Revenue

$90.00M

2022

Funding

$54.00M

2026

Valuation & Funding

Wingspan raised $24M in Series B funding in July 2025, led by Touring Capital, bringing total capital raised to $54M. Andreessen Horowitz, Long Journey Ventures, Distributed Ventures, Company Ventures, and 186 Ventures participated in the round.

Previous investors include Ludlow Ventures, Asymmetric, and other strategic backers across multiple funding rounds.

Product

Wingspan provides an all-in-one platform designed specifically for onboarding, paying, and supporting independent contractors, freelancers, and gig workers.

By connecting both companies and contractors in a graph that treats both as first-class entities and persists as contractors pick up new jobs and clients, Wingspan allows contractors to get paid more quickly and makes it easier for them to manage their administrative and financial tasks across all of their clients.

Key features of the platform include:

Data collection and onboarding: Wingspan has built-in forms to collect essential details from contractors, such as tax information and banking details. Once a company signs up and connects their existing systems (like HR or finance software), Wingspan pulls in the necessary data. The aim is to make onboarding faster by reducing the number of steps involved and by storing the contractor profiles within the platform.

Paying contractors: Wingspan handles the process of paying contractors. It consolidates payments, meaning instead of the company needing to individually process each payment to different contractors, Wingspan allows them to handle it all within one system. This includes payments to contractors both in the U.S and internationally. Wingspan's banking services are backed by J.P. Morgan and Lead Bank.

3rd-party integrations: Wingspan has been built with an 'API-first' approach. This means it has been designed to connect and share data with other systems a company might use. For instance, if a company uses a particular HR platform, Wingspan can pull data from that platform into its system. This aims to reduce the duplication of data entry across different systems.

Automating workflows: Wingspan's software automates certain tasks involved in managing contractors. It has features for automatically collecting necessary documents from contractors, for scheduling and processing payments, and for tracking the status of different contractors.

Wingspan Embed: In July 2025, Wingspan launched an embedded contractor management product designed for HR, HCM, and PEO platforms to white-label within their own offerings. The embedded solution includes contractor onboarding, payments, tax automation and 1099 compliance, tax withholding, debit cards (the Wingspan Wallet), instant payouts, and insurance products. Insperity launched "Insperity Contractor Management powered by Wingspan" in July 2025, covering onboarding, W-9 collection, TIN verification, payments, and 1099 reporting, with contractors getting access to multiple payout methods and optional financial features.

Business Model

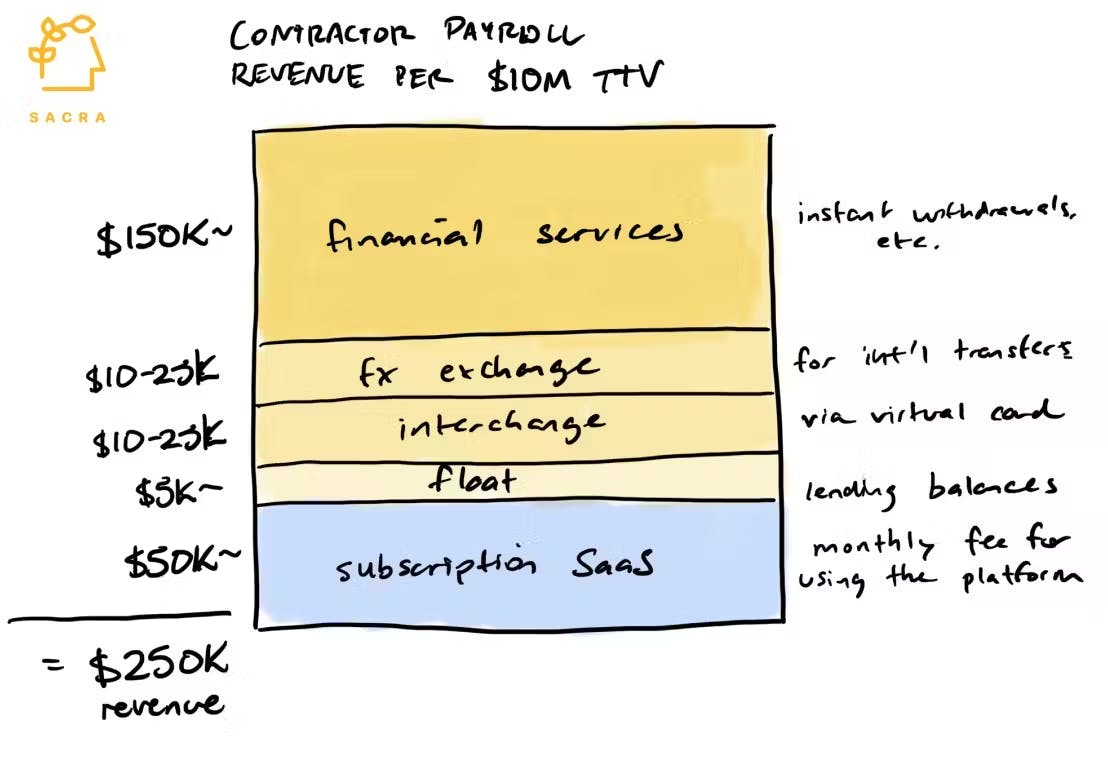

Wingspan turns the the transactional business of contractor payments into subscription SaaS by layering a set of workflow products on top.

