Revenue

$300.00M

2026

Funding

$7.46M

2024

Growth Rate (y/y)

2,816%

2024

Revenue

Sacra estimates that Lovable hit $300M in annual recurring revenue (ARR) at the end of January 2026, up from $250M at the end of 2025 and $206M in November 2025.

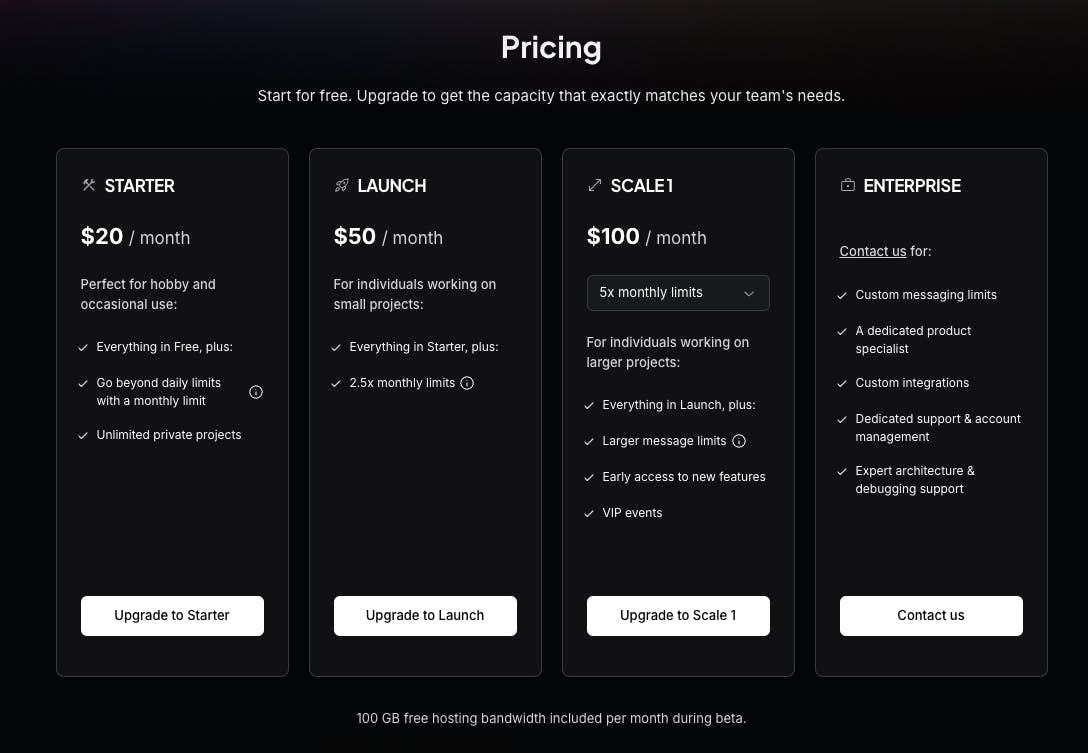

Lovable monetizes via a tiered SaaS model, starting at $20/month and scaling to $100/month for premium features, with custom enterprise plans offering advanced integrations and dedicated support.

Additional usage-based fees apply to AI code generation tasks—e.g., building a basic game might cost $1 in credits, while more complex applications can cost $50 or more—enabling Lovable to align revenue with user engagement and app complexity. The company employs a land-and-expand strategy: users start with a free tier that includes hosting and basic build functionality, then upgrade as project demands increase.

Key revenue drivers include high-volume usage from non-technical founders and product teams prototyping apps, as well as integrations with services like Supabase and GitHub that facilitate downstream developer handoff. Lovable processes over 1,000 builds daily, and its accelerating conversion of free users into paid subscribers has been the core lever behind its growth.

In November 2025, Lovable said it is nearing 8 million users and is seeing roughly 100,000 new products built on the platform each day.

Valuation & Funding

In November 2025, Lovable was reported to be in talks to raise a new round at a $6 billion valuation.

