Revenue

$145.91M

2025

Valuation

$4.00B

2025

Funding

$530.00M

2025

Revenue

Sacra estimates that Synthesia hit $146 million in annual recurring revenue (ARR) in September 2025, up from $88M ARR at the end of 2024. The company announced it crossed $100 million in ARR in April 2025.

The company derives 70% of its revenue from enterprise deals, with over 60,000 customers globally including more than 80% of Fortune 100 companies. Customers include Bosch, Merck, and SAP. Revenue is geographically balanced, with approximately 50% from the United States and the remaining 50% split between Europe and Asia.

The average enterprise customer creates content in 7 different languages, with 40% of all generated videos being translated versions, highlighting translation as a core driver of expansion revenue rather than a peripheral feature.

Valuation & Funding

In January 2026, Synthesia closed a $200M Series E round led by GV that valued the company at $4B post-money, nearly doubling the valuation from its Series D just one year earlier. The round included participation from Evantic, Hedosophia, NVentures (Nvidia's venture arm), alongside existing investors Accel, Kleiner Perkins, NEA, PSP Growth, Air Street Capital, and MMC Ventures.

The financing included an employee share sale facilitated in partnership with Nasdaq at the same $4B valuation, giving long-tenured staff liquidity while remaining shareholders.

Synthesia was previously valued at $2.1 billion as of their Series D round in January 2025, which raised $180 million led by NEA (New Enterprise Associates).

The company has raised over $530 million in total funding across multiple rounds. Their valuation has more than doubled from the $1 billion mark achieved during their $90 million Series C in 2023, led by Accel and NVentures.

Key investors include GV, Evantic, Hedosophia, NVentures, NEA, Accel, Kleiner Perkins, Air Street Capital, PSP Growth, MMC Ventures, and Atlassian Ventures. Founded in 2017, Synthesia has grown to approximately 600 employees after increasing headcount roughly 40% over the past year, heavily concentrated in engineering and AI research across 7 countries. In April 2025, Synthesia also received a strategic investment from Adobe's venture arm as part of a partnership, though the amount was undisclosed.

Product

Synthesia is a browser-based AI video platform that converts text scripts into videos of realistic digital humans speaking in 140+ languages without filming, cameras, or actors. Users log into Synthesia STUDIO, type or paste a script, select an AI avatar from a library of 230+ pre-recorded options or create a custom avatar using smartphone video, and click generate to receive a finished video in minutes.

The workflow mirrors PowerPoint or Canva: users compose scenes by positioning avatars against backgrounds, adding text overlays, screen recordings, charts, or imported slides, then arranging elements either from templates or blank canvas.

After entering the script and choosing an avatar, Synthesia's AI synthesizes natural speech in the selected language and animates facial movements, expressions, and body language to match the spoken content and emotional tone of the script.

The platform's latest version, Synthesia 3.0, adds interactive video agents that can hold real-time conversations with viewers embedded directly in videos. These agents draw on company-specific knowledge to answer questions, run comprehension checks, simulate sales objections after training modules, conduct recruiting case studies, or let product demo viewers ask feature questions without leaving the video player. The company is prioritizing development of conversational, audio-visual agents that can respond to questions and role-play scenarios, with an initial focus on sales training and potential expansion into recruiting and other workplace uses as the technology matures.

The company also ships a Courses product that lets enterprises assemble multi-module learning programs, embed conversational agents for practice scenarios, and run automated assessments—moving beyond one-off video creation toward complete training workflows.

For translation, users click a button to localize any video into dozens of languages with synthesized voice dubbing that matches lip movements, letting global companies create region-specific content without separate filming sessions or voice actors.

Custom avatars are created either through professional filming in controlled environments or via the newer selfie avatar feature that generates a digital twin from 2-3 minutes of smartphone footage.

Synthesia owns its video player and publishing stack rather than simply exporting MP4 files, allowing the company to layer interactive features, capture engagement analytics, and control the end-to-end experience from creation through distribution. Videos integrate with learning management systems, CRM platforms, and internal communication tools for deployment across enterprise workflows.

