Revenue

$2.64B

2021

Valuation

$5.98B

2021

Funding

$21.60B

2021

Product

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey in New York City, initially launching a single coworking space called Green Desk before expanding into the WeWork brand.

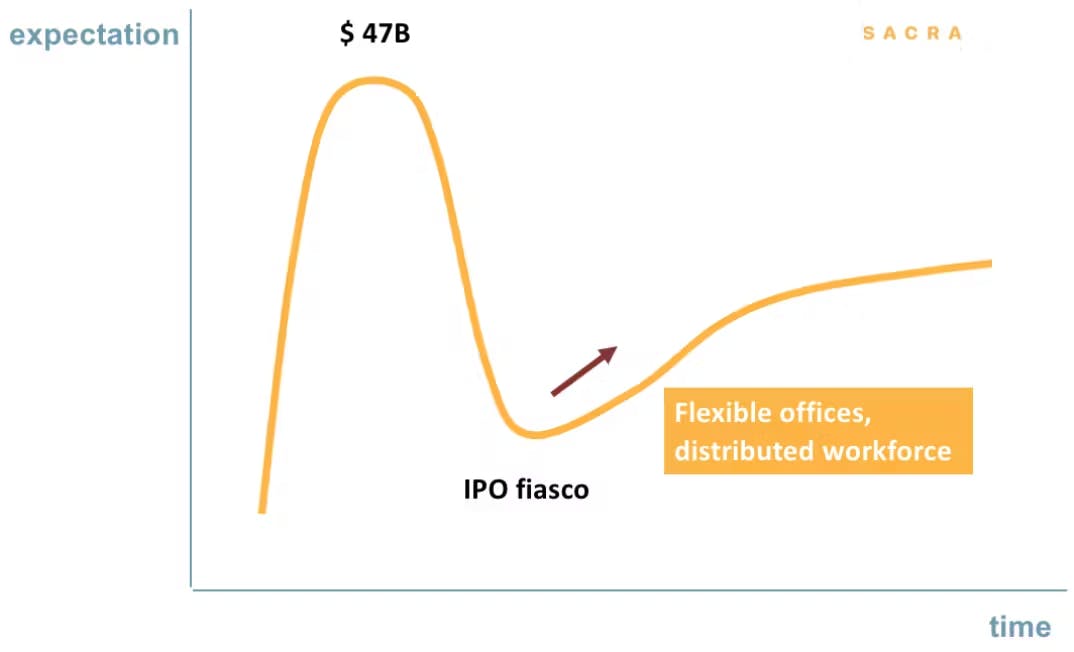

WeWork found product-market fit as a flexible office space provider for startups and small businesses who needed professional workspaces without long-term lease commitments. The product solved a key pain point for growing companies that couldn't predict their space needs 5-10 years in advance.

The core product is a fully-furnished, ready-to-use office space that can be rented on flexible terms. Members get immediate access to professional amenities including conference rooms, phone booths, printing facilities, and high-speed internet. The spaces are designed to foster collaboration through shared common areas while still providing private areas for focused work.

WeWork evolved to serve enterprise clients by offering customizable office suites that could accommodate larger teams while maintaining flexibility. Their "All Access" membership allows individuals to work from any WeWork location globally, while dedicated offices provide teams with their own private space.

The product includes a mobile app for booking meeting rooms, connecting with other members, and managing workspace access. Community managers at each location handle day-to-day operations and organize networking events to facilitate connections between members.

Business Model

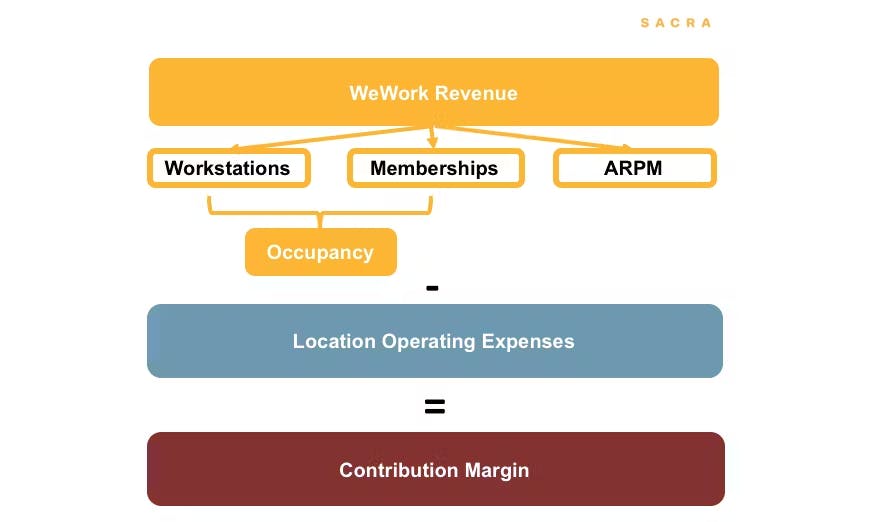

WeWork is a flexible workspace provider that transforms long-term commercial real estate leases into short-term, subscription-based office solutions for businesses and individuals. The company leases large office spaces on 10-15 year terms, renovates them into modern collaborative workspaces, and subleases them at a premium through flexible membership plans.

