Revenue

$784.00M

2023

Valuation

$4.00B

2021

Funding

$556.10M

2021

Growth Rate (y/y)

80%

2023

Valuation: $4.00B in 2021

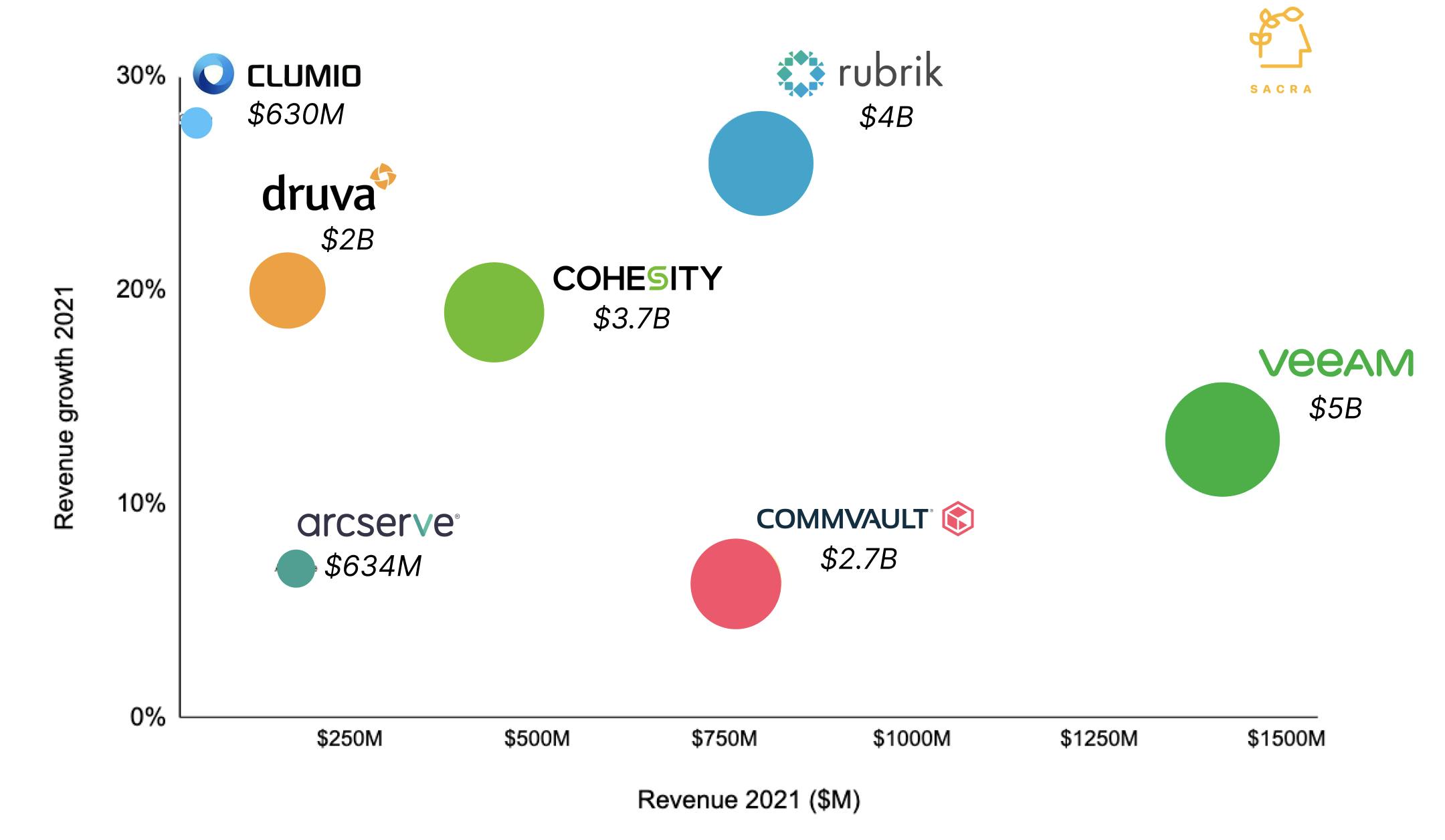

Rubrik has raised a total of $565.2M from investors like Bain Capital Ventures, Khosla Ventures, Microsoft and Lightspeed Venture Partners. The company was last valued at $4B after an investment made by Microsoft in 2021 for about a 5x multiple on revenue, which is within the typical range for companies in this space.

