Valuation

$15.00B

2024

Funding

$293.31M

2024

Product

Ripple was founded in 2012 by Chris Larsen, Jed McCaleb, David Schwartz, and Arthur Britto, evolving from Ryan Fugger's earlier RipplePay concept that aimed to create a peer-to-peer financial network.

Ripple found product-market fit as a cross-border payment settlement system for banks and financial institutions, offering them a way to conduct international transfers more quickly and efficiently than traditional correspondent banking systems.

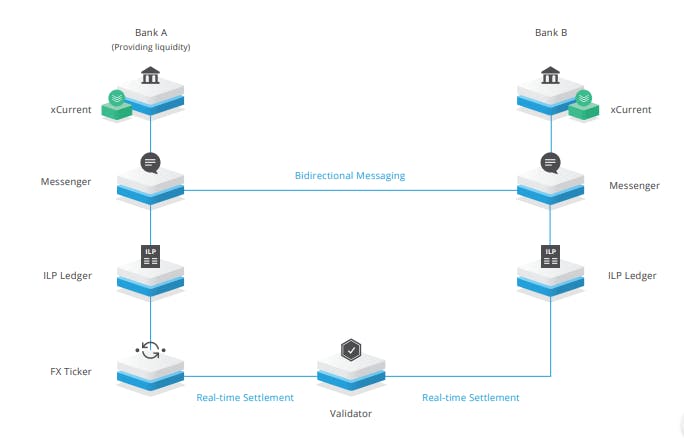

The company's core product, xCurrent, enables banks to settle cross-border payments with end-to-end tracking and real-time messaging. When a bank initiates a transfer, xCurrent pre-validates the transaction details with the receiving institution, confirms funds availability, and locks in exchange rates before settlement. This reduces the typical 3-5 day settlement window to mere seconds.

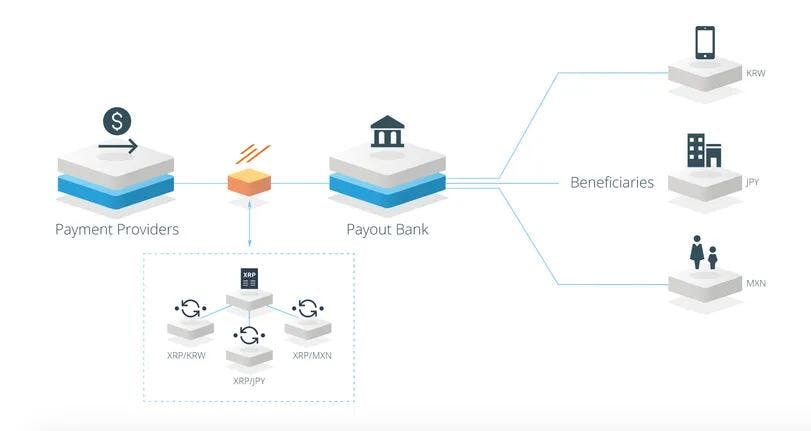

Ripple later expanded its product suite with xRapid (now called On-Demand Liquidity), which helps financial institutions source liquidity for cross-border payments, and xVia, which provides a standardized interface for corporates and payment providers to send payments globally. These products work together to form RippleNet, a network that connects financial institutions, payment providers, and digital asset exchanges for frictionless global payments.

Business Model

Ripple is a financial technology company that operates a global payments network called RippleNet, connecting banks and payment providers to enable fast, low-cost cross-border transactions. The company generates revenue through three main channels: software licensing fees for its xCurrent payment processing platform, sales of its XRP cryptocurrency, and interest fees from its institutional lending product.

The company's core product, xCurrent, charges financial institutions an upfront installation fee of approximately $10 million plus annual licensing fees ranging from $100,000 to $500,000 depending on usage volume. Banks use xCurrent to settle international payments in real-time with end-to-end tracking and cheaper fees compared to traditional correspondent banking networks.

Ripple's competitive advantage stems from its hybrid approach combining traditional financial infrastructure with blockchain technology. While competitors like SWIFT rely on outdated messaging systems and nostro-vostro accounts, Ripple's solution enables direct bank-to-bank settlement in seconds.

The company has secured over 100 banking partnerships and positioned XRP as an optional bridge currency for providing on-demand liquidity in markets where traditional banking relationships are costly to maintain. This two-pronged strategy of enterprise software sales and cryptocurrency liquidity provision gives Ripple multiple paths to monetization in the $155 trillion cross-border payments market.

