Revenue

$43.00M

2022

Valuation

$1.20B

2023

Funding

$161.30M

2023

Growth Rate (y/y)

30%

2023

Revenue

Pilot hit about $43M ARR in 2022, up 30% from the year before. COVID was a tailwind for Pilot’s business—revenue doubled during the first year of the pandemic as adoption of digital solutions for SMB tasks like finances rose. Growth has slowed in the years since with the downturn across the startup ecosystem, with Pilot’s business heavily indexed on tech startups in the seed to Series B+ stage.

Pilot announced crossing 1,000 customers in 2020, and was at roughly 1,700 at the end of 2022, with an average revenue per customer of around $25,000.

Business Model

InDinero (founded in 2009) was the first tech-enabled bookkeeper, ingesting a company’s financial data and using overseas labor arbitrage with accountants based in the Philippines ($6-$15 per hour) to handle their books.

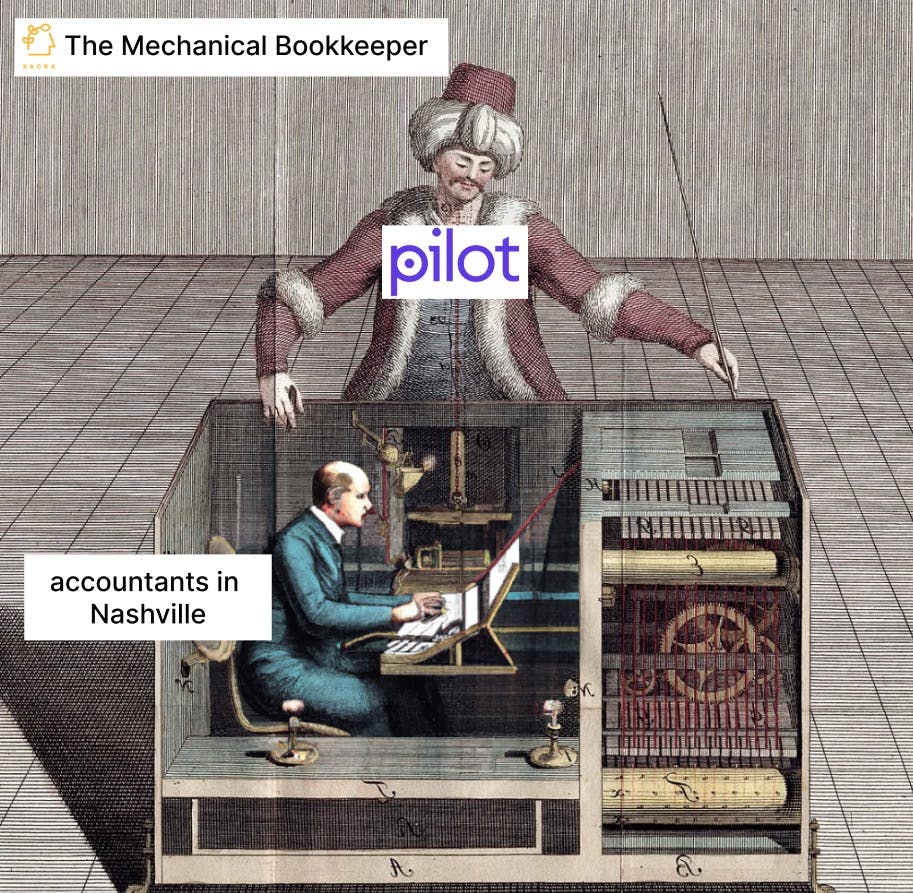

Pilot brought a more white-glove, human experience to tech-enabled bookkeeping with lower-cost but still domestic workers based in Nashville (roughly $30 per hour).

