We’re thrilled to announce this week’s exclusive with David Peterson, operator, investor, and no-code evangelist! Previously served in a variety of GTM functions including Co-founder (Steward), Head of Growth (CompStack) and Account Management (Google), his current role at Airtable focuses on building Airtable for Startups and establishing their global consultant partner network. Having worked with hundreds of early-stage companies, David is also an angel investor & advisor (Levity, Gamma, Oslash, Rocketlane, Deci + more). We were honored to pick his brain on all things cap table related, including:

- Why the biggest winners in no-code have already been built 🏰

- The secret to building a successful horizontal platform ↔️

- How he organizes & tracks his angel investments (template included below) 💰

- Cap table tips and insights ⼏

- The state of no-code in 2030 🔮

TCT: You’re a big proponent of no-code (Why “no code operations” will be the next big job in tech), clarifying that “no-code” to you is open-world software, meaning, software that’s designed in 3D, software that trusts its users with the power to build. From an investor’s point of view, what’s the best way to capitalize on this thesis?

My instinct is that the biggest winners in the no/low code platform wars have already been built. These platforms (Airtable, Coda, Notion, Retool, Bubble etc.) may not be ubiquitous yet, but we’ll see at least some of them reach escape velocity over the next few years. That dynamic is laying the groundwork for the next big set of opportunities in the space. Two specific theses that I’ve been tracking:

First, with the platforms in place (even if they aren’t ubiquitous just yet), I’m really excited by companies that turn challenging technical problems into “no-code” building blocks that can be seamlessly added to any workflow. For example, companies like Levity and Obviously.ai are making it dead simple to develop custom machine learning algorithms. These are problems that are too specific or technically challenging for the platforms to solve in-house, but unlock massive value for end-users.

Second, inspired by my colleague Taylor Savage, I think we’re on the cusp of the next SaaS app gold rush. We’ve seen the proliferation of verticalized SaaS software over the past 20 years. My prediction is that the next SaaS explosion will be software built on top of the platforms mentioned above. There are a few reasons for this: (1) upfront development costs have continued to plummet, even more so when building on top of a platform like Airtable which handles a lot of the complexity of building a new SaaS app out-of-the-box, and (2) these platforms are naturally horizontal, leaving vertical feature gaps that can be exploited by developers. I’m not sure if there’s a venture-scale opportunity here, and VCs do tend to shy away from platform-dependent businesses (for good reason), but there’s a lot of money to be made. There are already a lot of consultants in the space, and I wouldn’t be surprised if we started seeing “SaaS app studios” sprout up that are exclusively focused on these platforms in the next 6-12 months.

Every VC wants to invest in the next horizontal platform, but they’re scared. So they all offer the same advice: choose a vertical, prove it out, then expand horizontally.

— David Peterson (@edavidpeterson) January 20, 2021

This is bad advice and a huge mistake.

Can you tell us a bit more about how you’d approach it from the VC perspective and how not to make this mistake?

Okay, so I’ll be the first to admit that this thread missed some nuance :)

First, not all products ought to be horizontal! There are massive vertically-focused companies out there. If you want to build that (or fund that), go for it.

That being said, if the company has made the decision to go horizontal, the reality is that they’ll still need to go after specific use cases to gain initial traction. The challenge is executing on use-case specific go-to-market without undermining the horizontal nature of the product.

I think there are some good examples of different approaches here. One might be the Amazon approach (an “internalized platform”). Start with one vertical (books). Expand by building out business units focused on additional verticals, all plugging in to the central logistical nervous system of the company. Another might be the Salesforce approach (or an “externalized platform”). Build the toolkit, own some high priority use cases yourself, but largely rely on partners to build the vertical-specific solutions on top.

So from an investor perspective, that’s the question I’d dig in to. How are the founders thinking about going to market? If they want to build a horizontal product, do they have a clear idea of their path from early-stage go-to-market (which is more about identifying target use cases and balancing vertical GTM with a horizontal vision) to the broader horizontal play?

