Revenue

$195.30M

2023

Valuation

$1.00B

2022

Funding

$328.00M

2022

Growth Rate (y/y)

139%

2022

Revenue

Note: Revenue and loss figures as per Swile's filings with the French regulators.

Swile made €11M in 2021, an increase of 139% over 2020, and its losses also grew almost at the same rate, reaching €41M. Swile mentions that it had €20M in ARR in 2021, which is expected to grow to €140M in 2022 through the acquisition of Bimpli, an employee benefits company. When the acquisition is completed, Swile will have 75,000 clients and cover 5M employees, up from 30,000 clients and 1M employees pre-acquisition.

Swile operates in France and Brazil, with 93% of the revenue coming from France. Swile’s clients include Carrefour, Le Monde, Airbnb, TikTok, Paris Saint-Germain, Spotify, and Red Bull in France, and Bayer, FIAT, Whirlpool, Ambev, and Petlove in Brazil.

We estimate that Swile makes money in three ways:

- 3.5% commission from restaurants and other partners on purchases made by employees using its cards.

- Fees from employers for using Swile for benefits management.

- Interest on the money its clients have added to the cards, but the employees haven’t used.

The commission earned from merchants on card swipes is the biggest part of Swile’s revenue.

Valuation & Funding

Note: All figures as per publicly available information.

Swile has raised $328M through 5 funding rounds, valuing the company at $1B with a valuation/revenue multiple of 91x. Some of its notable investors include SoftBank, Index Ventures, Eurazeo, and Headline.

Swile is richly valued compared to other employee benefits companies such as Edenred (revenue multiple: 7x) and Sodexo (0.6x). However, its multiple is comparable to other VC-funded fintechs like Ramp (81x), Brex (38x), Revolut (65x), and hrtechs like Rippling (208x) and Gusto (36.5x).

Swile's last funding round was in October 2021, when the fintech multiples were much higher. As the market has become tougher in the last six months, many fintechs have lost substantial value. Publicly listed consumer fintechs’ revenue multiple has dropped by two-thirds to 4.4x. Even privately held fintechs are raising new rounds at substantial discounts. Klarna raised a new round at an 85% discount to its earlier valuation of $45B, and Stripe reduced its valuation by 30%.

Public consumer fintech includes Robinhood, Lending Club, Nubank, Paypal, Block, SoFi, Coinbase, Affirm, and Dave.

Public employee benefits companies include Edenred, Sodexo, and Wex.

