Revenue

$9.90B

2025

Valuation

$66.00B

2024

Funding

$4.10B

2024

Growth Rate (y/y)

23%

2024

Revenue

Sacra estimates that Shein generated $9.9B in revenue in Q1 2025, after generating $38B in 2024 (up 23% YoY), as U.S. shoppers rushed to place sub-$800 orders ahead of the rollback of de minimis tariff exemptions. Projected sales for fiscal year 2025 are $60B, with a net profit target of $2.6B.

In the same quarter, the company booked more than $400M in net income, lifting its profit margin to about 5% and implying an annualized run-rate above $40B—an early rebound from 2024's net profit decline to roughly $1B.

The surge was driven by fast-fashion apparel and accessories shipped directly from China, alongside growing sales of home goods and third-party marketplace SKUs that increased average order values and Shein's take rate.

Stable fulfillment costs across its proprietary logistics network turned the Q1 volume spike into margin, while parallel sourcing expansions into Vietnam aim to cushion future duty exposure once the U.S. removes de minimis for all countries on August 29. Shein's U.K. arm posted £2.05B in sales in 2024, up 32.3% YoY, with pre-tax profit rising to £38.25M from £24.43M.

Valuation

Shein is valued at about $10 billion as of August 2025. Previously, Shein was valued at $45 billion as of January 2024, with shares being offered on the secondary market at this valuation.

Previously, based on their 2023 valuation of $64B, the company was valued at 2x their revenue of $32.2B.

The company has raised at least $4 billion in total funding, with their most recent round being $2 billion in May 2023. Earlier rounds included $1.5 billion raised in 2022 and $500 million in 2019. Previous investors have included General Atlantic and Sequoia Capital China.

In July 2025, Shein privately filed for a Hong Kong IPO to accelerate its listing process. In August 2025, the company began weighing moving its parent back to mainland China to clear CSRC review after its London plan stalled. This signals a Hong Kong path and potential corporate reorganization tied to regulatory approval.

Product

Zara (1975) became Europe’s biggest apparel brand by vertically integrating retail and design and using Chinese manufacturing to produce cheap, on-trend clothes—which combined with the success of Alibaba (1998, B2B) in connecting Western dropshippers with low-cost products manufactured in China—inspired the 2008 founding of Shein (2008, Tiger Global, $4B raised) as an direct-to-consumer marketplace for women’s clothing made in China.

Shein started as a wedding dress dropshipper, but as AliExpress (2010) commoditized dropshipping, Shein began designing its own clothing, footwear, handbags and accessories, leveraging social media and a network of 3,000 modular suppliers in Guangzhou to quickly design, manufacture, and ship on-trend knockoffs of brands like Gucci, Chanel, Fendi—and Zara.

The company has pioneered a "real-time retail" model that leverages data analytics and AI to rapidly identify emerging fashion trends, produce small batches of new designs within 3-7 days, and scale production of popular items.

This agility allows Shein to offer a vast and constantly refreshing product selection, with over 600,000 items across women's, men's, and children's fashion, as well as accessories and home goods. The platform adds 1,000-3,000 new SKUs daily, ensuring a steady stream of new options for its primarily young, female customer base.

A key feature of Shein's product strategy is its extremely low pricing, with most items priced between $8-$30, significantly undercutting traditional fast fashion retailers.

This is enabled by Shein's tightly integrated supply chain and proprietary software system that connects consumer behavior data directly to manufacturing.

Shein has expanded beyond its core platform to include several complementary offerings.

The Shein X program serves as a designer incubator, collaborating with independent designers to create exclusive collections. The company has also experimented with pop-up stores in major cities, providing physical retail experiences to complement online shopping.

Business Model

Shein's core business model revolves around its ability to quickly identify fashion trends, design new products, and bring them to market in as little as 3-7 days, compared to 3-4 weeks for traditional fast fashion retailers.

This is enabled by a tightly integrated supply chain and proprietary software system that connects consumer behavior data directly to manufacturing. Shein produces small initial batches (100-200 units) of each new design, allowing it to test market demand with minimal inventory risk. Popular items are then rapidly scaled up in production.

The company's pricing strategy focuses on extreme affordability, with most items priced between $8-$30. However, Shein has recently begun raising prices on about a third of its core products to improve profit margins ahead of a potential IPO. For example, the average price of women's dresses in the U.S. increased 28% to $28.50 between June 2022 and June 2023.

Shein's growth is driven by its mastery of social media marketing, particularly on platforms like TikTok and Instagram. The company leverages a vast network of influencers and user-generated content to create viral "haul" videos showcasing its products. This strategy, combined with its ultra-fast production cycle and low prices, has allowed Shein to capture significant market share among Gen Z consumers globally.

Competition

Shein competes with fast fashion retailers, ecommerce platforms, and social commerce companies in the global apparel market. Its unique real-time retail model and digital-first approach have disrupted traditional fast fashion, while also challenging established ecommerce players.

