We've expanded Sacra Filings with 729 new metrics and ratios, growing from 933 to 1,662 total financial datapoints for leading private companies, including gross margin, free cash flow, and debt-to-equity ratios.

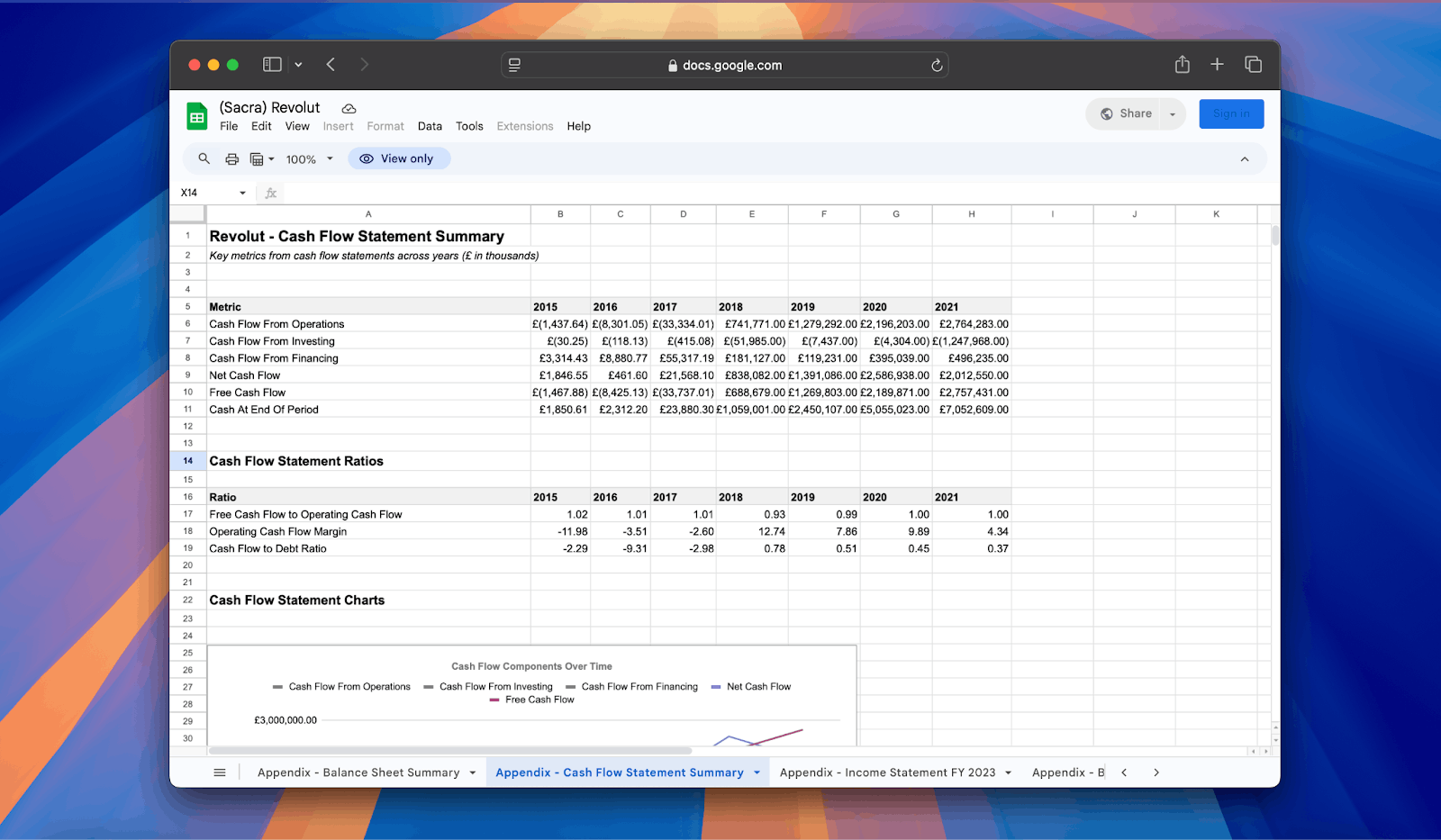

Check out our Revolut model to see the expanded Sacra Filings in action.

Expanding our financial coverage

When we launched Sacra Filings a few weeks ago, we started with the basics: revenue data, income statements, and balance sheets for 32 leading UK tech companies.

Now we've significantly expanded our offering to include cash flow statements and comprehensive financial ratios—all integrated with Sacra Charts to enable custom visualizations and comparisons across companies.

We anticipate continuing to add to our UK coverage—while expanding within Europe and to India—as we go deeper on the 2,000 most important growth and pre-IPO technology startups than anyone else.

Behind the scenes

To make this expansion possible, we developed an AI-powered pipeline that:

- Automatically fetches and downloads important filing documents

- Extracts and validates structured data from financial statements

- Calculates hundreds of financial metrics from raw financial data

- Generates visualizations highlighting meaningful trends

- Consolidates historical filings to create time-series analysis

Our AI approach allows us to scale our coverage far beyond what would be possible with manual analysis while maintaining high accuracy and reliability.

How to get started

Sacra Filings with our deeper company coverage and financial metrics is available now to all Pro members.

Sign up for Pro access to start exploring private company financials in unprecedented detail.

Have questions or feedback? We'd love to hear from you: email us at founders@sacra.com.