Business Model

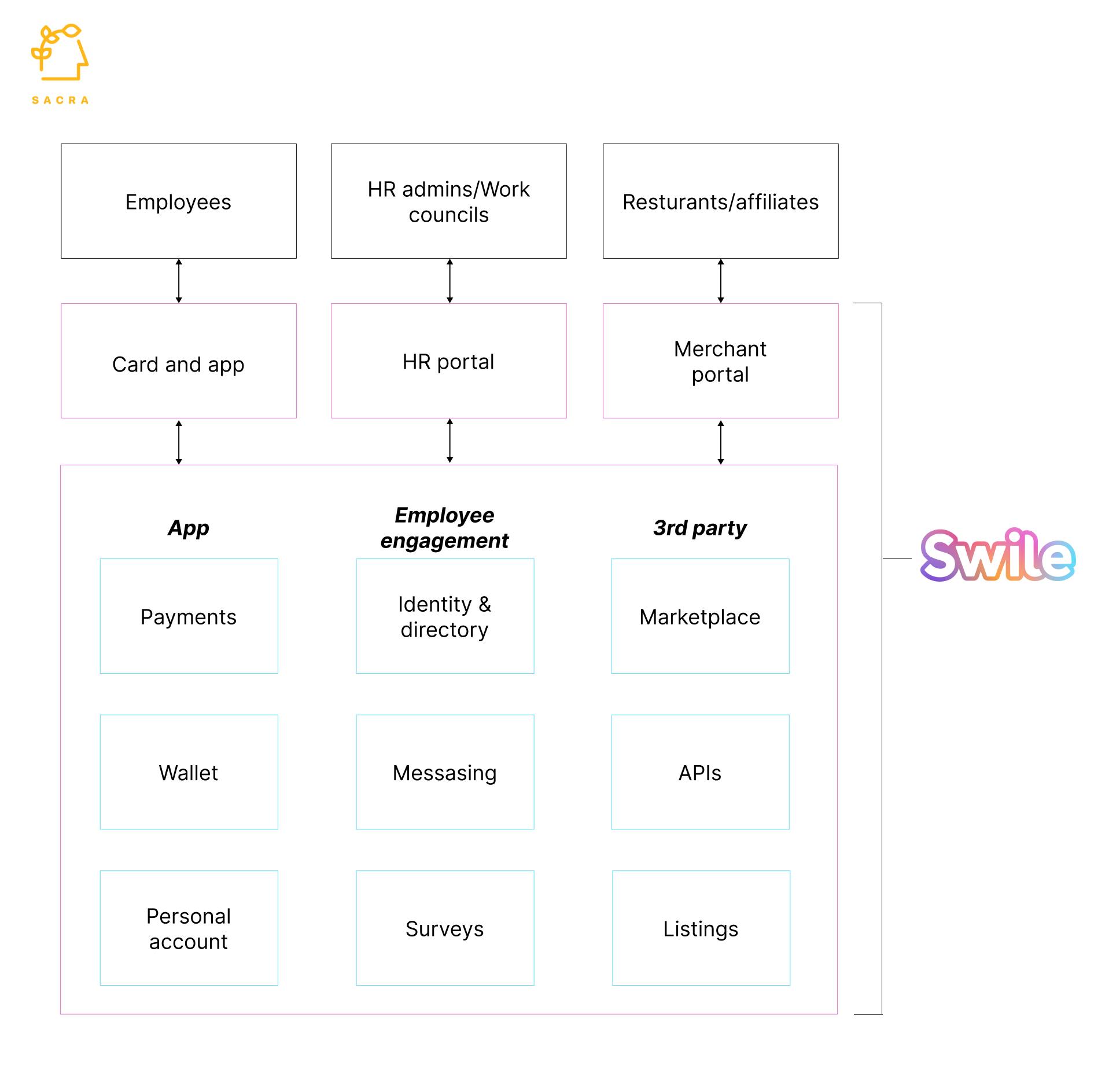

Launched in 2017 in France, Swile is used by employers to manage employee benefits like meal vouchers, gift cards, and mobility benefits, and employee engagement activities such as surveys and team events. There are four notable aspects to Swile’s business model: neobank-style card and app, multi-product growth, acquisitions, and D2C style marketing.

Neobank style card and app

Swile is to the employee benefits market what Revolut is to the banking market. Like Revolut, which found a wedge into the banking market through a cheap forex card with a modern app-based consumer experience, Swile introduced an app-based meal card with a slick app that gave it a wedge into the employee benefits market.

In France, businesses of a certain size have to support their employees’ lunch breaks. Large companies often build cafeterias, and SMBs hand out meal vouchers worth up to €19 per day that employees use in pre-approved restaurants. Before Swile, the meal vouchers were made out of paper, which HR admins handed over to employees monthly.

These paper vouchers were often misplaced, stolen, or damaged before employees could use them. Even restaurants found it cumbersome to collect physical vouchers, send them to companies, and wait for weeks to be paid.

Swile, which started as Lunchr, launched meal cards for SMBs using Mastercard’s payment rails, making them instantly usable at any restaurant that accepts Mastercard. Swile’s app provides a superior employee experience to paper vouchers with spend tracking & notifications, linking a personal debit card to the app to seamlessly pay for lunches above the daily limit, a listing of restaurants that accept meal vouchers, and discounts on team orders.

Swile pays restaurants through direct deposits in two to three days, compared to weeks earlier, and creates additional revenue for them through in-app listings. Employers easily manage monthly top-ups in a few clicks and get the assurance that employees aren’t abusing meal vouchers by using them in places where they aren’t allowed or on Sundays/public holidays, as the app automatically blocks such uses.

This enabled Swile to acquire new customers rapidly, and within five years, it gained 13% of France's meal voucher market, covering 900,000 employees.

Growth in Swile's userbase.

Multi-product growth

As a B2B2E company, Swile sells employee benefits management SaaS to SMBs, while employees use Swile's cards. We’ve seen SaaS companies grow by using their initial product-market fit as a wedge to get into a company and then making more money by layering new products to eat up as many use cases as possible. Such companies charge more for bigger product bundles or, in the case of fintechs like Swile, process larger transaction volume and earn more affiliate commission/interchange fees. Multi-product companies are stickier as they become embedded in too many workflows to be ripped out easily.