You’ve been an active angel investor and advisor (Levity, Gamma, Oslash, Rocketlane, Deci + more) for a little over a year now. How did you get into angel investing, and how did you go about getting the money for your first investment?

I kind of fell into angel investing without planning on it. I’ve always loved brainstorming about early-stage ideas, so naturally started meeting with investors and founders to discuss what they were working on. One time, a founder mentioned they were raising a round, and I was just so bullish on the company, I surprised myself and asked if I could put in a small check. They were nice enough to say yes.

What’s your angel investing due diligence process like, and how quickly do you decide on an investment?

Minimal, at best! I don’t have a big pile of cash I’m trying to deploy, so I’m not actively hunting for new companies to push through my pipeline. Really I’m just looking for founders and products that I’m unabashedly excited about. The two questions I ask myself are:

- Could I imagine using this product myself?

- Am I still thinking about the product when I’m going to bed later that night?

If the answer to both of those questions is yes, I’ll try to get a small allocation…and then wrack my brain for ways to be as useful as I possibly can be.

How do you stay organized for your angel investments (managing notes, SAFEs, performance, pipeline, etc?)

Shameless plug for Airtable here :)

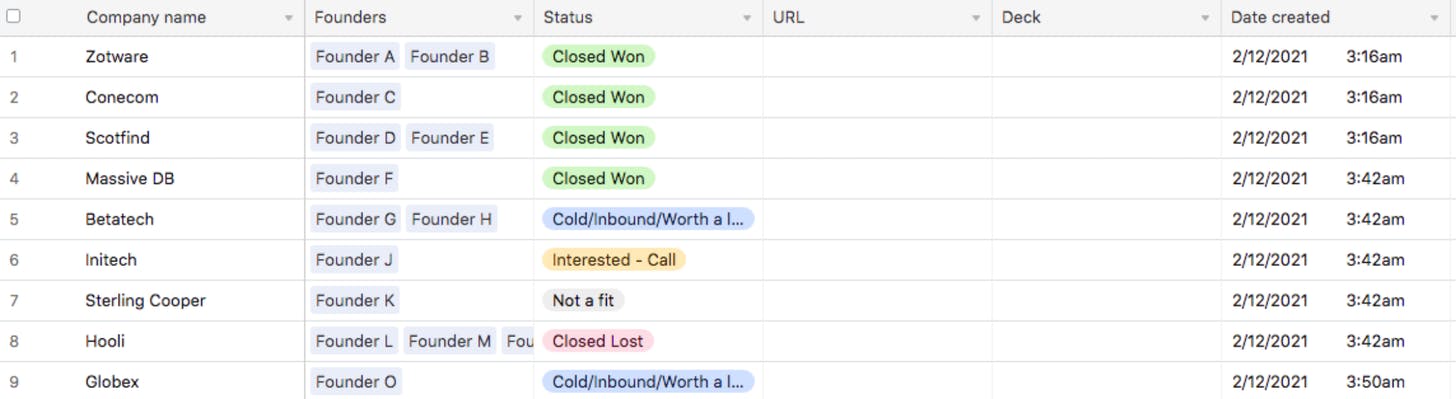

I’ve created a combined CRM, dealflow tracker, and portfolio tracker. The number of investments and contacts are low enough that I don’t need a very robust system. This lets me keep track of everything that I really care about (contacts, docs, notes, performance over time) in one place.

David’s Simple Angel investor CRM:

It’s pretty simple, but given the impressive systems I’ve seen some investors build with Airtable, I know it will scale up easily over time.

There’s a handful of options for angel investors looking to get on the cap table (crowdfunding, syndicates, SPV’s, and direct allocations). Which option would you recommend to first-time investors and why?

