Revenue

$144.60M

2022

Valuation

$2.70B

2022

Funding

$1.10B

2022

Growth Rate (y/y)

10.3%

2022

Valuation & Funding

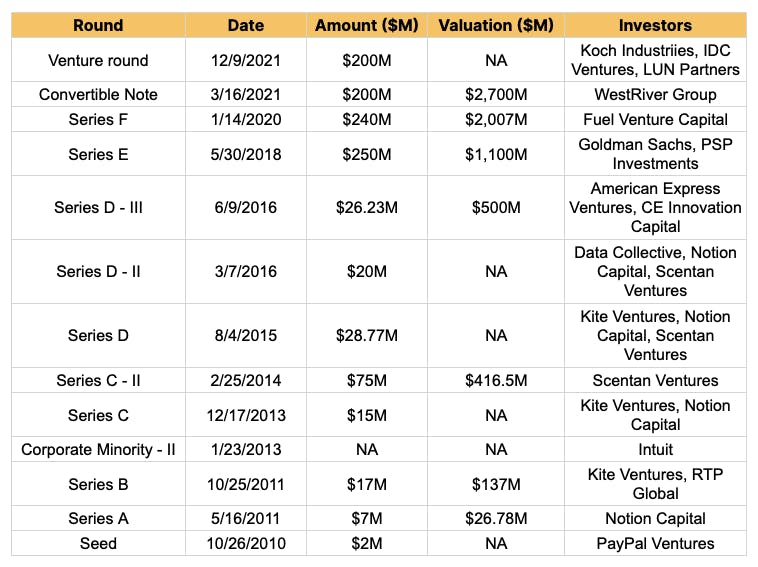

Tradeshift has raised $1.1B from notable investors such as Goldman Sachs, PayPal Ventures, West River, and Koch Industries. It was last valued at $2.7B at an estimated valuation/revenue multiple of 19x.