Competition

Ripple operates in the cross-border payments and settlement market, competing against traditional financial infrastructure providers, blockchain networks, and emerging fintech solutions.

Traditional financial infrastructure

SWIFT dominates international payments with its established network of over 11,000 financial institutions. While SWIFT's technology is dated, requiring 3-5 days for settlement and charging high fees, they maintain deep relationships with major banks and have launched SWIFT gpi to modernize their offering. Traditional correspondent banking networks like JPMorgan and Citigroup also compete by leveraging their existing nostro/vostro account relationships.

Enterprise blockchain solutions

Private/permissioned blockchain networks pose a significant threat to Ripple's xCurrent product. IBM's Hyperledger Fabric and R3's Corda allow banks to implement distributed ledger technology without depending on a native cryptocurrency. These solutions have gained traction with major financial institutions who prefer the control and privacy of permissioned networks. Unlike Ripple's XRP-based solution, these platforms don't eliminate the need for pre-funded nostro accounts.

Cryptocurrency payment networks

Stellar, founded by former Ripple co-founder Jed McCaleb, offers an open-source protocol for cross-border transactions using its native Lumens (XLM) token. While Stellar targets a broader market including individuals and smaller institutions, its technical architecture closely mirrors Ripple's. Other cryptocurrency projects like Bitcoin's Lightning Network and Ethereum-based payment channels provide alternative approaches to fast, low-cost international transfers, though with less institutional adoption.

The competitive dynamics continue evolving as central banks explore their own digital currencies (CBDCs), which could reduce demand for private cross-border payment solutions like Ripple's in the long term.

TAM Expansion

Ripple has tailwinds from the massive inefficiencies in cross-border payments and growing demand for real-time settlement, with opportunities to expand into adjacent markets like central bank digital currencies (CBDCs) and institutional cryptocurrency services.

Cross-border payments infrastructure

The global cross-border B2B payments market exceeds $150 trillion annually, with traditional settlement taking 3-5 days and costing up to 10% in fees. Ripple's RippleNet can reduce these costs by 40-70% while enabling near-instant settlement. The company's early partnerships with over 300 financial institutions provide a strong foundation for capturing more of this market as banks seek to modernize their infrastructure.

Central bank digital currencies

As central banks explore issuing their own digital currencies, Ripple is positioned to become a key infrastructure provider. The company is already working with Bhutan and other countries on CBDC initiatives. The CBDC market could reach $5-10 trillion by 2030 as countries seek to maintain monetary sovereignty while modernizing their financial systems.

Institutional crypto services

Ripple can leverage its regulatory compliance expertise and banking relationships to expand into institutional cryptocurrency custody, trading, and settlement services. The institutional crypto market is projected to reach $1.3 trillion by 2025. The company's experience with XRP and existing financial infrastructure positions it well to serve as a trusted bridge between traditional finance and digital assets.

Emerging markets expansion

There is particular opportunity in emerging markets where existing financial infrastructure is less developed. Ripple's lower-cost solution could help banks in these regions leapfrog traditional correspondent banking relationships while providing enhanced access to global financial networks.

Risks

Bank adoption uncertainty: While Ripple has secured numerous partnerships, actual adoption of XRP for cross-border settlements remains limited. Most financial institutions are only piloting RippleNet's messaging system rather than using XRP for liquidity. The value proposition requires widespread institutional buy-in to create network effects, but banks may be hesitant to give up control over correspondent banking revenues without significant compensation. The lack of meaningful XRP usage by banks could eventually undermine Ripple's core thesis around institutional adoption.

Regulatory classification risk: Ripple's dual role as both a technology provider and XRP issuer creates unique regulatory challenges. The SEC lawsuit highlights the ongoing debate about whether XRP is an unregistered security given how Ripple has historically sold and marketed it. An adverse ruling could severely restrict XRP trading and force fundamental changes to Ripple's business model and token distribution strategy.

Central bank disruption: Ripple's vision of XRP as a bridge currency faces growing competition from central bank digital currencies (CBDCs). As more countries develop their own digital currencies, the need for a private intermediary token like XRP could diminish significantly. Central banks are unlikely to cede control of cross-border settlements to a private company's token when they can create their own digital settlement rails.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.