Revenue

$100.00M

2023

Valuation

$800.00M

2021

Funding

$704.60M

2021

Growth Rate (y/y)

354%

2021

Revenue

Petal grew revenue 4.5X in 2021, from $11M to $50M. That growth was driven largely by growth in its customer base, which increased 3X in 2021 to 300,000.

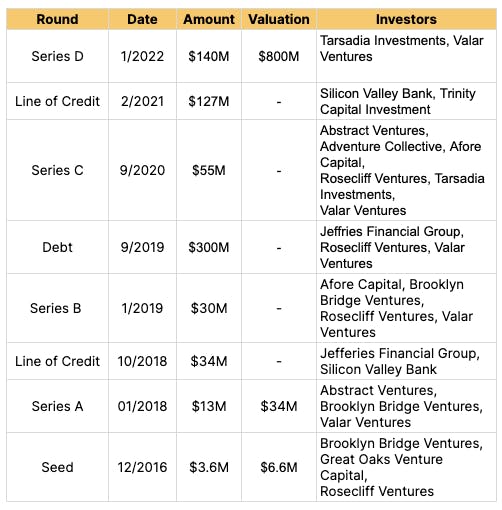

Valuation & Funding

Petal was acquired by Empower Finance in April 2024. Terms of the deal were not disclosed, but multiple sources indicated the sale was for a fraction of Petal’s previous valuation.

Petal had last raised at a $800M valuation in January 2022, backed by Silicon Valley Bank, Jeffries, Valar Ventures, and Afore Capital.

Product

Petal provides virtual and physical credit cards to people with thin credit histories. Instead of relying on a traditional credit score, Petal determines creditworthiness by hooking up to a borrower’s bank account and looking at their cash flows via their income, savings, and spending.

Petal found its initial product-market fit providing well-designed, deposit-free credit cards to Gen Z/Millennial consumers. Their cards feature bold color schemes that stand out from traditional bank cards, and they can be personalized, while their mobile app allows users to track expenses, offers, and interest payments from a straightforward, clean digital user interface.

Upon the receipt of a new card application, Petal connects with the applicant’s bank account, ingests the raw transaction data, categorizes it, and then uses a ML-based algorithm to calculate a credit limit.

Recently, Petal announced it would be spinning out the software it uses to run this process—CashScore—and selling it to other fintechs under the name Prism Data. Similar to other fintechs like Privacy (which spun out Lithic), this move could provide a significant source of recurring B2B revenue.

Competition

Petal competes with other fintechs that use alternative data to issue credit cards. It also competes with both legacy banks and neobanks that offer their own secured credit cards.

Fintechs

One of Petal's closest competitors, TomoCredit, has raised $17M. TomoCredit grew revenue 10X in 2021 and has more customers than Petal at 500,000. A key difference from Petal is that TomoCredit’s cards don't charge interest—customers pay the balance in full each month by opting into a weekly autopay schedule.

Another competitor is Oportun which offers credit cards without security deposits and credit checks. It offers a Visa card through WebBank (also used by Petal) with a credit limit of up to $1000, variable APR (24.9% to 29.9%), and no rewards program.

Fintechs like Deserve, meanwhile, target international students living in the U.S, using factors like school major, student visa, and bank account balance to assess their creditworthiness.

Banks

Neobanks such as Chime and Step offer secured credit cards by bolting them on top of customer accounts.

Chime asks customers to move money from their checking accounts to credit builder accounts linked to their cards. Their spending limit is capped based on the amount of money in the credit builder account.

TAM Expansion

Tailwinds

New applications for credit cards have returned to their pre-COVID levels in the United States, with 25% of consumers applying for a new credit card in the 12 months leading to Oct 2021. That’s a 15.7% increase year-over-year. At the same time, 70M people in the US have thin credit files and have difficulty accessing credit products.

On the other hand, neobank accounts are expected to number 53.7M by 2025, up from 29.8M today. That growth is being driven largely by younger generations turning away from incumbent bank accounts with high fees, opaque pricing, and poor digital user experiences.

Petal sits at the intersection of these two trends—demand for credit products from the young and others with thin credit files, and predominantly younger people seeking out digital-first banking experiences—and we expect Petal will benefit from them in the years to come.

Ecosystem

Petal’s homebrew CashScore credit scoring technology could be extended to offer other kinds of products to consumers with thin credit files but good cashflow. These could include payday and consumer lending products (market size: $35.4B), auto finance products ($245.6B), and POS lending products ($164B).

API

Underwriting customers with thin credit files is a major problem for fintechs, banks, and many players in between.

As Petal spins out their CashScore technology as a B2B service under the name “Prism Data”, they could become the core API for cashflow-based creditworthiness assessments: a service that could have use cases in consumer lending, tenant screening, insurance premiums, mortgage lending, and more.

The opportunity here is large: just looking at credit cards, expanding access to 50% of the 70M people with thin credit files could lead to about $13.2B in net new annual spending.

Risks

Rise of BNPL

In 2021, BNPL (buy now pay later) transaction volume grew 4X from 2020, hitting $100B for the year. This growth has been largely driven by Gen Z, whose BNPL purchases grew 6X from 2019 to 2021, and Millennials (whose grew 2X)—Petal’s core demographics.

BNPL services like Klarna can offer consumers longer interest-free payback periods on their purchases as well as the perception of more transparent fees. The continued growth of these kinds of products can impact not just Petal, but other fintechs looking to own payments, particularly for younger consumers.

Churn

Customers generally come to Petal because they have thin credit files and aren’t able to get another kind of unsecured card. By reporting payments to the big three credit reporting agencies, Petal helps those customers build their credit and improve their scores. 70% of Petal’s customers have no or thin credit history before using Petal, and reportedly, the average score that users reach is 676.

The risk here is that as customers’ credit scores improve, they may churn: to other neobanks, to identity-centric credit cards like Daylight for the LGBT community, or to cards with better offers like those offered by Chase or American Express. In 2020, Petal launched the lower-APR “Petal 2” to address this, but over time it’s likely they will need to continue to layer on more products to ensure customers have a place to go within their ecosystem once they “graduate” from existing products.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.