Hi everyone 👋

Sign Up Today!

To get these right in your inbox

If rules proposed by the SEC last month become law, about 3,000 of the biggest public companies will have to start tracking and reporting data on their greenhouse gas emissions.

That will be a huge tailwind for SaaS companies automating the time-consuming, manual workflows associated with carbon reporting and offsetting, from carbon accounting ERPs like Persefoni to API-based carbon credit providers like Patch.

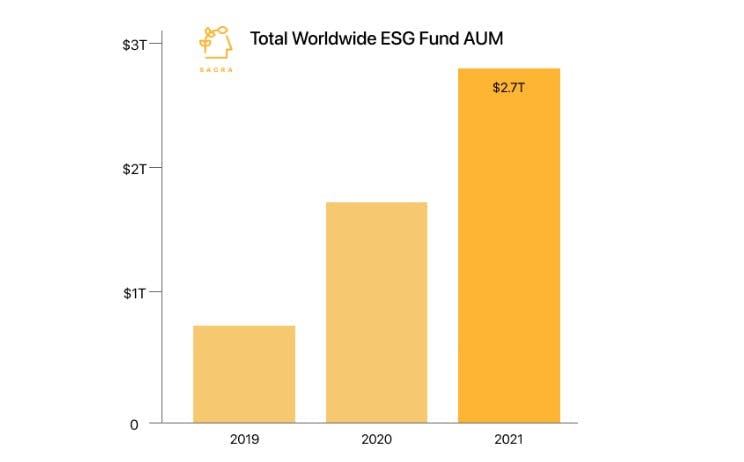

Global demand for sustainable assets is growing rapidly. Last year, total ESG funds under management hit $2.74 trillion.

Companies and funds use carbon accounting providers to quantify their total carbon footprint, and then they use APIs like Patch to programmatically navigate the project marketplace and pay for the right amount of carbon offsetting.

These kinds of companies could be prime picks and shovels for a world where companies and funds have to prove they are run sustainably—rather than merely assert it.

For more on the SaaS stack emerging around decarbonization, check out our interviews with Brennan Spellacy, the CEO and co-founder of Patch, and Ryan Miller, VP & GM of Private Markets at Persefoni.

Thanks!

Jan & team

Brex is getting into FP&A

Financial planning & analysis tool Pry was recently acquired by Brex for $90M just six months after leaving beta. That’s a big win for a team of 10 that raised just a $4M seed round.

In case you missed it, we interviewed Pry CEO and co-founder Andy Su back in February about the FP&A space and the digitization of the SaaS backoffice.

We raised the possibility with Andy that companies like Brex and Ramp would eventually want to build out their own FP&A capabilities to further capitalize on the powerful point of integration they own in the corporate card:

- To speak directly to Brex and Ramp… FP&A is certainly something that I think they can build and would be exciting and interesting for them to build. But I'm not worried because FP&A is such a large market. There should be multiple players that win. So if Brex or Ramp decides to build here, then it'll further validate that there's something here and that we will eventually do quite well. (link)

This acquisition is a strong sign that Brex is looking to expand the back-office side of its business, and it amps up the competition between them and expense-management focused corporate card Ramp.

New & upcoming interviews

Reply to this email to offer questions you’d like us to ask upcoming interviewees, request specific interviewees and offer feedback.

New

- Ryan Miller, VP & GM, Private Markets at Persefoni: $101M Series B from Prelude Ventures to build the ERP for carbon

- Brennan Spellacy, Co-Founder and CEO at Patch: $20.8M Series A from Coatue to build the API layer connecting corporations and funds with carbon offset projects

Upcoming

- Mike Bell, CEO of Miso Robotics: $35M Series D via equity crowdfunding—talking to learn more about how robotic ghost kitchens can reshape the economics of on-demand food delivery

New company profiles

Here are all of our recently published or updated company profiles:

- Figma: $200M Series E from Durable Capital Partners to take on the Adobe Creative Suite

