Revenue

$100.00M

2024

Valuation

$1.00B

2024

Funding

$98.00M

2024

Growth Rate (y/y)

20%

2024

Revenue

Sacra estimates that PandaDoc hit $100M in annual recurring revenue (ARR) in 2023, up 20% from $83M at the end of 2023, valued at $1B as of their 2021 Series C for a 25x multiple on their $40M ARR in 2021, with 56,000 customers for average revenue per customer (ARPC) of about $1.8K.

Compare to e-signature and contract leader DocuSign (NASDAQ: DOCU) at $2.8B of revenue, up 3.55% from the end of 2023, valued at $12.58B for a 4.5x revenue multiple, and document storage & workflow company Dropbox (NASDAQ: DBX) at $2.53B in revenue, up 1.3% from the end of 2023, valued at $8.15B for a 3.2x revenue multiple.

Valuation & Funding

PandaDoc reached a $1 billion valuation following its funding round in September 2021. The company has raised a total of $61.05 million across 10 funding rounds since its founding. Key investors include OMERS Growth Equity, Microsoft's M12 venture fund, and One Peak Partners. As of 2024, PandaDoc reports $100 million in annual recurring revenue and serves over 56,000 customers globally.

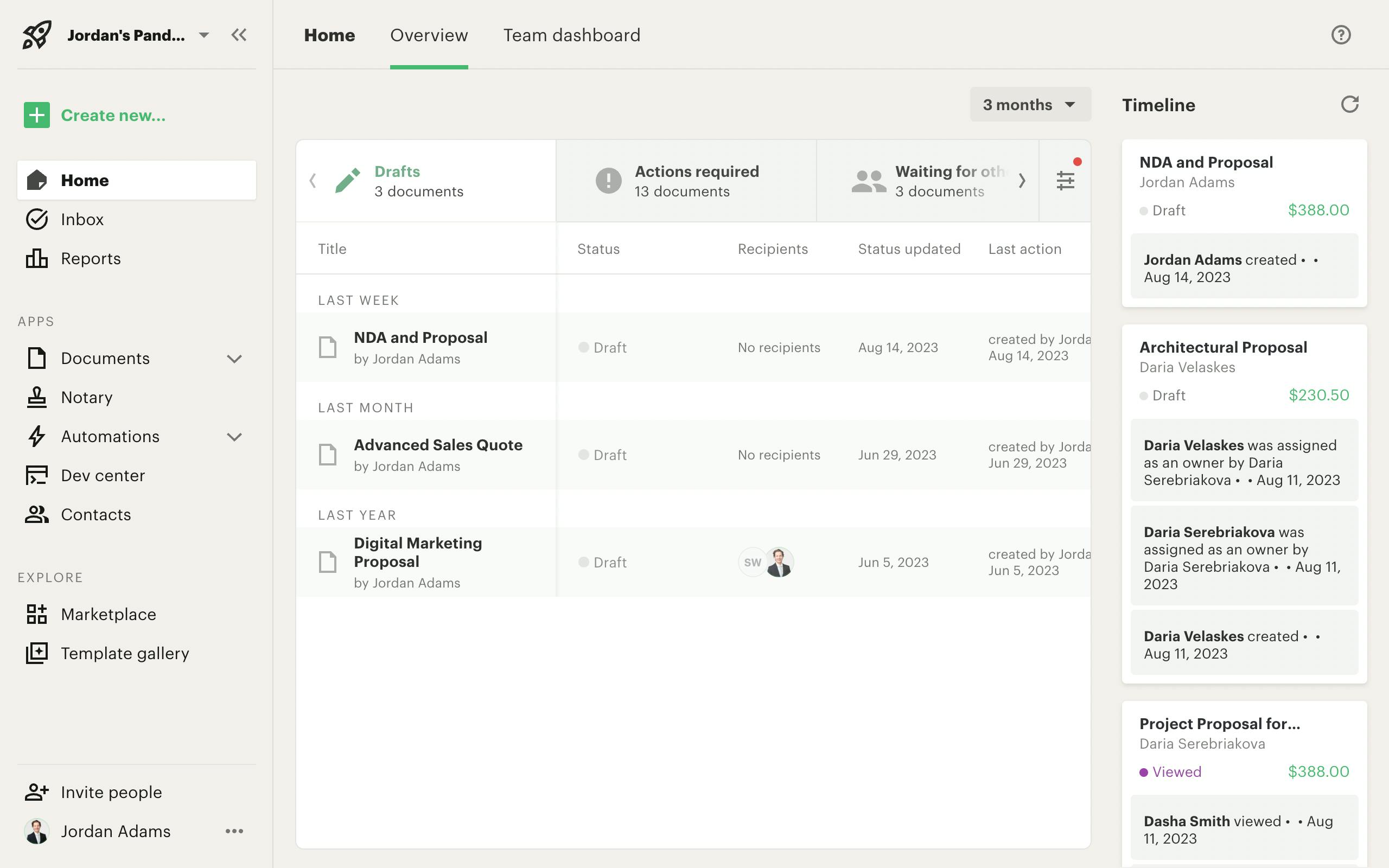

Product

Founded in 2011 in Belarus, PandaDoc found product-market fit by undercutting DocuSign (NASDAQ: DOCU) on price, offering unlimited documents and e-signatures as part of a SaaS subscription versus DocuSign's $5 per e-signature model.

This pricing strategy, combined with a user-friendly platform for document workflow automation, resonated strongly with small to medium-sized businesses looking to accelerate their sales cycles and improve efficiency.

PandaDoc's rapid growth is evident in its early financial milestones, hitting $1M ARR after just 6 months and $5M ARR after 18 months.

The company is part of a wave of successful startups from the former Soviet Bloc, including Estonia's Pipedrive (2010), Romania's UiPath (2005), and Russia's Miro (2011). These companies have leveraged the high-quality technical talent available in their low cost of living countries to build strong, aggressively priced competitors to established B2B SaaS companies.

The key products PandaDoc offers include:

1. Document Management Software: Allows users to securely create, edit, share, and store business documents in the cloud.

2. Proposal and Contract Management: Enables rapid creation of professional sales proposals and contracts using customizable templates, with integrated e-signature capabilities.

3. Workflow Automation: Streamlines document-centric business processes with features like approval workflows and CRM integrations.

4. CPQ (Configure, Price, Quote) Software: Helps sales teams quickly generate accurate quotes.

5. Industry-Specific Solutions: Tailored offerings for sectors like construction, government contracting, and marketing.

6. API and Integrations: Allows developers to embed PandaDoc functionality into existing applications and workflows.