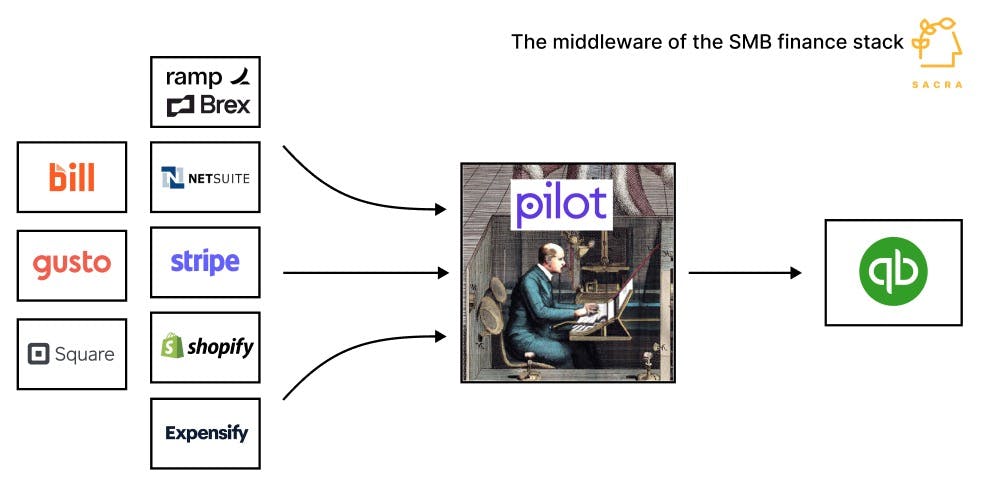

Pilot is fundamentally a kind of middleware between SMB finance tools like Stripe, Gusto, Expensify and QuickBooks, the SMB system of record PIlot is built on top of.

Pilot charges $500 to $840+ per month with mandatory annual contracts for access to their platform and to their core bookkeeping services. This is an ongoing service that includes monthly reconciliations, categorization of transactions, and other tasks related to financial record keeping.

In addition, Pilot offers professional services for tax preparation, fractional CFO services, and claiming R&D tax credits. Pilot charges a separate fee for these professional services, which are provided by its in-house team, with the fee for these services is based on the complexity of the business's financial needs and the level of service required.

Competition

Pilot operates in a highly competitive market with both traditional bookkeeping services and cloud-based accounting software companies.

While Pilot’s bookkeepers primarily communicate with clients over email and may ping clients to confirm uncategorized transactions or answer questions about their books, traditional “main street" bookkeepers—which tend to be priced competitively to Pilot if not at lower rates—offer the ability to hop on a phone call to chat.

Pilot is in the early stages of competing with other cloud-based back-office SaaS like QuickBooks, Gusto, Brex, and Ramp, which offer small business owners the ability to manage their finances and automate a growing number of their back-office tasks. Brex recently purchased FP&A platform Pry, which overlaps with Pilot’s FP&A offering, and much of the manual categorization workflow around transactions happens in tools like Brex and Ramp today. Meanwhile, QuickBooks is the system of record and foundation that Pilot is built on.

Product

Pilot offers a range of financial services for startups and small businesses.