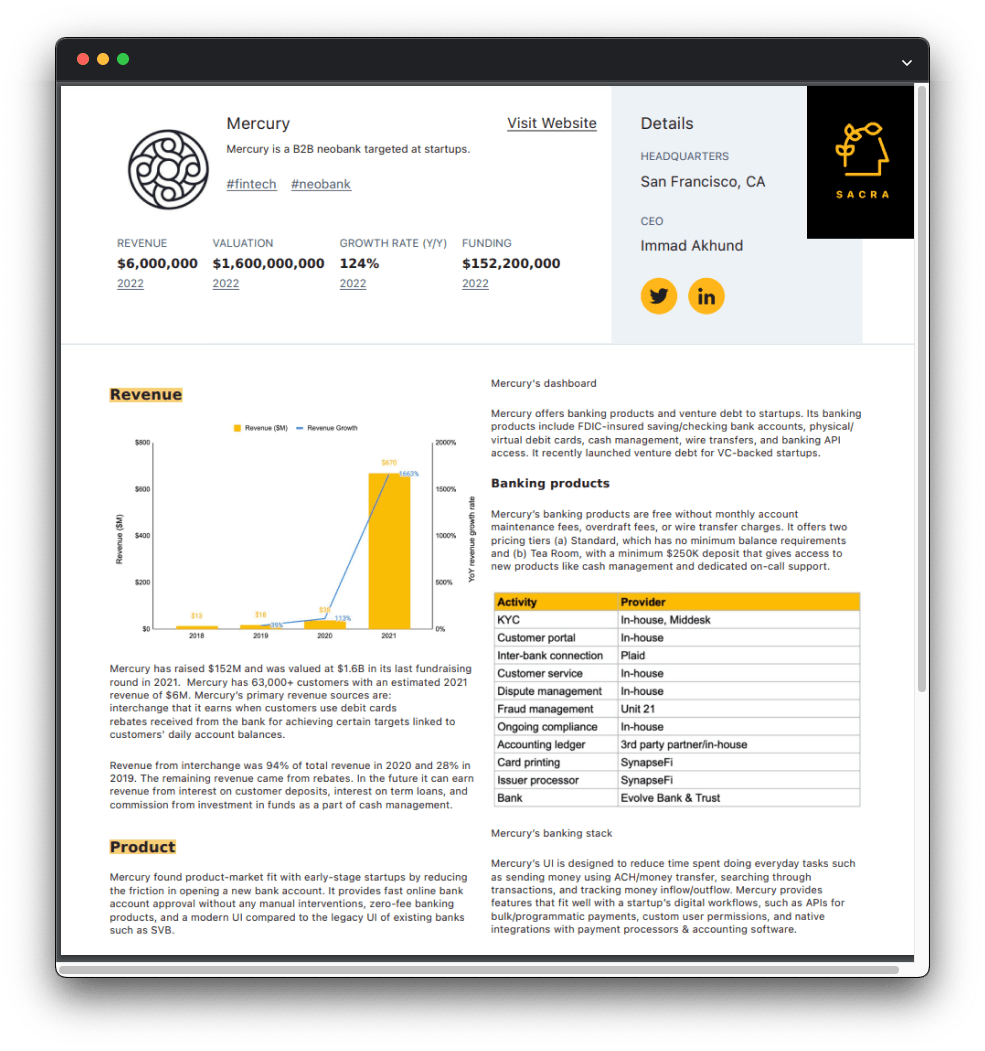

- Mercury: $120M Series B from Coatue to disrupt SVB and build a better bank for startups

Reply to this email to let us know what other companies you’d like us to cover.

Product update: New company page PDFs

Last week, we launched a new iteration of our company pages that brings together in one place all of our expert interviews and analysis on that company.

To download a PDF of one of our company profiles, just hit the "View PDF" button at the top of the page.

If you're interested in licensing Sacra company profiles to share with investors, customers or readers, reply to this email to let us know.