Most companies use Synthesia for internal communications (CEO messages, policy updates), training modules that need translation into multiple languages, sales enablement content, customer onboarding, and increasingly for external marketing campaigns and social media as avatar quality has improved past the uncanny valley threshold that previously limited public-facing use.

Synthesia is now trusted by 90% of Fortune 100 companies and 70% of the FTSE 100, strengthening its enterprise positioning alongside its interactivity features, AI dubbing with frame-accurate lip sync, and Veo 3–powered generative assets—capabilities that expand usage across training, onboarding, and multilingual localization. The company employs approximately 600 people after increasing headcount roughly 40% over the past year, heavily concentrated in engineering and AI research across 7 countries.

Business Model

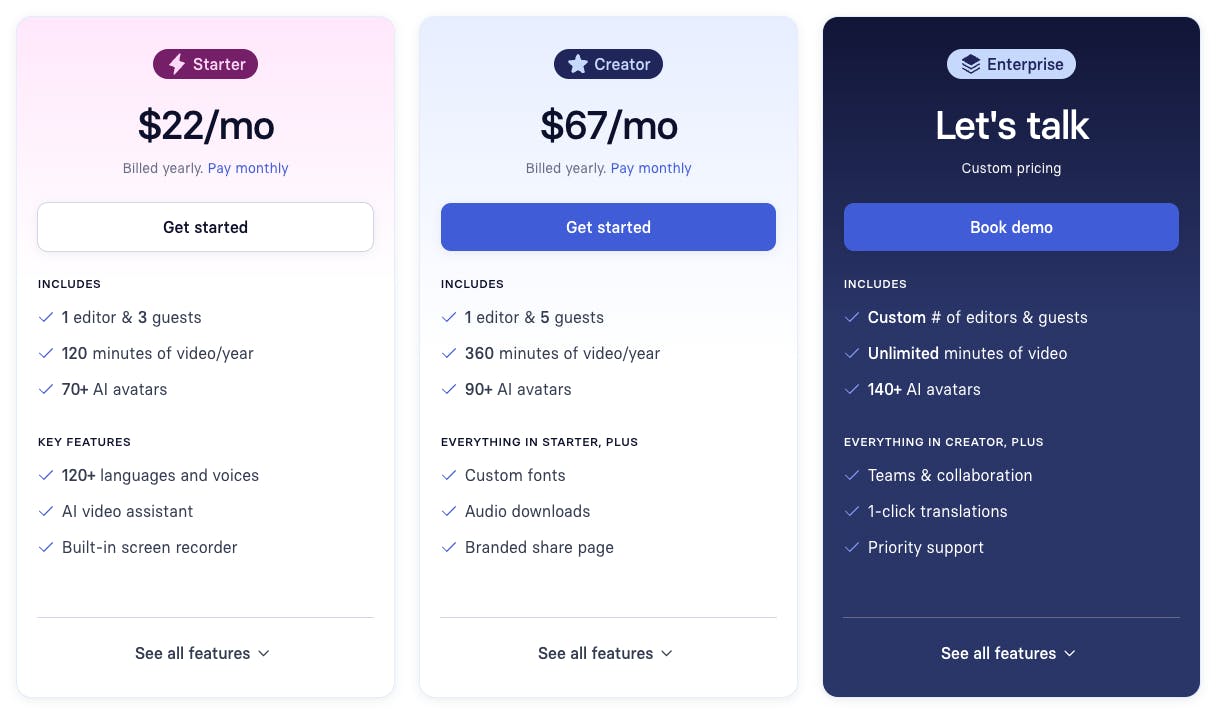

Synthesia operates a B2B SaaS model with tiered subscription pricing based on usage limits and feature access, blending self-service plans for individuals and small businesses with enterprise contracts negotiated through a dedicated sales team.

The company monetizes high-velocity video creation via consumption-based credits rather than the slower expansion mechanics of storage and bandwidth that legacy video platforms rely on, though this comes with lower gross margins due to GPU compute costs.

The pricing structure includes a Starter plan at $30/month with approximately 10 minutes of video generation, a Creator plan at $80-90/month with increased limits and priority support, and custom-priced Enterprise plans with high or unlimited usage, enhanced security features, API access, and white-glove onboarding.

