Revenue

$358.80M

2024

Valuation

$11.50B

2025

Funding

$968.00M

2025

Growth Rate (y/y)

102%

2024

Revenue

Sacra estimates Whatnot hit $359M in revenue in 2024, growing 102% YoY, with the livestream shopping platform achieving $3B in GMV. The company's core revenue comes from its marketplace take rate, charging sellers an 8% commission in the US (6.67% in UK/EU) plus a 2.9% + $0.30 payment processing fee per transaction.

Whatnot's rapid growth is driven by exceptional user engagement metrics, with the average shopper purchasing 12 items weekly and sneaker enthusiasts spending $500 monthly. The platform maintains a 62% month-over-month customer retention rate and has cultivated a loyal seller base, with 62% of sellers exclusive to the platform.

The company has successfully expanded beyond its initial collectibles focus, with fashion emerging as its fastest-growing category. Over 500 sellers have achieved $1M+ in annualized sales, demonstrating the platform's ability to support high-volume merchants.

Recent revenue diversification efforts include the launch of advertising products in 2023, starting with boosted livestreams, which has pushed the overall take rate from 12% toward 12.5%. Despite growing competition from TikTok Shop's aggressive 6% commission rates, Whatnot's combination of entertainment and commerce continues to drive strong marketplace dynamics and revenue growth.

Valuation & Funding

In October 2025, Whatnot announced it had raised $225M at an $11.5B valuation, bringing total funding to ~$968M. The round included up to $126M in secondary for existing shareholders.

Whatnot was previously valued at $4.97 billion in its Series E funding round in January 2025, when it raised $265 million.

Investors across rounds include Greycroft, DST Global, Andreessen Horowitz, Avra, Lightspeed Venture Partners, and Durable Capital.

Product

Whatnot was founded in 2020 by Grant LaFontaine and Logan Head, initially launching as a marketplace focused on Funko Pop collectibles trading.

Whatnot found product-market fit as a livestream shopping platform for collectible enthusiasts, particularly those interested in trading cards, toys, and rare items. The platform merged the engagement of live video with the thrill of collecting, allowing sellers to showcase their items in real-time while building personal connections with buyers.

