Revenue

$7.50M

2023

Valuation

$750.00M

2024

Funding

$315.00M

2024

Growth Rate (y/y)

200%

2023

Revenue

Sacra estimates Nile hit $7.5M in ARR at the end of 2023, with approximately 75 customers paying between $25K to $300K annually. The company tripled its customer base between September 2022 and August 2023, suggesting strong growth albeit from a small base.

Based on public contracts like University of Missouri Kansas City ($211,410) and Nile's own statements about "$100,000 annual repeat deployments," average contract values hover around $100K, flexing higher for larger deployments in the educational vertical. Educational institutions make up ~35% of Nile's customer base, mid-market startup offices constitute ~45%, and the remaining ~20% consists primarily of retail and medical offices.

Nile's model of bundling commodity hardware with a SaaS subscription priced at a premium means gross margins should exceed those of traditional networking vendors like Cisco (~64%) and Juniper (~60%). While all vendors face similar hardware manufacturing costs (~$300-700 per AP), Cisco and Juniper lose 25-30% of end customer value to channel partner markups.

Valuation & Funding

Nile was valued at $750M in its Series C round completed in July 2023, which raised $175M. The company's previous Series B round in December 2019 valued the company at $414.62M with a $125M raise, while its Series A in December 2017 valued the company at $55M with a $15M raise.

The company has raised a total of $315M across three funding rounds. Sacra estimates Nile reached $7.5M in ARR by the end of 2023, implying a revenue multiple of 100x on its latest valuation.

Product

Nile was founded in 2018 by former Cisco CEO John Chambers and former Cisco Chief Development Officer Pankaj Patel to reimagine enterprise networking as a service.

Nile found product-market fit as a network-as-a-service (NaaS) platform for educational institutions and mid-market enterprises with lean IT teams, offering a subscription-based model that eliminates upfront hardware costs and bundles everything from wireless access points to security software into a single managed service.

