Revenue

$30.00M

2024

Funding

$84.00M

2024

Growth Rate (y/y)

43%

2024

Revenue

Sacra estimates Valimail hit $30M of annual recurring revenue (ARR) in Q2'2024, up roughly 60% year-over-year, with gross margins of about 70%.

Recent requirements from Google and Yahoo for improved email deliverability, effective February 2024, have provided substantial tailwinds for Valimail's core business.

Valimail's growth trajectory shows steady progression from $9M ARR in 2019 to approximately $17M by 2023. The company's 2019 strategic partnership with Microsoft—which made Valimail its preferred partner in DMARC authentication—has been instrumental to its 3x growth between 2019 and 2024.

The company's revenue mix is heavily dependent on channel partnerships, with Sacra estimating that 50-60% of revenue comes through managed service providers (MSPs) and other partners, similar to Proofpoint's channel mix at IPO. Valimail maintains a network of roughly 100 channel partners, including Twilio, Pax8, and Symantec.

Valuation & Funding

Valimail has raised a total of $84 million in venture funding since its founding in 2015. The company's most recent funding was a $45 million Series C round led by Insight Partners in 2019.

Key investors include Insight Partners, Tenaya Capital, and Shasta Ventures. Earlier investors Bloomberg Beta and Flybridge Capital Partners participated in the company's seed round.

Product

Valimail was founded in 2015 by Alexander Garcia-Tobar and Peter Goldstein to solve the complex problem of email authentication and domain protection. Garcia-Tobar previously served as VP of Business Development at email security company Agari, while Goldstein brought technical expertise from senior development positions at RSA Security.

Valimail found product-market fit as an automated DMARC implementation solution for large enterprises struggling with email authentication. Their timing coincided perfectly with Google's introduction of email authentication flags in user inboxes, creating urgent demand from organizations needing to achieve DMARC compliance to prevent their emails from being flagged as suspicious.

The core product, Valimail Enforce, automates the process of implementing DMARC authentication through a one-time DNS update. When an email is sent claiming to be from a Valimail client, it's checked against Valimail's system before delivery. The system maintains an automatically updated list of approved senders for each company, allowing legitimate emails through while rejecting unauthorized ones.

For IT teams, Valimail eliminates the complex, manual work typically required for DMARC implementation. The platform's "Instant SPF" technology bypasses traditional SPF's 10-domain lookup limit, enabling customers to authorize new senders with a single click rather than through time-consuming DNS updates.

