Revenue

$50.00M

2021

Valuation

$1.20B

2026

Funding

$299.00M

2026

Growth Rate (y/y)

51%

2022

Valuation: $395.00M in 2022

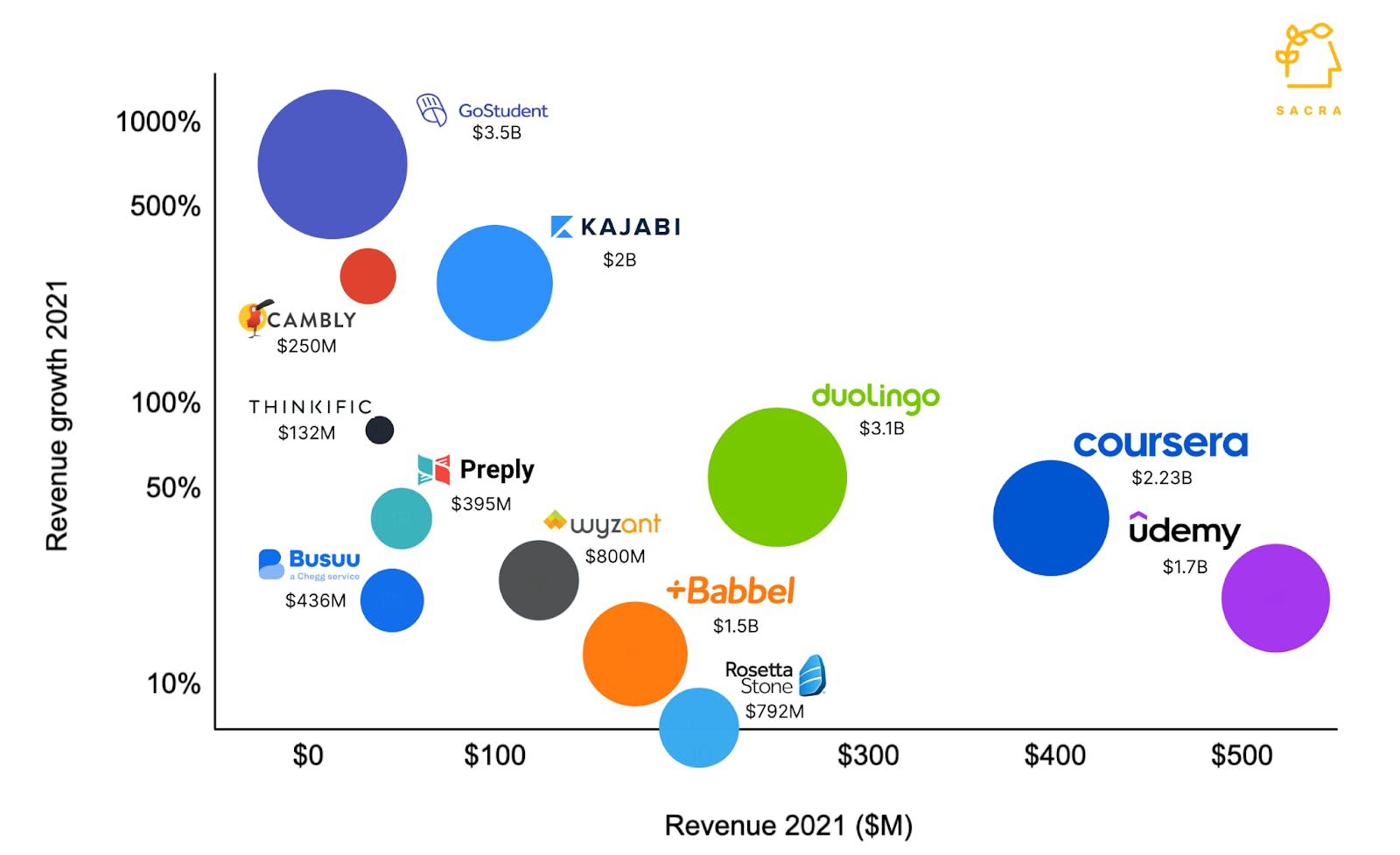

Note: Data for Udemy, Duolingo, and Thinkific gathered from S-1/10K docs. For other companies, valuation, revenue, and growth rate are based on SEC disclosures, Delaware filings, Sacra estimates, and reports from TechCrunch. Bubble size corresponds to company valuation. Vertical axis has a log scale. Estimates are up-to-date for July 2022.

Preply has raised $100M from Hoxton Ventures, Owl Ventures, Evli Growth Partners, and others. It was valued at $395M in March 2022 with a valuation-to-revenue multiple of 8x.

One of its closest competitors, GoStudent, is valued at $3.5B and has raised $685M. Duolingo, the largest language learning app globally, has a market cap of $3.1B with a valuation to revenue multiple of 12x.

Scenarios: $120M to $420M ARR by 2026

To evaluate Preply's future potential, we analyze multiple scenarios projecting annual recurring revenue (ARR) through 2026. These projections consider various growth trajectories and market multiples, factoring in both industry dynamics and company-specific performance indicators within the edtech space.

| 2021 Revenue ($M) | $50M | ||

|---|---|---|---|

| 2021 Growth Rate (%) | 38.89% |

Preply achieved $50M in revenue for 2021, demonstrating solid growth of 38.89% year-over-year. While this growth rate is healthy, it represents a normalization following the company's explosive 4X expansion in 2020 during the COVID-driven shift to digital learning.

| Multiple | Valuation |

|---|---|

| 1x | $50M |

| 5x | $250M |

| 10x | $500M |

| 15x | $750M |

| 25x | $1.2B |

Based on Preply's $50M revenue, valuations span from $50M at a conservative 1x multiple to $1.25B at an ambitious 25x multiple. The current $395M valuation sits between 7-8x multiples, suggesting room for growth while remaining more conservative than Duolingo's 12x multiple.