PandaDoc's platform is designed to be user-friendly, with drag-and-drop editing and a library of over 750 templates. It integrates with popular CRM and business software, enhancing its utility for sales and business operations across various industries, with a particular emphasis on companies selling services.

Business Model

PandaDoc is a subscription SaaS company that provides an all-in-one document workflow automation platform. The company generates revenue through tiered subscription plans based on features and number of users, with pricing ranging from $19 to $49 per user per month for its main plans.

At its core, PandaDoc solves the problem of inefficient, paper-based document processes for businesses. The platform allows users to create, share, track, and e-sign documents like proposals, contracts, and forms. This streamlined approach accelerates deal cycles and improves win rates for sales teams.

PandaDoc's business model leverages a freemium strategy to drive adoption. The company offers a free e-signature plan with limited features, which serves as an entry point for potential customers. As users experience the value and require more functionality, they can upgrade to paid plans with additional capabilities like custom branding, CRM integrations, and advanced workflow tools.

The company employs a land-and-expand strategy within organizations. By initially targeting individual teams or departments, PandaDoc can demonstrate value and then expand usage across the enterprise. This approach, combined with the scalability of its pricing model, allows PandaDoc to grow revenue as customers increase their usage and add more users over time.

PandaDoc's competitive advantage stems from its comprehensive feature set that goes beyond basic e-signatures to include document creation, analytics, and integrations with popular business tools. The platform's ease of use and focus on SMBs and mid-market companies also differentiates it from enterprise-focused competitors like DocuSign.

By continuously expanding its product offerings and targeting a broad range of industries, PandaDoc has positioned itself as a leader in the growing document automation market, with potential for further expansion into adjacent workflow and productivity solutions.

Competition

PandaDoc competes in the document automation and e-signature market, facing competition from several categories of players:

E-Signature Focused Providers

DocuSign is the clear market leader in e-signatures, with over 70% market share. As the pioneer in the space, DocuSign benefits from strong brand recognition and network effects.

Meanwhile, larger software bundles have acquired e-sign players—like Adobe's 2011 acqusition of EchoSign, Dropbox's 2019 acquisition of HelloSign, and Box’s 2021 acquisition of SignRequest—to drive retention by owning the complete lifecycle of critical documents like contracts and proposals.

