Revenue

$109.00M

2021

Valuation

$537.00M

2022

Funding

$226.88M

2023

Growth Rate (y/y)

90%

2022

Revenue

Revenue estimated using publicly available information.

Valuation & Funding

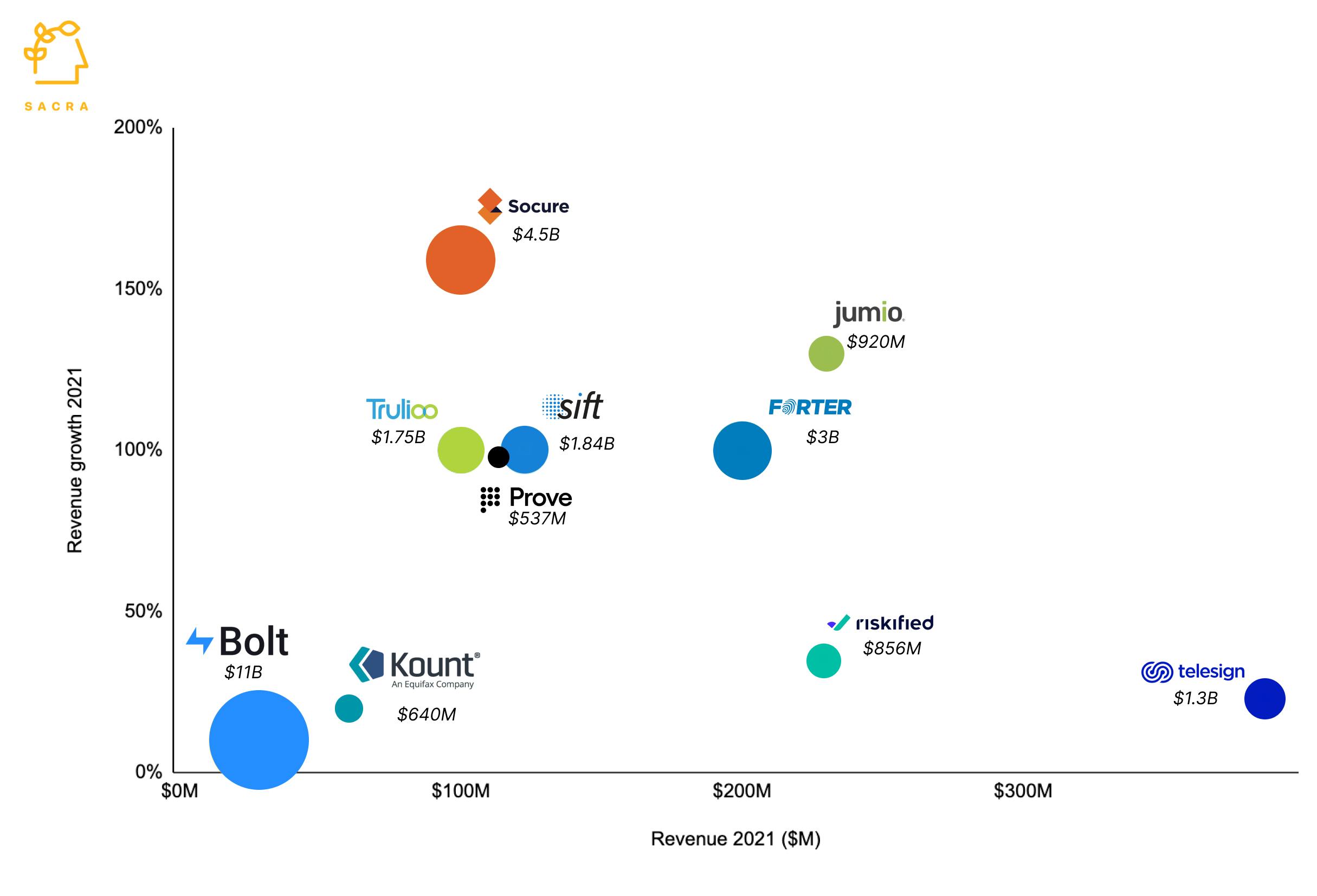

Prove's competitors by revenue and revenue growth. Bubble size indicates valuation. Figures estimated using publicly available information.

Prove has raised $221M from investors such as Relay Ventures, Synchrony, TransUnion, and American Express Ventures. It was last valued at $537M, pegging its valuation/revenue multiple at 4.7x. Socure is one of the highest valued identity verification companies. It has raised $648M with a valuation of $4.5B for a valuation/revenue multiple of 45x.