Enterprise customers also get advanced collaboration tools, custom avatar creation, brand compliance features, and dedicated customer success managers.

Revenue scales primarily through consumption-led expansion as customers increase usage across more teams and use cases within their organizations.

As enterprises onboard hundreds or thousands of creators who rely on Synthesia for routine communications, training updates, and sales content, credit consumption rises and customers upgrade to larger plans with better per-minute economics.

The company's cost structure centers on R&D (the company employs over 400 people across 7 countries, heavily concentrated in engineering and AI research), cloud infrastructure for GPU-intensive video rendering and voice synthesis, and go-to-market expenses for enterprise sales and customer success. V

ariable costs per video include compute for avatar animation and speech synthesis, but these remain significantly lower than subscription fees, resulting in gross margins likely in the 70-80% range—below pure software's 85%+ margins but well above professional services businesses.

A key business model differentiator is Synthesia's investment in enterprise-grade security, compliance, and responsible AI governance. The platform maintains SOC 2, GDPR, and ISO 27001 certifications and enforces strict policies against unauthorized deepfakes or misuse, including content moderation that sometimes rejects customer videos for policy violations.

This compliance-first positioning creates competitive advantage with risk-averse enterprise buyers willing to pay premium pricing for peace of mind, even as lower-priced competitors emerge.

The enterprise focus also drives the company's strategic decision to own hosting and delivery infrastructure rather than just exporting video files, as large organizations demand analytics, access controls, and integration with existing systems that standalone files can't provide.

Competition

The AI video market is bifurcating along whether products serve marketers (who need hosting, analytics & lead capture) or developers (who need APIs, SDKs & webhooks) and whether they're focused on generating net-new content or editing & distributing it. Synthesia positions as an end-user SaaS platform for marketers and L&D teams, competing against both avatar-native startups and legacy video platforms adding AI features.

Enterprise-focused platforms

Synthesia's primary direct competitors include Colossyan, which targets corporate learning and development departments with a similar AI avatar video creation platform. Colossyan raised a $22M Series A in 2023 but remains smaller than Synthesia in market presence and enterprise traction.

Hour One competes in the same space with its virtual human platform for businesses, focusing on ecommerce and marketing content. They raised about $20M in Series A funding in 2022 and offer slightly lower pricing with some free video minutes to attract users.

Both competitors offer comparable basic functionality (text-to-video with avatars in multiple languages), but Synthesia maintains advantages in enterprise security features, collaboration tools, interactive video agents, and the breadth of its avatar library—plus crucially, the brand recognition of serving 80% of Fortune 100 companies creates a trust moat.

Consumer-friendly innovators

HeyGen represents the fastest-growing competitive threat, reaching an estimated $95M ARR in September 2025 after growing 1024% year-over-year in 2023-24. HeyGen gained traction through aggressive marketing and innovation in avatar creation technology.

While Synthesia initially required professional filming sessions for custom avatars, HeyGen pioneered an "Instant Avatar" tool that creates custom avatars from smartphone selfie videos in minutes, significantly reducing the barrier to personalization. Synthesia responded with similar "Selfie Avatar" functionality, demonstrating how competition accelerates feature parity.

HeyGen operates at a slightly lower price point and balances individual creators and small businesses alongside enterprise clients, compared to Synthesia's 70% enterprise revenue concentration—but HeyGen is rapidly moving upmarket as it matures, creating more direct collision.

API and platform integrators

Tavus represents a fundamentally different strategic approach, building APIs and developer tooling that embed AI avatar generation directly into other software platforms rather than standalone SaaS products.

This model bets on a future where AI talking head videos become native features within existing business software like HubSpot (for sales and marketing), Intercom (for customer support), or Shopify (for ecommerce)—similar to how Twilio provides communications infrastructure rather than end-user apps.

Synthesia's enterprise relationships, interactive video agents, compliance certifications, and full-stack platform (creation + hosting + analytics) provide some defense against this infrastructure-layer threat, though the company may eventually need to offer its own developer APIs to hedge.

Legacy platforms adding AI

Canva ($3.3B ARR) incorporated AI avatar generation through HeyGen's API integration alongside transcription, translation, and basic video editing into its all-in-one creative platform, bundling video features into existing $14.99/month subscriptions rather than requiring separate contracts.