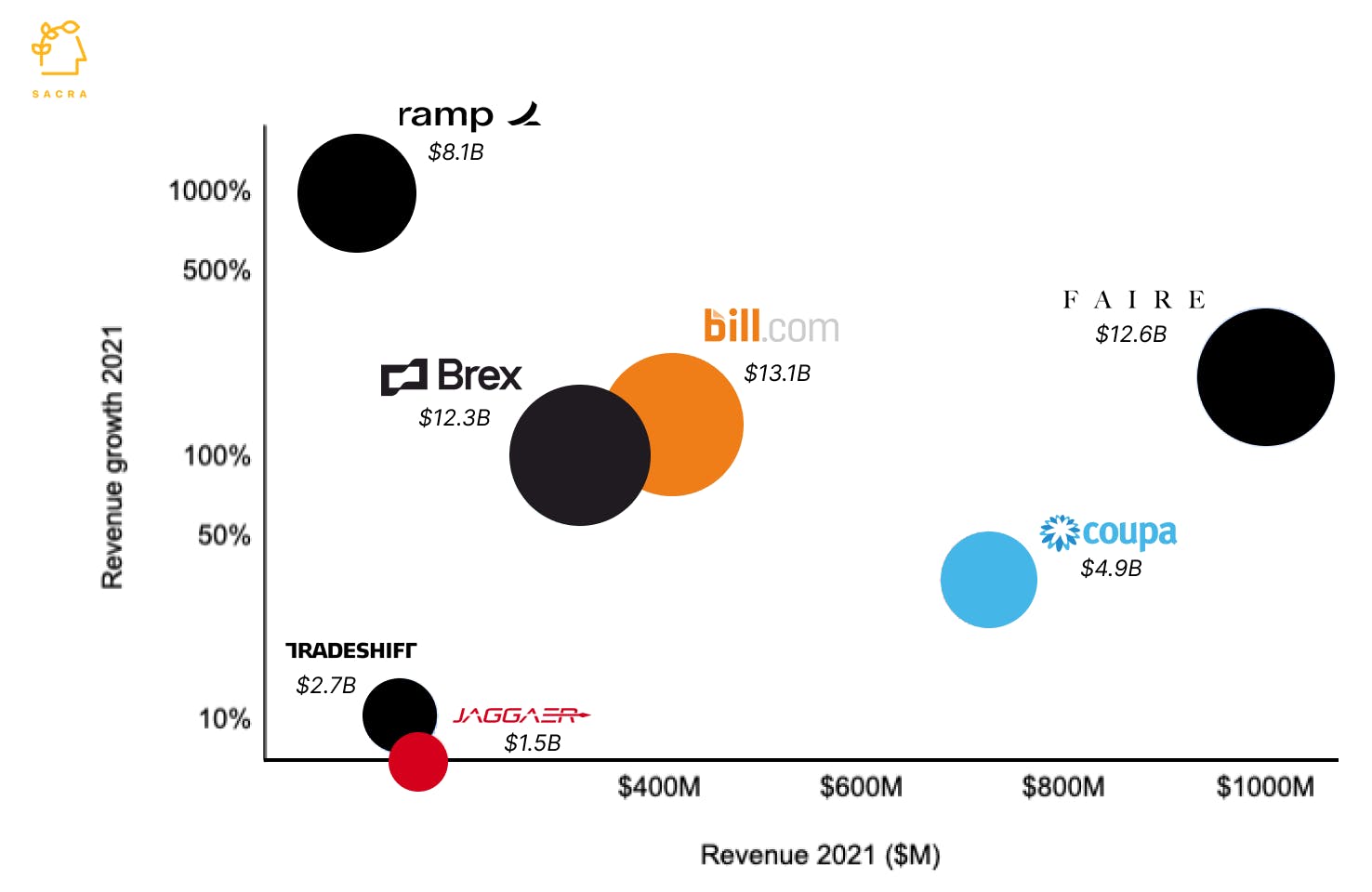

Tradeshift’s publicly listed competitors in the enterprise procure and pay space trade at lower multiples, with Coupa at 6.8x and Basware at 3.3x.

Business Model

Tradeshift is a platform that provides SaaS and financial products to enterprises and their suppliers to make it easier for them to do business with each other.

Suppliers can list their services on Tradeshift for enterprises to connect and transact with them. Tradeshift provides free core services to suppliers, such as listings, digital invoicing, payment analytics, and a dashboard to build supply-side liquidity.

Tradeshift sells e-procurement SaaS to enterprises bundled with the supplier pool whose KYC and compliance are managed by Tradeshift. Enterprises can also onboard their existing suppliers to Tradeshift. Tradeshift also sells the payments and spend management SaaS to enterprises, which makes it easier for them to purchase from and pay their suppliers digitally.

Once the suppliers start sending invoices and getting paid using Tradeshift’s platform, Tradeshift leverages transaction data to offer working capital management products to suppliers, such as early invoice payment for a fee. Direct access to transaction data gives Tradeshift better underwriting ability without asking for paperwork like traditional trade financing companies.

