ChowNow, Lunchbox, and the $12B product-market fit of pizza that launched food delivery

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: COVID was a huge tailwind for DoorDash/Uber Eats, but it drove down the margins of newly delivery-reliant restaurants to 1-2%. Now, vertical SaaS for restaurants like ChowNow ($64M raised) and Lunchbox ($72M raised) are positioning against the aggregator model with their blended take rate of ~10% vs. 30%. Read our interviews with Chris Webb, CEO and co-founder of ChowNow, and Hadi Rashid, CEO and co-founder of Lunchbox, for more.

Check out our weekly email for more insights like this into private companies.

Success!

Something went wrong...

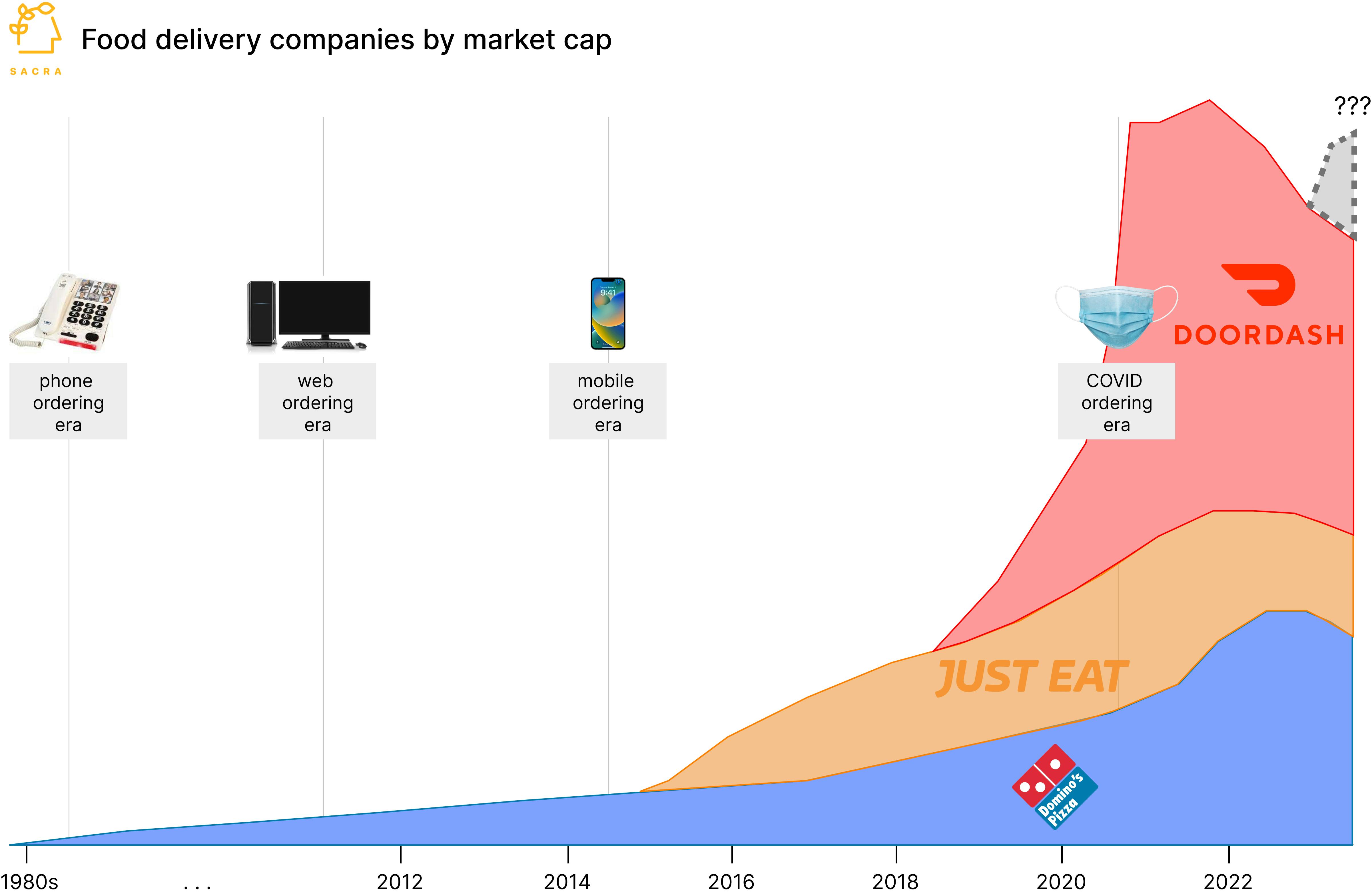

- Domino’s (NYSE: DPZ, $510M revenue in 2021) kicked off the modern era of food delivery, finding product-market fit with the delivery pizza—the perfect food for delivery due to the natural insulating properties of cardboard, sauce and cheese—delivered in 30 minutes or less. They’ve grown 180x since 2010 by re-building the company as a tech-forward brand—today, they’re a $12B company, almost as valuable as DoorDash. (link)