For instance, Box passed $300M ARR through its 2015 IPO as a single-product company. Later that year, Box went multi-product, and they would go on to launch enterprise solutions for data governance (Box Governance), encryption key management (Box KeySafe), security (Box Shield), and workflow automation (Box Relay). Today, only 36% of Box’s revenue comes from customers of its core product alone. Roughly 64% of revenue comes from multi-product customers, and 35% comes from its enterprise bundle of 3+ products, up 3x from 12% two years ago.

Similar dynamics play out across other companies like Block and Datadog. Two private companies that have raised up rounds in 2022, Rippling ($12B) and Ramp ($8B), went multi-product from day 1, combining a set of related point solution systems into one coherent product to solve a much larger business problem.

Swile benefits from onboarding all employees when a company switches to Swile. It can layer new products on the app and push it to all employees through an update. It added many new products since its rebranding from Lunchr to Swile in 2020.

- Swile now covers gift vouchers and sustainable mobility payments. Instead of handing out paper cheques and managing the payouts in Excel sheets, companies can top-up their employees’ Swile cards with these benefits as they do for meal vouchers.

- It built a discount marketplace within the app where employees can buy tickets for concerts, movies, and theme parks or convert their gift vouchers to cards that can be used at Amazon, Decathlon, and Carrefour.

- The app also has a basic employee engagement tool with an employee directory that employees use to message each other ala Slack, pay their colleagues ala Venmo/Lydia, or organize team events. HR admins use it for employee engagement surveys and getting a pulse of their company.

Revenue by product usage.

Unlike Edenred or Sodexo, which offer different cards for different benefits, Swile bundles all benefits into one app and card. This makes life easier for employees as they don’t have to install different apps for paying for lunches or purchasing concert tickets. Providing a single window for topping up and managing all employee benefits helps HR admins also as they don’t have to navigate through tens of browser tabs throughout the day.

Acquisitions

In the five years since its launch, Swile acquired five companies with new products, such as gift vouchers and employee engagement tools, coming out of these acquisitions. Its most recent acquisition of Bimpli, the employee benefits platform of Groupe BPCE, is its largest at an estimated price of €440M. Groupe BPCE takes 22% of Swile at $2B, and Swile gets 100% of Bimpli, creating a company with over €140M in ARR, a 7x jump over Swile’s 2021 ARR of €20M.

List of Swile's acquisitions.

D2C style marketing

Even though Swile sells to businesses, its marketing communication looks like a D2C company selling directly to employees. It created a distinct brand image among employees through a quirky tone of voice and colorful visuals in a category that was otherwise known for bland and transactional marketing communications.

It was the first employee benefits company where the employees could personalize the card with their names and preferred colors. As a part of its rebranding to Swile, it embedded 3D human figurines into its communications, which represent its user base and lend a fun element to its communication. The rebranding coincided with the lockdowns in France when places like restaurants, stores, cinemas, etc., where Swile’s card is used, were shut. But Swile leveraged this as an opportunity to break the clutter around cards through an aggressive campaign.

3D figurines that are integral to Swile’s communication strategy.

Advertisement from Swile during lockdowns in France.

Product

Employees use their Swile card and app to spend employee benefits at restaurants, stores, and online marketplaces. Swile’s core product is the app where employers can load different employee benefits, including meal vouchers, gift vouchers, and sustainable mobility payments. Once loaded by the employers using their portal, each of these sit inside the Swile wallet, which stores different types of benefits independently and can pull the right one at the right time at the time of payment. For instance, you can choose to pay a €100 gift card with your €20 Christmas benefit from last year, €30 from the Christmas benefit from this year, €30 more from the cultural benefits you just received, and complete the last €20 with your card. Employees can also link the app to their personal debit card to pay for meals beyond their daily allowance and send payments to their colleagues for team events or lunches.

The app also provides basic employee engagement features such as customizable templates for employee surveys, employee directory, messaging between employees, team events, and payment collection for a team event.

Swile has APIs for authentication, payments, and vendor management which it uses to increase its functionality by connecting to other apps/services. For instance, Swile integrates with 3rd party delivery services such as Uber Eats and Deliveroo, and employees can check restaurants that accept meal vouchers in those apps and order food. It also has a discount marketplace where employees can use their gift vouchers.

Swile app has a wallet, employee surveys, and P2P transfers.

Swile’s HR dashboard.

Swile's card in pink.

Competition

The global meal vouchers and employee benefits market is estimated to be worth $204B and expected to grow to $320B by 2029 at a CAGR of 5.9%. Europe is 30% of the market and Brazil 15%. The market is driven by Government regulations that mandate certain employee benefits and provides tax incentives to employers.