Fast fashion competitors

In the fast fashion space, Shein's primary competitors are Zara, H&M, and ultra-fast fashion brands like Fashion Nova and Boohoo. While Zara pioneered the fast fashion model with 3-week design-to-store cycles, Shein has compressed this to as little as 3 days. This allows Shein to respond to trends faster and offer a constantly refreshed selection of thousands of new SKUs daily.

But contrary to the narrative that Shein is killing Zara, Shein’s success has allowed Zara to maintain growth by shifting its positioning upmarket—as a more “ethical” form of fast fashion—while Shein focuses on winning on selection and price.

Unlike Zara and H&M, which rely heavily on physical retail, Shein is purely digital. This gives it greater flexibility in inventory management and global expansion. Fashion Nova and Boohoo share Shein's online-only model, but lack its sophisticated supply chain integration and data-driven design process.

Ecommerce platforms

In the broader ecommerce landscape, Shein competes with giants like Amazon and niche fashion retailers like ASOS. Shein differentiates itself through its focus on trendy, low-cost apparel and its highly engaging mobile app experience.

While Amazon offers a wider product range, Shein's specialized fashion focus thus far has allowed for better curation and a more tailored user experience. However, Amazon is becoming more competitive now—with their planned launch of a Shein-like discount store, connected directly with Chinese merchants and based out of their Shenzhen "innovation center".

Social commerce

Shein's heavy reliance on social media marketing and influencer partnerships puts it in competition with emerging social commerce platforms like TikTok Shop as well as other Chinese firms like Temu (NASDAQ: PDD, $35B revenue, up 90% YoY), which is quickly becoming a major competitor in the American market.

Its approach of using user-generated content and "haul" videos on platforms like TikTok and Instagram has been highly effective in reaching Gen Z consumers. This strategy has allowed Shein to build brand awareness and drive sales without the high customer acquisition costs typically associated with digital marketing.

TAM Expansion

Shein has tailwinds from the rapid growth of ecommerce and social media-driven fashion, and has the opportunity to expand into adjacent markets like:

Geographical expansion

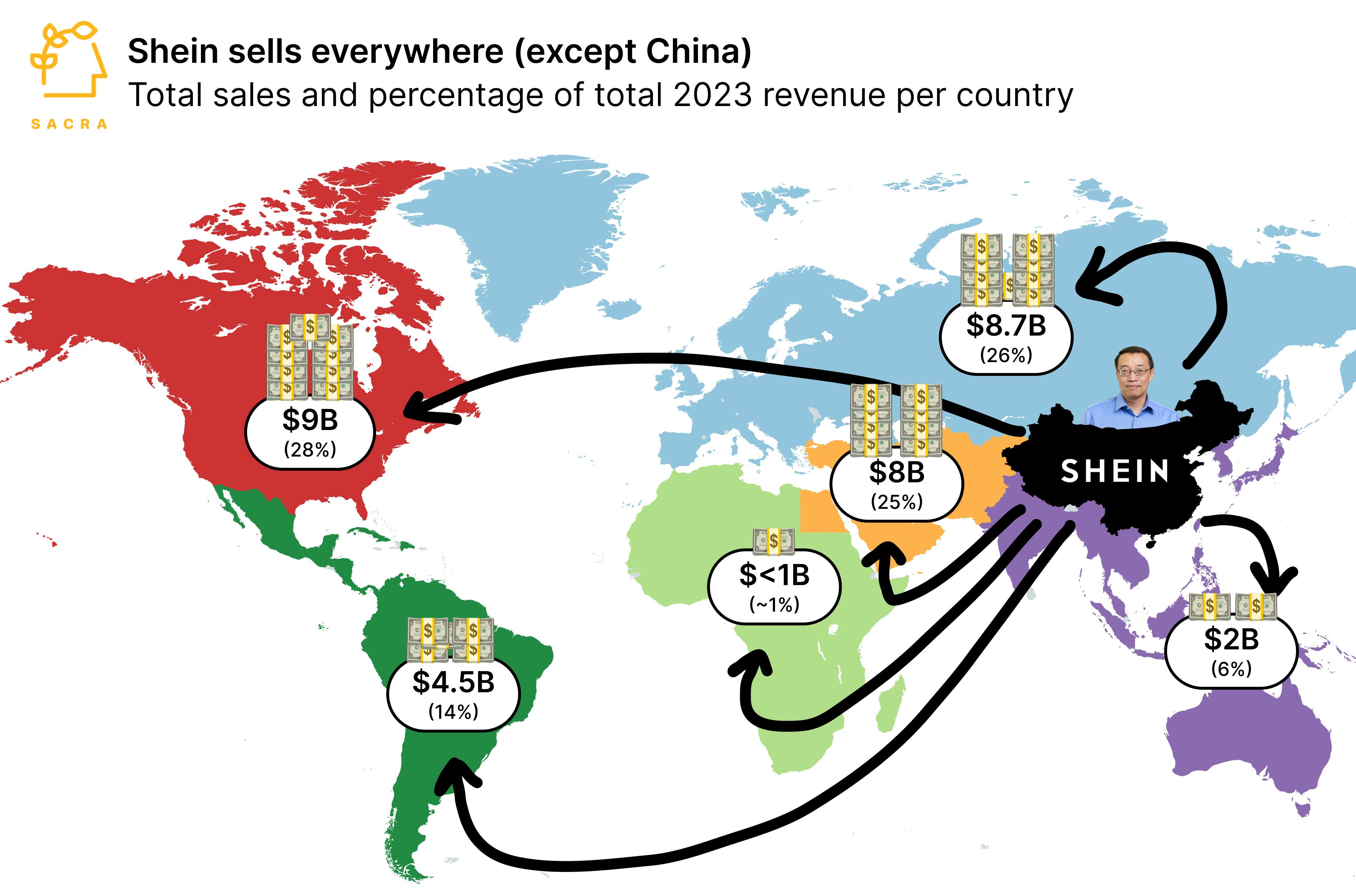

Shein's real-time retail model, which allows it to rapidly design, produce, and sell trendy clothing at ultra-low prices, has proven highly successful in markets outside China—like Brazil ($1.4B revenue in 2022, growing 35% YoY), Japan (growing 110% YoY), and Australia (growing 40% YoY).

The company has significant room for further international expansion, particularly in emerging markets with large young populations. Shein's ability to localize its offerings and leverage social media for marketing gives it an edge over traditional retailers in new markets.

As Shein expands globally, it can leverage its scale and data to further optimize its supply chain and reduce costs. The company's investments in logistics, including plans for distribution centers in the US, will help improve delivery times and customer experience as it grows. Shein's international growth also provides a hedge against potential regulatory challenges in any single market.

Product category expansion

While Shein has become the face of cheap goods flooding American markets tax-free, fast fashion was a wedge into Shein’s next stage—building a global everything store with a massive selection in direct competition with Temu (~$50B GMV in 2024, up 250%) for price-sensitive consumers across electronics, toys, furniture, and more:

Beauty and cosmetics: Shein's young, fashion-conscious customer base is a natural fit for affordable beauty products. The company could leverage its existing supply chain and marketing capabilities to quickly scale in this category.

Footwear: Shoes are a natural extension of Shein's apparel offerings and could benefit from the same rapid design and production cycle.

Electronics and gadgets: Low-cost, trendy tech accessories could appeal to Shein's core demographic and benefit from the company's existing distribution network.

In November 2025, Shein launched a Newegg storefront on its U.S. marketplace, featuring more than 1,000 technology products curated for gamers. The assortment spans gaming laptops, ultrabooks, earbuds, and over‑ear headphones, blending fashion and tech. The partnership expands Shein’s marketplace into electronics and reinforces its push beyond apparel into broader lifestyle categories.

To help it expand outside fast fashion where Shein has its key advantage and supplier relationships, Shein launched a managed marketplace (35% of GMV in 2023), attracting independent retailers and top Amazon sellers from other product categories by offering low sales commissions (5-10% vs. Amazon’s 20-40%) and access to Shein’s global market of 90M consumers.

Platform development

Shein has the potential to evolve from a retailer into a broader ecommerce platform. By opening up its infrastructure to third-party sellers, Shein could become a marketplace for a wide range of affordable, trend-driven products. This would allow Shein to capture more value from its user base and traffic while diversifying its revenue streams.

The company's sophisticated algorithms for trend prediction and demand forecasting could be valuable to other retailers and brands, potentially opening up opportunities in retail analytics and software services. Additionally, Shein's expertise in influencer marketing and social commerce could be leveraged to create tools or services for other businesses looking to reach young consumers online.

Risks

EU regulatory escalation: Shein faces coordinated, multi-jurisdiction regulatory pressure across Europe that could force costly operational changes or restrict market access. The EU's CPC Network has formally notified Shein of broad consumer law violations covering fake discounts, pressure selling, and missing return-right disclosures, and the European Commission has since opened formal DSA proceedings against Shein focused on illegal products, addictive design features, and recommender-system transparency—its third escalation after two prior requests for information. Taken together, these actions signal that European regulators are treating Shein as a systemic enforcement priority rather than an isolated compliance matter.

Overreliance on social media marketing: Shein's growth has been fueled by aggressive social media marketing, especially on TikTok. Changes to social media algorithms or a shift in Gen Z preferences could dramatically increase customer acquisition costs. Shein's razor-thin margins leave little room to absorb higher marketing spend without compromising its low pricing.

Geopolitical tensions: As a Chinese company selling globally, Shein is vulnerable to escalating US-China tensions. Forced divestiture or bans (as happened with TikTok in India) in key markets like the US could cripple Shein's growth trajectory. Even without outright bans, heightened scrutiny of Chinese tech companies could damage Shein's brand and deter potential customers.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.