Revenue

$20.00M

2023

Valuation

$317.00M

2023

Funding

$75.00M

2024

Product

Merge was founded in June 2020 by Shensi Ding and Gil Feig, former Columbia University classmates. Ding, previously Chief of Staff at Expanse, and Feig, Head of Engineering at Jumpstart, identified a common problem: the resource-intensive nature of building and maintaining software integrations. They began by focusing on Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS) integrations.

Merge found initial traction with B2B SaaS companies struggling to build and maintain integrations. By offering a unified API for HR, ATS, and CRM systems, Merge enabled companies to integrate with dozens of platforms in weeks instead of months. Early customers like Ramp used Merge to quickly build HR integrations for their "Ramp for HR" product. This product-market fit led to rapid growth, with Merge growing ARR 30x in 12 months and reaching 2,500 customers including TripActions, Bill.com, and Drata.

The core product offering of Merge is a Unified API that authenticates, normalizes, and syncs data across API providers. Key features include:

1. A single programming interface for syncing data from multiple third-party platforms

2. A Common Model that standardizes data across platforms

3. Merge Link, a UI component for end-user authentication

4. Comprehensive API documentation and SDKs in multiple languages

5. Real-time analytics and alerting

In their first two years, Merge built and released 150 integrations, expanding from HR to ticketing, accounting, and file storage categories to serve a broader range of B2B integration needs. By October 2022, Merge had grown to 55 employees and raised $75 million in funding, positioning itself as a key player in the B2B integration space.

Business Model

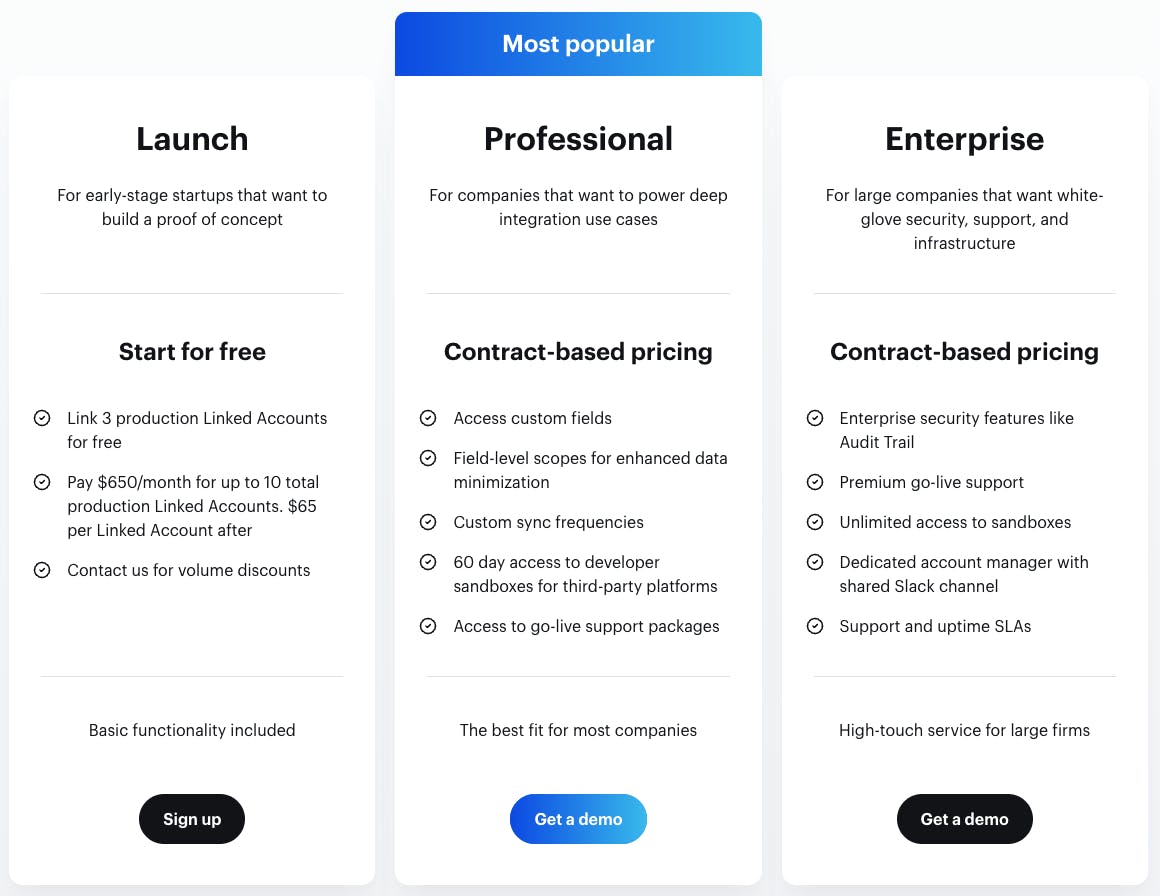

Merge is a subscription SaaS company that provides a unified API platform for B2B software integrations. The company generates revenue through a tiered pricing model based on the number of integrations and level of support required by customers.

At its core, Merge offers a solution to the complex and resource-intensive process of building and maintaining integrations with various HR, ATS, CRM, and other business software systems. By standardizing these integrations through a single API, Merge allows its customers to rapidly implement multiple integrations without the need for extensive in-house development.