I think that depends on your goals with angel investing in the first place. If you’re just looking to get exposure to the asset class, investing in a rolling fund or as part of a syndicate is an easy, low friction way to get started. Personally, my goals are to be directly involved and do whatever I can to make these companies I’m betting on be successful. As a result, for me, direct allocations (however small!) make a lot more sense.

Sign Up Today!

To get these right in your inbox

What’s your secret for getting on the cap table?

I wouldn’t claim to have any special secrets, but here are two things that have worked for me.

First, assuming you’re already connected with the founder and excited about the company, just ask! Even if it’s a tiny check that won’t materially impact the company, don’t be shy. Express your excitement, pitch how you can be useful, and hope for the best.

Second, what if you’re not connected with the founder? If you use the product and you genuinely love it — send a note to the founder offering your thoughts (and maybe some virtual high fives to the team for a job well done)! Worst case, your authentic excitement just gave that team a little pick-me-up. Best case, maybe there’s some way you can help and now you’re on the founder’s radar.

Do you have aspirations for investing full time? What milestones would you need to achieve in order to pursue this?

At this point, no. Though definitely not ruling it out.

I’ve loved the little bit of investing that I’ve been able to do as an “operator.” Because I’m still in the weeds at Airtable every day, I feel like I’m able to offer (somewhat) useful operational advice based on my experience. I think you lose a bit of that when you start investing full time. Also, let’s be honest, it’s much easier to convince a founder to take a small angel check vs. letting you lead a round. So I’m wary to even compare the two.

That being said, as somebody who enjoys project-based work and going deep on a wide variety of topics, I can absolutely see the allure of investing full time.

Candidly, something that I think is critical to being a good investor, but I’m not sure I have yet, is muscle memory for a good deal. I don’t think you develop that muscle memory without making a lot of bad investments, or missing out on a lot of great investments, or both. You need to take enough swings that you get a feel for what matches your style and intuition, and what doesn’t. So I’ve got some work to do in that department.

What are you passionate about outside of work?

I find myself drawn to anything that lets me work with my hands, so more recently that’s been baking and cooking. My dream is to go spend a few months at a nearby bakery (I’m in London, so have my eye on E5 Bakehouse), put myself to work carting some bags of flour around, and learn whatever I can. We’ll see if I can convince them to take me on as an unpaid flour hauler/apprentice.

What’s the state of no code in 2030?

I think this is a classic case of that William Gibson quote which is all too popular in venture circles: “the future is already here, it’s just not evenly distributed.”

Through my work at Airtable, I’ve seen companies that have built amazingly impressive systems — essentially company-wide, fully custom ERPs — using only no/low-code tools. These systems easily rival, and more often than not replace, the SaaS applications these companies were using before. These systems, in my opinion, are the future.

However, from an outsider’s point of view, it’s easy to discount them. They’re not feature complete. They’re easily broken with an errant click or inadvertent deletion. They’re complicated and hard for anybody but the original builder to understand.

But I think they’re disruptive, in the true Christensen sense of the word. Yes, they’re worse in countless ways, but they make up for it by being powerful, flexible, and fast. As I’ve written elsewhere, when the person who feels the pain is also empowered to build the solution, the result is magical and utterly unique. Mass market software forces users to conform to a specific way of working. With no-code tools, people can build the solution that matches how they actually do their work. That’s what’s disruptive.

What does that mean? In the coming years, my bet is many SaaS tools are going to lose significant market share to these homegrown systems. And in 2030 “no-code” won’t be a category. We won’t even talk about it as such because it will be everywhere. It will just be...software.

Follow David (@edavidpeterson) for more insights into no-code, startups and angel investing!

Deal News 2/6-2/12

Pre-seed

- Level: $1,500,000 led by NextView Ventures, Untapped Capital. Building financial services for the new economy.

- Zeta: $1,500,000 led by Deciens Capital, Precursor Ventures. Zeta is a financial services company that offers fully automated money management tools.

Seed

- Uptime App: $16,000,000 Uptime App: Thousands of 5-minute Knowledge Hacks from the world’s best books, courses and documentaries, for free.