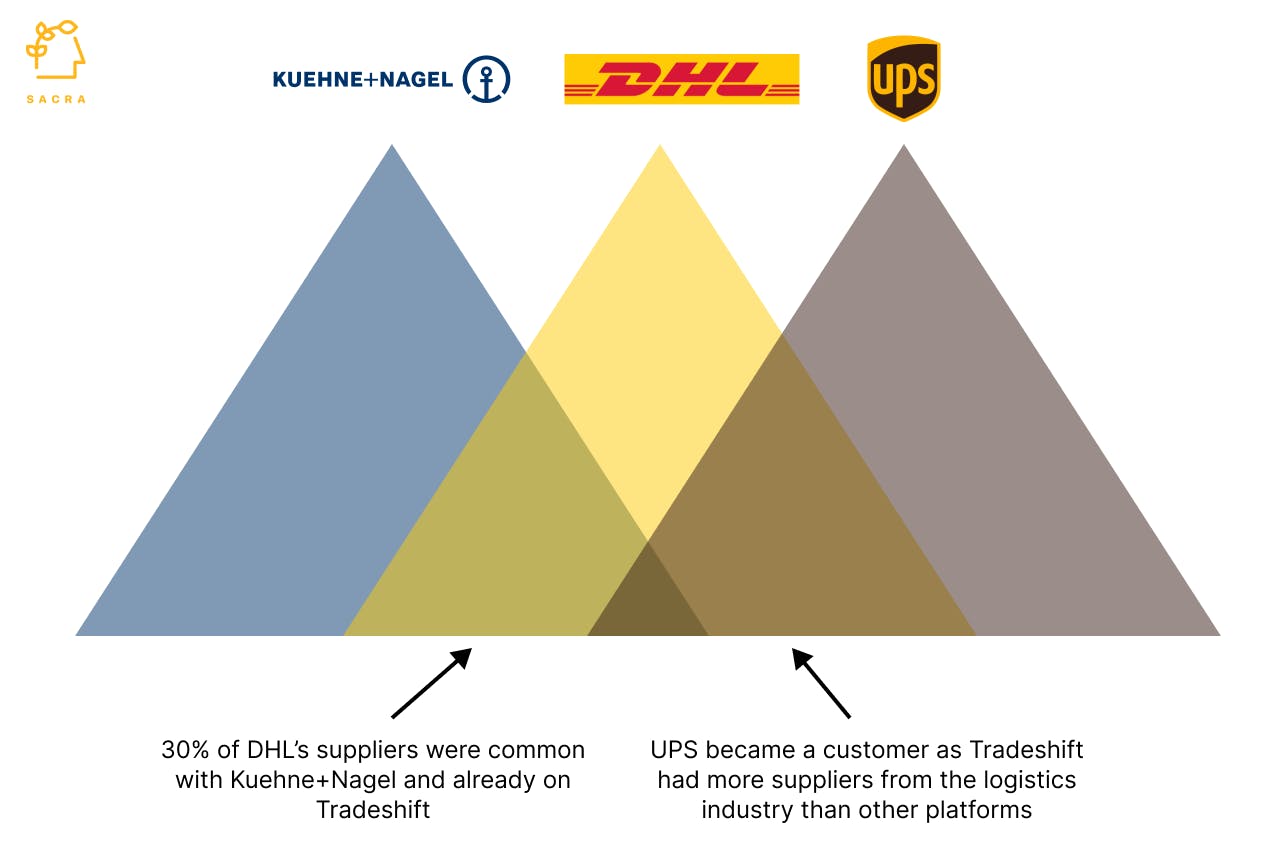

As more suppliers and enterprises join Tradeshift’s platform, they benefit from two-sided network effects. For instance, Kuehne + Nagel onboarded its suppliers to Tradeshift when it became a customer. 30% of these suppliers were also selling to DHL, which became a Tradeshift customer and onboarded its supplier base to Tradeshift, leading to UPS becoming its customer as Tradeshift connected more suppliers in the logistics industry than other platforms.