- Launching in 1999, Seamless (AMS: TKWY) aggregated demand for the urban office lunch and dinner crowd ordering from the web on their desktop, giving customers a single site through which they could order from “menu of menus” of restaurants with their own in-house delivery fleets. Seamless would merge with Grubhub in 2004, the combined company doing $2.1B in revenue in 2021 after being acquired by Just Eat Takeaway. (link)

- DoorDash (NYSE: DASH) reinvented Seamless for mobile, bundling location-aware logistics into the marketplace model, enabling delivery for every restaurant with a focus on suburban markets with higher basket sizes and lower courier costs due to lower COL/traffic. As of Q3’22, DoorDash GMV is at $13.5B, growing 30% YoY—more broadly, 53% of adults say that buying takeout or delivery food is key to the way that they live, up from 29% around 2010. (link)

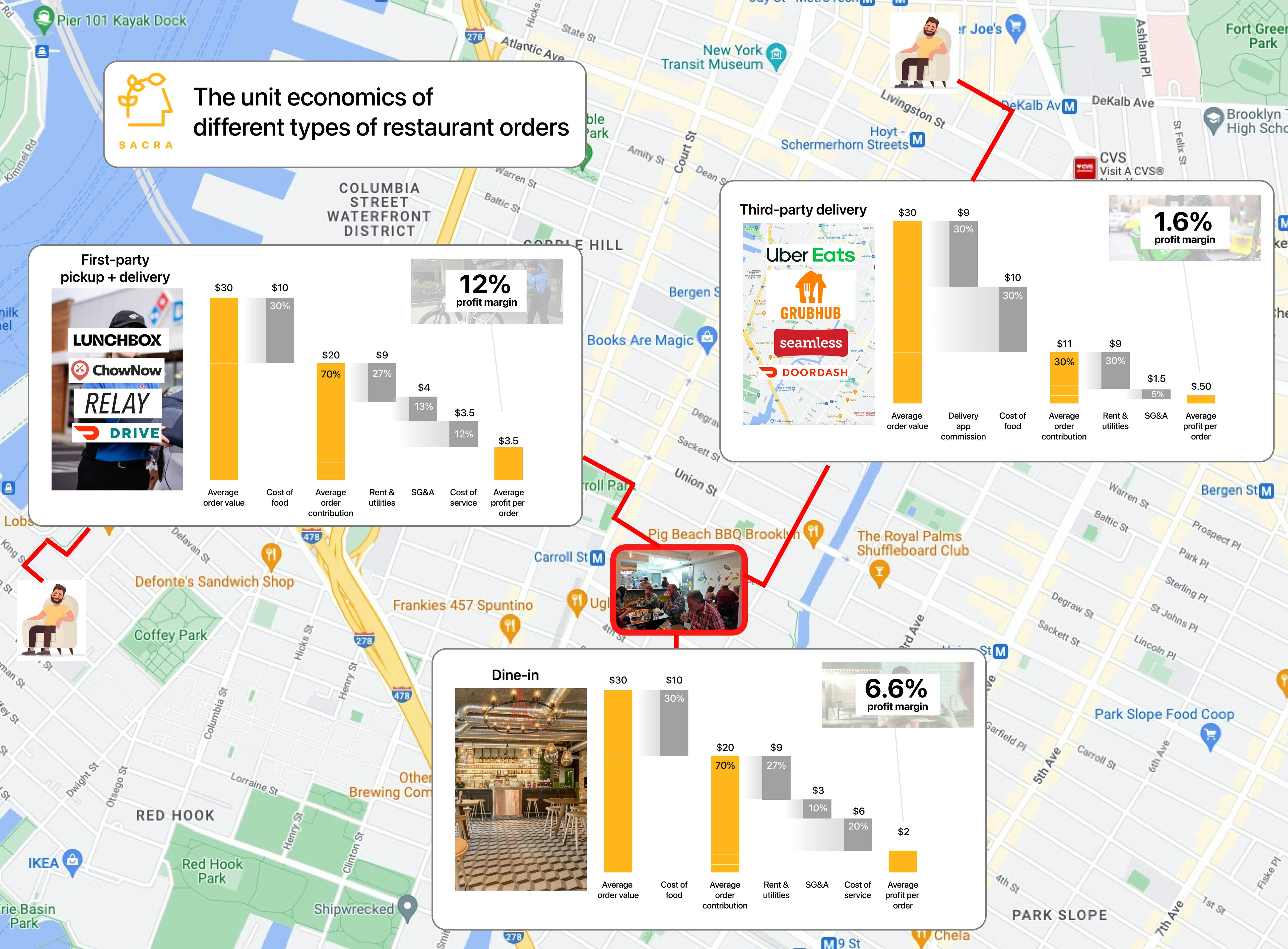

- In 2020, as COVID lockdowns shut down in-person dining, demand shifted online and DoorDash’s GMV grew 227% to $8.2B—but with a take rate that drove restaurant margins down to 1-2% . Post-COVID, with order growth slowing—in Q2’22, orders were up just 23% YoY—the delivery apps are struggling for profits, generating -$0.70 contribution margin even with their 30% take rate on AOV of $34 after delivery costs (16%), CAC (8%), and IT costs (3%). (link)

- Positioned against the aggregator model stepped in B2B SaaS for your own website with a much lower blended “take rate” of 11% vs 30% by combining products like ChowNow ($64M raised), Lunchbox ($72M), BentoBox ($52M), Popmenu ($87M) or ZenChef ($59M) for online ordering, Relay ($1M) or OnFleet ($41M) for delivery, Wix (NASDAQ: WIX) or Fisherman ($1M) for the website and Toast (NYSE: TOST) and Square (NYSE: SQ) for the point-of-sale (POS). Fixed price subscription SaaS allows for a predictable cost structure and upside on volume versus a marketplace take rate that takes a cut of every transaction. (link)

- 20K+ restaurants are using their owned software stack to drive re-engagement through the SMB toolset of loyalty, email marketing, and push notifications—and otherwise take an omnichannel approach of meeting their customers where they are on marketplaces like DoorDash and Goldbelly ($113M raised), without becoming wholly dependent on any one. By taking orders on Grubhub/Uber Eats/DoorDash but delivering orders via e.g. Relay, restaurants can cut down the commissions they pay by 75%. (link)