Brazil and France have highly concentrated markets with only 3-4 large players, including Sodexo and Edenred, the two largest employee benefits companies globally. However, the rise of banking-as-a-service (BaaS) companies makes it easy for startups like Swile to load employee benefits on a card that can be used just like a regular debit card, improving the employee experience that helps them acquire customers rapidly.

Entry barriers disruption

Legacy companies like Edenred and Sodexo have built networks with millions of restaurants and affiliates, which their customers can instantly offer to their employees. These restaurants get additional revenue as Edenred and Sodexo sign up more customers, and more restaurants want to join the network. These two-sided network effects are powerful at scale and difficult for a new entrant to replicate quickly in the past, creating formidable entry barriers. Businesses treat meal voucher companies as utilities like electricity and security. They don’t surface on management’s radar until something goes wrong, giving them low churn and high LTV per employee.

Unlike these legacy companies, fintechs today are not spending decades rebuilding the affiliate network. Instead, they use Banking-as-a-Service platforms to latch onto the existing merchant network of Mastercard or Visa. For instance, Swile uses a BaaS company Treezor to access the Mastercard rails and have its card accepted at more than 200,000 restaurants, disrupting the entry barriers created by the legacy companies. We also see this trend in countries like Brazil, where Caju uses Dock, and India, where PayTM uses Zeta.

Digital transformation of legacy companies

Even though Edenred and Sodexo introduced prepaid meal cards before Swile, the poor employee experience stalled adoption. However, in the past few years, they have improved the digital employee experience and are catching up with Swile's features. Of Edenred’s €30B payment volume, 90% is digital. Its digital products include contactless pay-at-table solutions, integration with 200+ food delivery companies, and integration with Google Pay/Apple Pay. Similarly, Sodexo processes 1B digital employee benefits transactions. In 2021, it acquired Wedoogift, a gifting platform in France, to become one of France's largest gift voucher companies.

Growth in Edenred’s digital transactions volume.

Remote workforce

Before COVID, ~5% of Europeans worked remotely, which increased to 12% post-COVID, with the number of remote workers in many capital regions reaching 25%. Similarly, in Brazil, ~11% of the workforce is working remotely post-COVID, with large cities having a much higher percentage, often reaching one-fourth of the workforce. While the number of remote employees may decrease in the next couple of years, it is expected to remain higher than pre-pandemic levels.

Another trend dove-tailing with remote working is the increase in Gen Z employees. In the next five years, ~3.5M Gen Z employees will join the French workforce, and ~40M will join Brazil’s workforce. These employees prefer flexible working conditions, look for companies that align with their value systems, and want their employers to care for their well-being. Companies expect to work harder to keep these young remote employees fully engaged, and employee benefits such as meal vouchers, gift cards, and spend cards are expected to play an important role.

~20% of employers in Europe are adding benefits like an increase in health benefits, home delivery of meals, and stipends for well-being services for remote workers in 2022. This is also more practical for controlling spending when the employees spending corporate budget are hundreds of miles away.

Country-wise dynamics

Key employee benefits companies in Brazil and France.

France

In France, Government regulations greatly impact the size and growth of the employee benefits market. For instance, during COVID, the French Government doubled the daily limit of meal vouchers from €19 to €38 to help the hard-hit restaurant sector. Similarly, in 2019, it introduced tax-exempted sustainable mobility benefits to encourage employees to use green transport mediums like public transportation, bikes, and ride-sharing.

A low unemployment rate and high inflation create another tailwind for the market. The unemployment rate in France is at its lowest in 13 years, maximizing the number of employees who use employee benefits. At the same time, with the inflation rate at 6.1%, the highest since 1985, the Government is introducing new employee benefits regulations to help people cope with high prices. These include increasing tax exemption for employers and using meal vouchers for buying food that’s not immediately consumable, like meat and poultry.

The market is dominated by legacy companies Edenred, Sodexo, and Up Group, with Swile becoming the fourth largest player after acquiring Bimpli.

Brazil

Brazil is one of the largest employee benefits markets in the world, worth over $27B, and expected to grow 9% annually for the next 3-4 years. The employee benefits are driven by tax benefits for employers and include an annual Christmas bonus, food vouchers, meal allowance, transportation vouchers, and gym memberships. Meal allowance is the biggest segment, with Sodexo, Edenred, Alelo, and VR having 90% of the market and iFood, Caju, Flash, and other startups the remaining 10%.

