Hi everyone 👋

Sign Up Today!

To get these right in your inbox

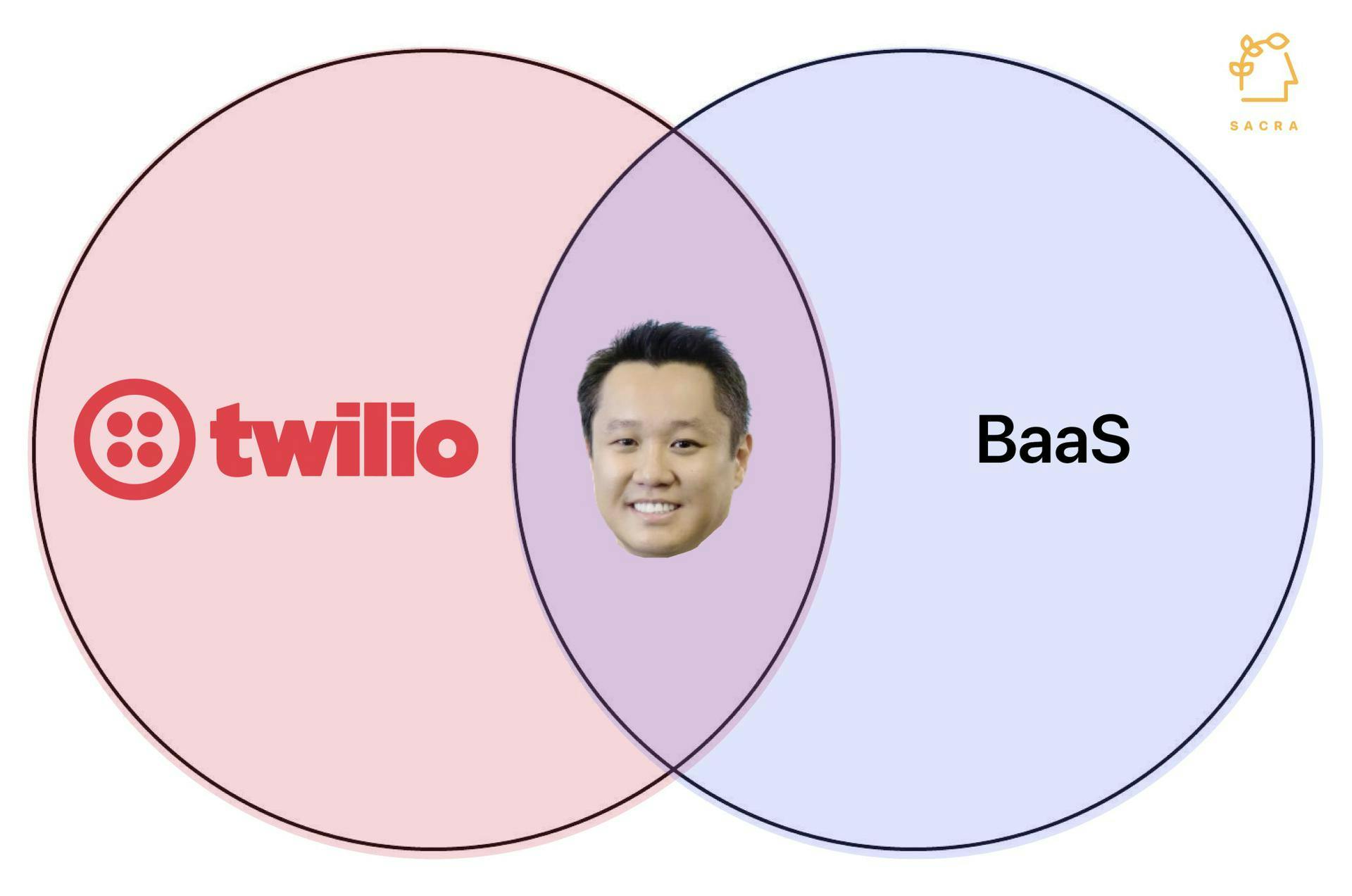

BaaS (banking-as-a-service) is in its nascency, pushing $1B in transaction volume through its pipes, 1/60th of what Marqeta does on card issuing—but the promise of becoming a unified API layer for banking as Twilio has done for telephony has huge potential, driving $150M in investment in the last 1.5 years.

A few of our key learnings from digging in with Roy:

[O]n their own [sponsor banks] may not have the reach and the distribution that they have with a platform like Bond. We go out there and talk to brands, we know what are the latest use cases and where users are getting a lot of benefits. (link)

For some of the largest companies, it's a way to better engage their customers and get data... If [the Apple Card] becomes your primary card, Apple has a really good window into how you spend and your user behavior. Companies spend a lot of money trying to understand their most loyal customers' behavior. (link)

As volumes go up, we could drive more and more cost savings back to our customers... Over time, I believe there's going to be an opportunity to be a completely utility-based platform... not dissimilar to AWS or other kinds of utilities that you've seen in the past, including Twilio. (link)

Our conversation with Bond CEO Roy Ng dives into more detail on the business of BaaS. Give it a read and let us know what you think by replying to this email.

Thanks!

Jan