That's higher than slower growing competitors like the publicly listed Commvault, which is valued at $2.7B at a multiple of 3.5x, and Veeam, the largest data back-up vendor based in Europe, which is also priced around 3.5x.

Scenarios: $2.1B to $8.9B ARR by 2028

To evaluate Rubrik's potential future valuation, we've modeled multiple scenarios based on varying growth rates and revenue multiples through 2028. These projections account for different market conditions, competitive dynamics, and company performance factors in the data protection and management space.

| 2023 ARR ($M) | $784M | ||

|---|---|---|---|

| 2023 Growth Rate (%) | 47.09% |

Rubrik's $784M ARR in 2023 demonstrates robust momentum, with a strong 47.09% growth rate reflecting successful market penetration. This performance supports their premium valuation multiple compared to competitors like Commvault and Veeam, while indicating healthy expansion in their core data protection business.

| Multiple | Valuation |

|---|---|

| 1x | $784M |

| 5x | $3.9B |

| 10x | $7.8B |

| 15x | $11.8B |

| 25x | $19.6B |

Based on $784M ARR, valuations range from $784M at 1x to $19.6B at 25x multiples, with the current $4B valuation sitting near the 5x mark. This positions Rubrik in line with industry standards while leaving room for significant upside as they expand into security and compliance markets.

| 2028 Growth Rate | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| 10.0% | $784M | $1.1B | $1.4B | $1.7B | $1.9B | $2.1B |

| 15.0% | $784M | $1.1B | $1.4B | $1.8B | $2.1B | $2.4B |

| 20.0% | $784M | $1.1B | $1.5B | $1.9B | $2.3B | $2.8B |

| 30.0% | $784M | $1.1B | $1.5B | $2.1B | $2.8B | $3.6B |

| 45.0% | $784M | $1.1B | $1.7B | $2.4B | $3.5B | $5.1B |

| 50.0% | $784M | $1.2B | $1.7B | $2.6B | $3.8B | $5.8B |

| 55.0% | $784M | $1.2B | $1.8B | $2.7B | $4.2B | $6.5B |

| 65.0% | $784M | $1.2B | $1.9B | $3B | $4.8B | $8B |

| 70.0% | $784M | $1.2B | $1.9B | $3.1B | $5.2B | $8.9B |

Revenue projections indicate potential 2028 ARR ranging from $2.1B to $8.9B, representing growth scenarios between 10% and 70%. This spans from conservative market-aligned expansion to aggressive hypergrowth, with the midrange scenarios around 45-50% aligning with Rubrik's recent performance trajectory.

| 2028 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $2.1B | $10.4B | $20.9B | $31.3B | $52.2B |

| 15.0% | $2.4B | $12B | $24B | $36B | $60.1B |

| 20.0% | $2.8B | $13.8B | $27.6B | $41.3B | $68.9B |

| 30.0% | $3.6B | $17.9B | $35.8B | $53.6B | $89.4B |

| 45.0% | $5.1B | $25.7B | $51.4B | $77.2B | $128.6B |

| 50.0% | $5.8B | $28.8B | $57.7B | $86.5B | $144.2B |

| 55.0% | $6.5B | $32.3B | $64.5B | $96.8B | $161.3B |

| 65.0% | $8B | $40B | $80B | $120B | $200B |

| 70.0% | $8.9B | $44.4B | $88.7B | $133.1B | $221.9B |

Projected 2028 valuations range from $2.1B at conservative growth/multiple assumptions to over $220B in aggressive scenarios, with midrange estimates between $25-50B reflecting sustained growth and sector-typical multiples. These scenarios account for Rubrik's expansion into security and compliance markets.