Broader Document Workflow Platforms

PandaDoc's primary competitive advantage lies in its end-to-end document automation platform.

In this category, it competes with companies like Conga, which offers a suite of contract lifecycle management tools integrated with Salesforce.

However, Conga's solutions are generally more complex and enterprise-focused compared to PandaDoc's SMB-friendly offering. Proposify is another competitor focused specifically on sales proposal automation, but lacks PandaDoc's e-signature and payment collection features.

CRM and Sales Enablement Ecosystems

Many CRM platforms like Salesforce, HubSpot, and Microsoft Dynamics offer native document generation and e-signature capabilities.

While these integrations can be convenient for existing customers, they often lack the depth of features and flexibility provided by PandaDoc's purpose-built solution.

PandaDoc has carved out a strong position by focusing on ease of use and a comprehensive feature set tailored for SMBs. Its freemium model, introduced at the start of the pandemic, has helped drive rapid user growth and position it as one of the top three e-signature solutions by usage.

The company claims to have over 30,000 paying customers across 130 countries, with 80% user growth and 63% revenue growth in the past year.

TAM Expansion

Product Vision and Expansion

PandaDoc is building towards a future where it's not just an e-signature provider, but a central hub for all document-related workflows within an organization.

The company is aggressively colonizing sales data rooms (DocSend), CPQs (DealHub), payments (Stripe Payment Links), and notarization (Notarize), among other functions.

A key ongoing focus for PandaDoc is deepening its integrations with major CRM, ERP, and other business systems, positioning itself as a critical connective layer in the business software ecosystem.

The company is also investing heavily in its API and developer tools, enabling greater customization and embedding of its services into other applications. This approach allows PandaDoc to become more deeply entrenched in its customers' operations, increasing switching costs and driving long-term value.

Secular Market Growth

The market for e-signatures and document workflow solutions is indexed to the digitization of the global economy, driven by the fundamental role that contracts and formal agreements play in business operations worldwide.

As DocuSign—which has been growing at 30-50% year-over-year since hitting $200M ARR—demonstrates, the size of this market is vast.

Additionally, the horizontal nature of the market provides multiple avenues for growth. From financial services and retail to healthcare and government, virtually every industry relies on digital document workflows.

This ubiquity not only provides diverse growth opportunities but also insulates companies like PandaDoc from sector-specific downturns.

The sheer size of the market means that being the dominant player isn't necessary for significant success. Even as a number two, three, or four player, PandaDoc has substantial growth potential.

M&A Potential

There's a clear trend of larger software bundles acquiring e-sign players to enhance their document lifecycle capabilities and drive customer retention. Notable examples include Adobe's acquisition of EchoSign in 2011, Dropbox's purchase of HelloSign in 2019, and Box's acquisition of SignRequest in 2021.

PandaDoc's comprehensive platform, established SMB customer base, and advanced workflow capabilities make it an attractive potential acquisition target. Large enterprise software companies without robust e-signature and document workflow solutions could see PandaDoc as a means to quickly fill this gap in their offerings.

Potential acquirers might include enterprise content management platforms looking to expand their workflow capabilities, CRM or ERP providers aiming to own more of the document lifecycle within their systems, or productivity suite providers seeking to enhance their collaboration and workflow tools.

Risks

1. Commoditization of e-signature: While PandaDoc offers broader document workflow automation, e-signature remains a core part of its value proposition.

As e-signature becomes increasingly commoditized and integrated into other software platforms, PandaDoc may struggle to differentiate and maintain pricing power.

This could pressure margins and growth, especially as larger competitors like DocuSign expand their offerings.

2. Overreliance on SMB market: PandaDoc's focus on small and medium businesses has driven its growth, but may limit its ability to move upmarket.

Enterprise customers often require more complex features, stronger security, and dedicated support.

PandaDoc's product and go-to-market strategy may not be well-suited for this transition, potentially capping its total addressable market and growth trajectory.

3. Channel partner dependency: PandaDoc has invested heavily in building out its channel partner program, which now accounts for a significant portion of revenue.

While this approach can accelerate growth, it also introduces risks around partner management, margin pressure, and potential disintermediation.

If key partners were to develop competing solutions or shift allegiances, it could materially impact PandaDoc's growth and profitability.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.