- Homa Games: $15,000,000 led by e.ventures, Idinvest Partners. Homa Games is specialised in the publishing, user acquisition and monetization of mobile games.

- Mobix Labs: $10,000,000. Mobix Labs is a manufacturer of semiconductors that are used for 5th generation technology.

- TomoCredit: $7,000,000. TomoCredit helps millennials get the credit cards they deserve by analyzing alternative data sets.

- Kargo: $6,000,000 led by Founders Fund. Kargo offers a smart loading dock to make operations intuitive and responsive using computer vision.

- Accord: $6,000,000 led by Stripe. Accord is a customer-facing collaborative workspace, built for B2B sales.

- RAW Labs: $5,500,000 led by Investiere. RAW Labs SA tames the exponential growth of Big Data through innovative tools which federate and query raw data in-situ.

- anecdotes: $5,000,000 led by Aleph, Glilot Capital Partners. anecdotes empowers compliance leaders with innovation by streamlining their infosec compliance efforts.

- PayZen: $5,000,000. PayZen is a health care fintech startup that aims to tackle the growing patient payment responsibility problem.

- Rhino Health: $5,000,000 led by LionBird. Rhino Health eliminates the complexity, expense and risk of moving and managing huge volumes of data.

Series A

- Fabric: $43,000,000 led by Norwest Venture Partners. Fabric is a headless commerce platform helping direct-to-consumer and B2B brands utilize an eCommerce platform designed for their needs.

- Lusha Systems Inc: $40,000,000 led by PSG. B2B engagement is based on trust. Lusha helps you build that trust.

- SpyBiotech: $32,500,000 led by Braavos Investment Advisers. SpyBiotech Operators of a biotechnology platform intended to generate next-generation vaccines.

- BigHat Biosciences: $19,000,000 led by Andreessen Horowitz. BigHat Biosciences is a protein therapeutics company that develops an antibody design platform guided by artificial intelligence.

- theator: $15,500,000 led by Insight Partners. Theator is a surgical intelligence platform that combines artificial intelligence and computer vision to improve surgeon performance.

- Nothing: $15,000,000 led by GV. Nothing is removing the barriers between people and technology to create a seamless digital future.

- Equip Health: $13,000,000 led by Optum Ventures. Equip Health provides a virtual eating disorder treatment program designed to assist families recover from eating disorders at home.

- Capitalize: $12,500,000 led by Canapi Ventures. Capitalize is a fintech company that helps people find and transfer old retirement accounts and open new ones.

- SmartHop: $12,000,000 led by Union Square Ventures. SmartHop is a business-in-a-box platform that empowers small trucking companies and owner-operators to earn more while doing less.

- Insightin Health: $12,000,000 led by Blue Heron Capital, The Blue Venture Fund. Insightin Health is a provider of data-driven decision-making technology for healthcare member acquisition, retention, and engagement.

- Prefect: $11,500,000 led by Patrick O'Shaughnessy. Prefect is a new workflow management system, designed for modern infrastructure and powered by the open-source Prefect Core workflow engine.

- C-Zero: $11,500,000 led by Breakthrough Energy Ventures, Eni Next. C-Zero is unlocking the zero-emission energy embedded in natural gas

- SoLo Funds: $10,000,000 led by ACME Capital. SoLo is a lender company allowing members to easily access and supply short-term funds for immediate needs.

- Gentem: $10,000,000 led by Vulcan Capital. Gentem helps providers get paid more and faster than ever before by automating medical billing and simplifying the reimbursement experience.

Series B

- Plus.ai: $200,000,000 led by CPE Capital, Guotai Junan International, Hedosophia, Wanxiang International Investment. Plus develops self-driving trucks to enable large-scale commercialization of autonomous transport.

- Savage X Fenty: Lingerie by Rihanna: $115,000,000 led by L Catterton. Savage X Fenty celebrates fearlessness, confidence and inclusivity.

