Revenue

$1.00B

2025

Valuation

$22.50B

2025

Funding

$1.90B

2025

Growth Rate (y/y)

133%

2025

Revenue

Sacra estimates that Ramp hit $1B in annualized revenue in August 2025, up 110% YoY from ~$476M in August 2024.

Ramp exited 2024 with net annualized revenue up 133% year over year as total payments volume (TPV) rose to $57B from $22.3B in 2023, reflecting rapid adoption across larger customers and expansion beyond corporate cards into bill pay/AP automation, procurement and travel.

Revenue is predominantly tied to payments activity, while growth is being driven by multi-product penetration that increases wallet share per customer and routes more spend onto Ramp, plus deeper upmarket wins that carry higher absolute TPV even with modest take-rate compression.

In September 2025, Ramp surpassed 45,000 business customers and has begun shifting a greater share of contribution profit toward non-card products, with over 30% expected to come from software and services beyond cards by year-end.

Valuation & Funding

Ramp was most recently valued at $22.5B following its $500M Series E-2 round led by ICONIQ Growth in July 2025. This was up from $16B at its Series E in June 2025. Earlier, a $150M secondary tender in March 2025 had pegged the company’s valuation at $13B.

In total, Ramp has raised about $1.9B in equity financing since its 2019 founding. Notable investors across rounds include Founders Fund, ICONIQ Growth, Thrive Capital, General Catalyst and Khosla Ventures.

At Sacra-estimated $1B in annualized revenue in August 2025, the latest valuation implies a 22.5x revenue multiple.

Product

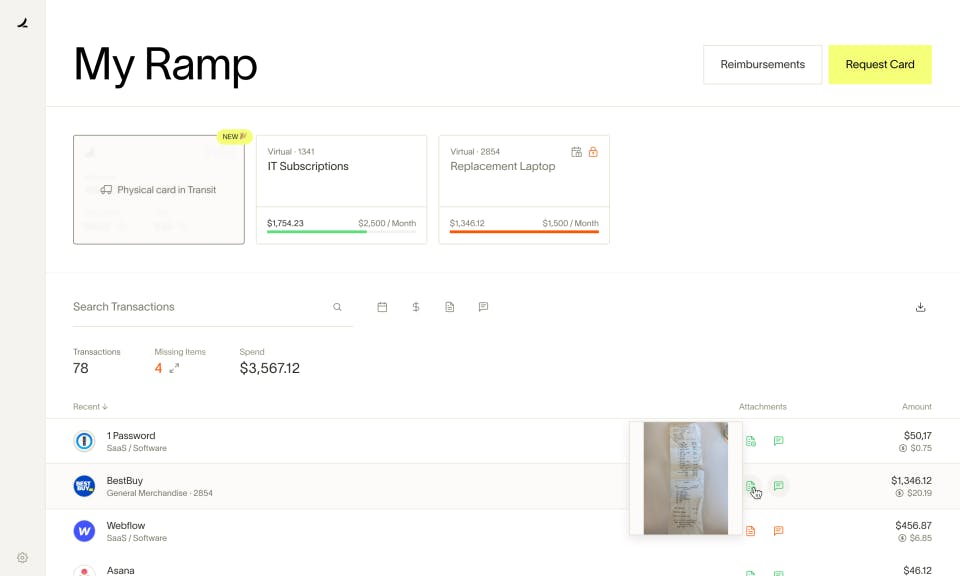

Into a market of corporate cards like Brex and American Express focused on cash back, Ramp launched a business card vertically integrated with expense management, repositioning the corporate card market around business cost savings rather than points and perks.

In-product workflows around approval and spend for card issuing give finance control over distributed spend, enabling all employees to access corporate credit, incentivizing companies to move all spend onto one provider, and creating lock-in via weekly active engagement with the platform.