- Restaurants have the opportunity to monetize as brands—centered around but not limited to food—to make revenue outside their 4 walls, via memberships, loyalty programs, D2C wine clubs, catering, events & classes, and ghost kitchens (1500+ in the US). Software platforms like Lunchbox and ChowNow have a role to play in helping create and monetize good products that can drive value for restaurants across the ecosystem—like memberships, which provide restaurateurs with recurring cash flow vs. gift cards which slam restaurants with bulk redemptions. (link)

- In transitioning from a marketplace to an Amazon-like utility that powers every restaurant, DoorDash has built out vertical SaaS interoperable with a restaurant’s owned SaaS stack—giving restaurants access to their massive logistics network as well as a family of products including capital (DoorDash Capital), healthcare (via Sesame), and staffing (via LANDED) they need to operate. By renting access to their Dashers as a last-mile logistics offering for any restaurant or small business for a flat fee of $7-$11 per order, DoorDash grows their dasher node/order density, lowering their cost structure and powering the rest of their flywheel. (link)

- Toast (74K+ restaurants) and Square (~2.3M businesses) are looking to leverage their lead in POS software across in-house dining and web into building vertically-integrated SaaS for 22M restaurants to sit positioned as the platform to DoorDash’s aggregator for $800B of annual sales the way Shopify did with Amazon. Building vertical SaaS for restaurants—payments, workforce management, integrations with 3rd party delivery, capital, memberships, and more—and running payroll for the more than 15M+ people employed by the industry also provides a massive personal fintech opportunity. (link)

- To win, companies will have to avoid making Groupon’s core mistake that cost them 98% of their market cap—sacrificing marketplace health to maximize their take rate—giving an advantage to upstarts with the business model flexibility to find a win-win with the restaurants they serve. Taxing the GDP of restaurants only means something if those companies are able to also grow that GDP. (link)

For more, check out our interviews with the CEO of ChowNow Chris Webb, the CEO of Lunchbox Hadi Rashid, and this other research from our platform:

- Rappi: The $7B Meituan of Latin America [2021]

- Andrew Yates, CEO of Promoted.ai, on driving marketplace ARPU with personalization

- Sebastian Mejia, co-founder of Rappi, on building for multi-verticality in on-demand

- Mike Bell, CEO of Miso Robotics, on automating across the value chain of fast casual food

- Former corp dev at a European on-demand unicorn on dark store unit economics

- Matt Brown, Co-Founder of Bonsai, on the rise of vertical ERPs