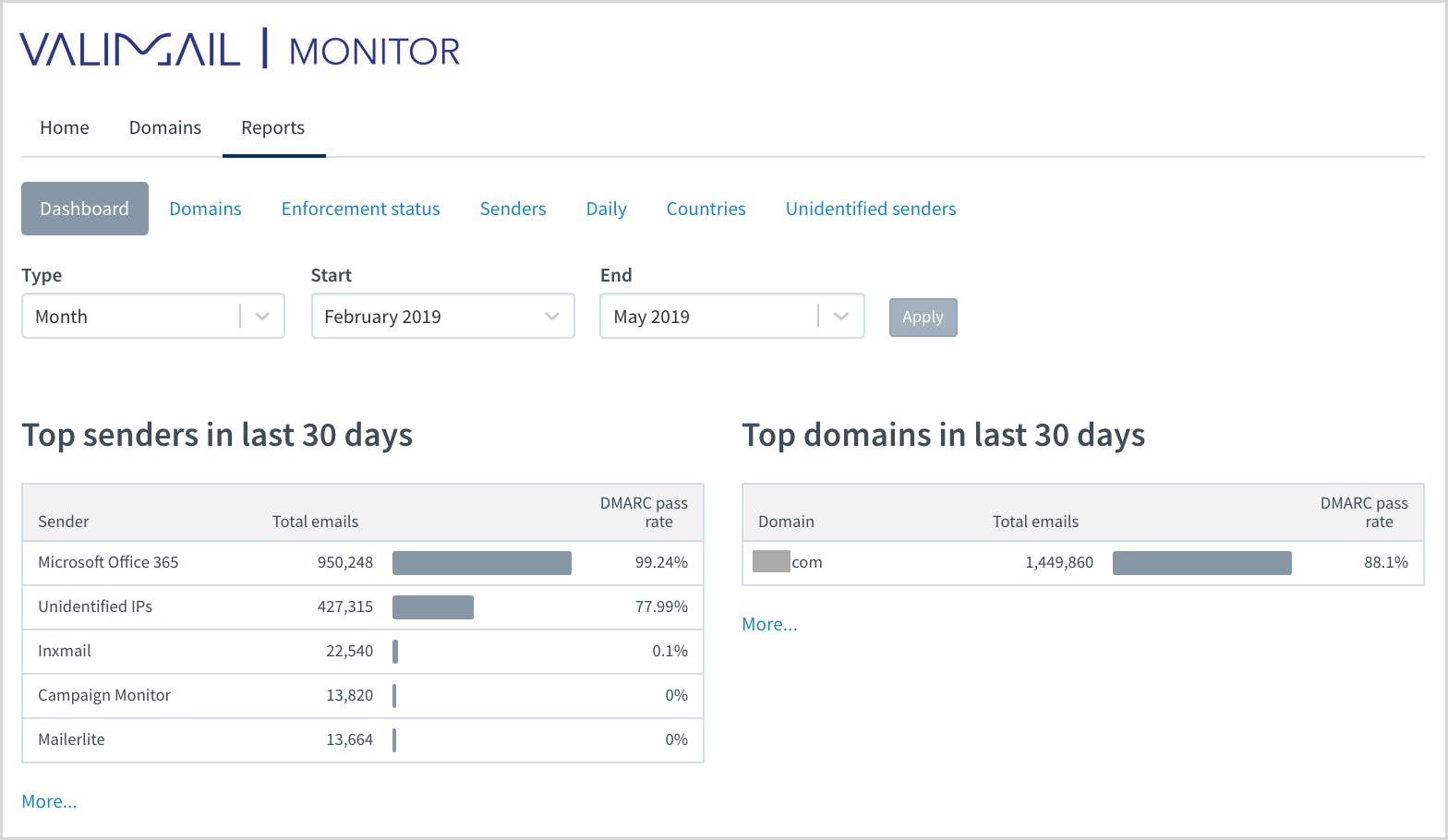

Valimail later expanded its product line to include Monitor (a free DMARC visibility tool), Align (for Google/Yahoo compliance), and Amplify (for brand logo display in email clients), building on their core expertise in email authentication automation.

Business Model

Valimail is a SaaS company that provides automated email authentication services through a tiered product strategy, with pricing based on domain volume and features needed. The company's core offering helps organizations prevent email spoofing and improve deliverability through DMARC implementation, a critical but technically complex email security standard.

The company employs a freemium go-to-market model centered around Valimail Monitor, a free tool that provides basic DMARC monitoring and reporting. This serves as a low-friction entry point, particularly for Microsoft Office 365 users through a strategic partnership. Organizations requiring full DMARC enforcement capabilities can upgrade to Valimail Enforce, which starts at $5,000-$8,000 annually and increases based on number of domains and email volume.

Valimail's business model leverages strong channel partnerships, particularly with Microsoft, which drives 50-60% of revenue through referrals. This mirrors successful models from email security companies like Proofpoint. The company's automated approach differentiates it from competitors by eliminating manual configuration processes - customers can authorize new email senders with a single click rather than complex DNS updates.

Competition

Valimail operates in the email authentication and security market, which includes both established email security platforms and specialized DMARC providers.

Enterprise email security platforms

Large platforms like Proofpoint, Mimecast, and Cisco dominate the broader email security market, offering comprehensive suites that include spam filtering, anti-phishing, and basic DMARC capabilities. These companies capture significant market share through established channel partnerships and integration with popular email platforms. Proofpoint and Mimecast together controlled 30% of the $3.7B email security market in 2020, with Proofpoint reaching $1.2B in revenue in 2021.

Specialized DMARC providers

A growing segment of specialized providers focuses exclusively on DMARC implementation and management. Key players include Agari (now part of Fortra), dmarcian, Red Sift, and PowerDMARC. These companies typically offer both free DMARC monitoring tools and paid enforcement solutions, similar to Valimail's Monitor/Enforce model.

Platform native solutions

Major email platforms are developing native DMARC capabilities. Microsoft Defender for Office 365 is working on DMARC reporting features, while Google Workspace includes basic DMARC authentication. However, these built-in tools often lack the advanced management and automation features of dedicated solutions.

The market is seeing increased consolidation, exemplified by Fortra's acquisition of Agari and Cofense's purchase of Cyberfish. This trend, combined with new requirements from Google and Yahoo mandating email authentication by 2024, has accelerated demand for DMARC solutions, particularly among enterprises seeking automated implementation tools.

TAM Expansion

Valimail has tailwinds from the rapid rise in sophisticated phishing attacks and new email authentication requirements from major providers like Google and Yahoo, with opportunities to expand into adjacent markets beyond its core DMARC implementation services.

Email security infrastructure

The shift toward cloud-based email and proliferation of SaaS services has created an increasingly complex email authentication landscape. With organizations using dozens of third-party services to send email on their behalf, Valimail's automated authentication platform becomes more valuable. The company's "Instant SPF" technology, which bypasses traditional SPF lookup limits, positions them to capture more of the broader $3.7B email security market currently dominated by legacy providers like Proofpoint and Mimecast.

Brand protection and engagement

Valimail's support for Brand Indicators for Message Identification (BIMI) opens up opportunities in the marketing technology space. By enabling brands to display their logos in email clients, Valimail can help drive increased engagement and deliverability - key priorities for marketing teams. This positions them to expand beyond pure security into email marketing optimization, a $2B+ market growing at 13% annually.

Enterprise identity management

As organizations struggle with shadow IT and unauthorized cloud services, Valimail's visibility into email sending patterns positions them to expand into broader identity and access management. Their existing integration with Microsoft and ability to detect unauthorized service usage creates natural expansion opportunities into the $13.4B identity governance market, particularly for cloud-first enterprises seeking better control over their SaaS environments.

Risks

Three key risks for Valimail:

Overreliance on Microsoft partnership: Valimail's growth has been heavily driven by its Microsoft partnership, which provides free DMARC monitoring to Office 365 users. While this has enabled rapid customer acquisition, it also creates significant dependency risk. If Microsoft were to build native DMARC capabilities or partner with another provider, Valimail could lose its primary distribution channel and face challenges maintaining its growth trajectory.

Low monetization of free users: With 65,000 customers but only $30M in ARR, Valimail's average revenue per customer of ~$430 is substantially below industry peers like Mimecast ($10,000-20,000). While the large free user base represents expansion opportunity, it also suggests potential challenges in converting users to paid products. The company needs to prove it can successfully monetize its broad but shallow customer relationships.

Commoditization of core offering: As major platforms like Microsoft Defender, Sophos, and Cisco add native DMARC capabilities, Valimail's core differentiation around automated DMARC implementation could erode. The company may need to expand beyond pure authentication into adjacent security areas to maintain growth and avoid margin pressure, but faces well-funded incumbents in those broader markets.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.