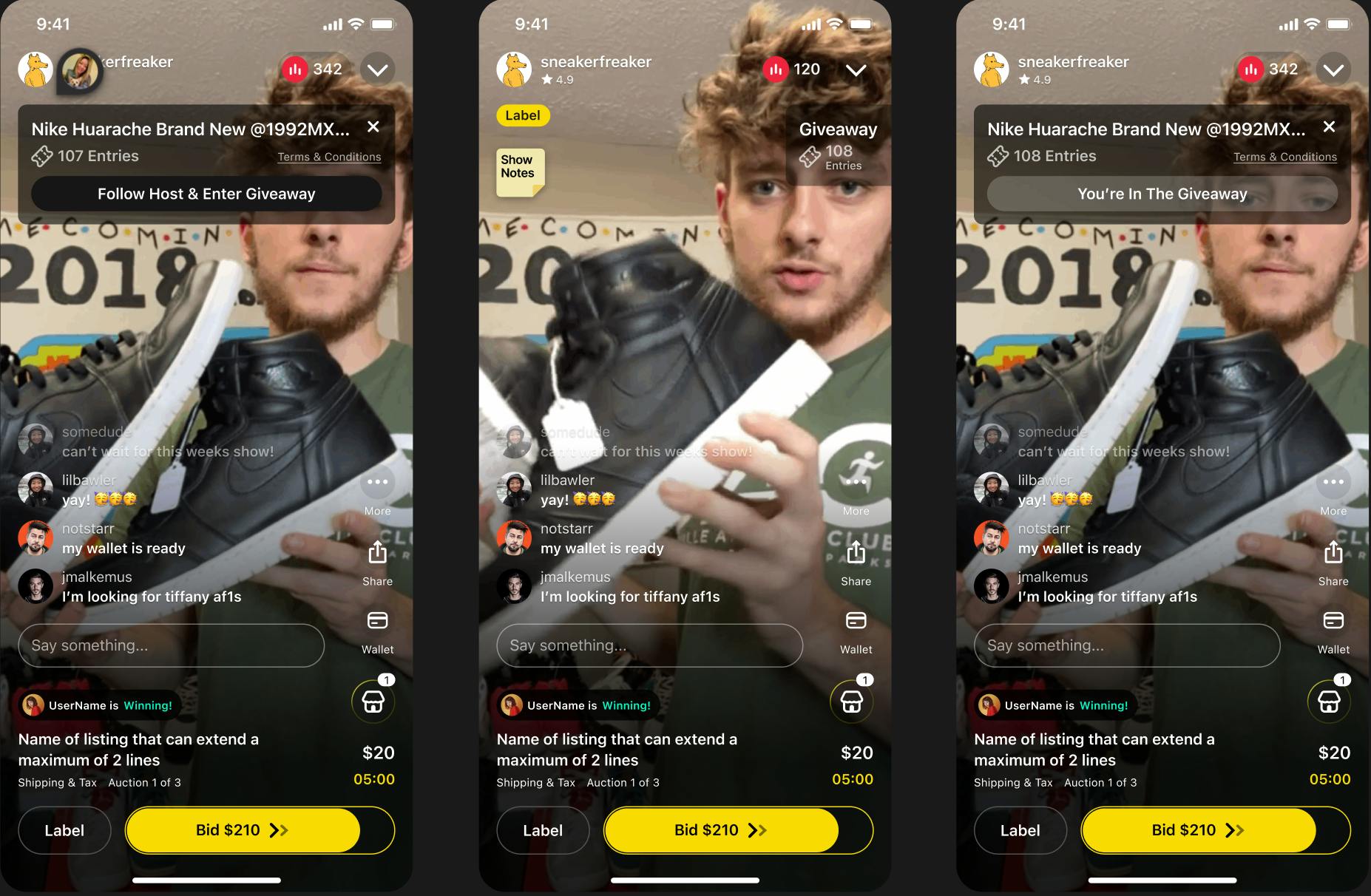

The core product enables sellers to host live video auctions where they can display, discuss, and sell items to an engaged audience. Sellers can conduct "breaks" where multiple buyers split the contents of unopened card packs, run mystery box openings, or showcase individual items for auction or immediate purchase. Buyers participate through live chat, place bids, and make instant purchases during streams.

Beyond live auctions, Whatnot offers traditional marketplace listings for collectibles across numerous categories including sports cards, Pokemon cards, toys, comics, and fashion items like sneakers. The platform has expanded to serve various collector communities, with features like live chat during streams fostering social connections between buyers and sellers. Each seller essentially operates their own micro-channel, building a following of collectors who share their specific interests.

Business Model

Whatnot is a livestream shopping marketplace that connects collectors and enthusiasts with sellers through interactive video commerce, primarily focused on collectibles, fashion, and luxury items. The platform generates revenue through a transaction-based model, charging sellers an 8% commission on most sales plus a 2.9% + $0.30 payment processing fee per transaction.

The platform offers category-specific commission structures to drive adoption in strategic verticals, with reduced rates for coins (4%) and electronics (5%). For high-value items, Whatnot waives commissions on portions of sales exceeding $1,500 to attract luxury sellers.

Whatnot's competitive advantage stems from its entertainment-driven commerce model, which generates 10x more transactions than traditional peer-to-peer marketplaces. The platform's livestream format creates strong buyer-seller relationships, with 62% of sellers remaining exclusive to Whatnot despite competition from TikTok Shop and others.

The company employs a product-led growth strategy by expanding into adjacent categories like fashion and luxury goods while maintaining its core collectibles focus. Recent initiatives like the Rewards Club program drive buyer retention and increase seller engagement, with beta tests showing 12% higher spending per buyer and 20% more repeat purchases.

Whatnot has also begun diversifying revenue through advertising products, including boosted livestreams and show promotions, while maintaining marketplace dynamics through careful monetization calibration.

