Revenue

$150.00M

2023

Valuation

$5.70B

2023

Funding

$415.00M

2023

Growth Rate (y/y)

36%

2023

Revenue

Sacra estimates Workato hit $150 in annual recurring revenue (ARR) in 2023, up approximately 36% year-over-year from $110M in 2022.

Workato's rapid expansion has been driven by strong enterprise adoption, with notable customers including AT&T, Atlassian, Box, GitLab, Nokia, and Toast. The company's focus on providing an accessible, no-code/low-code integration and automation platform has resonated well in the market.

Revenue mix is primarily composed of software subscriptions (estimated 80%) and services (estimated 20%).

Valuation & Funding

Workato was last valued at $5.70B as of 2021. Based on 2021, when the company generated $30M in ARR against that $5.70B valuation, Workato commanded a 190x revenue multiple.

The company has raised $415M in total funding across 9 rounds. Key investors include Altimeter Capital, Battery Ventures, and Redpoint Ventures, with notable participation from Fabrica Ventures.

Product

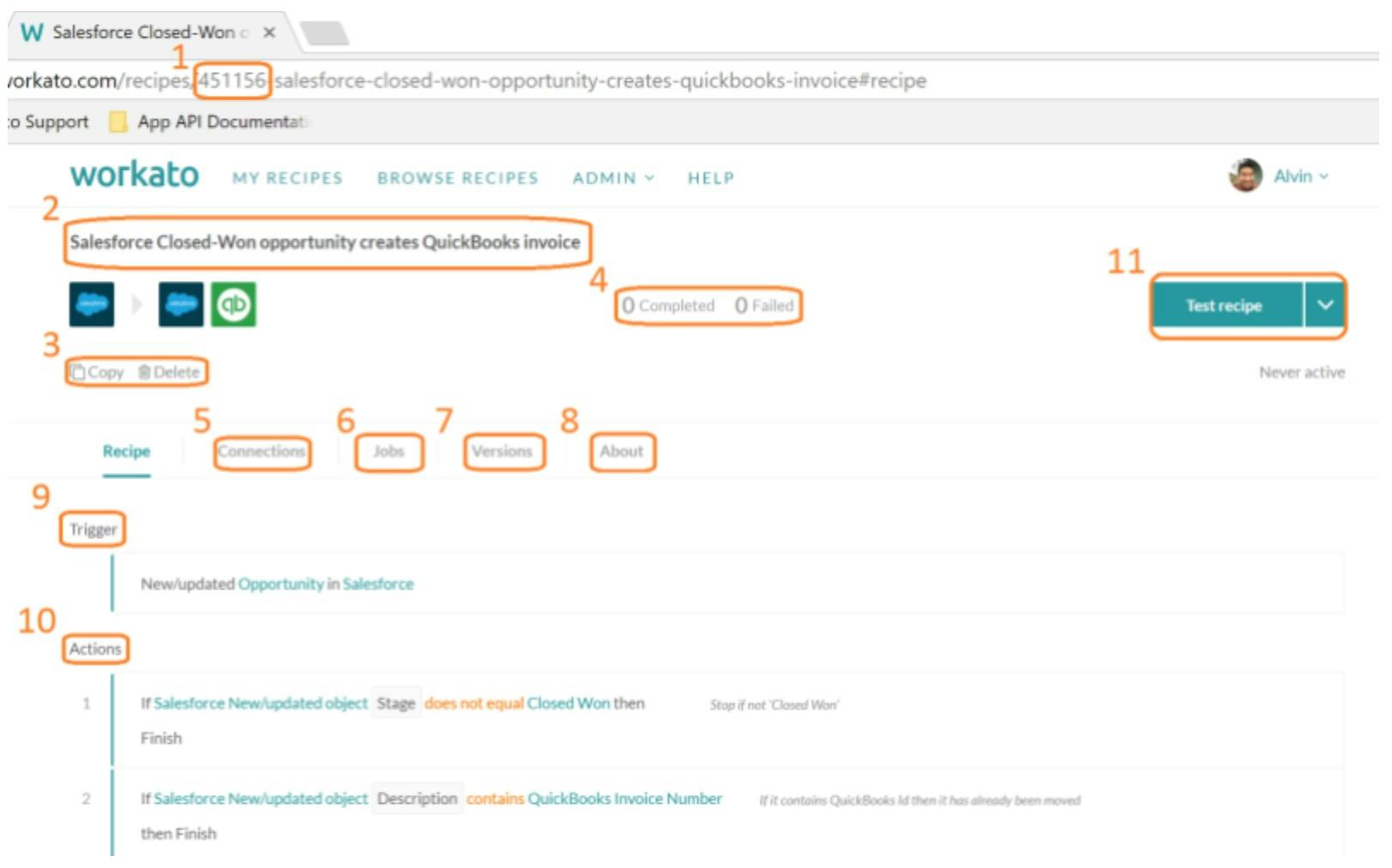

Workato is an automation and integration platform. It provides users with the ability to connect various enterprise applications to create automated workflows, commonly referred to as "recipes" within the platform.

The platform boasts a repository of over 500,000 pre-configured solutions or "recipes". These recipes allow users to automate processes across several operational areas, including HR, marketing, sales, finance, IT, revenue operations, and product integration.

Workato is designed to integrate with a broad range of enterprise applications. Some of the notable applications it supports include Salesforce, Slack, ServiceNow, Snowflake, and Workday.

One of the differentiating aspects of Workato, as evidenced from available data, is its emphasis on a no-code or low-code experience. This implies that users, regardless of their technical proficiency, should be able to use the platform to create and manage workflows.

