Valuation

$3.60B

2025

Funding

$401.00M

2025

Valuation & Funding

Whoop was last valued at $3.6B in August 2021, following a $200M Series F round led by SoftBank's Vision Fund 2. The company has raised approximately $401M in total funding across multiple rounds.

Key investors include SoftBank, IVP, and Foundry Group. The company's October 2020 Series E round raised $100M at a $1.2B valuation.

Product

Whoop was founded in 2012 by Will Ahmed, John Capodilupo, and Aurelian Nicolae while at Harvard, initially developing a wearable device to help elite athletes optimize their training and recovery.

Whoop found product-market fit as a 24/7 wearable health coach for professional athletes and serious fitness enthusiasts, particularly in endurance sports and professional leagues, who needed detailed insights about their body's recovery and readiness to perform.

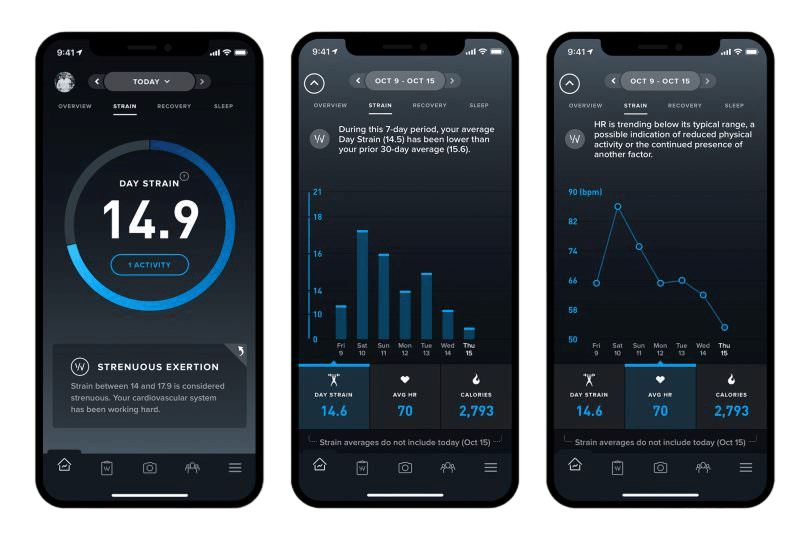

The Whoop strap continuously monitors physiological signals including heart rate variability, respiratory rate, and sleep patterns. It translates this data into three core metrics: Recovery (indicating readiness to perform), Strain (measuring cardiovascular load), and Sleep (analyzing quality and quantity). Users wear the screenless device constantly, receiving insights through the mobile app that help them make informed decisions about training intensity and recovery needs.

The platform stands out through its emphasis on recovery tracking, using overnight HRV measurements during deep sleep to establish reliable baselines.

Athletes and coaches use these insights to optimize training schedules and prevent overtraining. The Whoop Unite platform extends these capabilities to organizations, enabling teams and corporations to monitor aggregate health metrics across groups while maintaining individual privacy.

In September 2025, Whoop opened its Advanced Labs blood-testing service to what it says is a 350,000-person waitlist, offering Quest Diagnostics panels integrated with Whoop’s continuous monitoring—priced at $199 for one annual test, $349 for two, or $599 for four—on top of the $200–$350 annual device membership. This expands Whoop’s subscription footprint into lower-cost, out-of-pocket wellness testing alongside companies like Function Health ($500/year).

In November 2025, Whoop launched Advanced Labs Uploads, enabling members to upload prior lab results at no cost and integrate 65 biomarkers with continuous data and AI coaching in-app. This expands Advanced Labs beyond the paid Quest Diagnostics panels to a free, globally available feature bundled with membership. Advanced Labs and memberships became HSA/FSA-eligible in the U.S. starting November 13, 2025.

Business Model

Whoop is a wearable-as-a-service company that combines hardware and software into a subscription model, providing continuous health monitoring and personalized insights. The company has evolved from targeting elite athletes to serving a broader market of fitness enthusiasts and health-conscious individuals.

