Revenue

$1.40B

2024

Funding

$4.80M

2024

Growth Rate (y/y)

20%

2023

Revenue

Click here to access our OnlyFans dataset.

OnlyFans generated $1.4B in revenue in 2024, up 7% year-over-year from $1.3B in 2023 on about $7.2B in gross payments volume. The platform recorded pre-tax profit of about $684M in fiscal year 2024.

OnlyFans's biggest revenue generator is the 20% take rate that it collects on each content sale or membership on the platform.

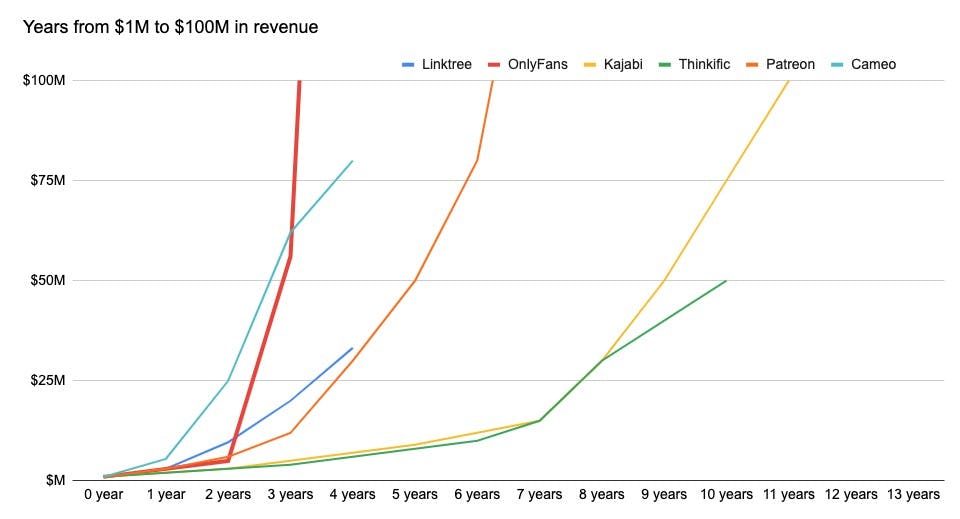

OnlyFans became a cultural phenomenon during COVID, growing from $56M in revenue to nearly $1B over the 2020-1 lockdown period when there was a hiatus on entertainment production, including professional porn.

In October 2025, OnlyFans CEO Keily Blair said the platform has paid out $25B to creators since 2016.

Valuation & Funding

OnlyFans is reportedly in exclusive talks with San Francisco-based Architect Capital to sell a majority stake at a $5.5B enterprise valuation (including ~$2B in debt, with equity valued at ~$3.5B) as of January 2026.

Under the proposed terms, Architect would acquire close to 60% of the business. Architect has indicated it sees opportunity to improve OnlyFans' financial infrastructure, including tools to pay under-banked creators, and believes the company could pursue an IPO in 2028.

Earlier in May 2025, OnlyFans was in talks with an investor group led by Forest Road Co. at a valuation of around $8B, though those negotiations did not result in a transaction.

OnlyFans is owned by Ukrainian-American entrepreneur Leonid Radvinsky through parent company Fenix International, after he bought a majority stake in 2018 from the platform's British founders.

Product

OnlyFans is fundamentally an Instagram-like social media platform built around the idea of paywalled interactive content subscriptions rather than a feed of content from your friends.

Designed to give fitness influencers, reality stars and travel bloggers an easier way to monetize their followings via subscriptions, OnlyFans found product-market fit with NSFW creators with its 20% take rate (vs. the 40% charged by sites like MyFreeCams).

OnlyFans has built the biggest and most trusted brand in their space—the Coinbase of amateur porn—backed by bank-grade KYC/AML to verify creator identities and human monitoring of all content and messaging, fostering good relationships with law enforcement and regulators.

Today OnlyFans is about 3x as big as Pornhub parent company MindGeek (~$450M in 2022, and flat since 2018)—which Visa and Mastercard demonetized amid concerns about revenge porn and CSAM being uploaded anonymously to the site.

As a fan, once you subscribe to a performer on the platform, you’re able to view their feed, see additional content available to purchase, send them DMs, and interact with other members of their community.

As a performer, you can use the OnlyFans back-end to set your own prices for your subscription, create different tiers of service, message some or all of your fans, and upload and create photos and videos.

A statistics page allows performers to see their growth over time and assess how different kinds of content are working for conversion and engagement.

OnlyFans doesn’t expose users’ names or email addresses to performers, making it difficult for those performers to move their audience off-platform.

