Hi everyone 👋

Sign Up Today!

To get these right in your inbox

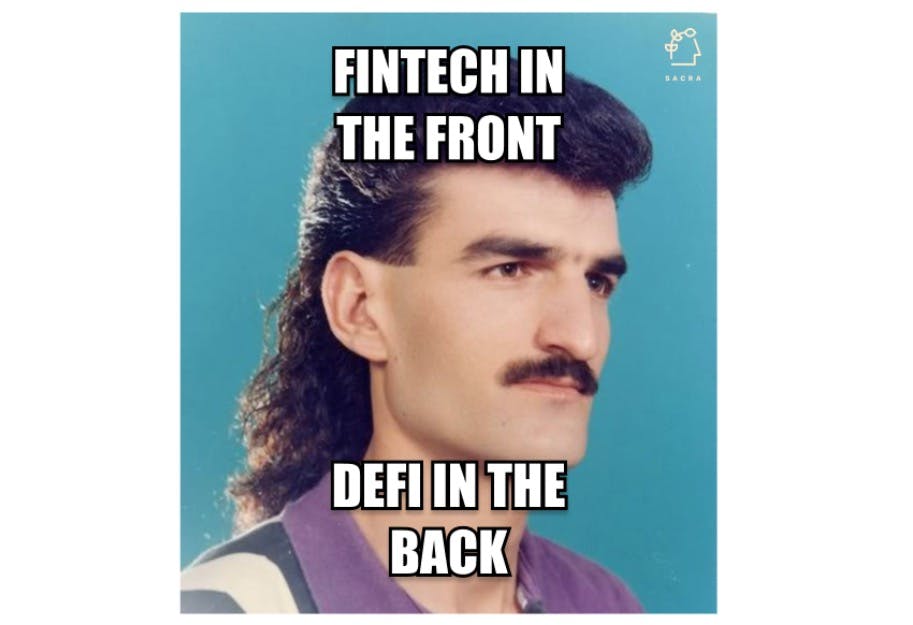

While crypto and fintech have run on separate parallel tracks, in 2022 we're seeing the trend of developers chopping and screwing those boundaries to invent new consumer experiences.

Developers are growing DeFi mullets—building consumer products that take the UX of consumer fintech and wrap it around a backend powered by DeFi with companies like Eco, which offers a checking account with 5% APY via crypto.

These DeFi mullets and other kinds of novel consumer experiences contrast with the kind of straightforward, playbooked opportunities like neobank for X and vertical SaaS for Y enabled by banking-as-a-service (BaaS) platforms: build a brand around a specific customer segment, augment with tools and services, and launch a bunch of financial services to grow ARPU.

But it's point solutions that are enabling developers to invent new kinds of consumer products and experiences. To understand the upside, look no farther than buy-now-pay-later (BNPL), which was a novel consumer experience 5 years ago and today is an $80B market.

To learn more about how developers are remixing existing fintech categories and building these kinds of novel experiences, we talked to:

- Meg Nakamura, CEO of Apto (card issuing)

- Shamir Karkal, CEO of SIla (ACH)

- Nikil Konduru, GTM Strategy at Lithic (card issuing)

Here are some of our key takeaways:

It all comes down to [banking-as-a-service platforms] making it incredibly easy to get started. The way in which they're able to facilitate that is, every program fits within a certain framework of features and functionality. If that framework works for you and a vanilla program design accomplishes your needs, then it's perfect for you. You click a button, and you can deploy a card… On the flip side, if you have any customizations or bespoke desires, [they’re] not going to be your best partner. [They’re] going to continue to be great for some customers, but not great for others. —Meg (link)

I think the experience of a lot of [BaaS customers] was that it seems like a very compelling proposition when you start. You're like, "Hey, everything that I could possibly imagine is built into this platform. It's just one API call away." And then a lot of customers realize that it's really hard to be good at everything... It's more work to integrate [point solutions] than it is to just integrate one API. But you'll probably end up finding out that, as you scale, it ends up being a much better solution. —Shamir (link)

One of the best things about this job is getting to interact with exceptional founders. I have conversations every week with folks that are building incredibly creative, incredibly disruptive businesses. Many of these I’m confident can become giant businesses, even the ones building in what you might otherwise think of as niche markets. We have an idea of the serviceable addressable market sizes across different industries but there’s always room for surprises to the upside as we’ve learned and re-learned about fintech and vertical SaaS in equal measures this last decade. As a result, at Lithic, we’re heads down focused on building the most flexible card issuing tools that customers can leverage for any number of novel use cases. —Nikil (link)

For more on how banking-as-a-service platforms and point solutions enable novel forms of fintech, check out our full interviews with Meg, Shamir, and Nikil.

