Revenue

$206.00M

2024

Funding

$368.41M

2021

Revenue

Since Neo4j was founded, Amazon (Amazon Neptune), Microsoft (Microsoft Azure Cosmos DB), Oracle (Oracle Big Data Spatial and Graph), IBM (IBM Graph) and SAP (HANA) have all launched their own competing graph databases.

Valuation & Funding

Neo4j is valued at $2.34B as of their 2021 Series F with participation from One Peak, Creandum, and Greenbridge Partners.

The company has raised $581.1M in total funding across 10 rounds. Their investor base includes firms like GV (formerly Google Ventures), Eurazeo, and One Peak.

Product

What makes graph databases useful is that for any node in a dataset—like a user account, a past purchase, or a credit card number—they allow you to quickly and efficiently traverse and read from all the nodes that have some relationship with it. In a relational database, doing that requires writing a series of slow, memory-intensive joins.

This is why social networks like Facebook and LinkedIn were built on graph databases. It's also why, in recent years, they have become popular for machine learning, recommendation algorithms, and fraud detection.

Neo4j is open source and drives most of its revenue from AuraDB, which is a fully managed service version of its product that is deployable via AWS or Google Cloud. AuraDB is a subscription-based service that charges based on the amount of storage used.

On top of AuraDB, theyʼre launching different vertical solutions and building an ecosystem of software and services (with the potential for premium pricing) to help teams solve specific problems with their graph databases, which today includes:

- Neo4j Graph Data Science: Machine learning and analytics suite

- Neo4j Bloom: Data visualization

- Neo4j Developer Tools: Database browsing and localized editing

- Neo4j GraphQL Library: API development

Neo4jʼs growth to date reflects the extent to which enterprise businesses across different industries have started investing in personalization, analytics, and artificial intelligence. Neo4j has over 1,000 customers including Pfizer, PepsiCo, the WHO, CNN, BMW Group, Comcast, NASA, UBS, and Volvo Cars. More than 75% of the Fortune 100 is using Neo4j.

Competition

Since Neo4j was founded, Amazon (Amazon Neptune), Microsoft (Microsoft Azure Cosmos DB), Oracle (Oracle Big Data Spatial and Graph), IBM (IBM Graph), and SAP (HANA) have all launched their own competing graph databases.

Today, Neo4j is overall only the 19th most deployed database platform in the world, behind relational platforms like Oracle (#1) document-based platforms like MongoDB (#5) and

While graph databases were designed for analyzing the connections inside high volumes of changing data, relational, key-value and document databases are still faster at writing information to databases and for use cases like storing time-series, logs, or large chunks of content.

The most likely outcome is that graph databases continue to exist alongside other databases that are better at other tasks. For example, you might run your ecommerce storeʼs product catalog on a document database like MongoDB, your cart on Redis, and your recommendation algorithm on Neo4j—with each one syncing up with the others.

TAM Expansion

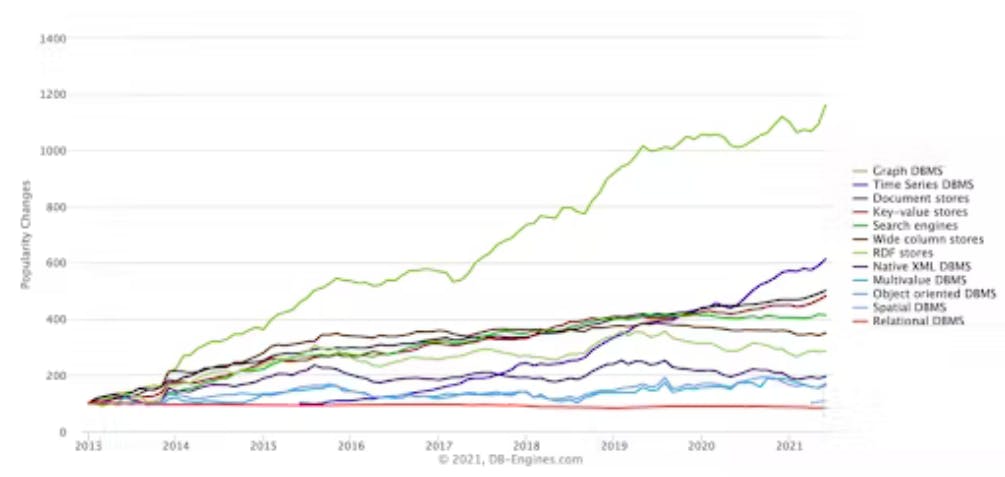

About five database companies have crossed $100 million ARR—MongoDB, Redis, Couchbase, Datastax, and Neo4j. Graph databases, however, have been the fastest growing database category of the last decade, by a significant margin.

Neo4jʼs key bet is on the continued growth of workloads involving complex relationships between nodes. The tailwinds behind the biggest use cases for Neo4j today, are significant:

Fighting financial fraud: Fintechs raised $134 billion in 2021, up 67x from $2 billion a decade ago. As fintech grows, it means more transaction volume, more participants, and greater need for compliance and risk management solutions

Recommendation engines: COVID grew the ecommerce market in the U.S. by 50% from $578 billion per year to $870 billion per year, accelerating the ongoing digitization of retail—and driving more retailers to find ways to adapt and grow online

Cybersecurity: Cybercrime losses are growing 15% year-over-year, on track to hit $10.5 trillion by 2025, and VCs invested $11.5 billion in cybersecurity startups in 2021. The ability of security teams to efficiently sift through their data for risks is becoming increasingly important.

Broader tailwinds include the continued expansion of the overall database and NoSQL markets: companies spent $50 billion on database software in 2021, a figure expected to double over the next three years.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.