- Instabox: $90,000,000 led by EQT Ventures. Instabox is a delivery service available to select online partners where packages are delivered to smart box locations 7 days a week.

- Mighty Buildings: $40,000,000 led by Khosla Ventures, Zeno Ventures. Mighty Buildings develops 3D printing technology and a automation platform that makes housing more affordable for customers.

- Isotropic Systems: $40,000,000 led by SES S.A.. Isotropic Systems develops multi-service, high-bandwidth, low power, fully integrated terminals designed to support the satellite industry.

- Vivun: $35,000,000 led by Menlo Ventures. Vivun offers an AI-powered software for PreSales, designed to transform how B2B technology companies go to market.

- Monte Carlo: $25,000,000 led by GGV Capital, Redpoint. Monte Carlo is a digital data reliability platform designed to monitor and offer alert for missing or inaccurate data.

- Nobl9: $21,000,000 led by Battery Ventures. Nobl9 Service Level Objective platform connects your reliability metrics to business goals via a modern engineering workflow.

- Lengoo: $20,000,000 led by INKEF Capital. Lengoo is a full-service technology platform for customer-specific machine translation using neural networks.

- WireWheel.io: $20,000,000 led by ForgePoint Capital. WireWheel.io is a software company that revolutionizes data privacy and protection as-a-service for companies.

Series C

- Pony.ai: $100,000,000 led by Ontario Teachers' Pension Plan. Pony.ai is a startup that builds full-stack autonomous driving solutions.

- RapidSOS: $85,000,000 led by Global Venture Capital, Insight Partners. RapidSOS is a creator of an emergency response data platform that securely links life-saving data to 911 and first responders.

- Human Interest: $55,000,000 led by Glynn Capital Management. Human Interest is a 401(k) provider that helps employees of small and medium-sized businesses save for retirement.

- NYMBUS: $53,000,000 led by Insight Partners. NYMBUS is a provider of banking technology solutions for financial institutions to innovate and grow.

- Jackpocket: $50,000,000 led by The Raine Group. Jackpocket is a third-party app providing a secure way to order official state lottery tickets.

- Pivotal Commware: $50,000,000 led by Tracker Capital Management. Pivotal Commware develops software-defined antennas and radios that use holographic beamforming to increase network speed and capacity.

- Swift Navigation: $50,000,000 led by Forest Baskett, Greg Papadopoulos. Swift Navigation offers hardware and software that makes GPS positioning technology available for autonomous vehicle and device guidance.

- Labelbox: $40,000,000 led by B Capital Group. Labelbox is a collaborative data training platform that creates and manages labeled data for machine learning applications.

- Seraxis: $40,000,000 led by Eli Lilly. Seraxis is a privately owned biotechnology company.

Series D

- Thrasio: $750,000,000. Thrasio is a digital consumer goods company that acquires private label Amazon FBA businesses and direct-to-consumer e-commerce brands.

- Armis Security: $125,000,000 led by Brookfield Asset Management. Armis Security offers an agentless IoT security solution that lets enterprises see and control any device or network.

- Kong: $100,000,000 led by Tiger Global Management. Kong is an open-source platform to manage and secure APIs and Microservices.

- Hyperfine Research: $90,000,000. Hyperfine Research mission is to democratize healthcare by making medical imaging accessible to everyone around the world.

- Modern Health: $74,000,000 led by Founders Fund. Modern Health is a mental well-being platform for innovative companies offering therapy, coaching, and self-guided courses all in one app.

Series E

- Reddit: $250,000,000 led by Vy Capital. Reddit is an online platform that enables users to submit links, create content, and have discussions about the topics of their interest.

- Enevate: $81,000,000 led by Fidelity Management and Research Company. Enevate is a rechargeable energy storage technology company delivering innovative battery capacity in Li-ion ecosystem.

Sources: Crunchbase, LinkedIn, Twitter