Meg Nakamura on winning underserved markets with card issuing

Where banking-as-a-service platforms can offer a broad range of services through their sponsor bank relationships, point solutions like Apto index on interoperability and making it easier than ever for developers anywhere to build using their fintech primitives—with a particular eye towards markets that have been underserved by existing financial and fintech infrastructure.

Nikil Konduru and Shamir Karkal on fintech point solutions

Companies like Lithic (card issuing) and Sila (ACH) are coming after incumbents like Jack Henry, Global Payments, FIS, and Fiserv (which earn a combined $40B in revenue per year)

But their approach, differentiated from end-to-end banking-as-a-service BaaS platforms, is to peel off specific functions and build best-of-breed solutions—then, critically, to partner with each other so that fintech developers can easily build using them.

Q&A on ultrafast delivery with Matt Newberg, founder of hngry.tv

On Thursday (1/20) at 10am PT/1pm ET, join us for a Q&A with Matt Newberg, founder of hngry.tv and host of The Feed podcast.

We'll discuss the rise of ultrafast delivery and companies like JOKR and Gorillas, trends in food tech, and how COVID has forever changed how we order and eat food and groceries.

And in case you missed it, check out Sacra's coverage of Ultrafast Delivery: The $28B Market to Build the On-Demand Bodega.