Business Model

OnlyFans is a subscription-based content platform that enables creators to monetize their fan base through monthly subscriptions and pay-per-view content. The company generates revenue by taking a 20% cut of all earnings on the platform, with creators keeping 80%.

Creators set their own subscription prices, ranging from $4.99 to $49.99 per month, with the average around $7.21. They can also offer pay-per-view content, typically charging $5-10 per minute for videos or $5+ per image. This flexible pricing model allows creators to tailor their offerings to their specific audience and content type.

The platform's business model also benefits from high retention and monetization potential. The parasocial relationships fostered between creators and fans drive ongoing subscriptions and additional purchases of pay-per-view content. OnlyFans further monetizes through tips and custom content requests, creating multiple revenue streams for both creators and the company.

Competition

OnlyFans' reliance on creators bringing traffic from external social media is both a strength and weakness. It allowed for rapid scaling but makes the platform vulnerable to competitors—creators can easily swap out their OnlyFans link on their Linktree for a rival platform, whether a membership platform or a SFW alternative to OnlyFans.

Membership platforms

In the broad scope of content, OnlyFans competes with other membership-based creator economy platforms like Fanhouse, Patreon, Substack, and Buy Me A Coffee.

Fanhouse is the closest to OnlyFans in terms of its emphasis on the feed and sharing photo and video content, although a key difference is that they forbid all explicit adult or nude content in their terms of service—instead, “performers” share content like vlogs and life updates and participate in group chats with their fans.

Patreon is the largest membership site competitor to OnlyFans, with roughly 8M+ patrons and more than 250,000 creators on the platform. Patreon cracked down on adult content in 2017 amid pressure from payment partners but has since loosened up—today, mature content marked “Patron Only” is accepted on the platform.

Adult content sites

Within the adult entertainment industry, OnlyFans competes with established tube sites like Pornhub (owned by MindGeek) and newer creator-focused platforms like Fansly.

OnlyFans has positioned itself as a more ethical alternative to tube sites, with stringent creator verification processes and better revenue sharing.

It generated about 3x the revenue of Pornhub's parent company MindGeek in 2023 ($1.3 billion vs. ~$450 million). However, competitors like Fansly are gaining traction by offering better internal discovery features for smaller creators, potentially peeling off market share from OnlyFans.

SFW creator platforms

A new category of competition has emerged in the form of safe-for-work (SFW) creator platforms like Passes and Sunroom.

These platforms aim to attract a wider base of influencers and models by taking a smaller cut of earnings (e.g., Passes takes 10% vs. OnlyFans' 20%) and maintaining a no-nudity policy.

This positioning allows them to classify as lower-risk merchants with banks, potentially benefiting their cost structure. While these platforms don't directly compete for OnlyFans' core adult content creators, they could appeal to mainstream influencers and celebrities who might otherwise consider OnlyFans for monetization.

TAM Expansion

With 17% growth in 2022 and 20% in 2023, OnlyFans at $1.3B in revenue has decelerated at scale compared to Canva at $2B in 2023 (growing 50%) and Chime at $1.3B (growing 30%).

OnlyFans’s ability to go upmarket and expand their TAM is limited by their NSFW positioning—creators on OnlyFans lose out on more mainstream opportunities like brand deals, modeling contracts or appearing in Netflix shows, unlike with SFW upstarts like Passes.

SFW content

One key area of potential TAM expansion for OnlyFans and a large focus for the business today hinges on getting beyond explicit, adult content as the only type of content on their platform.

OnlyFans’s aim is for their site to be the core membership platform of the creator economy for everyone from fitness influencers to chefs to comedians.

