Hi everyone 👋

Sign Up Today!

To get these right in your inbox

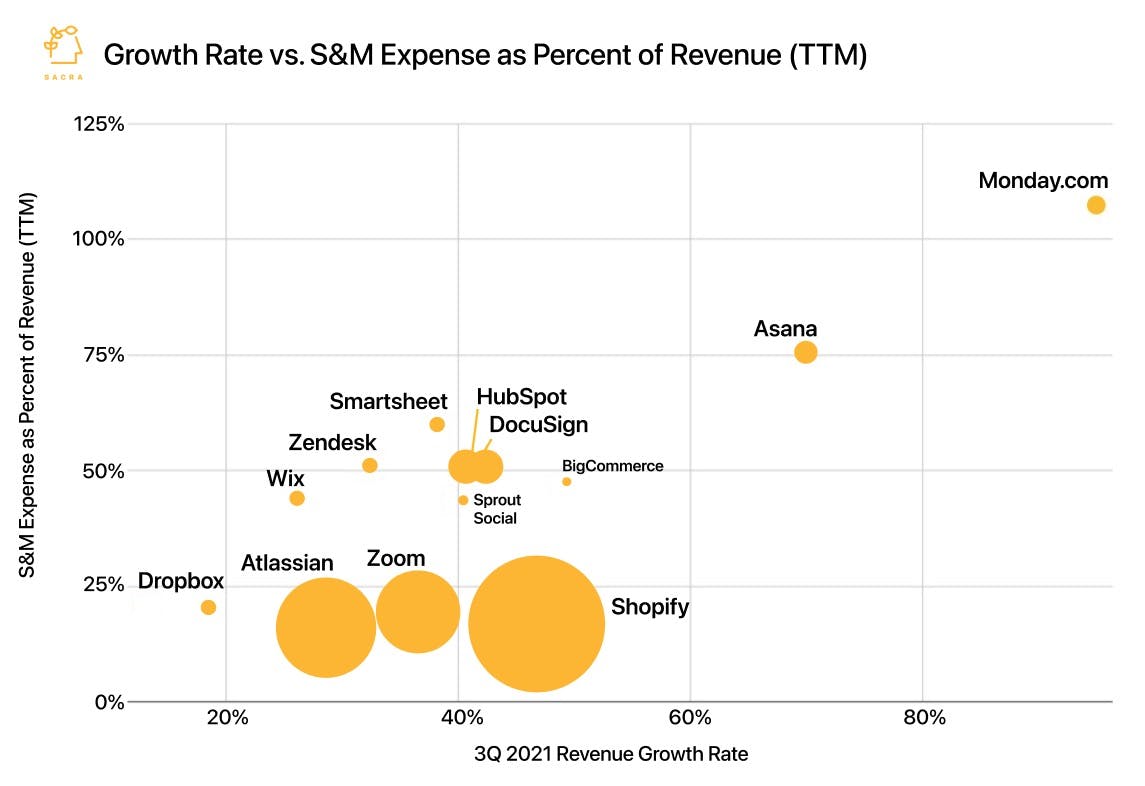

A SaaS company’s sales and marketing expense has historically been its biggest drag on operating margins and largest expense category and that’s what makes product-led growth (PLG) potentially so consequential.

PLG’s promise is dramatically increased sales efficiency that scales not by growing the sales team’s headcount and by running more ads with Facebook and Google, but by adding more value and driving more engagement in the product.

Sales efficiency at scale is the eighth wonder of the world

Figma, for instance, takes its product data, moves it into its data warehouse Redshift with Segment, and then pulls it back out into Salesforce via Census for its sales team to have highly targeted conversations with deeply engaged users to drive expansion and upsell.

The success of companies like Figma and Canva with this PLG sales motion has turned it from a niche process implemented by engineers to a best practice with a playbook and with software—products like HeadsUp, which gives sales and success teams pre-baked PLG metrics they can connect to their data warehouse and shift into end-user tools or use directly as a CRM.

To get a better understanding of the data stack that supports the modern PLG playbook, we talked to Earl Lee, the CEO and co-founder of HeadsUp. Some of our key takeaways:

There's now customer data being generated in so many places that's not the CRM, and fundamentally, all of that has started to gravitate towards being stored in the warehouse, so the gravity is shifting towards the warehouse… [I]t's hard, as Salesforce, to re-architect your entire platform to be built on top of this notion of a cloud data warehouse, especially when all these other vendors have already built tools on top of your own platform. I'm not sure how [Salesforce] go from point A to point B there. (link)

You need to be able to draw insight and to structure that information such that people can then act on it. What is doing that? Today, transformation tools like dbt are doing that, if you take the lens of the data team really owning everything end-to-end, but I think also applications that are able to plug into the data warehouse, consume this raw information and then turn that into actionable insights. That's also assigning meaning to the raw data. The tools that are less about moving data around and more about, how do you take all this crude oil and refine it -- I think those refineries are where a lot of the value will accrue. (link)

[O]ne consistent theme, long-term, will be that the lines between sales and success increasingly become blurred, because there's not much difference between a user who's free and a user who's been a paying customer for a while. Your job as a go-to-market team should be to help that user unlock value from the product and continue to realize new value in the product, because that's ultimately how you're going to drive revenue… [U]timately activation drives towards conversion, so these growth teams are, I would say, a parallel layer on top of traditional sales, marketing, and customer success. (link)

Sean Lynch, co-founder of Census, on reverse ETL

Reverse ETL tools like Census act as the return path for data from the data warehouse into end-user tools like Salesforce, HubSpot, Intercom, and Zendesk, where it can be used by sales and success teams to build deeper relationships with customers and precisely target their upsells.

Matthew Moore, Lime's Head of Design, on Figma’s path upmarket

At $10B in valuation, Figma’s long-term upside now rests on their ability to take their product-led GTM into the enterprise and compete with Adobe. If they succeed in scaling product-led sales, Figma has the potential to grow more efficiently than Adobe, which spends 27% of revenue on sales and marketing.

Our conversation with Lime head of design and ex-Uber design manager Matthew Moore goes into more detail on how Figma's use case as a collaborative platform between marketing, product, and engineering positions it against Adobe.