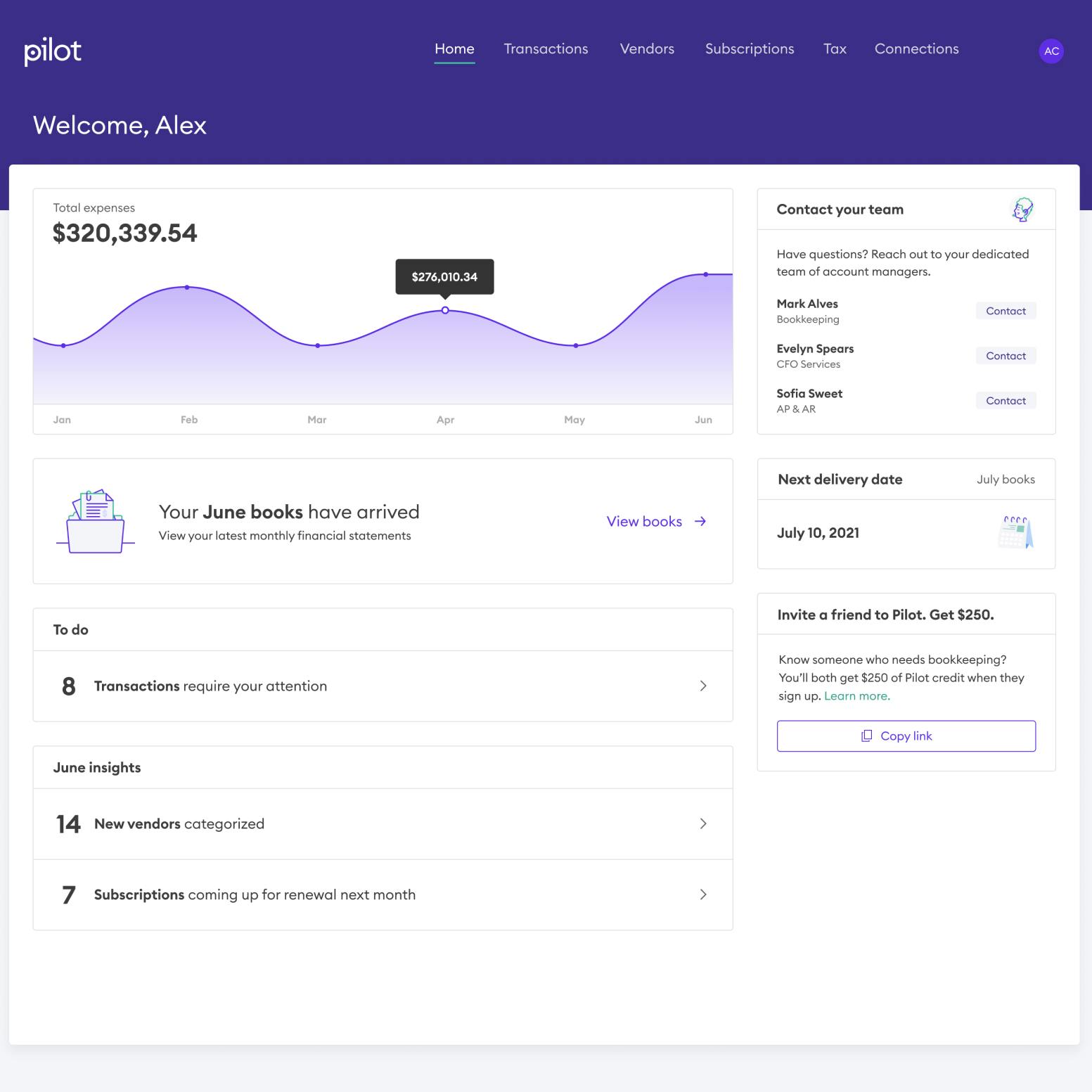

Bookkeeping: Pilot's main product, its bookkeeping service, includes a dedicated bookkeeper who manages the company's accounts, prepares financial reports, and assists with tax compliance.

Clients sign up for Pilot service and connect their financial accounts, such as bank accounts, credit cards, and payment processors. Once connected, Pilot's software automatically pulls in all the financial data, such as transactions and balances, and a human (assisted by software) categorizes them.

Pilot's team of bookkeepers manually reviews the data to ensure accuracy and completeness, reaching out to the client over email to clarify any unclear transactions or ask for missing information.

Tax: Pilot's tax service helps businesses prepare and file their federal and state tax returns, provides tax planning, and gives ongoing tax support.

Pilot uses the financial data that has been entered into its bookkeeping software to prepare the tax returns. This data is automatically imported into the tax software.

Once imported, Pilot tax experts prepare the returns, after which they are reviewed by another team member to ensure accuracy and completeness.

Fractional CFO: Pilot's CFO service provides businesses with access to help with financial planning, budgeting, forecasting, and other strategic financial tasks.

TAM Expansion

Tech-enabled services businesses can achieve increasing returns to scale either by 1) selling more SaaS into their customer base—see Carta or Scale—or, 2) by offering more adjacent services that leverage their existing access into their customers’ data, like Vanta which went from SOC-2 certification to offering automated compliance for ISO 27001, HIPAA, GDPR, and other security frameworks.

Pilot’s status as a trusted, human advisor to companies has so far given them the ability to do the latter and cross-sell other services like tax, fractional CFO, and R&D tax credits.

On the other hand, the end-user SaaS side of the product is relatively underdeveloped—Pilot has a big opportunity to do more here and build a workflow product that SaaS founders and finance teams will use more frequently the way they do with a product like Carta (which is invoked every time a new team member is hired or fired).

SMBs today spend about $60B per year on bookkeeping and accounting, meaning Pilot today has only 0.4% penetration into the market.

Risks

Operational complexity: A key risk for Pilot is that scaling up the services side of the business—which is what makes them the vast majority of their money today—brings operational overhead and can lower the overall quality of the product.

Company culture: Part of Pilot’s vision for growing as a venture-scale business and continuing to improve their margins as they scale is automating more of bookkeeping—this could put the software/product side of the company at odds internally with the side of the company focused on providing bookkeeping services today.

Lack of lock-in: While Pilot provides valuable bookkeeping services to its clients, it does not have a high frequency of engagement with them. Clients do not need Pilot month-to-month to run their business, creating a low level of engagement that could make it easier for them to switch to a competitor if they find a more compelling option.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.