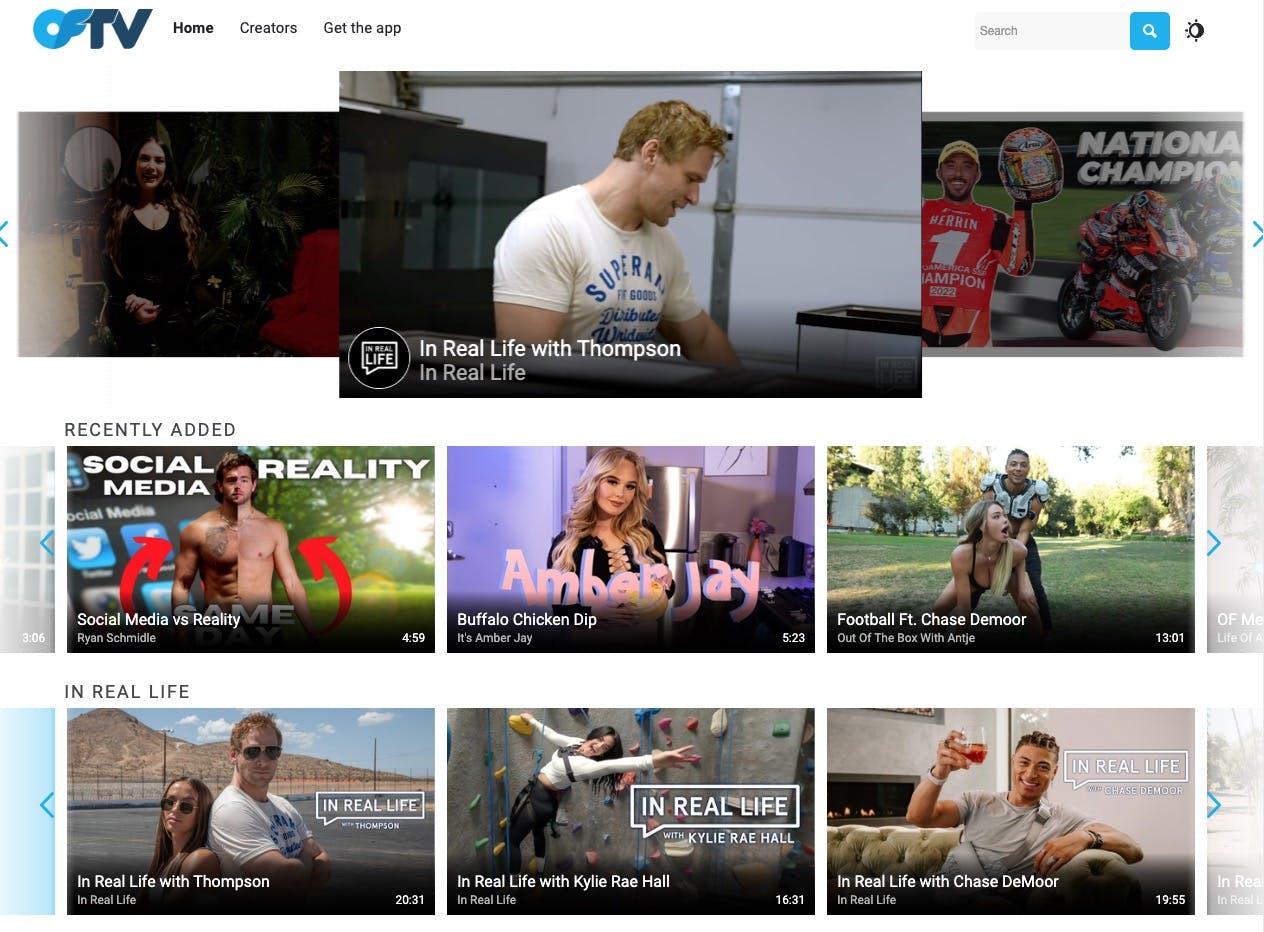

In an effort to do this, OnlyFans launched the Youtube-like OFTV in August 2021—a new streaming platform and app with original video content from OnlyFans creators across these different verticals like comedy, music, fitness and cooking.

Generative AI

As AI gets better, OnlyFans has the opportunity to integrate AI-powered features to enhance user experiences and creator productivity.

This could include AI chatbots to handle routine fan interactions, allowing creators to focus on producing content and managing higher-value engagements. AI could also be used to personalize content recommendations, increasing user engagement and spending.

Furthermore, OnlyFans could explore AI-generated content as a complementary offering to human-created content.

This might include personalized AI avatars or AI-enhanced images and videos, opening up new creative possibilities for creators and potentially attracting a new segment of users interested in AI-human interactions.

Risks

1. Regulatory Backlash: OnlyFans' reliance on adult content puts it at risk of increased regulatory scrutiny and potential payment processor restrictions. While the platform has implemented strict verification processes, any perception of inadequate content moderation could lead to demonetization threats similar to what Pornhub faced. This could severely impact revenue and force a pivot away from its core user base.

2. Creator Disintermediation: OnlyFans' success hinges on creators bringing their own audiences from other platforms. However, this leaves the company vulnerable to creators migrating followers to competing sites or their own platforms. The lack of strong network effects or internal discovery features means top creators could easily switch to alternatives offering better revenue splits or features.

3. AI-Driven Commoditization: The rise of AI chatbots and content generation tools threatens to commoditize the personalized interactions that drive OnlyFans' retention and monetization. As AI becomes more sophisticated at simulating intimate conversations, it could undermine the perceived value of creator-fan relationships, potentially reducing subscriber willingness to pay and overall platform engagement.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.