Business Model

Workato is a subscription SaaS company that prices based on the number of seats a customer needs, the number of apps they need to integrate with, the products in the suite that they choose to use, and the number of integrations or 'recipes' they want to run.

Sacra estimates that they generate around 80% of their revenue from software subscriptions and another 20% from services—onboarding, training, support and other offerings to help companies use Workato.

Workato's focus on the enterprise—their customers include AT&T, Atlassian, Box, GitLab, Nokia, and Toast—means that top-down sales are a big part of their business model, likely targeting chief information officers (CIOs), directors of IT, heads of digital transformation, chief technology officers (CTOs), and others responsible for organization-wide purchases of tools for streamlining operations and improving connectivity between tools.

Workato's initial focus when it came to GTM, however, was on boutique consultants—early adopters of Workato's product who were able to serve as champions of the product, suggest it to their own clients, and drive expansion to what became ultimately bigger, more valuable deals. About 33% of revenue was partner-influenced through the early years—now, Workato's goal is to increase that to 50%+ and more, lessening the need for expensive top-down sales and driving a more organic sales motion.

Competition

Workato's biggest competitor in the enterprise is Salesforce's MuleSoft, which they acquired in 2018 for $6.5B—the two are regularly competing for big deals for enterprise projects around things like employee onboarding, and they're expected to compete more and more frequently now that Salesforce is looking to become the "unified platform" for enterprise work.