Vimeo, Wistia, and Descript are racing to incorporate AI features like avatar generation, instant translation, and AI editing while leveraging their existing customer bases and hosting infrastructure.

Adobe, which strategically invested in Synthesia and reportedly discussed a $3B acquisition in 2025, integrated Firefly Video into Premiere Pro—representing the "innovator's dilemma" risk where incumbents bolt AI onto installed bases, though Adobe's interest in acquiring Synthesia suggests their native development hasn't satisfied internal targets.

TAM Expansion

Synthesia's long-term ambition is creating a new, owned media format by layering interactive agents on top of video—aiming for a generational, platform-scale business rather than a "clip generator"—with the vision that "static video will be a relic of the past" as interactivity and personalization become standard.

Interactive AI video agents

Synthesia's most promising expansion vector is evolving from static, one-way video content to interactive video experiences. The company is actively developing technology that will allow avatar videos to respond to viewer questions in real-time.

This would essentially merge Synthesia's realistic avatar video capabilities with backend AI systems like large language models to create conversational video agents. For example, a customer could ask an AI avatar questions about a product, and the system would generate a relevant video response on the fly.

Synthesia plans to release its first interactive video agent tool in the first half of 2025. This expansion would move the company beyond content creation into interactive experiences—entering markets served by chatbots, call center AI, and even certain functions performed by live instructors or sales representatives.

The interactive capability could significantly expand Synthesia's addressable market by capturing time-sensitive use cases that static videos can't handle, such as customer support, sales qualification, and personalized education.

Vertical market penetration

While Synthesia currently focuses on internal corporate communications and training, deeper penetration into specific verticals represents a substantial growth opportunity.

The education sector is particularly promising. Schools, universities, online course creators, and educational publishers could use Synthesia to create lecture content, tutoring materials, and explanatory videos in multiple languages. This could transform how educational content is created and localized globally.

The media and news sector offers another expansion path. Digital media outlets could use AI anchors for routine news reports, especially for localizing content across regions or languages. Advertising agencies could create hyper-localized campaigns by swapping avatar ethnicity, language, and cultural references while maintaining consistent messaging.

Government and public sector organizations present a third significant vertical. These entities often need to produce public information content in multiple languages (health guidelines, citizen services information) and could benefit from Synthesia's rapid video creation and translation capabilities.

Geographic expansion and localization

While Synthesia already serves global clients, more focused geographic expansion could drive substantial growth, particularly in regions with unique language needs or content regulations.

Japan represents a strategic target market, with Synthesia earmarking part of its 2025 funding for expansion there. This would require developing avatars that match Japanese business customs and appearance norms, plus marketing efforts tailored to local business practices.

Similar opportunities exist across Asia, where video communication is particularly valued and multilingual content is essential for business. Developing region-specific avatars (with appropriate cultural attire, speaking styles, and gestures) could open doors to new markets.

Expanding into regulated industries in different countries (healthcare, finance, government) would require adapting to local compliance frameworks, but would unlock significant enterprise value. Synthesia's existing focus on security and compliance positions it well for this expansion.

Risks

Ethical misuse concerns: Synthesia's technology enables the creation of realistic videos of people saying things they never actually said, which carries inherent risks of misuse for disinformation or deception. A 2023 incident where Synthesia's platform was allegedly used to create propaganda videos for an authoritarian regime in Burkina Faso (violating the company's terms) highlights the challenge of preventing misuse at scale while maintaining an accessible service.

Technological commoditization: The core technology of generating talking head videos from text is being replicated by an increasing number of competitors at lower price points. As open-source AI models improve and democratize this capability, Synthesia faces pressure to continuously innovate on quality and features to justify its premium positioning or risk seeing its technology become a commodity feature integrated into broader platforms.

Regulatory uncertainty: The regulatory landscape for AI-generated media is rapidly evolving globally. New rules could require visible disclosure of AI-generated content (watermarks, disclaimers), restrict certain applications, or impose significant compliance costs. These potential regulations could impact customer adoption if they reduce the perceived authenticity of the content or add friction to the creation process.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.