Hi everyone 👋

Sign Up Today!

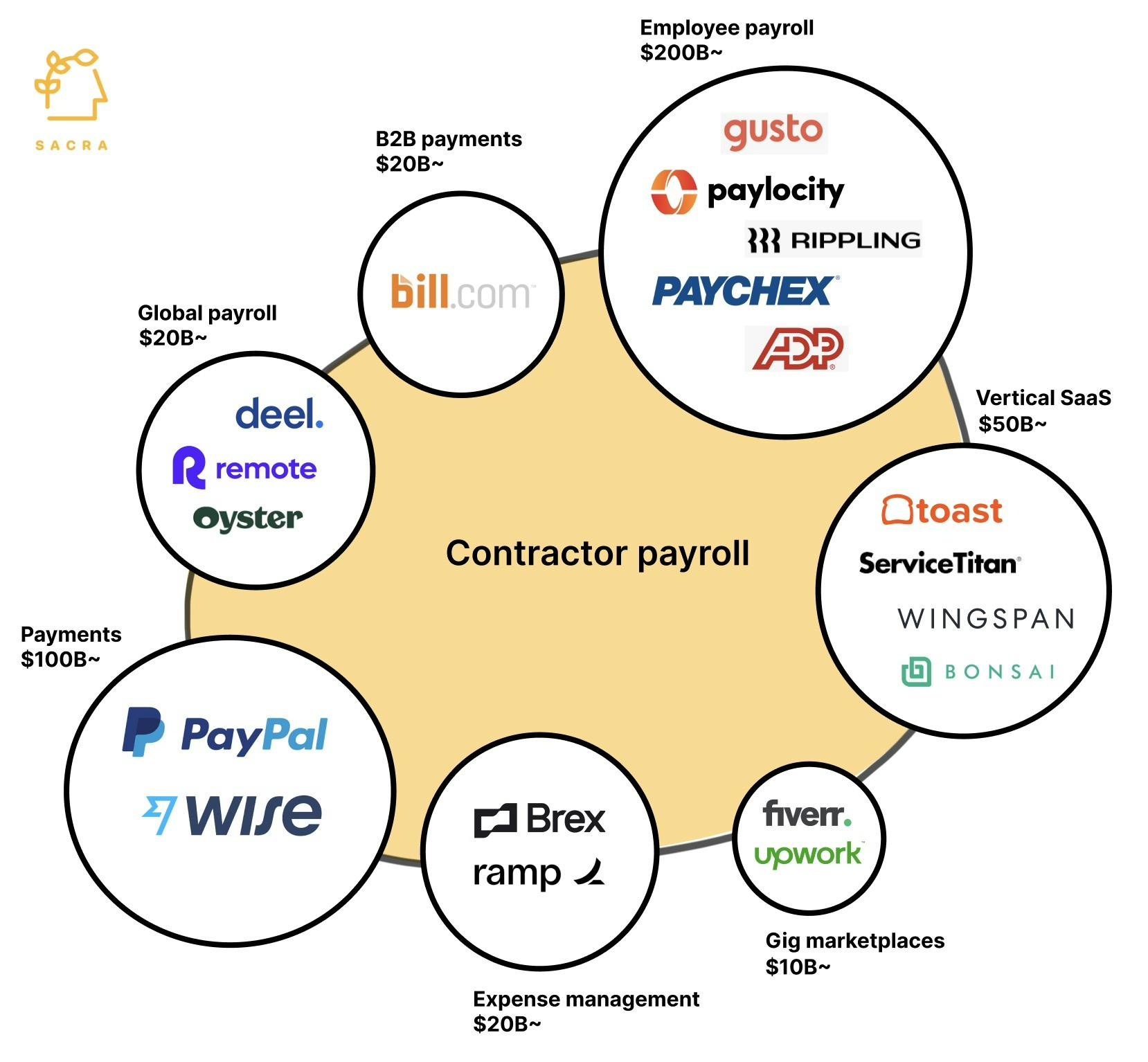

To get these right in your inbox

TL;DR: Global payroll companies like Deel, along with up-and-comers like Wingspan and Bonsai and incumbents like ADP and Bill.com, are all going after the worldwide network of independent contractors and the trillions in deposits they represent. For more, read our new report on contractor payroll, and then check out our reports on Gusto (with revenue model), Justworks and Rippling, as well as our interviews with Dan Westgarth at Deel, Anthony Mironov at Wingspan, Matt Redler at Panther, and Ved Sinha from Upwork.