The core business model is characterized by gross margin of about 80%, with major costs composed of cloud hosting, executing payments (ACH, push to debit), and international banking and currency exchange, client retention of about 90% (due to the high switching costs of swapping out your payroll provider), and capital spend to total sales around 5% due to relative lack of fixed assets.

Wingspan charges customers a monthly fee to access their payments and compliance tools, and an additional per-seat fee based on the number of contractors that a company is paying.

Teams: For businesses, Wingspan offers a "Teams" plan, which costs $500 per month with an additional fee of $5 per month per contractor paid. This plan includes full-service payroll for up to 10 contractors per month, unlimited contractor profiles, and access to 27+ contractor health and financial benefits. The aim here is to provide a comprehensive, bundled solution to businesses that manage a small to medium-sized pool of contractors.

Companies: For businesses with more extensive contractor needs, Wingspan offers a "Companies" plan. This costs $1,000 per month plus $5 per month per contractor paid. It comes with unlimited contractor payments, e-signatures, accounting sync, and reporting. The "Companies" plan is designed for larger businesses with greater administrative needs and a larger contractor workforce.

The majority of revenue comes from monetizing on payroll volume via:

Markups on financial services: Wingspan can make money selling financial services into the contractors that use their product, like their instant transfers of wages to bank accounts.

Interest on float: Wingspan makes some money by lending out float—money held by a platform that’s in the process of clearing an account.

Interchange split: Wingspan can make roughly $1.05 per every $100 that a contractor spends using their virtual card via interchange: the fee set by card networks for using their payment rails to move money

Competition

As B2B products all compete to eat up B2B transactions, we’re seeing the widespread bundling of contractor payroll into their products.

These companies want to eat up contractor payroll and include it in the larger bundle of payments and back-office functions they already perform: employee payroll companies like ADP, Paylocity, Paychex, Rippling, and Gusto, vertical SaaS like Wingspan, Bonsai, and Toast, expense management companies like Bill.com, Brex, and Ramp, B2B payments businesses like Wise, Square, Melio and Routable, payments businesses like PayPal and Venmo, and global payroll businesses like Deel, Panther, Remote, Oyster, and Papaya Global.

Some of these services target different segments of customers. For example, Wingspan primarily targets mid-market companies paying hundreds or thousands of contractors with a particular need for workflow automation around contractor payments—their average ACV on SaaS is around $20K-$70K. Gusto, which is focused on SMB payroll, brings in about $260M a year in revenue on more than 200,000 customers for about $1.3K per customer.

On the other hand, they’re threatened by an emerging set of companies like Check ($119M raised) and Zeal ($15.4M raised) that are abstracting the payroll function into a set of APIs open to any vertical SaaS to use.

All of these different kinds of companies want to own contractor payroll because ewhile employees are networked via professional graphs like LinkedIn, freelancers are networked via payments graphs.

This is a network with high built-in retention, trillions in fund flows every year, and a long list of monetizable products and services that can be sold into it.

TAM Expansion

The big opportunity for Wingspan is to build a closed loop payments network for the $1.4T and growing of freelancer payments made every year.

Embedded distribution

Wingspan launched its B2B2B distribution strategy in July 2025 with Wingspan Embed, allowing HR, HCM, and PEO platforms to white-label contractor management directly within their products. The company signed Insperity as an anchor partner, with Insperity subsequently adding "Insperity Contractor Management powered by Wingspan" to its HR solutions portfolio. This embedded approach lets Wingspan reach contractors indirectly through platforms that already serve employers, multiplying distribution without direct sales costs for each end customer.

Contractor wallet and financial services

Cash App found product-market fit with Americans living paycheck-to-paycheck for whom speed was of the essence because of potential ripple effects from income volatility. In the freelancer economy, volatility is the rule, with contractors going from company to company, making their income lumpy and unpredictable.

If a platform like Wingspan can guarantee timely freelancer payment based on the amount of work done, it would give contractors a vastly upgraded sense of financial security—and also give their platform the kind of stickiness that Cash App was able to reach in the consumer space by reducing time-to-money in the same way. Wingspan offers the Wingspan Wallet—a card and account experience with instant payouts—as part of its contractor-facing offering.

By owning the contractor wallet with that 10x better experience, Wingspan gains an opening into selling a range of other products and services into their network. The same way that Gusto has launched products like Embedded Payroll and Gusto Wallet on top of their network of SMBs, Wingspan has the opportunity to launch value-add products like:

Freelancer insurance: Liability insurance protects freelancers against claims that they provided the wrong service or their work was faulty in some way

Contractor loans: Getting a loan as a freelancer can be notoriously difficult, but contractor payroll platforms could more easily underwrite these

Healthcare and benefits: By acting as a PEO, contractor payroll platforms can get cheaper healthcare for their workers and take that burden off companies

Earned wage access: Contractor payroll platforms can make earned funds immediately available to contractors for a fee (typically 1%~)

Talent marketplace: Contractor payroll platforms can allow both companies and contractors to search across their network of workers to staff new projects

Data advantage

Across these various product lines, contractor payroll platforms can derive a powerful advantage over other traditional providers by virtue of the data and visibility they have into the activities of both contractors and companies.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.