We’re thrilled to announce this week’s exclusive with Ben Zises, angel investor, advisor, syndicate lead, and fund manager! As the first investor and founding advisor at quip, Ben invested in 30+ early-stage startups before launching SuperAngel fund (portfolio includes Haus, Caraway, and Envoy) earlier this year, which focuses on investing at “day zero” stage CPG, eCommerce prop-tech, and future of work companies. He previously founded RetailMLS, a marketplace for retail space, and spent years in real estate before transitioning to investing full time. We sat down to discuss:

- His founder due diligence checklist (including a personal question he asks every founder before investing) 🔎

- The story behind his first angel investment 🪥

- Why he launched a fund and his metrics to date 💰

- How he sources LP’s 🌏

- The state of venture capital in 2030 🔮

TCT: You’re a “day 0” investor, which is usually one of the first checks into a company during the pre-launch stage (e.g. quip, Caraway, Arber, Lalo, Haus & JUDY). How do you go about vetting companies at the pre-launch stage? Can you share more about your decision-making framework for understanding their business model and likelihood of becoming a billion dollar company at such an early stage?

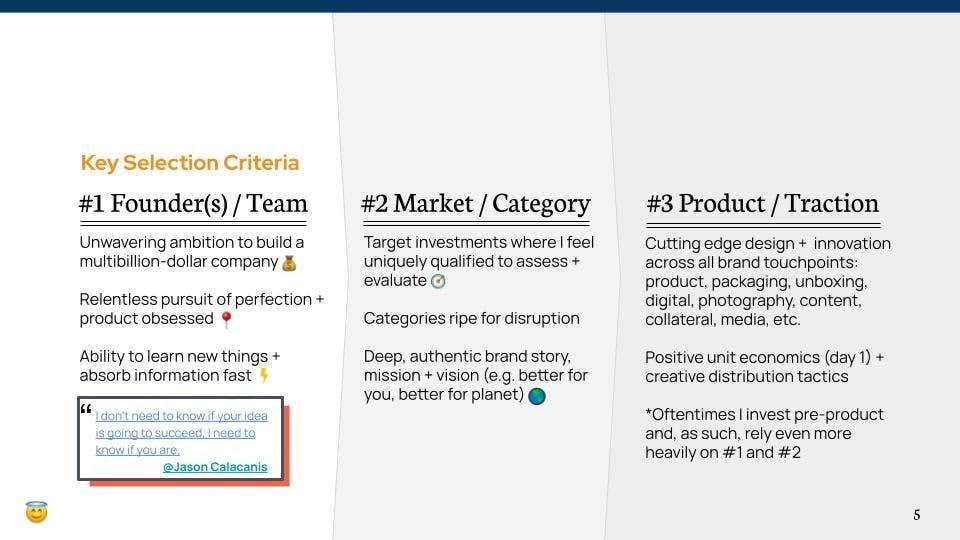

The #1 selection criteria I consider when making an investment decision is the founder(s), period. Specifically, I look for three character traits:

- (i) unwavering ambition to build a multibillion-dollar company,

- (ii) relentless pursuit of perfection (e.g. pride in craftsmanship, product obsessed), and

- (iii) ability to learn new things & absorb information fast

A founder who has these will also be resourceful and resilient. The hard part, however, is figuring out a quick and efficient way to determine whether these attributes are present. Unlike many investors, I do this by being upfront and explicit, sometimes asking uncomfortable personal questions. One question I ask every founder is, “What motivates you, and, more importantly, where did that motivation come from?” I like to understand if there is some personal, professional or family/childhood related experience that gives them an extra ‘chip on their shoulder,’ where they will stop at NOTHING to prove everyone wrong. Building a successful, venture-backed company is nearly impossible (I personally failed at it myself) - as such, the ones that succeed often need a leader with these unique skill sets and mental fortitude. See the slide below from my fund deck titled ‘Key Selection Criteria’.

You were the first investor & founding advisor at quip, a DTC oral care company which has since gone on to raise follow on rounds from some of the most notable venture funds in the world, including ACME (Uber, SpaceX, Airbnb, Robinhood, Slack, etc.). How did you meet the founder(s) and get into this deal, and what has the journey been like supporting them during their growth phases? Has your role as an investor changed at all since the pre-launch stage to now?

