Revenue

$4.00M

2023

Funding

$16.50M

2024

Growth Rate (y/y)

60%

2023

Revenue

Sacra estimates Paragon hit $4M in annual recurring revenue (ARR) at the end of 2023, up approximately 60% year-over-year from $2.5M ARR at the end of 2022.

Paragon's customer base has grown to over 100 clients, with an average annual contract value (ACV) of $30,000 to $40,000. The company is increasingly targeting mid-market and enterprise customers, aiming for six-figure ACV deals.

Valuation & Funding

Paragon 28 Inc (FNA) currently has a market capitalization of $591.48 million and an enterprise value of $669.82 million as of November 2023. The company went public on October 15, 2021, with an initial market cap of $1.20 billion. Currently trading at $7.08 per share, the company has a calculated intrinsic value of $17.21 per share based on base case projections. Due to limited publicly available information, details about private funding rounds and key investors prior to the IPO cannot be verified.

Product

Paragon, founded in 2019 by Brandon Foo and Ishmael Samuel, emerged from Foo's experience with integration challenges at his previous startup, Polymail. The company joined Y Combinator's Winter 2020 cohort and raised a $2.3 million seed round, launching its core product in early 2021.

Paragon found product-market fit by targeting B2B SaaS companies needing to build customer-facing integrations. Initially focusing on Y Combinator startups, Paragon grew from $0 to $1M ARR in two years. The company's embedded iPaaS (Integration Platform as a Service) solution allowed developers to create integrations 70% faster than building in-house, addressing a critical pain point in the SaaS ecosystem.

The platform's key features include:

1. Developer-first approach: Native integration capabilities that provide fine-grained control and customization.

2. Unified API: Simplifies integration with multiple SaaS applications.

3. Action API: Provides a wrapper over downstream integration APIs with improved documentation and typing.

4. ETL capabilities: Offers data extraction, transformation, and loading directly into customers' databases.

5. Customizable authentication: Manages end-user authentication credentials for various app integrations.

Paragon's focus on developer-friendly, customizable integrations differentiated it from no-code workflow solutions, attracting mid-market and enterprise clients. The platform now processes 100 million requests monthly, supporting approximately 45 pre-built integrations with popular SaaS apps like Salesforce, HubSpot, and Slack.

In July 2025, Paragon launched Managed Sync, a product for fully managed high‑volume data ingestion and permissions. Managed Sync introduces a Sync API to enable full third‑party data syncs with two calls and a Permissions API to check users’ access on retrieved data. Subsequent updates added CRM and ticketing pipelines, expanding coverage across Salesforce, HubSpot, Pipedrive, Zoho CRM, Dynamics 365 Sales, and leading support tools.

Business Model

Paragon is a subscription SaaS company that provides an embedded integration platform for B2B software companies.

The core of Paragon's business model is enabling its customers to quickly build and maintain integrations with third-party applications, pricing based on usage volume and the number of integrations implemented.

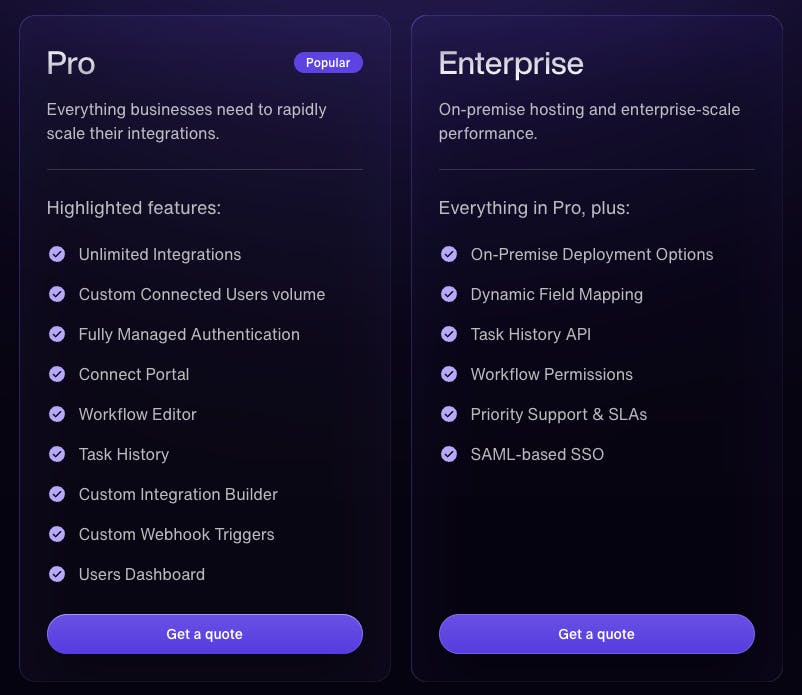

Paragon's revenue stream primarily comes from its tiered pricing model, with customers paying an average of $30,000 to $40,000 annually.