- In the first phase in the history of labor geo-arbitrage, gig work marketplaces like Elance/oDesk—now Upwork ($1.72B)—democratized geo-arbitrage for simple gig-like tasks. With these marketplaces, anyone could do offshore basic gigs—writing blog posts, designing illustrations, etc.—to countries with lower costs of living. (link)

- Next, we saw employer of record companies like Globalization Partners ($4.2B) and Velocity Global ($500M raised) emerge to help companies offshore entire departments. Coming out of the Great Financial Crisis, these companies helped businesses geo-arbitrage at a greater scale. (link)

- Today, we’re seeing global payroll companies like Deel ($12B), Remote ($3B) and Oyster ($1B) grow rapidly by helping companies geo-arbitrage from day 1, when building out their core team. With the rise of global talent, the rising cost of healthcare and benefits, and COVID as tailwinds, we've seen more and more companies looking to hire globally from the beginning. (link)

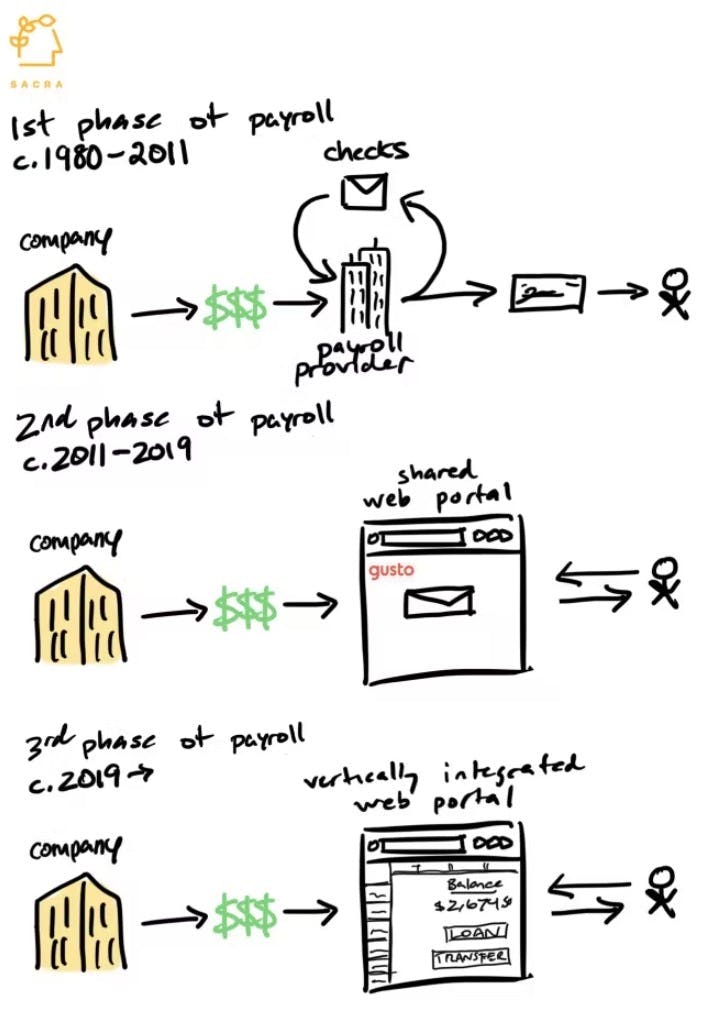

- Deel’s initial product-market fit came from layering a payroll experience on top of international contractor payments—which we call “contractor payroll”—which abstracted away local compliance and enabled employers to pay their teams in local currency with a single click. Instead of paying for an EOR, you can hire your core team as contractors first—without relying on apps like Wise ($8B) or PayPal ($97B) that are built for one-off payments, require laborious record keeping and create legal/regulatory risk. (link)

- Contractor payroll businesses combine the sticky, 90% retention business of payroll with an 80% gross margin SaaS workflow on top. Contractor payroll businesses drive SaaS revenue from access to their management/compliance features, and transactional revenue from the financial services they offer contractors/float/foreign exchange/interchange. (link)