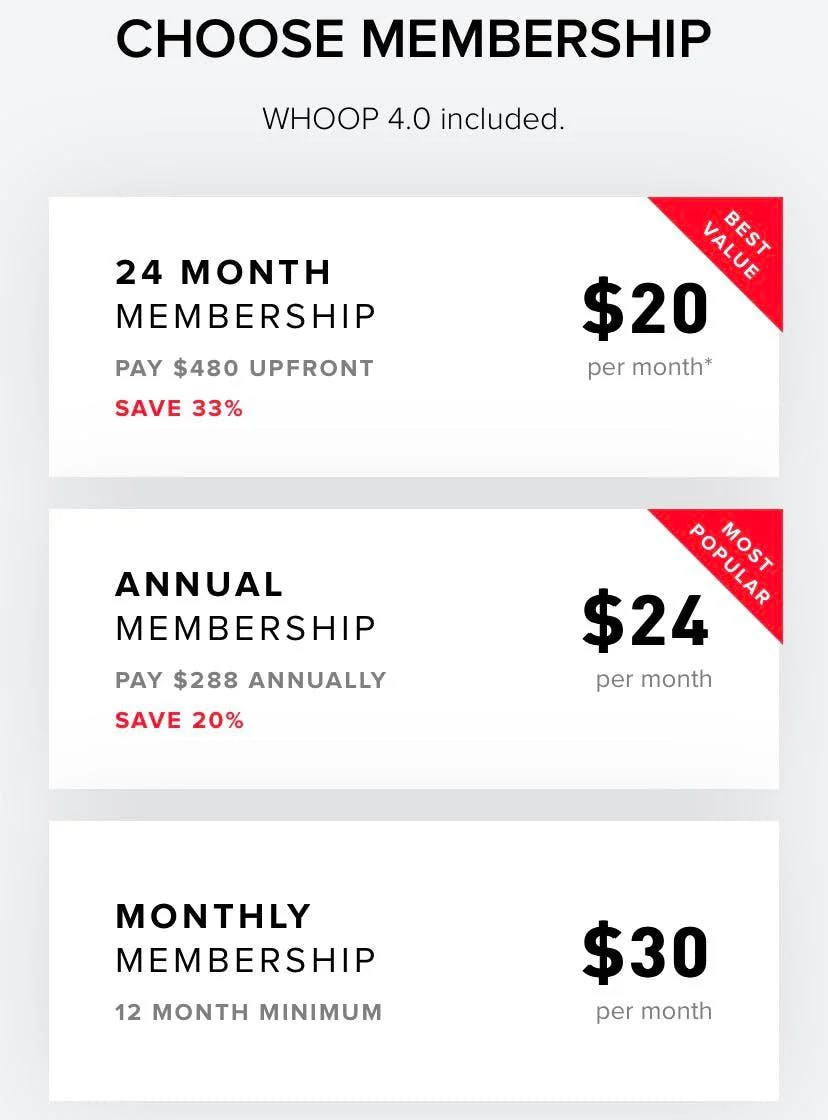

The core revenue stream comes from membership subscriptions priced at $30 per month, with discounts available for annual commitments. This subscription includes both the hardware device and access to Whoop's analytics platform, which provides detailed insights on recovery, strain, and sleep performance.

Whoop's enterprise offering, Whoop Unite, targets corporate wellness programs and healthcare organizations, creating a B2B revenue stream alongside its consumer business. This platform offers aggregate data analytics and program management capabilities for organizations.

The company employs a product-led growth strategy through strategic partnerships with professional sports leagues and athletes, who serve as both users and brand ambassadors. Whoop's focus on continuous hardware innovation, with free device upgrades for existing members, helps maintain subscriber retention and lifetime value.

Whoop differentiates itself through professional-grade analytics, collecting significantly more data per user than competitors, and its deliberate focus on health insights rather than general smartwatch features. The company's AI-powered Whoop Coach and stress monitoring capabilities represent recent expansions of its value proposition.