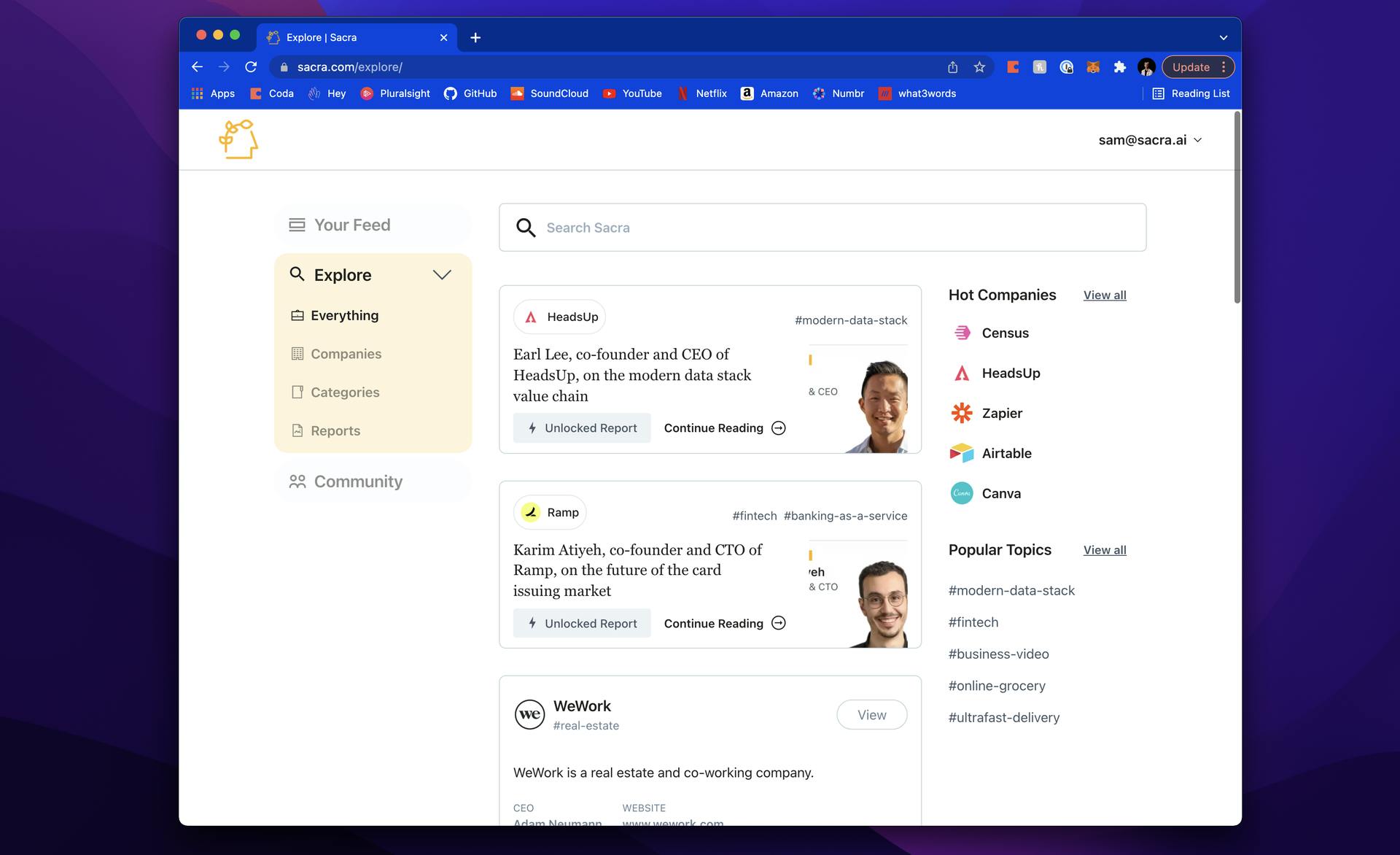

Product update: Design refresh

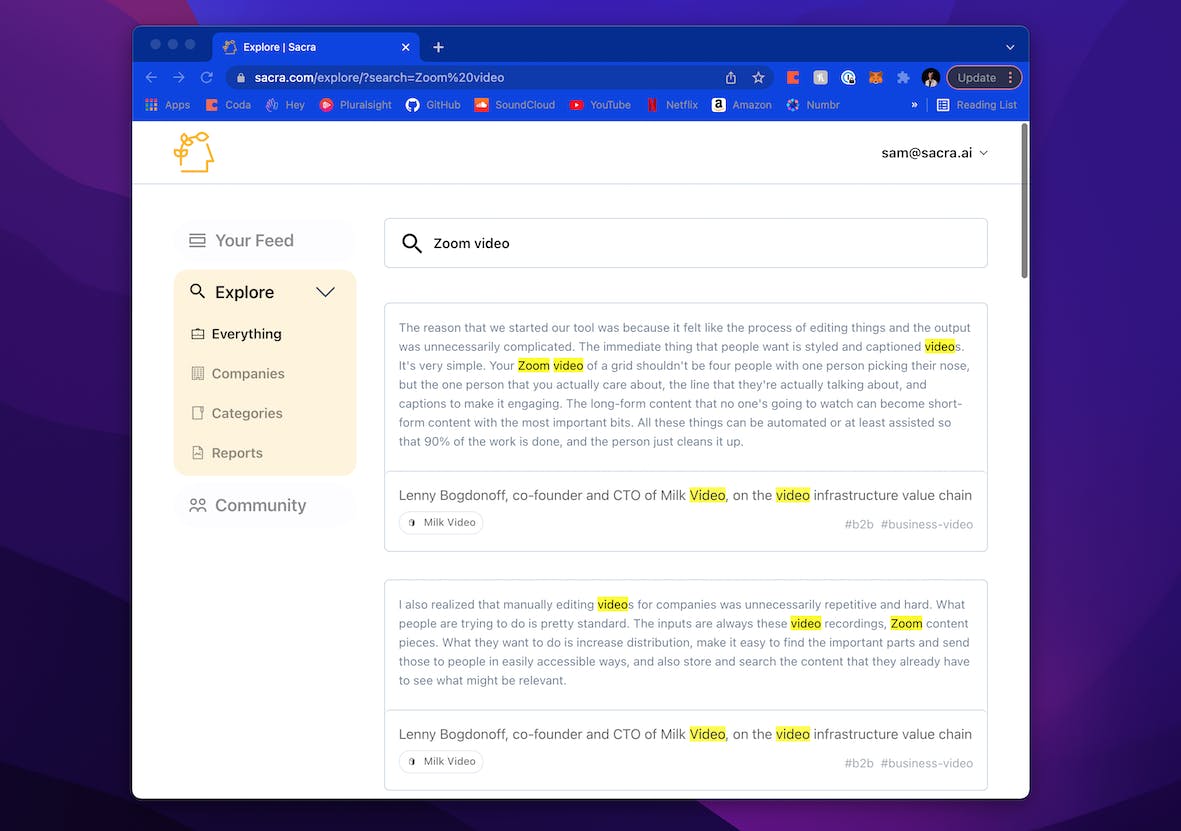

Each of our pages have been standardized into a three pillar format, and we shrank down our previews so you can see more results on each page.

We’ve also simplified search, so when results are clicked, they take you to the section of the document with your search query highlighted.

Reply to this email if you have feedback on this or any other features you'd like to see on the Sacra site!