Their core revenue comes from membership fees, with pricing varying by location and commitment level. In prime markets like London, hot desks start at £285 monthly while private offices begin at £450 monthly. Enterprise clients, which now represent 40% of revenue, typically sign longer 15-month commitments with volume discounts.

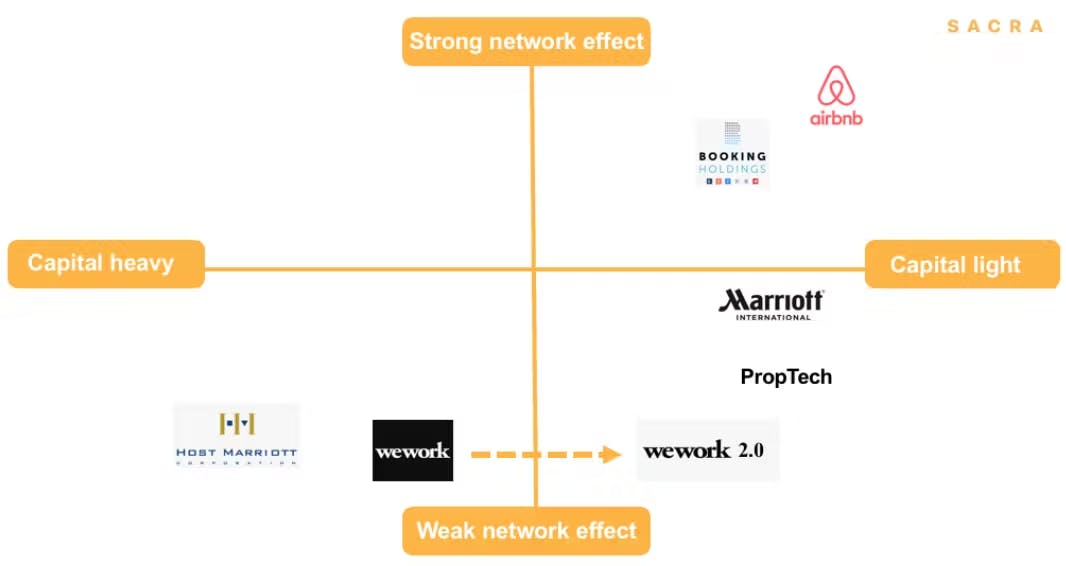

WeWork's competitive advantage stems from its ability to maximize space efficiency through sophisticated office design and management - averaging 60 square feet per employee versus the industry standard of 200-400. The company is evolving beyond pure arbitrage by offering "Powered by We" - an enterprise service where WeWork manages and optimizes clients' existing office spaces for a fee. This capital-light franchise model, similar to hotel chains like Marriott, allows WeWork to expand without taking on lease liabilities.

The company also generates ancillary revenue through services like meeting room rentals, event spaces, and community programming that create additional value for members beyond just workspace.

Competition

WeWork operates in the flexible workspace market, which includes traditional office landlords, specialized coworking operators, and emerging property technology companies.

Global flex space operators

IWG (formerly Regus) is the largest competitor with 3,306 locations and 445k workstations globally. Unlike WeWork's focus on dense urban markets and enterprise clients, IWG operates across a broader range of cities with a more traditional serviced office model. The Office Group and Industrious target premium urban markets with a focus on high-end amenities and enterprise customers.

Traditional real estate players

Major commercial landlords like Vornado and Boston Properties have begun offering their own flexible workspace solutions. These landlords typically convert portions of existing buildings into coworking spaces, leveraging their real estate portfolios but lacking WeWork's operational expertise and brand recognition. Some have opted to partner with operators like Industrious and Convene rather than compete directly.

Property technology platforms

A new category of competitors is emerging through the "Powered by We" model, where companies provide workspace management software and services without directly operating spaces. This includes companies like Breather and Knotel that focus on space-as-a-service technology platforms for landlords and enterprise clients. These companies compete with WeWork's enterprise offerings while avoiding the capital intensity of leasing and operating physical locations.

