Revenue

$94.49M

2024

Valuation

$500.00M

2024

Funding

$64.00M

2024

Growth Rate (y/y)

89%

2024

Revenue

Sacra estimates that Photoroom is at $94M of annual recurring revenue (ARR) as of 2024, up 89% year-over-year.

As of December 2023, Photoroom had reached 100 million downloads of its apps and was at $50 million ARR, just three years after launch. The company had doubled its revenue in the preceding six months.

The company officially launched in February 2020, getting to 300K monthly active users (MAUs) and $1M ARR by August, growing 50% month-over-month, and $2M by the end of December 2020.

Valuation & Funding

PhotoRoom raised $43M at a $500M valuation in March 2024, led by Balderton Capital with participation from Aglaé and Y Combinator. With $65M ARR as of March 2024, this implies a 7.7x revenue multiple.

PhotoRoom has raised a total of $64M from multiple prominent investors including Balderton Capital, Aglaé, Y Combinator, Kima Ventures, FJ Labs, Meta, and various angel investors.

Product

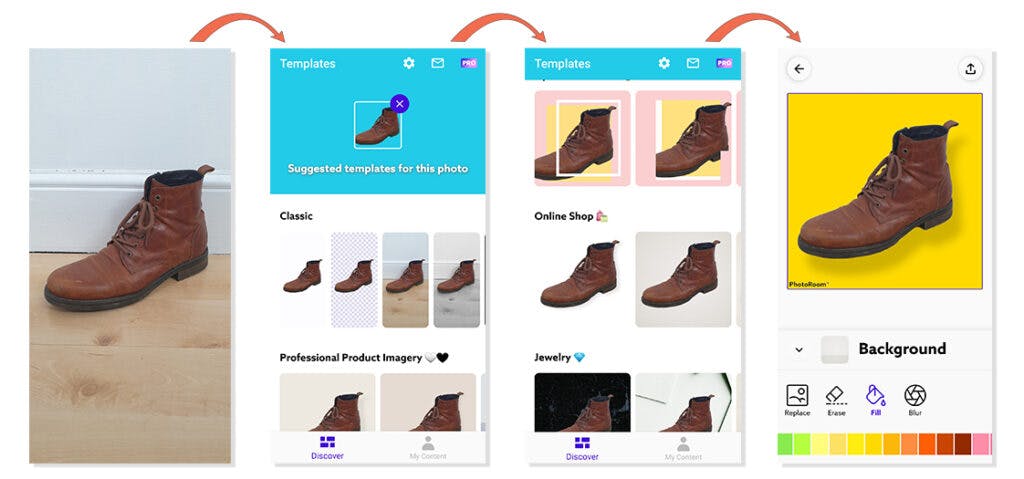

Photoroom is a mobile-first, AI-powered photo editing platform that offers a wide range of tools, including background removal, AI-generated backgrounds, retouching, blurring, AI-generated shadows, white backgrounds, custom text addition, background color changing, image outlining, and bulk resizing.

The company found product-market fit in early 2020 with vendors on platforms like eBay, Depop and Poshmark who need to optimize their product images for different online marketplaces and social media platforms—but who don't necessarily have the skills or money necessary for a platform like Photoshop.

Photoroom saw its growth spike 2020 after a shoutout from Gary Vaynerchuck and some prominent eBay influencers. COVID was a huge tailwind as offline retailers started to migrate online and looked for apps like Photoroom to help them optimize their images, and the Photoroom watermark that sellers saw everywhere helped distribute the product.

In November 2025, Photoroom introduced an AI Video Generator that turns product images into short animations on iOS and Android, expanded Virtual Model customization (fit, lighting, poses, backgrounds), and shipped a 20x faster Batch editing experience on web with “Apply all” for consistent catalog edits.

Business Model

Photoroom operates on a freemium model, offering a limited set of features and a cap on the number of images that can be processed for free. The company has various pricing tiers that vary by country, with the basic Pro tier on mobile priced at £3.99/week or £69.99 annually in the U.K and $4.99/week or $89.99 annually in the U.S. Photoroom also has separate rates for web users, Shopify customers, larger business users, and for its API.

The company has demonstrated impressive capital efficiency, scaling to $20M in ARR on just $2M of invested capital, and achieving profitability. The company's payback period is currently 1 month, which Photoroom credits to the willingness of their mobile customers to pay upfront.

Photoroom's growth accelerated after making a few tweaks to their generative AI model, including increasing their image generation speed by 100 times (from 3 minutes to 2 seconds), focusing on producing a quick first draft for iteration rather than a perfect image immediately, perfecting their image accuracy to ensure products always looked right, and removing the prompt generation.

Competition

Photoroom’s mission is based around the idea of making studio level photography accessible to any entrepreneur.

Canva is more around design on your desktop. It's also transitioning from a simple social media asset designer to nearly $1B ARR platform looking to displace the traditional productivity suite (email, word processor, spreadsheet) with the visual communication tools that have become essential for sales & marketing, product, HR and potentially everyone in an organization (slides, images, videos).

Adobe's Photoshop, on the other hand, is more for the 10s of millions of people who are professionals spending the day in front of their computer.

PhotoRoom is providing that service for people who are more in the grey area between prosumers and SMBs—people who can’t afford or don't know how to use Photoshop but need it for their business or side hustle.

TAM Expansion

The core customers of Photoroom today are SMBs, but they've gone upmarket via the PhotoRoom API. In May 2022, Warner Brothers marketed the Barbie movie using the PhotoRoom API to do a marketing campaign where people could create Barbie posters with their technology powering it on the back-end.

Meanwhile, the Wolt team used it to help the restaurants in their marketplace create studio-quality photography for their dishes and their spaces.

Other API customers of Photoroom include Netflix, Lionsgate, Zomato, Shopify, Audi, Hennessy, Thermos, Selency, Faire, and Zepto.

The upside for Photoroom is that they become the visual processing layer of every high-growth marketplace and high-volume content business that needs to optimize their content to drive higher conversion rates.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.