Revenue

$70.00M

2023

Valuation

$600.00M

2023

Funding

$149.10M

2024

Growth Rate (y/y)

40%

2023

Revenue

Sacra estimates Tray.io hit $70M in annual recurring revenue (ARR) in 2023, up approximately 40% year-over-year from $50M ARR in 2021, and up from just $500K ARR in 2018.

Valuation & Funding

tray.io was valued at $600 million as of November 2019. The company has raised a total of $149.37 million across 10 funding rounds. Key investors include Meritech Capital Partners, Spark Capital, and GGV Capital. The most recent funding activity was a financing round in September 2022, with participation from investors including the Canada Pension Plan Investment Board and Stepstone Group.

Product

Tray.io was founded in 2012 by Rich Waldron, Alistair Russell, and Dominic Lewis in the UK. Initially experimenting with email workflows, the founders moved to San Francisco and pivoted to creating an automation solution for finding and contacting VCs.

This experience led to the concept of Tray.io as a general-purpose automation platform.

The company found product-market fit by targeting IT departments and business technologists in enterprise organizations seeking to automate complex, multi-app workflows without extensive coding.

Tray.io's low-code platform allowed non-developers to create sophisticated automations, expanding from marketing and sales use cases to finance and operations. Between 2018 and 2021, the company grew from $500k to $20M ARR, reaching $50M ARR by 2022.

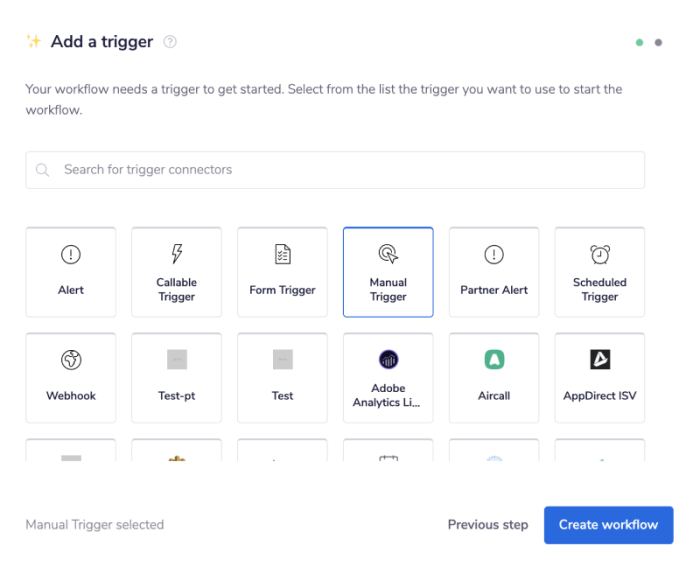

Tray.io's core product is an Integration Platform as a Service (iPaaS) that enables users to build integrations and automations across various SaaS applications. Key features include:

1. Low-code interface: Allows both technical and non-technical users to create complex workflows.

2. Extensive connector library: Supports integration with a wide range of popular business applications.

3. Scalability: Handles high-volume data processing and complex business logic.

4. AI-powered automation: Recently introduced Tray Merlin AI, which uses natural language processing to generate workflows from plain English requests.