The market remains highly fragmented - the top six players control only 51% of market share by revenue. Competition is intensifying as the shift toward flexible workspaces accelerates, with JLL predicting 30% of office space will be flexible by 2030.

TAM Expansion

WeWork has tailwinds from the shift to flexible work arrangements and enterprise adoption of flexible office space, with opportunities to expand into adjacent markets like office management services and real estate technology platforms.

Enterprise workspace transformation

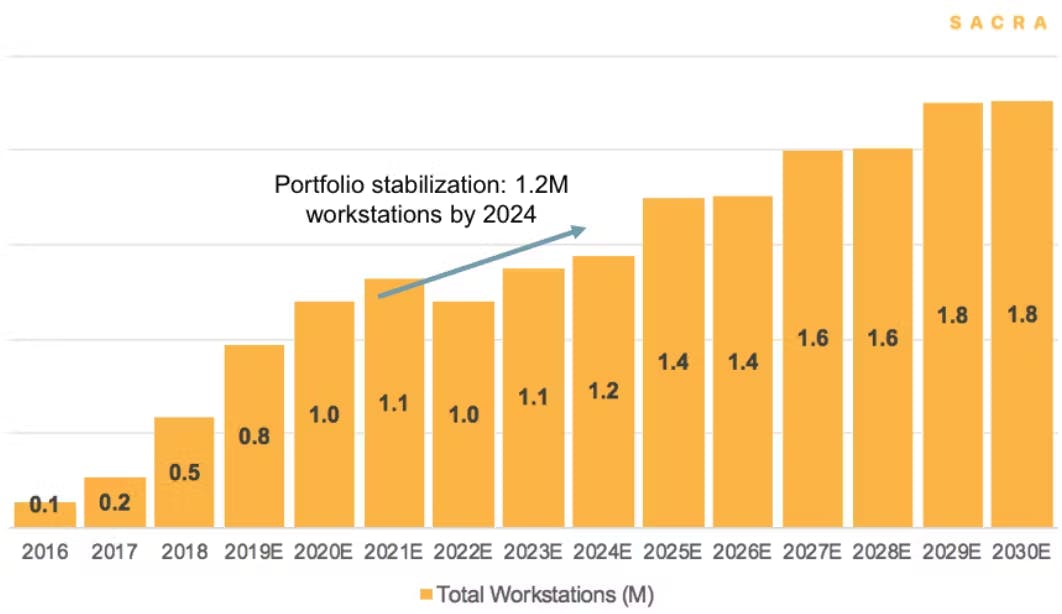

The enterprise segment now represents 40% of WeWork's revenue and is growing faster than other segments. Large companies are increasingly seeking flexible office solutions to support distributed workforces and reduce long-term lease commitments. WeWork estimates their total addressable market at $1.6 trillion across 280 target cities globally, with current penetration of only 0.2% in their markets.

Office management services

WeWork's "Powered by We" offering packages their expertise in office design, operations and community management as a service for landlords and enterprises. This capital-light expansion allows WeWork to generate revenue from spaces they don't lease directly. The company has already secured partnerships with major property investors like Nuveen and Ivanhoe Cambridge, suggesting strong potential for this model to scale.

Real estate technology platform

WeWork has developed proprietary technology for space utilization, booking systems, and community engagement. By leveraging data from hundreds of locations, WeWork could expand into providing building management software and analytics to property owners. The global property management software market is projected to reach $23 billion by 2025. WeWork's scale and operational expertise position them well to capture share in this growing market.

Risks

Duration mismatch exposure: WeWork signs long-term leases (15-20 years) while generating revenue from short-term memberships and flexible workspace agreements. During economic downturns, this mismatch could create severe cash flow problems as members can quickly reduce space or leave entirely while WeWork remains obligated to pay landlords. While the company has increased enterprise customers to 60% with longer commitments, the average lease length of 15 months still falls far short of WeWork's own lease obligations.

Capital-intensive growth model: WeWork's expansion requires massive upfront investments to build out new locations before they can generate revenue. With only 30% of locations considered mature and profitable, the company burns significant cash maintaining newer locations that take 24+ months to achieve target margins. This model demands continuous capital raising to fund growth, making WeWork vulnerable if financing conditions tighten.

Commoditization of flexible workspace: As more landlords develop their own flexible workspace offerings and competitors like IWG expand, WeWork's core product risks becoming commoditized. While WeWork has tried to differentiate through community and services, these offerings are increasingly standard across the industry. The company's high valuation assumes it can maintain premium pricing despite growing competition in what is fundamentally a real estate arbitrage business.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.