Key features helping businesses save time and money include:

Automatic expenses: Instead of an Expensify-style upload workflow around receipts, Ramp texts users when it detects usage of one of their programmatically-generated cards, and allows them to send a photo of the receipt for automatic categorization and record-keeping

Policy enforcement: Finance teams in Ramp can create rules around spending—by card, by vendor, by category, by department—and then Ramp can automatically enforce those rules on a card-by-card level.

Invoice digitization: Via optical character recognition (OCR), Ramp can decompose invoices into their constituent text parts—vendor, amount, items—so they can be reconciled and processed more quickly.

Competition

Ramp is in an increasingly crowded competitive landscape of companies looking to own card issuing and expense management, including Brex, Divvy (acquired by Bill.com in 2021 for $2.5B), Airbase ($641M valuation) and Teampay ($80M raised).

All of these companies have built workflows around approval and spend for card issuing that give finance control over distributed spend, (1) enabling all employees to have access to corporate credit, not just reimbursement, (2) incentivizing companies to move all spend onto 1 card provider and (3) creating lock-in via weekly active engagement with the platform.

Banking-as-a-service

Going back several years, the only way to issue a card as a fintech company was to become a bank yourself. Since then, card issuing and banking-as-a-service companies like Marqeta, Unit and Lithic have made it much easier for any company to issue physical and virtual cards.

By abstracting away the need to build the relationship with the network through the bank and replacing managed services with robust APIs with variable cost pricing, they’ve made it much more feasible for companies to build card-based fintechs like Ramp.

These companies, today, are continuing to reduce the barrier to embedding card issuing with interchange as a revenue stream, powering neobanks like Mercury (Mercury IO credit card launch in 2022) and vertical SaaS companies like Parker and Juni (ecommerce), Convoy (trucking) and Flexbase (construction)—all of which are collectively challenging Ramp when it comes to owning B2B payments.

These kinds of vertical products look to gain a foothold into expenses by designing deeper workflows around specific high volume expense categories, with the richest being advertising (19% of spend as reported by Ramp), general merchandise (15%) and software (13%).

In 2018, Brex launched a credit card for startups and hit 1,000 customers in 5 months underwriting cash in the bank, not historical financials, with 10x the credit limit of American Express and no personal guarantee.

With Brex, newly-formed startups could get approved for a corporate card within seconds by connecting their bank accounts via Plaid ($250M revenue in 2021) vs. filling out paper forms and waiting for weeks for approval from an American Express.

Unlike Amex, which charged $300-600/year for a corporate card, Brex gave away cards for free and offered startup-centric perks like AWS credits, monetizing transaction volume on the backend.

The proposition of free money, combined with the near-zero switching cost of adding or swapping out an existing card, gave Brex incredible acquisition velocity to land into startups and then expand as their volume grew.

TAM Expansion

With the rise of LLMs like OpenAI's GPT-4, finance and expense management platforms like Brex, Navan, and Datarails have rushed to launch AI-powered chat experiences for CFOs.

Ramp has positioned against this hype, focusing on using LLMs behind the scenes to automate away the mechanical turks previously required to OCR receipts to create structured transaction data, classify expenses, and make sense of invoices & contracts.

Where the models built by companies like Scale are trained on receipt data, LLMs provide companies like Ramp with generic models that can understand invoices and receipts at the same amount of accuracy at a fraction of the cost.

Ramp’s competitive advantage hinges on their access to data on what companies are purchasing, how much they are paying, and their specific contract terms, which data drives a flywheel that makes Ramp more useful as more companies use it.

In the upside case, Ramp’s AI tools catalyze Ramp’s colonization of the entire back office by offering customers better cost savings and insights in return for moving more of their finance operations to Ramp.

Ramp's growing emphasis on enterprise expense management enables them to play in high margin B2B subscription SaaS, grow with their most successful customers, and go after a slew of adjacent markets like bill pay (Bill.com, $642M 2022 revenue), reimbursements (Expensify, $169M 2022 revenue), and travel (Navan, $9.2B valuation), including the major incumbent platform SAP Concur (~$2B, 20%+ YoY growth).

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.