Product

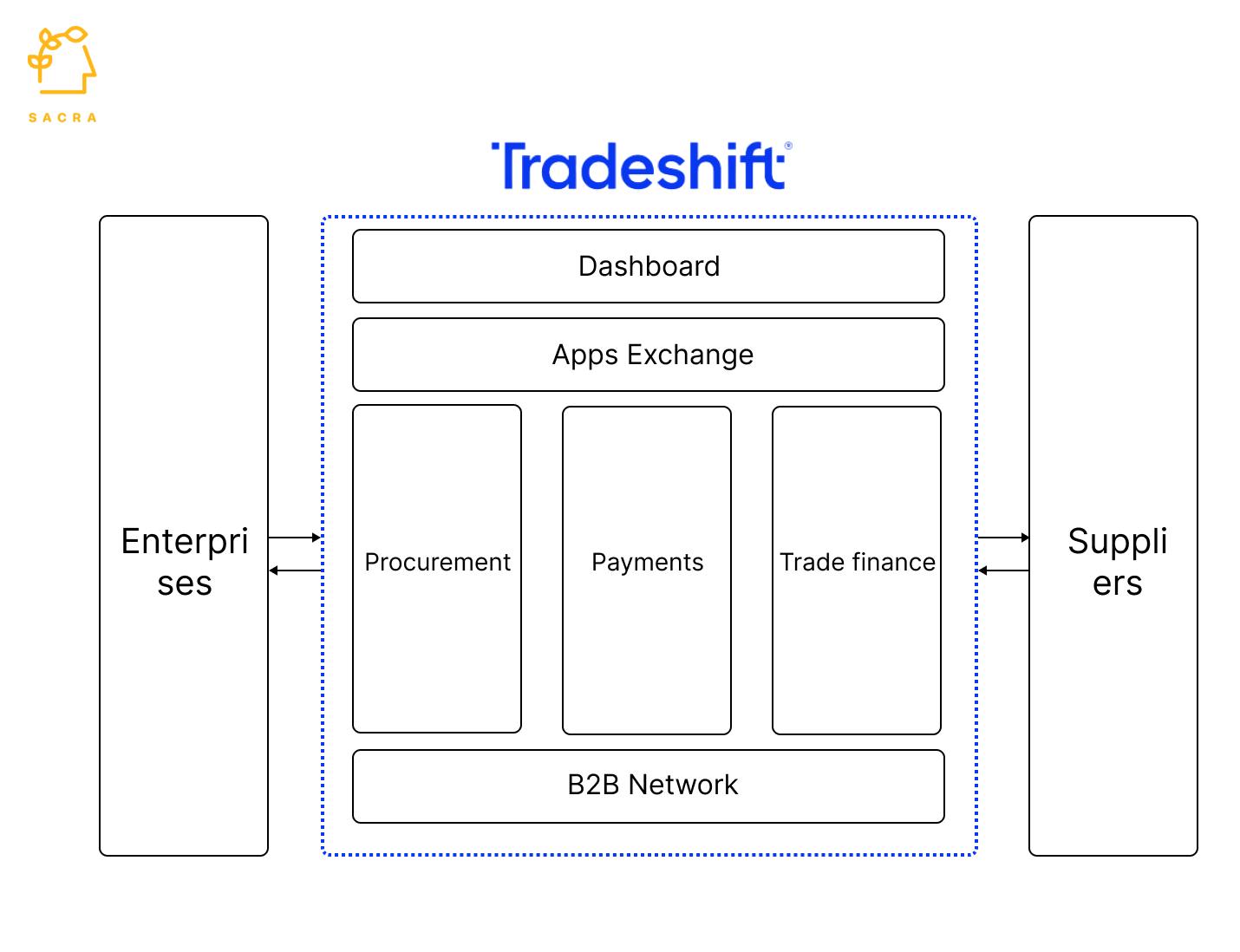

At the core of the Tradeshift platform is the SaaS that enables procurement, payments, and trade finance.

Procurement

Tradeshift provides digital workflows to enterprises for buying from their existing or new suppliers on Tradeshift’s platform. Enterprises can create a white-labeled marketplace of their selected suppliers and expose it to their employees for direct procurement as per pre-configured rules. Tradeshift also facilitates purchasing long-tail items through pre-approved virtual cards to make a one-time purchase.

Payments

Tradeshift’s payments workflows allow suppliers to send digital invoices to enterprises. The enterprises match them with their purchase rules and purchasing documents before payment. The payments platform complies with tax rules in 50 countries and provides dispute management. Tradeshift also provides account payable automation through algorithms that reduces manual intervention in making payments.

Trade finance

Tradeshift provides early payments to suppliers against outstanding invoices for a fee and collects the amount from their enterprise customers later. It leverages the transaction data on the platform to underwrite these payments without additional paperwork.