Competition

Whatnot operates in a market that includes traditional resale marketplaces, livestream commerce platforms, and vertical-specific marketplaces for collectibles and fashion.

Traditional resale marketplaces

eBay dominates with $75B in annual GMV and recently removed seller fees for private sellers in some markets. Depop ($550M GMV) and Vinted ($10B+ GMV) focus on fashion resale with no seller commissions, instead generating revenue primarily through buyer fees and services. Back Market (€2.16B GMV) specializes in electronics resale with a 14.8% take rate.

Livestream commerce platforms

TikTok Shop leads the space with a $17.5B GMV goal for 2024 and aggressive 6% commission rates in the US. CommentSold ($4.4B lifetime GMV) focuses on enabling small businesses and boutiques to run livestream sales. Both platforms leverage existing social media audiences rather than building dedicated communities around specific categories.

Category-specific marketplaces

StockX and GOAT dominate sneaker resale with authentication services and standardized pricing. Both platforms have expanded into luxury accessories and collectibles. Pokemon card marketplace TCGPlayer offers detailed card condition guidelines and authentication services. These specialists typically maintain higher take rates (12-15%) justified by category expertise and trust services.

The competitive dynamics are shifting as TikTok Shop's aggressive pricing and massive user base challenges specialist platforms. Meanwhile, traditional marketplaces are reducing fees to compete with no-commission models. Authentication services have become a key differentiator in high-value categories, with most platforms either building in-house capabilities or partnering with third-party authenticators.

TAM Expansion

Whatnot has tailwinds from the explosive growth of livestream commerce and collectibles markets, with opportunities to expand into new verticals and geographies while building a broader commerce infrastructure.

Livestream commerce expansion

The global livestream shopping market is projected to reach $600B by 2027. While currently focused on collectibles and fashion, Whatnot can expand into high-margin categories like electronics, home goods, and beauty products. The platform's proven ability to drive 10x more transactions than traditional marketplaces positions it well to capture market share from both ecommerce giants and specialty retailers.

Geographic expansion opportunities

Whatnot's UK operations have shown 155% GMV growth, significantly outpacing its overall growth rate. The Middle East presents a particularly compelling opportunity, with regional sneaker sales showing 35% higher AOV than global averages. Expansion into East Asian markets could tap into the region's established livestream commerce behavior.

Commerce infrastructure development

With $3B in GMV and over 500 million-dollar sellers, Whatnot can evolve beyond a marketplace into a broader commerce infrastructure player. The company could develop authentication services for high-value items, financial products for sellers, and inventory management tools. These services would increase platform stickiness and boost take rates beyond the current 12.5%.

Brand partnerships and retail integration

Recent partnerships with luxury brands and wholesale suppliers indicate potential to bridge the gap between traditional retail and livestream commerce. By becoming a key distribution channel for both new and secondhand goods, Whatnot could capture a significant portion of the $200B+ social commerce market while maintaining its high-engagement, entertainment-first approach.

Risks

Category expansion dilution: Whatnot's aggressive push into fashion and luxury risks diluting its core collectibles differentiation. While fashion represents a larger TAM, the platform lacks the authentication infrastructure of competitors like StockX and faces intense competition from TikTok Shop's lower fees. The company's trust and safety approach, which worked well for collectibles, may prove insufficient for high-value luxury items where counterfeiting is rampant.

Seller economics pressure: With an average seller earning just $25K annually and thousands of new sellers joining monthly, category saturation is becoming a serious issue. The introduction of advertising products to boost visibility, while good for revenue, increases the effective take rate on sellers who are already being courted by TikTok Shop's 6% commission rates. This could trigger seller migration, especially among top performers generating $1M+ in annual sales.

Geographic expansion challenges: Whatnot's international growth strategy faces headwinds from lower AOVs in European markets ($101 in UK vs $147 in US) and different consumer behaviors around livestream shopping. The platform's entertainment-driven model may not translate as effectively to markets with different shopping cultures and engagement patterns.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.