The story of how I met the quip founders is truly remarkable. It was a mix of hard work, hustle, paying attention to the early-stage landscape and innovation taking place throughout the economy, matched with old fashioned GOOD LUCK.

In January 2014 I flew to Miami to pitch a potential investor for my PropTech startup. The investor never came through but I ended up staying the weekend at a friend's place who took me with him to a party in Miami Beach.

At the time, I was an early customer of Dollar Shave Club and was particularly aware of how innovative and disruptive they were in the men's grooming space. At the party I overheard a group of strangers talking about a friend-of-a-friend that was starting a new ‘toothbrush subscription company.’ Back then, more than 7 years ago, there were very few consumer product categories that had been disrupted by digitally native brands, let alone ones offering a subscription component. While most people thought the idea was crazy, I immediately saw the potential and asked for an introduction to the founders, Simon and Bill.

Back in New York a few days later I invited them to my office next to Madison Square Park. I saw the toothbrush prototype IRL, along with the drive, determination and grit in their eyes, hearts and minds. I instantly believed in them, their mission and vision, knowing they would stop at nothing to accomplish their goals. Days later I handed them a check for $10k as the first investor (my first angel investment), and committed to supporting them in ANY way possible to make their dream a reality. Note: I continued investing throughout each of the subsequent financing rounds as the company grew.

After making that first investment in quip I hosted a handful of pitch events at my office, inviting my network of NYC angels to also hear their story, and ultimately connected them with other incredibly supportive early investors. Together, we were in the weeds helping with introductions, reviewing and refining their pitch deck, and responding to feedback on naming, logo and design iterations, etc. Over time, my role became more of a brand ambassador, champion, friend and cheerleader, less tactical. However, any time the company made ‘asks’ from its investors, I responded immediately, offering help in whatever ways I could to be most supportive.

You can read my tweet thread here to learn more about the story. Also below is a photo from the early days at quip’s Dumbo office, where every order was individually picked/packed, fulfilled and shipped from.

Simon and Bill’s attention to detail across every facet of the company was contagious. Both industrial engineers and product designers by trade, they took immense pride in their craft, always setting the bar high for others to follow - one of many reasons for their eventual success.

Sign Up Today!

To get these right in your inbox

(Simon Enever, quip’s founder & CEO and Ben Zises - September 1, 2016)

You’re the founder & GP of SuperAngel.Fund, an early stage fund investing in consumer, prop tech and the future of work. At what point did you decide to launch a fund and raise outside capital? Can you share any metrics on the fund performance to date?

A few years after the quip investment in 2014, I gained the confidence to start making other angel investments. I spent every waking moment outside of my ‘day job’ evaluating new investment opportunities, supporting portfolio companies, networking with other angels/VCs, and absorbing everything I possibly could about the industry. Since angel investing is not an ‘income producing’ venture, I knew that in order to dedicate my career towards this I would have to start a fund.

During summer 2020, a few months after covid hit and after my wife and I had our first child, I decided to transition out of my career in real estate to pursue my passion full time. The fund was announced in November and officially launched on January 1, 2021.

I have nearly 100 investors and manage over $3.5m in annualized commitments. You can read the fund deck here and recent Q1 2021 update here. Prior to the fund, I invested $3.6m into 32 companies on behalf of more than 200 investors (including direct and syndicate-led investments). Today, these investments are worth an estimated $23m (6.5x return multiple), with even more upside ahead.

My goals with the fund are quite simple - to deliver outstanding, above-market returns, and become the top performing angel fund in the world 🌎

The top performing venture funds deliver 3-4x over a 5-10 yr hold period (approx 12-20% IRR) - as such, that is the benchmark by which I hope to exceed.

How do you go about sourcing LP’s for your fund?

Since I had experience fundraising throughout my entire career for various investment opportunities, including real estate, my own startups, and eventually leading syndicates into angel investments, I’ve built a pretty deep investor network. My LPs include strategic angels, VCs, private equity professionals, founders/operators and service providers. Now that we are off the ground I am also getting introduced to new investors on a daily basis by existing LPs.

While a lot of new fund managers are doing this as a side gig, I am dedicated to this full time. There is simply too much competition out there, across every profession, such that if you are looking to become the best in the world at anything (which I am here), IMO, you can’t NOT do it full time.