The company's pricing structure starts with a free tier for basic usage, progressing to paid tiers that offer more integrations and enhanced support. The "Launch" tier, priced at $650 per month, serves as an entry point for growing companies, while the higher "Grow" and "Expand" tiers cater to larger enterprises with more complex integration needs. This tiered approach facilitates a land-and-expand strategy, allowing Merge to capture value as its customers' integration requirements grow.

A key competitive advantage for Merge is its focus on building a comprehensive, cross-category integration platform. Unlike competitors who may specialize in specific verticals, Merge's broad approach allows it to serve a wide range of B2B software companies, positioning it as a one-stop solution for integration needs across multiple categories.

This strategy not only expands Merge's total addressable market but also increases the stickiness of its product, as customers can rely on a single platform for all their integration requirements.

Competition

Merge competes with several categories of players in the B2B integration space, including unified API providers, embedded iPaaS solutions, and vertical-specific API platforms.

Unified APIs

In this category, Merge faces competition from companies like Apideck and Codat. Apideck offers integrations across a wide range of API categories, similar to Merge, but with less depth in each category.

While Apideck provides a built-in integrations marketplace, it lacks some of Merge's advanced features like custom field mappings. Codat focuses primarily on small business financial data, competing with Merge in the Accounting category. However, Merge has achieved feature parity with Codat in a shorter timeframe, demonstrating its ability to rapidly expand its offerings.

Embedded iPaaS

Merge competes with embedded iPaaS providers like Workato, Tray.io, and Paragon. These platforms offer visual drag-and-drop editors for building integration workflows, which can be triggered via API.

While this approach allows for flexibility, it often requires more technical involvement and lacks the standardized data models and built-in syncing capabilities that Merge provides. Paragon, for instance, is more developer-centric and lacks Merge's no-code UI for managing integrations. Workato, while more comprehensive, may be overly complex for companies seeking a streamlined integration solution.

Vertical-Specific APIs

In certain verticals, Merge faces competition from specialized players. For example, Finch provides a unified API specifically for HRIS and payroll integrations. While Finch offers both API-based and assisted integrations, Merge's purely API-based approach may provide better security and efficiency.

Kombo is another competitor focused on HR and recruiting tools, primarily serving the European market. However, Merge's broader range of integration categories and global focus give it an advantage in serving companies with diverse integration needs.

TAM Expansion

Merge has tailwinds from the increasing complexity of B2B software integrations and has the opportunity to grow and expand into adjacent markets like AI-powered data processing and enterprise workflow automation.

Proliferation of SaaS Apps

As the number of SaaS applications used by businesses continues to grow, the need for seamless integrations between these tools becomes increasingly critical.

Merge is well-positioned to capitalize on this trend by expanding its unified API offerings across more categories beyond its current focus on HR, ATS, CRM, and ticketing systems.

The company could target additional high-value enterprise software categories such as ERP, project management, and business intelligence tools.

By becoming the de facto integration layer for B2B software, Merge could significantly increase its total addressable market and cement its position as a crucial piece of enterprise technology infrastructure.

AI-Powered Data Processing

Merge's expertise in normalizing and standardizing data across various software platforms puts it in a unique position to expand into AI-powered data processing and analytics.

As more companies seek to leverage their data for business insights, Merge could develop advanced AI models that can automatically clean, categorize, and analyze data flowing through its integrations.

This expansion would not only increase the value proposition for existing customers but also open up new revenue streams from companies looking to harness the power of their data without building complex data pipelines and AI models from scratch.

Enterprise Workflow Automation

Building on its integration capabilities, Merge has the potential to move up the value chain into enterprise workflow automation.

By leveraging its deep understanding of how different software systems interact, Merge could develop no-code or low-code tools that allow businesses to create complex, cross-platform workflows without extensive engineering resources.

This expansion would position Merge as a key player in the rapidly growing market for business process automation, competing with established players like Zapier and newer entrants in the space.

Merge's expansion into these adjacent markets could significantly increase its long-term growth prospects and valuation potential.

By evolving from a pure integration platform to a comprehensive data and workflow solution, Merge could become an indispensable part of the enterprise software stack, potentially reaching valuations comparable to other critical infrastructure companies in the B2B space.

The company's strong foundation in building complex integrations at scale provides a solid launching pad for these expansions, potentially accelerating adoption and market penetration.

Risks

1. Market Education Challenge: As an embedded iPaaS provider in an emerging category, Prismatic faces the ongoing challenge of educating the market about the value of their solution.

While this presents growth opportunities, it also means a potentially longer sales cycle and higher customer acquisition costs. The company must continually invest in content marketing and thought leadership to drive adoption, which could impact short-term profitability.

2. Developer Resistance: Prismatic's value proposition relies on convincing B2B SaaS companies to outsource a core technical function (integrations) that many developers might prefer to build in-house.

There's a risk that technical teams could resist adopting an external platform, viewing it as a threat to their expertise or control. To mitigate this, Prismatic needs to demonstrate clear efficiency gains and offer flexible, code-native options that don't constrain developers.

3. Platform Lock-in Concerns: As B2B SaaS companies build more integrations on Prismatic, they may become increasingly dependent on the platform. This could lead to concerns about vendor lock-in, potentially slowing adoption or increasing churn as companies seek to maintain control over their integration strategy.

Prismatic may need to offer robust data portability and migration options to address these concerns and build trust with potential enterprise customers.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.