Competition

Whoop operates in the premium health and fitness wearables market, competing across three distinct segments: traditional wearables, recovery-focused devices, and corporate wellness platforms.

Traditional wearable competitors

Apple Watch and Garmin dominate the broader wearables market with one-time purchase models and comprehensive feature sets including GPS, notifications, and music playback. Apple's Watch SE starts at $250, while Garmin devices range from $200-$1000. These devices appeal to users seeking all-in-one functionality rather than specialized health tracking.

Recovery-focused competitors

Oura Ring represents Whoop's closest direct competitor, offering similar recovery metrics and a subscription model ($6/month after device purchase). Like Whoop, Oura emphasizes sleep quality and recovery tracking. Fitbit has also entered this space with its "Daily Readiness Score" for Premium subscribers ($10/month).

In November 2025, Oura CEO Tom Hale said the company is on track for $1B in 2025 sales and could reach “maybe close to $2B” in 2026.

Corporate wellness platforms

In the B2B space, Whoop Unite competes with established corporate wellness providers like Virgin Pulse and Vitality. These platforms typically offer broader health programming beyond just wearable data. Several traditional wearable makers have also launched enterprise offerings, including Fitbit Health Solutions and Garmin Health.

The competitive landscape is evolving as traditional device makers add recovery metrics and subscription services. Amazon's discontinuation of Halo in 2023 demonstrates the challenges of competing in this market without clear differentiation. Meanwhile, Oura's success ($5.2B valuation in 2024) validates the market opportunity for specialized recovery tracking devices with recurring revenue models.

TAM Expansion

Whoop has tailwinds from the growing wellness economy and corporate health initiatives, with opportunities to expand into clinical research, preventive healthcare, and enterprise wellness solutions.

Healthcare integration and clinical applications

Whoop's continuous biometric monitoring and extensive health data repository position it to expand into clinical research and healthcare applications. The company's ability to detect early signs of illness and track recovery metrics makes it valuable for clinical trials and patient monitoring. Healthcare providers could integrate Whoop data into their practices, creating a new revenue stream through healthcare partnerships and research contracts.

Enterprise wellness and productivity optimization

Through Whoop Unite, the company can tap into the multi-billion dollar corporate wellness market. Organizations increasingly recognize the link between employee wellness and productivity, creating demand for data-driven wellness solutions. Whoop's stress monitoring and recovery tracking capabilities could help companies reduce burnout and optimize workforce performance, while providing aggregated insights for organizational health initiatives.

International markets and specialized segments

Geographic expansion, particularly in Europe and Asia, represents significant growth potential. The company's success with professional athletes and corporate executives provides credibility to enter new markets. Whoop could develop specialized offerings for high-performance segments like military personnel, first responders, and competitive athletes in emerging markets. The company's subscription model and hardware-as-a-service approach make it easier to scale internationally compared to traditional device manufacturers.

Risks

Subscription value proposition erosion: The core differentiator of detailed recovery metrics and HRV tracking is being replicated by competitors like Fitbit and Garmin at lower price points.

This commoditization of recovery tracking could make Whoop's $300/year subscription increasingly difficult to justify. While Whoop's data analytics may be superior, the delta needs to remain significant enough to warrant the premium pricing.

Elite athlete dependency: Whoop's brand and growth strategy heavily relies on elite athlete endorsements and partnerships to validate its premium positioning.

If competing devices gain traction among professional athletes or if Whoop's effectiveness is questioned by influential users, it could damage the company's aspirational appeal. This could particularly impact expansion into corporate wellness and general consumer segments where the professional athlete association drives adoption.

Hardware upgrade cycle challenges: The subscription model requires Whoop to periodically provide hardware upgrades to retain users.

Each upgrade cycle creates significant costs and operational complexity while potentially cannibalizing new member acquisition. This creates pressure to continuously innovate hardware features while maintaining margins, particularly challenging in an inflationary environment.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.