| 2026 Growth Rate | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| 10.0% | $50M | $66M | $82M | $96M | $109M | $120M |

| 15.0% | $50M | $66M | $84M | $102M | $120M | $138M |

| 20.0% | $50M | $67M | $87M | $108M | $132M | $159M |

| 30.0% | $50M | $68M | $92M | $121M | $159M | $207M |

| 40.0% | $50M | $70M | $97M | $136M | $190M | $265M |

| 45.0% | $50M | $70M | $100M | $143M | $206M | $299M |

| 50.0% | $50M | $71M | $102M | $151M | $224M | $336M |

| 55.0% | $50M | $72M | $105M | $159M | $243M | $376M |

| 60.0% | $50M | $72M | $108M | $167M | $263M | $420M |

Revenue projections show potential outcomes ranging from $120M to $420M by 2026, representing growth scenarios between 10% and 60%. Even the conservative case demonstrates healthy expansion, while aggressive growth paths could position Preply as a major player in the online education market.

| 2026 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $120M | $599M | $1.2B | $1.8B | $3B |

| 15.0% | $138M | $692M | $1.4B | $2.1B | $3.5B |

| 20.0% | $159M | $795M | $1.6B | $2.4B | $4B |

| 30.0% | $207M | $1B | $2.1B | $3.1B | $5.2B |

| 40.0% | $265M | $1.3B | $2.7B | $4B | $6.6B |

| 45.0% | $299M | $1.5B | $3B | $4.5B | $7.5B |

| 50.0% | $336M | $1.7B | $3.4B | $5B | $8.4B |

| 55.0% | $376M | $1.9B | $3.8B | $5.6B | $9.4B |

| 60.0% | $420M | $2.1B | $4.2B | $6.3B | $10.5B |

Projecting forward to 2026, valuations range from $120M at conservative growth/multiple assumptions to over $10.5B in the most optimistic scenario (60% growth, 25x multiple). Even moderate scenarios suggest potential for significant value creation compared to Preply's current $395M valuation.

Bear, Base, and Bull Cases: 5.5x, 7.5x, 9.5x

Building on our revenue projections, we analyze three distinct scenarios using multiples of 5.5x (bear), 7.5x (base), and 9.5x (bull) to reflect varying market conditions and Preply's potential execution outcomes. These cases provide targeted insights while remaining within established edtech industry valuation ranges.

| Scenario | 2026 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 15% | 5.5 |

| Base 📈 | 25% | 7.5 |

| Bull 🚀 | 35% | 9.5 |

Growth projections range from conservative (15% with 5.5x multiple) to aggressive (35% with 9.5x multiple), reflecting various market scenarios. Even the bear case suggests healthy expansion, while the bull case positions Preply for significant growth in the online education market, though at more modest multiples than peers like Duolingo.

| Bear 🐻 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $50M | $66M | $84M | $102M | $120M | $138M |

| Growth | 38.89% | 32.46% | 26.94% | 21.42% | 17.85% | 15% |

| Base 📈 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $50M | $68M | $89M | $115M | $145M | $182M |

| Growth | 38.89% | 35.15% | 31.94% | 28.74% | 26.66% | 25% |

| Bull 🚀 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Revenue | $50M | $69M | $94M | $128M | $174M | $235M |

| Growth | 38.89% | 37.84% | 36.94% | 36.05% | 35.46% | 35% |

Our bear, base, and bull cases for Preply depend primarily on how effectively the company can maintain growth and compete in the evolving online education market

- In the bear case, competitive pressures and market headwinds lead to slowing growth of 15% and a modest 5.5x multiple, reaching a $761M valuation on $138M revenue

- In the base case, successful enterprise expansion and strong consumer growth support 25% growth and a 7.5x multiple, achieving a $1.36B valuation on $182M revenue

- In the bull case, expansion into adjacent categories and successful subscription model implementation drive 35% growth and a 9.5x multiple, resulting in a $2.23B valuation on $235M revenue.

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2021 Revenue | $50M | $50M | $50M |

| 2021 Growth Rate (%) | 39% | 39% | 39% |

| 2021 Multiple | 5.5 | 7.5 | 9.5 |

| 2021 Valuation | $275M | $375M | $475M |

| 2026 Revenue | $138M | $182M | $235M |

| 2026 Growth Rate (%) | 15% | 25% | 35% |

| Multiple | 5.5 | 7.5 | 9.5 |

| 2026 Valuation | $761M | $1.4B | $2.2B |

The uncertainty around these three cases depends primarily on Preply's ability to navigate competitive pressures, successfully expand enterprise offerings, and leverage its marketplace position into new verticals while maintaining strong tutor retention and monetization in an evolving online education landscape.

- In the Bear case: Economic pressures cause a pullback in corporate language learning budgets while increased competition from both horizontal platforms and other specialized marketplaces leads to commoditization, forcing Preply to compete primarily on price and putting pressure on their take rates.

- In the Base case: Preply successfully expands its enterprise offering while maintaining strong consumer growth, achieves greater tutor retention through improved monetization tools, and continues to benefit from the broader shift toward online language learning.

- In the Bull case: Preply leverages its marketplace position to expand beyond language learning into high-value adjacent categories (like business skills and test prep), successfully implements a subscription model, and becomes the dominant global platform for live online tutoring across multiple subjects.

Based on our analysis, Preply's valuation scenarios reflect significant upside potential, from $761M in the bear case to $2.2B in the bull case by 2026. Even the conservative projection suggests nearly 2x growth from today's $395M valuation, while successful execution could position Preply as a major edtech player.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.