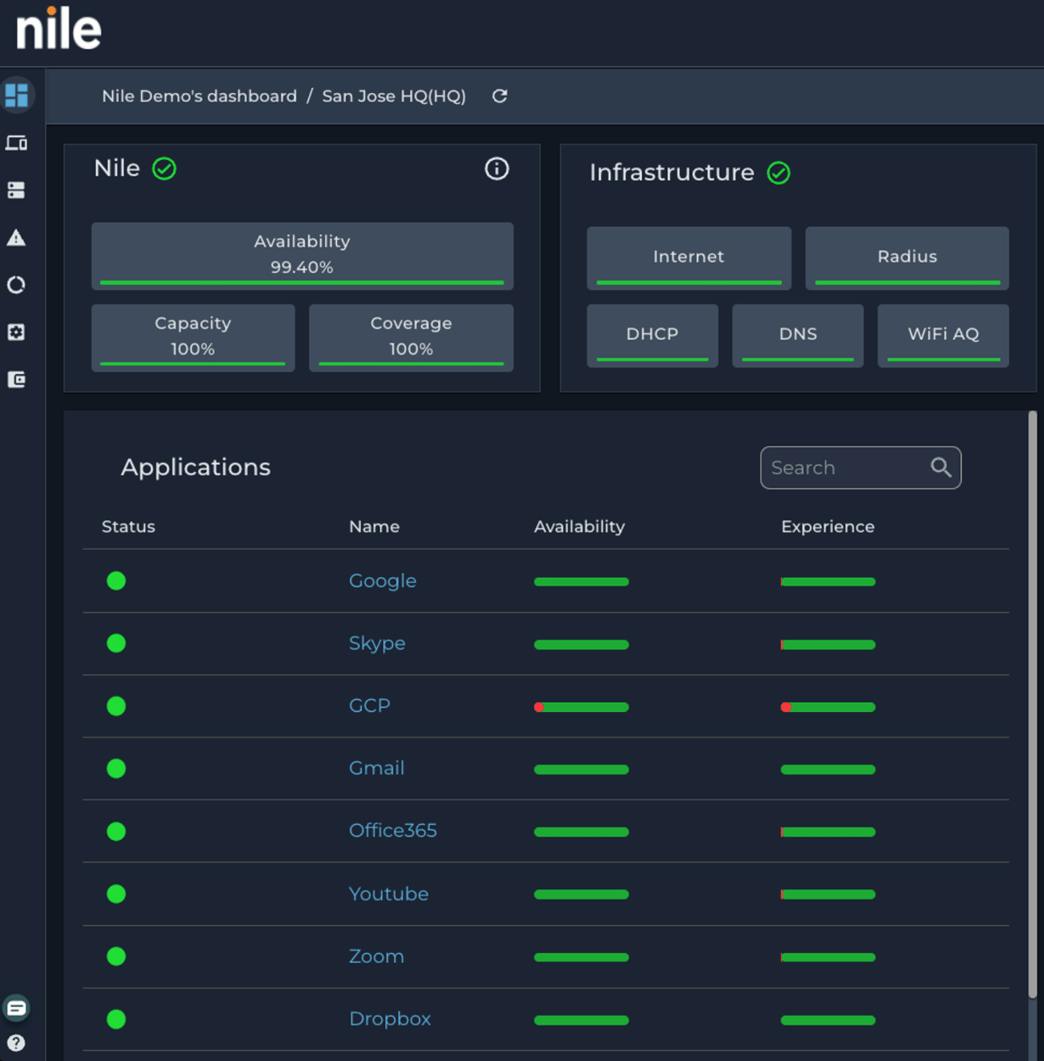

The company's core product, Nile Access Service, delivers campus networking infrastructure as a utility—customers simply specify their site locations and user counts, and Nile handles everything from predictive surveys to hardware installation to ongoing management. Unlike traditional networking vendors who sell through channel partners who manage deployments, Nile provides a SaaS management platform that lets IT admins configure and monitor their entire network through a single dashboard.

When a customer subscribes to Nile, they receive a "Nile Service Block" containing access points, switches, and sensors that Nile owns and manages. The hardware comes preconfigured with zero-trust security and automated management capabilities. Customers can choose between paying per square foot of coverage or per active user.

The platform particularly resonates with universities dealing with fluctuating enrollment (University of Denver pays Nile on a per-user basis that can scale both up and down) and mid-market startups with lean IT teams. These customers value Nile's ability to handle complex networking tasks while letting them focus on strategic initiatives rather than day-to-day network operations.

In October 2025, Nile expanded its NaaS offering with financially‑backed SLAs and AI‑powered lifecycle operations, including Nile Nav for simplified deployment. The company also extended its Zero Trust Fabric to add per‑device isolation, micro‑segmentation, and identity‑ and posture‑based access controls, reducing dependence on legacy VLAN and appliance‑centric designs. These changes sharpen the service’s outcomes‑based model and strengthen built‑in security.

Business Model

Nile has built a network-as-a-service (NaaS) platform to go after the enterprise networking market ($50B+ globally) with a subscription-based model, eliminating upfront hardware costs and bundling everything from wireless access points to security software into a single managed subscription service, turning capex to opex.

Where traditional networking companies like Juniper and Cisco sell through channel partners who manage deployments on behalf of customers, Nile provides a SaaS management platform that lets IT admins configure and monitor their entire network through a single dashboard, with capabilities like zero-trust security and access control bundled in.

Nile's core value proposition is transforming how organizations budget for networking—instead of requiring large, lumpy capital investments ($800-2000+ per access point, paid both upfront and every ~5 years in the typical refresh cycle) that strain IT budgets, customers can predictably budget networking as a flexible SaaS subscription.

This shift resonates particularly well with educational institutions and mid-market startups—two verticals with increasingly lean IT teams, constant pressure to maintain networking infrastructure due to increasing usage, and tight budgets.