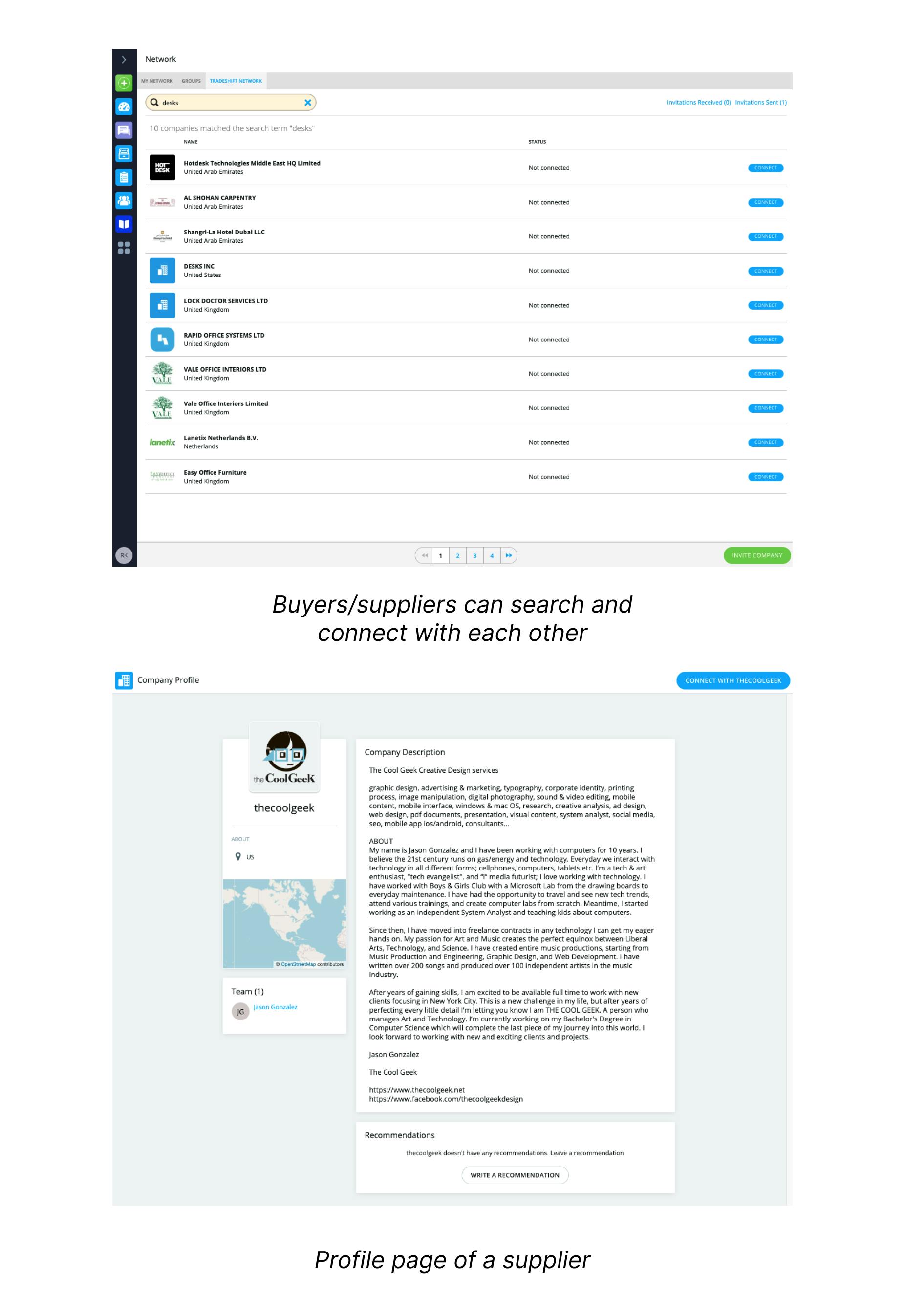

The platform runs on top of the B2B network, a company listings repository where buyers and suppliers can search and connect to send RFQ, purchase orders, or invoices.