Investors like that I am transparent, accessible and communicative - three seemingly obvious qualities yet ones not always present in other fund managers. At the end of every quarter I deliver detailed updates, including a 1-2 page investment memo on each company the fund invests in, describing how the deal was sourced and what I like in the opportunity.

What’s your favorite part of angel investing?

Meeting the smartest, most passionate and ambitious people in the world, and then having the ability to support and champion them to make their dreams a reality. Here is a recent tweet I shared on this topic.

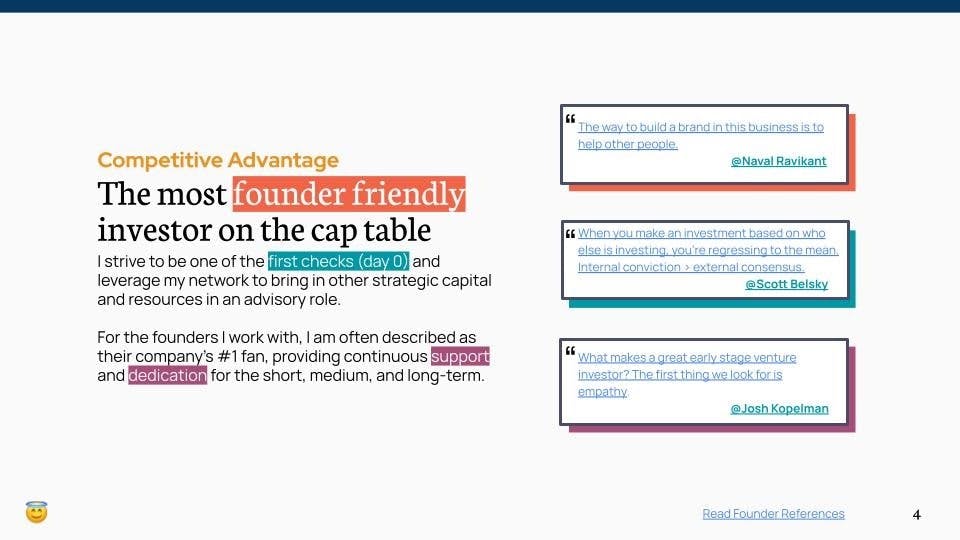

What’s your secret for getting on the cap table?

My reputation and founder references, which I am most proud of. I also don’t take myself too seriously and constantly promote the companies I invest in - see here for a recent video example and check out the fund’s instagram account here, which highlights each company we invest in.

What's your biggest cap table mistake, or company you passed on?

I'll share one that stands out where I had a very early look and passed - Manscaped. Take a peek at their YouTube channel here (140 million+ video views!). Long story short, after testing early product samples I felt it was a bit too gimmicky. Ultimately, however, it was clear that the founders had one very special, secret sauce - exceptional creativity and ability to capture attention/audience/eyeballs > customers, in an incredibly efficient manner. That super power was enough to win the day and they continued to improve their products over time. As we all know, one of the most critical pieces to building a successful, profitable, eCommerce company is to maintain positive unit economics and earn more from a customer than the cost to acquire them - and they clearly had a way to do this more efficiently than others.

What's the state of venture capital in 2030?

While the amount of money going into venture capital continues to hit record levels, I see this trend continuing over the next decade. One reason is the recent and forthcoming changes to SEC accredited investor rules. I expect that within 10 years, nearly every person that has money to invest will have a portion of their money in early stage private companies.

In addition, the announcement and launch of CartaX, coupled with announcement and launch of AngelList Transfers, will be transformational for early stage funds like mine and the venture capital industry as a whole.

These platforms act like ‘stock exchanges’ for private companies and enable founders, early employees and investors to sell shares seamlessly and efficiently to later stage investors- providing an alternative liquidity solution (outside a sale or traditional IPO). While still in their earliest days, I expect these platforms to have a meaningful and positive impact on our industry - allowing investors to realize returns more quickly and distribute capital to LPs on a shorter time-frame.

As risky as early stage investing may seem, with increased pools of capital, more educated founders coming online through programs like YC and On Deck, and new liquidity solutions, I expect it to become less risky with a greater percentage of positive outcomes.

Follow Ben on Twitter (@bzises) for more insights into angel investing across consumer, prop tech, and future of work companies!