Prove's multiple is comparable to its publicly-listed competitors. For instance, Riskified, with $229M in revenue and $856M in market cap, has a multiple of 3.7x. TeleSign, which intends to go public through SPAC, has a multiple of 3.4x with revenue of $386M and a $1.3B valuation.

Business Model

Prove’s business revolves around the proprietary dataset of identity information keyed on mobile phone numbers that they’ve built by aggregating data from mobile network operators such as AT&T and Verizon, credit bureaus such as TransUnion, and other third-party sources.

For each of the more than 1 billion consumer and small business identities in their database, Prove can supply information on things like name, address, location, SSN, and email.

Prove then makes that data accessible via API, which banks, fintechs, marketplaces, and others pull into their apps to:

- Increase conversion rate on signup by auto-populating new user information, instead of asking users to fill out long forms.

- Improve marketing automation by keeping customers’ contact information up-to-date.

- Mitigate fraud by checking identity fraud risk before greenlighting a transaction.

Prove makes money by charging companies to access its digital identity database. When companies link the customer profiles in their CRM to Prove’s database, they pay Prove a monthly fee for every linked profile. This SaaS-style pricing model makes its revenue predictable, compared to a usage-based pricing model.

Prove also earns revenue from multi-factor mobile authentication services where it charges per unit of communication sent, such as text SMS, voice SMS, or mobile push notification.

Prove's digital identity database revenue is higher margin, as seen in the case of Prove’s competitors, compared to revenue from mobile authentication services.

Product

Prove started out life as Payfone, a mobile payments company, but pivoted in 2015 to digital identity verification.

Prove offers three core products: Pre-Fill, Identity Manager, and multi-factor authentication. In 2025, Prove launched three new products: Unified Authentication, Verified Agent, and ProveX.

Pre-Fill

Pre-Fill helps companies improve conversion rates by auto-populating users' personal information instead of asking them to type it out.

Users enter their phone number with their SSN or date of birth at signup, which Prove uses to return other personal information and assess the chances that the signup is related to identity fraud. Prove also runs KYC checks with respect to things like sanctions, AML watchlists, and politically exposed persons. In May 2025, Prove announced surpassing 400M Pre-Fill transactions across 150M users, with 50M+ transactions added in the first four months of 2025. A spring 2025 release eliminated manual data entry for challenges like DOB or partial national ID numbers, relying instead on real-time authentication tied to device/phone possession.

Identity Manager

Companies can connect customer profiles in their CRM with Prove's database using the Identity Manager. Once connected, Prove enriches customer profiles by adding missing personal details and keeps the profiles fresh by adding/deleting information as needed.

This enables companies to improve the deliverability of marketing communication such as SMS and emails with up-to-date contact information.

Multi-factor Authentication

Prove's MFA solution comprises standard text or voice-based OTPs, instant links on messages for verification, and push authentication that uses app notifications to verify users are who they say they are.

Unified Authentication

In August 2025, Prove launched Unified Authentication, a passive/persistent customer recognition solution available in 190+ countries. It moves away from SMS OTPs and mitigates SIM swap risk.

Verified Agent

In October 2025, Prove launched Verified Agent for the agentic commerce market. The product provides a cryptographically backed chain of custody linking verified identity, intent, payment credentials, and consent, with initial support for AP2.

ProveX

Competition

Prove competes with two types of companies.

One category is fraud prevention companies that focus on helping businesses avoid identity fraud. This category comprises companies like Trulioo, Socure and Ping Identity as well as all-in-one fraud prevention platforms such as Sift and Kount that cover other fraud types such as check-out and policy abuse fraud.

Another category of competitors are companies focused on improving the customer experience by reducing disruptions in user journeys. This category includes all-in-one solutions such as Riskified, Bolt and Forter as well as identity fraud solutions such as TeleSign.

Fraud prevention

Trulioo is a key player in the identity proofing market with a valuation of $1.75B, backed by Goldman Sachs, Citi Ventures, and American Express Ventures. Like Prove, it has a database of 5B identities drawn from 400+ third-party sources that its customers use to verify user identity.

Socure is one of the largest companies in the digital identity verification market with a valuation of $4.5B. It has raised $647M from Bain Capital Ventures, Tiger Global Management and T. Rowe Price. It provides a number of identity verification products such as document verification, identity fraud prevention, compliance and email/phone risk scores.

Kount (part of Equifax)

Kount started as a digital identity management platform that expanded into other types of fraud, such as payment and bot detection. It raised $80M from CVC Capital Partners before being acquired by Equifax in 2021 for $640M. Kount has the upside of integrating its digital identity database with Equifax’s physical identity database for identity management.