The company offers two pricing models: a simple per-square-foot rate that scales with physical footprint, and a per-user rate that scales with actual network usage. This flexibility allows customers to align networking costs with either their physical infrastructure or user base, while Nile maintains full control over hardware refresh cycles and network operations through its proprietary equipment and management software.

Competition

Nile operates in the enterprise networking market, competing against both established networking vendors and emerging NaaS (Network-as-a-Service) providers.

Traditional networking incumbents

Cisco dominates the enterprise networking market with its traditional hardware sales model and Meraki cloud-managed offering.

Cisco generates 92% of revenue through channel partners who handle deployments and add 25-30% markup on hardware. Juniper has gained traction with its Mist platform, which manages 10,800+ access points across reference deployments and has won major accounts like Gap Inc (2,500 stores).

HPE Aruba and Extreme Networks round out the major incumbents, all primarily selling hardware with cloud management capabilities added on.

Emerging NaaS providers

Newer entrants like Meter and Join are pursuing true network-as-a-service models. Meter charges $0.15 per square foot for contracts between $250,000-$10M annually, targeting education, manufacturing and professional services.

Join focuses on F1000 corporate and mid-market enterprises, with 100-150 customers and 300% YoY growth. Both companies, like Nile, aim to eliminate upfront hardware costs and operational complexity.

Managed service providers

Traditional MSPs and VARs continue to offer network management services, but typically using third-party hardware which limits their ability to guarantee performance or innovate on the infrastructure layer.

Their model focuses on outsourcing operations rather than fundamentally changing how networks are consumed and deployed.

TAM Expansion

Nile has tailwinds from the enterprise shift to consumption-based IT and increasing network security requirements, with opportunities to expand beyond campus LAN into adjacent networking markets.

Enterprise networking transformation

TAM expansion analysis suggests 15x growth potential within existing accounts—in the education vertical, assuming $100K per deployment, Nile's existing contracts represent roughly 13% of total campus networking spend (within average $1.5M annual networking budgets).

The company's consumption-based model is particularly compelling for educational institutions with fluctuating enrollment and enterprises seeking to align network costs with headcount. This model positions Nile to capture a larger share of the $50B+ global enterprise networking market.

Security and adjacent markets

By extending zero trust principles to the access layer and integrating with cloud security providers, Nile can expand into the rapidly growing Secure Access Service Edge (SASE) market.

The company's architecture enables "campus ZTNA," allowing them to compete in the broader network security space by routing traffic to cloud security providers like Zscaler and Netskope.

Data center and specialized environments

While currently focused on campus networking, Nile doesn't yet sell into more complex environments like warehouses, where deployment costs run 2-3x higher than standard offices (1 AP per 1,500 sq ft vs 1 per 3,000 sq ft in offices).

Following competitors like Meter into these specialized environments would expand their addressable market, though likely with some pressure on margins due to increased hardware and deployment complexity.

Risks

Three key risks for Nile:

Enterprise resistance to full outsourcing: While Nile's zero-trust architecture and simplified management are compelling, many enterprises may resist fully outsourcing their network infrastructure and operations, particularly in regulated industries.

The company's all-or-nothing approach requiring customers to use Nile's proprietary hardware and management system could limit adoption among organizations that want more control or need to maintain existing security tools and processes.

Hardware supply chain exposure: By designing and manufacturing its own networking hardware, Nile takes on significant supply chain complexity and risk compared to pure software companies.

Component shortages, manufacturing delays, or quality issues could impact the company's ability to deploy and scale customer implementations quickly - a key part of its value proposition.

Feature set limitations: Nile's strategy of offering a simplified, standardized networking stack means deliberately excluding many enterprise networking features to reduce complexity.

While this enables better automation and reliability, it could prevent adoption by organizations with specialized networking requirements that need capabilities beyond Nile's streamlined feature set. This is particularly relevant for data centers and industrial environments where Nile currently doesn't compete.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.