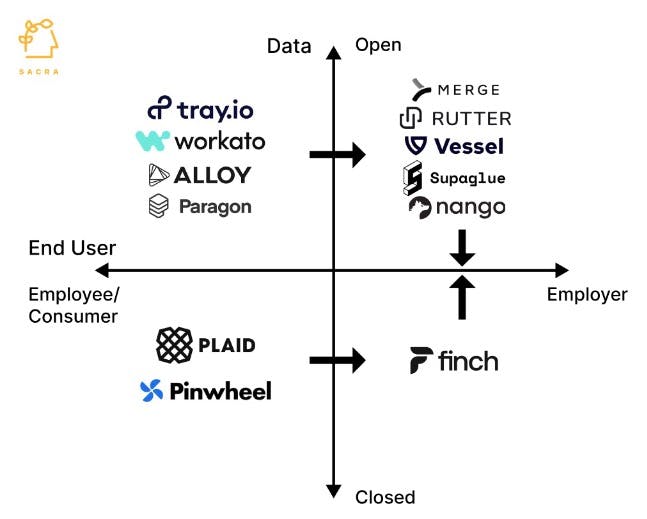

No-code workflow tools like Workato, Zapier, and Tray initiated the whole integrations space. They provided non-technical users the capability to transform data across internal integrations using drag-and-drop functionality. Later, they incorporated embedded authentication modals to cater to external-facing integrations.

Today, Workato finds itself in a competitive workflow automation market. Projections estimate the market's value at $18.45B by the end of 2023. Some of the companies they're competing with offer specific, verticalized solutions. For instance, AirSlate focuses on automating tasks such as e-signature collection.

TAM Expansion

Workato has tailwinds from the increasing adoption of SaaS applications and the growing need for enterprise automation. It has the opportunity to grow and expand into adjacent markets like embedded integration platforms and industry-specific automation solutions.

Enterprise Application Integration

The proliferation of SaaS applications in enterprises has created a significant need for integration and automation solutions. As companies continue to adopt more cloud-based tools, the demand for platforms that can seamlessly connect these applications and automate workflows across them will grow.

Workato is well-positioned to capitalize on this trend, as its platform allows both technical and non-technical users to create complex integrations and automations.

Workato can expand its market share by focusing on industries that are rapidly digitizing their operations, such as healthcare, financial services, and manufacturing.

By developing industry-specific templates and pre-built connectors, Workato can offer tailored solutions that address the unique integration challenges of these sectors. This approach could significantly increase Workato's total addressable market and drive adoption among enterprises that require specialized automation capabilities.

Embedded Integration Platforms

An adjacent market with substantial growth potential for Workato is the embedded integration platform space.

As SaaS companies seek to differentiate their offerings and provide more value to customers, there is an increasing demand for white-label integration solutions that can be embedded directly into their products.

Workato could leverage its existing technology to create a dedicated embedded integration platform, allowing other software companies to offer robust integration capabilities to their customers without building the infrastructure themselves.

This expansion would not only open up a new revenue stream for Workato but also strengthen its position in the broader integration ecosystem. By becoming the underlying integration engine for other SaaS products, Workato could significantly expand its reach and create a network effect that reinforces its market leadership.

AI-Powered Automation

As artificial intelligence and machine learning technologies continue to advance, there is an opportunity for Workato to incorporate these capabilities more deeply into its platform.

By enhancing its automation tools with AI-driven insights and recommendations, Workato could offer more sophisticated and adaptive workflow solutions. This could include features like predictive analytics for process optimization, natural language processing for easier automation creation, and anomaly detection for proactive issue resolution.

Expanding into AI-powered automation would allow Workato to address more complex use cases and potentially command higher prices for advanced capabilities. It would also position the company at the forefront of the next wave of enterprise automation, ensuring its relevance and competitiveness in the rapidly evolving technology landscape.

Risks

1. Commoditization of integration platforms: As the integration and automation market matures, there's a risk of commoditization, with competitors offering similar features at lower prices.

Workato's focus on enterprise customers and complex integrations provides some insulation, but increasing competition from both established players like Salesforce's MuleSoft and newer entrants could erode Workato's market share and pricing power. To counter this, Workato must continually innovate and differentiate its offering, potentially by leveraging AI and machine learning to create more intelligent, adaptive integrations.

2. Challenges in maintaining simplicity at scale: Workato's success is partly due to its emphasis on a no-code/low-code experience, making it accessible to both technical and non-technical users.

As the platform expands to serve larger enterprises and more complex use cases, there's a risk of feature bloat and increased complexity, potentially alienating its core user base. Workato must carefully balance adding advanced capabilities with maintaining its user-friendly interface to avoid losing its competitive edge in ease of use.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.