Customer experience

TeleSign

Like Prove, TeleSign uses phone number-linked data to enable its clients to ascertain the identities of their users. It made $386M in 2021 and covers 85% of the North American population with a strong presence in Latin America, Middle East Asia and Asia-Pacific. TeleSign has announced plans to go public through SPAC at a valuation of $1.3B in the second quarter of 2022.

Bolt is a checkout-as-a-service provider for medium to large ecommerce merchants. Boltʼs primary product is its wrapper around the checkout, providing a one-click experience at the consumer end while enabling merchants to maintain control of the customer experience. Bolt makes it easy for users to transact online by letting them save their personal details once and reuse it across different websites.

Riskified

Riskified is one of the largest online fraud detection companies focused on ecommerce, having raised a total of $229M. It processed $89B GMV in 2021. It covers different types of frauds such as payment, identity, and policy abuse frauds. Riskified listed in July 2021 at a $4.3B market cap.

TAM Expansion

The big trend driving the identity fraud prevention market is the shift from offline to digital across retail, banking, and healthcare industries. For instance, ecommerce is expected to reach 25% of all US retail sales in 2025, compared to 14% in 2020. Similarly, digital-only banks are expected to cover 20% of the US population in 2025, from 11.4% today. This shift was accelerated by COVID when both public and private entities moved to digital transactions.

Another trend is the smartphone becoming the default device to access digital services. This is being driven by falling prices, faster networks with 4G and 5G connectivity, and the generational shift to digitally native Millennials and Gen Z.

This digital shift has led to an increase in identity thefts and cyber attacks. Neobanks have twice the fraud rate compared to credit cards and three times higher than debit cards. In 2020, identity fraud caused $56B in losses across all US financial services firms.

The convergence of these three trends means that companies are constantly looking for better ways to verify identities and prevent identity fraud, which helps companies like Prove.

Using Pre-Fill for checkout

Prove's Pre-Fill product is used for new user registration but can be expanded downstream to other parts of the customer experience, like checkout. Creating a new user account is one of the top two reasons for cart abandonment in ecommerce websites leading to $18B of lost sales. An 'auto-fill with Prove' button can create a new user account in the background when the user checks out without any active input from them, and in turn, the company can get information valuable for marketing purposes.

Geographic expansion

In October 2025, Prove launched the Prove Identity Graph claiming coverage of 90%+ of digital consumers across 227 countries and territories. Asian and Latin American markets have sizable populations of mobile phone users—India (490M), Indonesia (170M), Brazil (118M), and so on. Mobile phones are the only computing device for most people in these countries. They use them to access online services such as banking, ecommerce, and healthcare, making mobile-based identity even more important for private and public entities, and marking a significant expansion opportunity for Prove.

Agentic commerce

In October 2025, Prove positioned its Verified Agent product to secure the estimated $1.7T agentic commerce market. The product addresses a new category where AI agents conduct transactions autonomously on behalf of verified users.

Biometric verification

Prove recently acquired UnifyID, a provider of passive authentication and mobile-based behavioral biometrics. UnifyID's SDK integrates with apps and uses the phone's sensors to map a user's behavioral traits such as how they walk, speed of walking, and how they use their phone. It uses this data to verify user identity standalone or in conjunction with multi-factor authentication.

Mobile-based biometric verification is one of the fastest-growing trends in identity verification, where the user doesn't have to actively send an input. By the end of 2022, 70% of the organizations implementing biometric identity verification will use mobile phones rather than any other device, up from 5% in 2019.

Risks

Document-centric verification gap: As online theft of personally identifiable information (PII) increases, some companies and governments are moving towards document-centric identity verification using ID card images and selfies. Prove provides multi-factor authentication through OTP but doesn't have a document-centric verification solution, which may impact its adoption for high-value, high-risk transactions in the long-term.

Big tech competition: Large companies in adjacent markets offer their own version of pre-fill as a feature, often based on robust identity verification. For instance, Apple offers pre-fill based on biometrics, Plaid using bank data, and Bolt by reusing credentials entered once across different websites. These providers have a larger view of user journeys than Prove, giving them access to better quality user data.

Agentic commerce execution risk: Prove's October 2025 launch of Verified Agent targets the $1.7T agentic commerce market, but this category is nascent with uncertain adoption timelines and unclear regulatory frameworks. If AI agent-driven commerce develops more slowly than projected or regulators impose restrictive requirements, Prove's investment in this expansion may not generate meaningful returns.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.