shortwave: $9M Seed from Union Square Ventures to displace Outlook alongside Front and Superhuman.

- Taimur Abdaal, Co-Founder and CEO of Causal: $19.5M Series A from Accel to build a horizontal modeling platform using FP&A as a wedge

- Alexis Rivas, Co-Founder and CEO at Cover: $60M Series B from Gigafund and Founders Fund to build better modular prefab houses and create the Tesla for homebuilding.

New company profiles

Check out a few of our recent company profiles.

- Gusto: Payroll provider that made about $260M of revenue in 2021, up 58% from $165M in 2020. Competitive with global payroll services like Deel and Panther.

- Voodoo: Mobile game publisher that is the third-largest app publisher globally, with 6 billion downloads and 300M+ MAU. Voodoo made $430M revenue in 2021, up 7% from 2020.

- Calm: The “Spotify for sleep” went from $150M a year before COVID to now doing $500M a year with 4M+ paying subscribers around the world.