This typically includes access to about five integrations and up to a million tasks or requests per month. As customers scale their usage or require more integrations, Paragon's pricing scales accordingly, with some clients reaching six-figure annual contract values.

Competition

Paragon competes in the embedded integration platform as a service (iPaaS) market, facing competition from both established players and emerging startups. The competitive landscape can be divided into two main categories: general iPaaS providers and specialized embedded iPaaS solutions.

iPaaS

Paragon competes with larger, established iPaaS companies that have expanded into the embedded integration space. Key players in this category include Workato, Tray.io, and MuleSoft (owned by Salesforce).

These companies offer both internal and customer-facing integration solutions, leveraging their existing infrastructure and customer base.

For example, Workato provides Workato Embedded, which allows SaaS companies to offer integrations to their customers. These larger players benefit from brand recognition and extensive resources, but their embedded offerings may lack the specialized focus of dedicated embedded iPaaS providers like Paragon.

Embedded iPaaS

In this category, Paragon faces direct competition from companies focused solely on embedded integrations. Key competitors include Prismatic, Cyclr, and Alloy.

These companies, like Paragon, offer developer-first platforms designed specifically for building customer-facing integrations. Prismatic, for instance, provides a low-code environment for creating integrations and a white-labeled integration marketplace. Cyclr emphasizes its visual integration designer and extensive pre-built connector library.

Paragon differentiates itself within this space through its focus on providing a native, code-first integration experience.

While competitors like Prismatic and Cyclr lean towards low-code or no-code approaches, Paragon's SDK and APIs are designed to give developers more control and flexibility. This approach allows for deeper, more customized integrations that can be seamlessly embedded into a product's user experience.

TAM Expansion

Paragon has tailwinds from the proliferation of SaaS applications and increasing demand for seamless integrations, and has the opportunity to grow and expand into adjacent markets like enterprise workflow automation and data orchestration.

SaaS Integration Ecosystem

The explosive growth of the SaaS ecosystem presents a significant opportunity for Paragon. As businesses adopt more cloud-based applications, the need for efficient integration solutions becomes critical. Paragon's embedded integration platform allows software companies to quickly build and maintain integrations with other SaaS applications, positioning them to capture a growing share of this market.

The average company now uses over 100 SaaS applications, a 38% increase from 2020. This trend shows no signs of slowing, creating an ever-expanding addressable market for Paragon. By focusing on developer-friendly tools and a wide range of pre-built integrations, Paragon can become the go-to solution for companies looking to enhance their products with robust integration capabilities.

Paragon's potential to expand goes beyond just adding more integrations. As they build relationships with both SaaS providers and the companies using their platform, they can leverage this network to create additional value-added services. For instance, they could develop analytics tools that provide insights into integration usage and performance, helping their customers optimize their products and integration strategies.

Enterprise Workflow Automation

An adjacent market that Paragon could expand into is enterprise workflow automation. While their current focus is on enabling product integrations for SaaS companies, there's a natural progression towards helping enterprises streamline their internal processes across multiple applications.

By leveraging their expertise in connecting different software systems, Paragon could develop tools that allow non-technical users within enterprises to create complex workflows spanning multiple applications. This would position them to compete in the rapidly growing iPaaS (Integration Platform as a Service) market, which is projected to reach $61.67 billion by 2030.

Data Orchestration and Management

Another potential avenue for expansion is data orchestration and management. As companies grapple with data spread across numerous SaaS applications, there's a growing need for solutions that can unify and manage this distributed data landscape.

Paragon could leverage its integration infrastructure to build data pipelines that extract, transform, and load data from various sources into centralized data warehouses or lakes. This would allow them to tap into the booming data management market, which is expected to reach $208.87 billion by 2028.

Risks

1. Commoditization of integration platforms: As the embedded iPaaS market matures, Paragon faces the risk of its core offering becoming commoditized. With competitors like Workato, Tray.io, and newer entrants offering similar capabilities, Paragon may struggle to maintain its competitive edge and pricing power.

This could lead to margin pressure and slower growth as customers have more options to choose from. To mitigate this, Paragon needs to continually innovate and expand its integration catalog to stay ahead of competitors.

2. Overreliance on go-to-market (GTM) integrations: While Paragon started with a focus on GTM integrations, an overreliance on this vertical could limit its growth potential.

As the company expands horizontally, it may face challenges in developing expertise and building credibility in new verticals. This could slow customer acquisition in non-GTM segments. To address this, Paragon should invest in developing deep domain knowledge across multiple verticals and potentially pursue strategic partnerships to accelerate expansion.

3. Scalability of support and maintenance: As Paragon rapidly expands its integration catalog (growing from 20 to 80 integrations in two weeks), there's a risk of stretching its support and maintenance capabilities too thin.

Customers rely on Paragon for mission-critical integrations, and any reliability issues could severely impact retention and reputation. The company needs to ensure its infrastructure and support teams can scale in tandem with its growing catalog to maintain high quality of service across all integrations.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.