5. Enterprise-grade security and governance: Ensures data protection and compliance.

Business Model

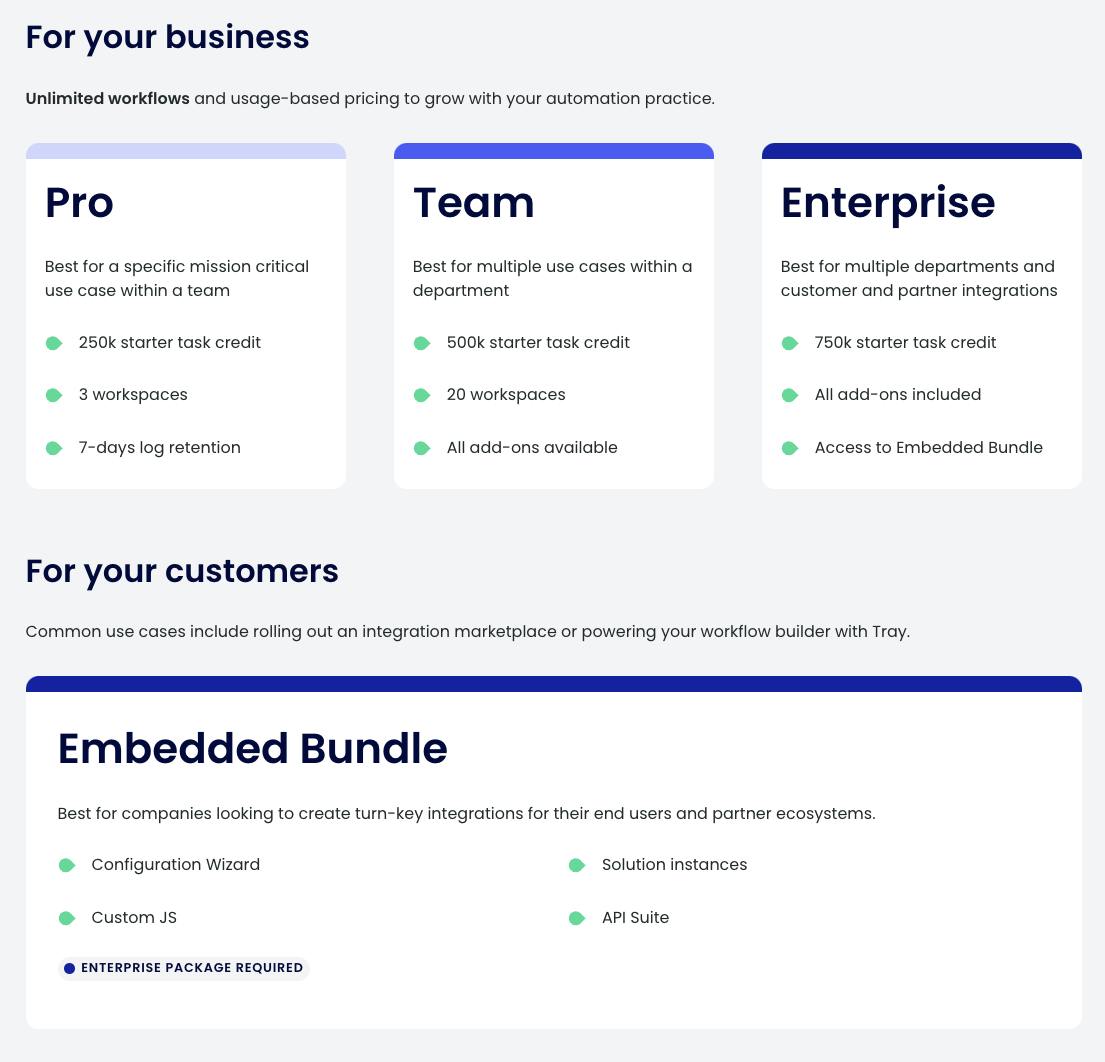

Tray.io is a subscription SaaS company that offers a low-code automation platform for enterprises, with pricing based on a combination of user seats and usage volume.

The company's core offering is its Universal Automation Cloud, which enables businesses to integrate various applications and automate complex workflows across their tech stack.

Tray.io generates revenue through tiered subscription plans, targeting both departmental teams and enterprise-wide deployments.

The pricing model is designed to encourage adoption and expansion within organizations, starting with individual teams and growing to company-wide usage.

A key differentiator in Tray.io's business model is its focus on empowering both technical and non-technical users to create sophisticated automations. This approach addresses a critical pain point in enterprise digital transformation efforts, where the demand for integration and automation often outpaces the capacity of IT departments.

Competition

Tray.io competes in the Integration Platform as a Service (iPaaS) market, with its primary focus on providing low-code automation and integration solutions. The competitive landscape can be divided into three main categories: traditional iPaaS providers, low-code automation platforms, and AI-powered integration tools.

Traditional iPaaS Providers:

In this category, Tray.io faces competition from established players like MuleSoft, Dell Boomi, and Informatica. These companies offer robust integration capabilities but often require more technical expertise to implement and maintain.

Tray.io differentiates itself by providing a more user-friendly, low-code approach that enables both technical and non-technical users to create complex integrations. For example, Tray.io's visual workflow builder allows users to design integrations without extensive coding knowledge, a feature not as developed in traditional iPaaS offerings.

Low-Code Automation Platforms:

Tray.io competes with low-code automation platforms such as Zapier and Workato. These platforms, like Tray.io, aim to make integration and automation accessible to a wider range of users.