Bear, Base, and Bull Cases: 5.5x, 6.5x, 8.0x

To provide a targeted analysis of Rubrik's potential trajectories, we've developed bear, base, and bull case scenarios. These cases factor in market dynamics, competitive pressures, security market expansion success, and enterprise adoption rates that could materially impact Rubrik's growth and valuation multiples.

| Scenario | 2028 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 15% | 5.5 |

| Base 📈 | 30% | 6.5 |

| Bull 🚀 | 40% | 8.0 |

Even in the bear case with 15% growth, Rubrik maintains a healthy 5.5x multiple, reflecting sustained market leadership in data protection. The base case projects continued expansion with a 30% growth rate and 6.5x multiple, while the bull scenario anticipates successful penetration into security markets driving 40% growth and an 8.0x multiple.

| Bear 🐻 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $784M | $1.1B | $1.4B | $1.8B | $2.1B | $2.4B |

| Growth | 47.09% | 38.46% | 31.05% | 23.63% | 18.83% | 15% |

| Base 📈 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $784M | $1.1B | $1.5B | $2.1B | $2.8B | $3.6B |

| Growth | 47.09% | 42.50% | 38.55% | 34.60% | 32.04% | 30% |

| Bull 🚀 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $784M | $1.1B | $1.6B | $2.3B | $3.3B | $4.6B |

| Growth | 47.09% | 45.18% | 43.55% | 41.91% | 40.85% | 40% |

Our bear, base, and bull cases for Rubrik depend primarily on their ability to expand beyond core data protection and successfully penetrate the cybersecurity market

- In the bear case: Rubrik's growth declines to 15% by 2028, reaching a $13.2B valuation ($2.4B revenue at a 5.5x multiple)

- In the base case: Rubrik maintains 30% growth through successful moderate expansion into security, achieving a $23.2B valuation ($3.6B revenue at a 6.5x multiple)

- In the bull case: Rubrik successfully transforms into a comprehensive security platform with 40% sustained growth, reaching a $36.6B valuation ($4.6B revenue at an 8.0x multiple).

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2023 ARR | $784M | $784M | $784M |

| 2023 Growth Rate (%) | 47% | 47% | 47% |

| 2023 Multiple | 5.5 | 6.5 | 8.0 |

| 2023 Valuation | $4.3B | $5.1B | $6.3B |

| 2028 Revenue | $2.4B | $3.6B | $4.6B |

| 2028 Growth Rate (%) | 15% | 30% | 40% |

| Multiple | 5.5 | 6.5 | 8.0 |

| 2028 Valuation | $13.2B | $23.2B | $36.6B |

The uncertainty around these three cases depends primarily on Rubrik's ability to transform beyond data protection, their success in penetrating the cybersecurity and compliance markets, and whether they can maintain competitive differentiation while expanding their product portfolio amid increasing market competition.

- In the Bear case: Rubrik struggles to differentiate in an increasingly commoditized backup market while facing intense competition from both legacy vendors and cloud providers, leading to pricing pressure and slower growth in its core business.

- In the Base case: Rubrik successfully maintains its position in data protection while gradually expanding into cybersecurity and compliance solutions, achieving moderate success in cross-selling these new offerings to its existing customer base.

- In the Bull case: Rubrik fully transforms into a comprehensive security and compliance platform, leveraging its unique data visibility and Microsoft partnership to capture significant market share in the $200B cybersecurity and $40B data governance markets.

These final valuations present a meaningful range of outcomes for Rubrik. Even the bear case projects solid growth to $13.2B by 2028, while the bull case at $36.6B would position Rubrik as a major player in both data protection and cybersecurity markets.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.