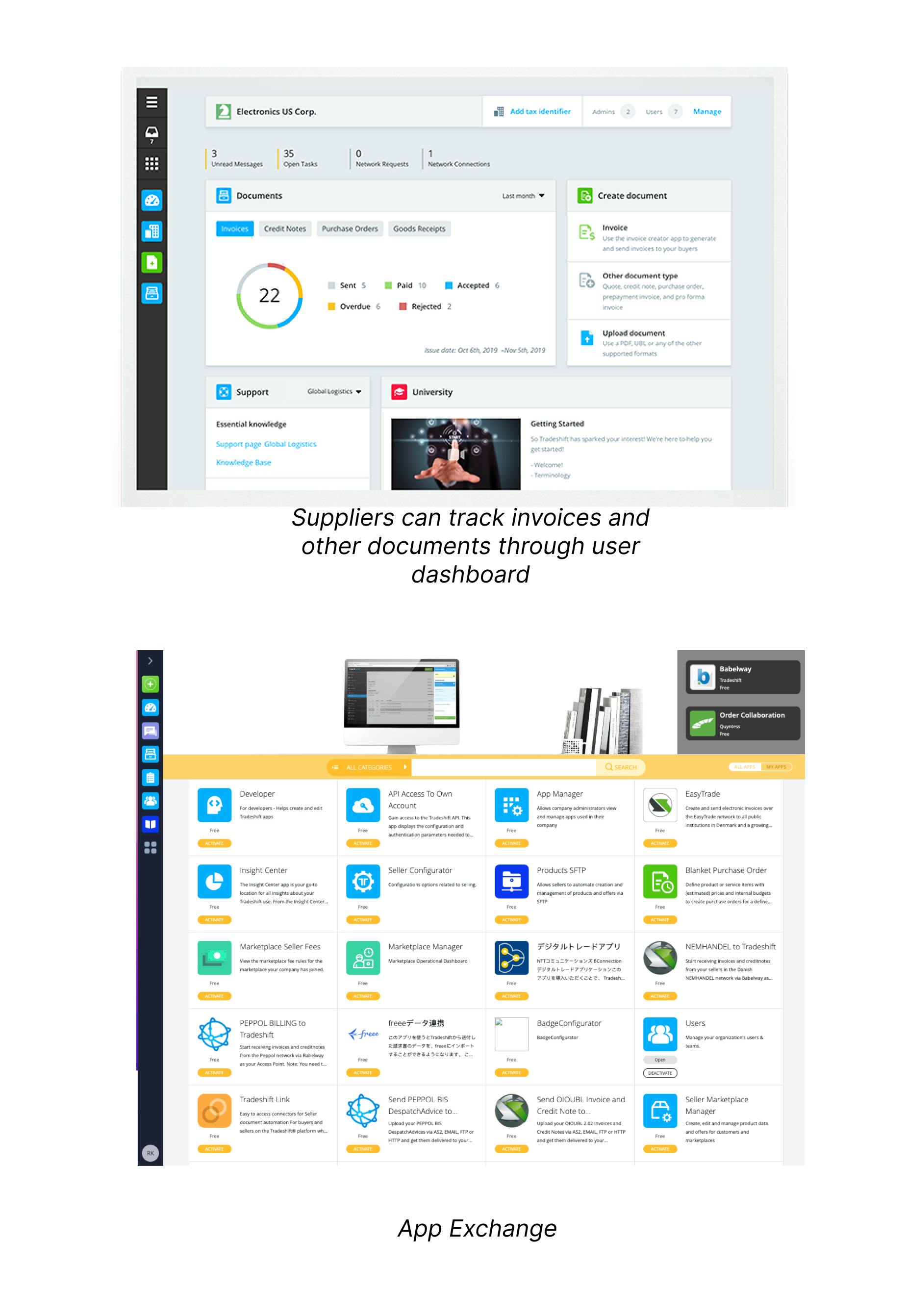

All the Tradeshift features are accessible through a dashboard where enterprises and suppliers can track payments, get insights into transactions, and message each other. Tradeshift also has a Salesforce-like app exchange with first-party and third-party apps for integrations, discounts, marketplace management, and user management.