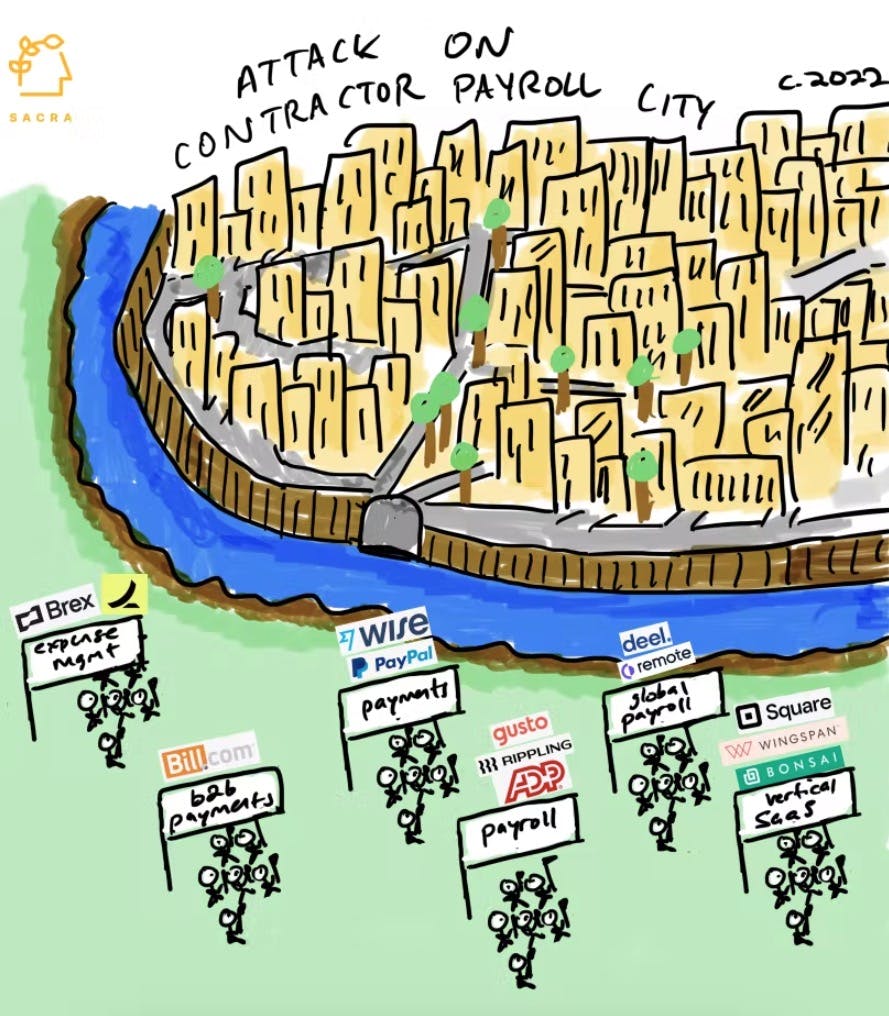

- Contractor payroll as a feature is becoming a part of many B2B products—from ADP ($96B) to Rippling ($11B), Bill.com ($12B) and Ramp ($8.1B)—as they compete to eat up all B2B transactions. Many of these companies are attacking the strategic chokepoint that is contractor payroll by weaponizing distribution and bundle economics they can use to win their target segment—from big companies hiring thousands of contractors like Wingspan ($20K-$70K ACV) to payroll providers like Gusto targeting SMBs. (link)

- APIs like Check ($119M raised) and Zeal ($15.4M raised) and products like Gusto Embedded Payroll are trying to commodify contractor payroll by abstracting it into a set of APIs any vertical SaaS like ServiceTitan ($9.5B) or Toast ($9B) can use to pay contractors and employees. With embedded contractor payroll, vertical SaaS products can build stickier products and drive additional revenue. (link)

- These companies want to own contractor payroll because contractors and companies are densely networked via payments graphs while employees are networked merely via professional graphs like LinkedIn. Owning that payments graph gives these companies access to a 60M+ user base with high stickiness, $1.4T in fund flows every year and growing, and a long list of monetizable products and services that can be sold into it. (link)

- Competition creates fragmentation across the contractor payments network—where a company may prefer paying with e.g. Bill.com while the contractor prefers payment over PayPal—perpetuating the slowness/friction in contractor payments. The contractor payroll platform that wins will need a value proposition that brings both sides—companies and their freelancers—together on the same platform. (link)

- The big opportunity to own contractor payroll is to build a closed loop network for the $1.4T and growing of freelancer payments made every year. Instead of just monetizing on the payer (company), these platforms are monetizing the payee (contractor) as well, and instead of being payroll-centric, payroll for these platforms is just a form of leverage to deploy a range of financial services. (link)

- Where Gusto ($10B) changed payroll by eliminating physical pay stubs and bringing employers and employees onto shared web portals, contractor payroll companies are building vertically integrated portals that capture the network of companies and freelancers. On top of the core payroll solution, these platforms layer on other neobank-like products and services that help contractors and that can be monetized via fees and interchange. (link)

- Cash App ($2B in gross profit/year) captured 70M consumer wallets by helping users get their money faster—today, contractor platforms can capture freelancer wallets by leveraging their position as payroll providers to do the same for contractors, who are paid late 30% of the time. By owning the contractor wallet with that 10x better experience, contractor payroll platforms then have an opening into selling a range of other products and services into their network. (link)

- On top of that closed loop payments network, contractor payroll platforms have the opportunity to multiply ARPU 5-7x ala Cash App by layering on new products for 60M+ freelancers. The ultimate vision for contractor payroll platforms is to look more like a vertical SaaS family of products for the millions of freelancers around the world, including benefits, insurance, lending, recruiting, and more. (link)

For more, read our full report on contractor payroll and check out this other research from our platform:

- Gusto company profile

- Gusto revenue model

- Justworks company profile

- Rippling company profile

- Dan Westgarth, COO of Deel, on the global payroll opportunity

- Ved Sinha, Former VP of Product at Upwork, on gig marketplaces

- Anthony Mironov, CEO of Wingspan, on building financial services for contractors

- Matt Redler, co-founder and CEO of Panther, on building a modern employer of record

Jan & team