The Brazilian Government recently updated the meal allowance law, banning employee benefits companies from passing any discounts to employers during contracting. This change loosens the grip of the legacy meal voucher companies by reducing their negotiation power.

Key company: Edenred

Edenred has a 30% share of the global employee benefits market, making it the largest company worldwide. Edenred processes €30B transactions annually for 900,000 companies, covering 50M users across 2M merchants.

It is France's largest employee benefits company, with 160,000 customers covering 7M employees and 40% market share. In Brazil, it's among the top two.

Edenred makes 60% of its revenue from employee benefits and 25% from fleet and mobility solutions. Edenred generates most of its revenue from merchant commissions when people use its cards.

Key company: Sodexo

Sodexo is one of the largest on-site corporate services and employee benefits companies, present in 72 countries. Even though employee benefits are only 4% of its top line, it is one of the largest companies in Brazil and France, issuing €7B worth of meal vouchers annually. Two-thirds of its employee benefits revenue comes from Europe, Asia, and the US, and one-third from Latin America.

TAM Expansion

Corporate spend management

Swile recently acquired Okarito to introduce travel management for SMBs, which it estimates covers 70% of SMBs’ business spend. The B2B payments market in Europe is estimated to be 4x the employee benefits market, expected to grow nearly twice as fast, and much more fragmented. ~60% of the B2B payments market is still cash but is expected to move digital over the next 10-15 years, creating a massive tailwind for the growth of digital corporate spend management companies like Ramp, Bill.com, and Brex.

Like Ramp, which started by giving an expense card to employees and is now expanding to capture the full stack of business payments, Swile can expand into 75,000 clients that already use Swile’s cards. As Swile rides Mastercard’s payment rails, it already has a global partner it needs to move forward, charging commissions to facilitate many of these transactions and tap the massive corporate spend management market.

Employee engagement

Swile is doubling down on employee engagement features to increase its app’s use frequency and make it stickier with employees. For instance, its new feature, Places enables employees to share an event and its place with their teams to invite them. Places also enables HR to engage with employees by suggesting places to organize events, team lunches, and book corporate get-togethers. Such employee engagement features also have the benefit of driving spending at Swile’s affiliate merchants and restaurants. Extending the employee engagement features to the new 4M employees, added after Bimpli’s acquisition, is also a big opportunity.

Neobank for employees

Swile’s 5M userbase is more than the combined userbase of two of the largest neobanks, N26 (2M users) and Revolut (1M users) in France. With a card used daily by employees, a highly recognizable brand, and the high stickiness of its users, Swile has the opportunity to add more personal finance features to its app and eat into the neobanks’ market share.

With France's strong neobank adoption and a growing smartphone penetration rate expected to hit 87% by 2025, there's room for more than a handful of neobanks.

Swile already offers bank-type features like P2P payments, linking a personal debit card to the Swile account, and Apple Pay/Google Pay-enabled mobile wallet. Swile recently launched a new subsidiary, Swile Payments, as a possible recognition of the neobanking opportunity.

Neobank app share of total mobile finance app downloads as on Q3 2021.

Geographic expansion

Swile has expanded rapidly in Brazil since it acquired Vee Benefits in 2021, covering 200,000 employees and 6000 customers. Brazil’s shared characteristics with France, such as a market driven by Government regulations, a culture of having meals together in office, the dominance of legacy companies, and high levels of digitalization of payments, make it an attractive market for Swile. By 2023, it plans to reach over 1 million users and 30,000 new customers.

Risks

High dependency on regulations

Any changes in Government regulations can adversely impact the employee benefits market. For instance, changes in Sweden over the last 15 years led to most of Edenred’s products being barely profitable. Thus far, the regulatory changes have been favorable for Swile in its home market, but if the French Government cuts back on benefits, Swile could be impacted the most as it is a smaller player.

Acquisition-led growth

Many of Swile’s new products come from acquired companies, and two of its large future bets are also through acquisitions: travel spend management by acquiring Okarito and expanding customer base by acquiring Bimpli. Challenges in cultural and technological integration of the acquired companies can slow Swile's growth.

High valuation

At 91x revenue multiple, Swile is richly valued compared to many of its fintech peers in Europe that are raising new funds at much lower valuations, such as Klarna and SumUp. Swile’s high valuation has implications for new investors to generate a sizable return and Swile’s ability to recruit high-quality talent for whom Swile may be too richly valued for any upside in their next job.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.