Competition

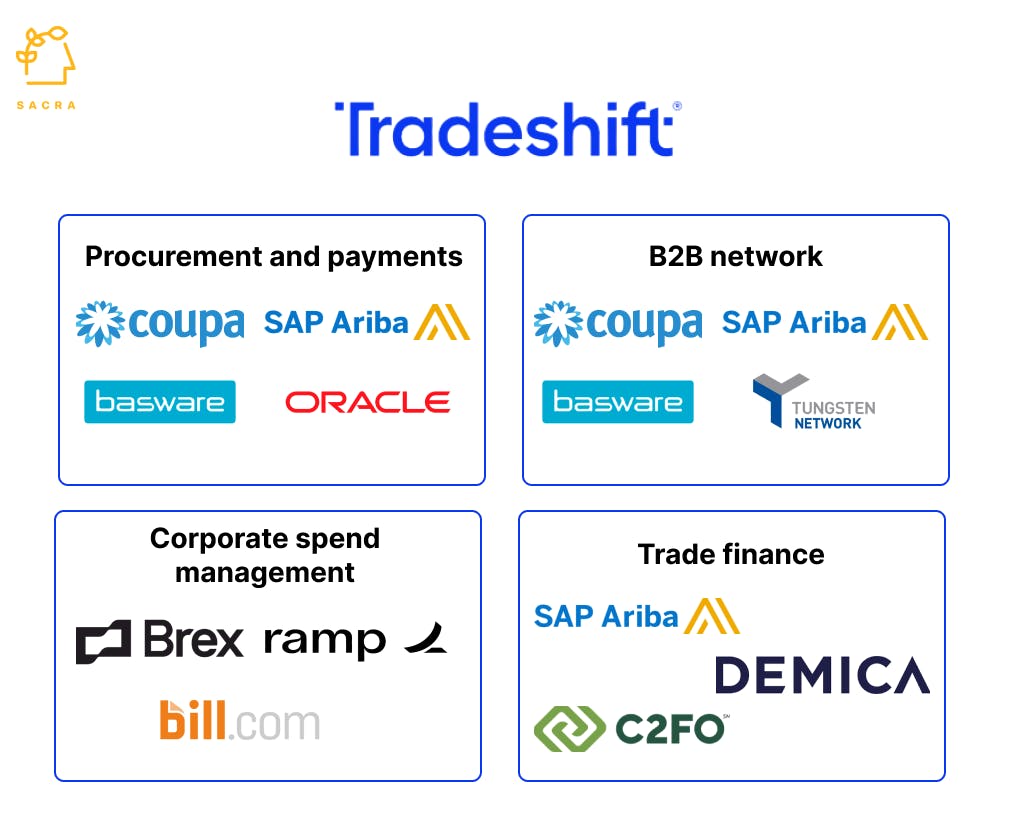

Tradeshift's share in the procurement market is estimated to be less than 1%, with the market leaders being SAP Ariba (16% market share) and Coupa (15% market share).

Tradeshift's advantage over SAP Ariba when it started was that it is natively cloud-based and didn’t have to acquire companies to build that capability. Also, unlike Coupa, which is also cloud-based, Tradeshift was not built as a suite of tools but as a network of suppliers and enterprises with network effects driving customer acquisition. Thus, Tradeshift started with a competitive advantage over the incumbents.

Over the last decade, the incumbents in this space have worked to catch up with Tradeshift's capabilities. For instance, SAP has built a network of suppliers and buyers, acquired Taulia to provide trade financing, and launched a virtual cards-based corporate spend management product with Barclays. Similarly, Coupa has built a supplier and buyer network and an app marketplace on its platform.

Tradeshift's target audience is enterprises, most of which already have procurement software. Procurement software has an ERP-like stickiness as it hits a company’s core workflows and cannot be ripped out easily, making replacement cycles longer and very complex.

Tradeshift’s newly launched virtual cards-based corporate spend management SaaS faces competition from fast-growing startups like Brex and Ramp, which started with SMBs but are now moving up the stack to enterprises.

TAM Expansion

Embedded fintech for suppliers

Tradeshift leverages the data flowing through its platform to provide working capital finance in the form of early payments to suppliers, which is a large market estimated to be worth $56T, almost the size of the global equity market. It can layer other financial services for suppliers by embedding them in its platform such as commercial insurance (market size: $700B), logistics insurance, ($45B) and forex.

GMV-based revenue model

Tradeshift has processed over $1T of cumulative GMV and can build products that take a transaction fee for facilitating these transactions unlike the current SaaS products with fixed billing. For instance, the corporate spend management product is delivered through one-time virtual credit cards on which Tradeshift charges a percentage of the transaction processed. Similar products for buyers can accelerate its growth by closely linking its revenue to the GMV processed.

Risks

Revenue model

One of the biggest risks for Tradeshift is its revenue model that monetizes the enterprises through SaaS-style fees rather than on the basis of the GMV processed. This constrains the scale of growth from existing customers as they process more GMV through Tradeshift, instead shifting the focus to selling more SaaS contracts to new customers.

Basic and dated experience

Tradeshift considers its foundation as a B2B network as a competitive advantage against the likes of Coupa and SAP Ariba and envisions the move of B2B software from cloud to network as a growth driver. However, its B2B network features and UI are basic and look dated. The experience of finding companies and connecting with them for transactions is not close to any of the modern consumer networks such as LinkedIn.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.