However, Tray.io sets itself apart by offering more advanced capabilities for handling complex business logic and enterprise-grade scalability. For instance, Tray.io's platform can handle high-throughput, mission-critical processes that may be beyond the scope of simpler automation tools.

This positions Tray.io as a solution that can bridge the gap between easy-to-use consumer tools and enterprise-grade integration platforms.

AI-Powered Integration Tools:

The newest competitive category involves AI-powered integration and automation tools. Tray.io has entered this space with its Tray Merlin AI feature, which uses natural language processing to generate workflows from plain English descriptions.

This puts Tray.io in competition with emerging AI-enhanced integration tools and chatbots that aim to simplify the creation of automated workflows. Tray.io's advantage in this category lies in its ability to combine AI capabilities with its existing robust integration platform, allowing for more sophisticated and reliable automations compared to standalone AI tools.

A key trend in the competitive landscape is the increasing demand for solutions that can handle complex, multi-application workflows while remaining accessible to non-technical users.

Tray.io has positioned itself well in this regard, offering a platform that scales from simple automations to enterprise-grade integrations. The company's focus on providing a unified platform for both low-code and more advanced integration needs allows it to compete effectively across multiple market segments, from SMBs to large enterprises.

TAM Expansion

Tray.io has tailwinds from the growing demand for enterprise automation and integration, as well as the rapid adoption of AI technologies.

The company has the opportunity to grow and expand into adjacent markets like AI-powered process optimization, advanced data analytics, and enterprise-wide workflow management.

Enterprise Automation and Integration

The increasing complexity of enterprise software stacks and the need for seamless data flow between applications continue to drive demand for integration platform as a service (iPaaS) solutions.

Tray.io is well-positioned to capitalize on this trend with its low-code automation platform that enables both technical and non-technical users to create sophisticated workflows across multiple applications.

As organizations seek to streamline their operations and reduce technical debt, Tray.io can expand its offerings to provide more comprehensive enterprise-wide workflow management solutions.

This could involve developing pre-built templates for common business processes across various industries, as well as offering consulting services to help enterprises optimize their automation strategies. By becoming a central hub for business process automation, Tray.io could significantly increase its average revenue per customer and strengthen its position in the market.

AI-Powered Process Optimization

The introduction of Tray Merlin AI represents a significant step towards AI-augmented automation. This positions Tray.io to tap into the growing market for AI-powered business solutions.

The company can further expand in this direction by developing more advanced AI capabilities that not only translate natural language into workflows but also proactively suggest process improvements based on usage patterns and industry best practices.

Tray.io could also explore partnerships with leading AI companies to integrate more sophisticated machine learning models into its platform.

This could enable features like predictive analytics for workflow optimization, anomaly detection in business processes, and intelligent decision-making within automated workflows. By positioning itself at the intersection of iPaaS and AI, Tray.io has the potential to create a new category of intelligent automation platforms.

Data Analytics and Insights

Given its position as a central hub for data flow within organizations, Tray.io has a unique opportunity to expand into advanced data analytics. By leveraging the vast amounts of data passing through its platform, the company could develop powerful analytics tools that provide insights into business processes, identify bottlenecks, and suggest optimizations.

This expansion could involve building native analytics dashboards, developing machine learning models for predictive analytics, and offering data warehousing solutions. By helping organizations not just move data but also derive actionable insights from it, Tray.io could significantly increase its value proposition and expand its total addressable market beyond traditional iPaaS solutions.

Risks

1. AI Commoditization: As generative AI capabilities become more ubiquitous, Tray.io's differentiation through its Merlin AI feature could erode.

Major cloud and SaaS players may integrate similar natural language workflow creation abilities directly into their platforms, potentially reducing the need for a separate iPaaS solution. This could slow Tray.io's growth and force price competition in a previously high-margin area.

2. Enterprise Sales Challenges: Tray.io's pivot towards enterprise customers represents a significant shift in sales strategy.

The company's historical success with smaller, more agile customers may not translate smoothly to longer, more complex enterprise sales cycles. Failure to adapt could result in missed revenue targets and slower growth, especially as the company aims to continue its rapid scaling from $50M ARR.

3. Data Governance Concerns: As Tray.io enables more non-technical users to create integrations across multiple systems, there's an increased risk of data mishandling or security breaches.

While the company emphasizes its security measures, a high-profile incident could severely damage trust with enterprise customers and hinder adoption of the "citizen integrator" model that is central to Tray.io's value proposition.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.