In July 2025, Lovable raised a $200M Series A led by Accel, with participation from Creandum and 20VC, valuing the company at $1.8B.

Notable investors include several prominent technology leaders and operators: Mattias Miksche, Siavash Ghorbani from Shopify, Fredrik Hjelm from Voi, and Creandum co-founder Stefan Lindeberg. The funding round also attracted participation from DeepMind angel operators and various AI founders.

Product

Lovable was founded in 2023 by Anton Osika and Fabian Hedin, emerging from their open-source project GPT Engineer which had gained over 50,000 GitHub stars.

Launched in June 2023, the command-line app builder GPT Engineer (built on GPT-4) became one of GitHub's fastest-growing open source projects ever, hitting 40,000 stars in 2 months before re-launching in November 2024 with a GUI as Lovable, an AI-powered full-stack app builder.

Lovable orchestrates multiple LLMs, using OpenAI's GPT-4 Mini for speed tasks and Anthropic's Claude for complex reasoning, monetizing based on the number of chats used (for code generation, editing, or refactoring), with pricing that starts at $20/month for their Starter plan (100 monthly chats).

The core product allows users to create everything from simple landing pages to complex full-stack applications with authentication, databases, and API integrations. Users interact with the platform by describing features they want to add, and Lovable handles the technical implementation including front-end design, back-end logic, and deployment. For example, a product manager can request "add user authentication with Google login" and the platform automatically implements the feature, including necessary database structures and security configurations.

The platform integrates with existing development tools like GitHub for version control and Supabase for backend services, allowing technical teams to take over and extend projects when needed. This has made it particularly valuable for rapid prototyping and MVP development, where teams need to quickly validate ideas before committing engineering resources.

Business Model

Lovable is a subscription SaaS company that enables users to build web applications through natural language prompts, positioning itself as an AI-powered full-stack development platform. The company monetizes through tiered subscription plans, starting at $20/month for basic features, scaling to $50/month for expanded capabilities, and $100/month for premium features including early access and VIP events. Enterprise customers receive custom pricing with dedicated support and integration services.

The platform transforms natural language descriptions into functional code, allowing both technical and non-technical users to create web applications without traditional programming knowledge. This democratization of software development addresses the significant gap between high demand for software development and limited developer supply.

Lovable employs a product-led growth strategy by offering a free tier with basic functionality and generous hosting bandwidth (100GB/month during beta), allowing users to experience the platform before committing to paid plans. The company's land-and-expand approach encourages users to upgrade as their projects grow more complex or require additional resources.

Key competitive advantages include proprietary AI technology that reliably handles complex development tasks where other AI tools typically fail, seamless GitHub integration, and the ability to generate both frontend and backend code while maintaining professional development standards.

Competition

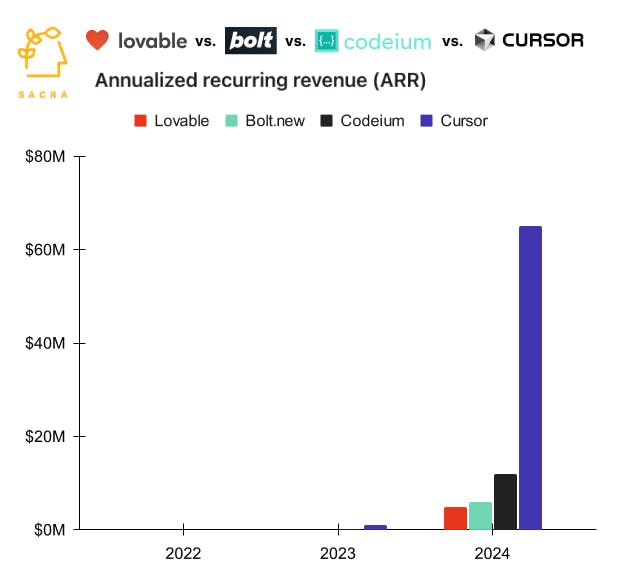

Lovable operates in the AI-powered software development tools market, which has seen significant activity in both established players and new entrants throughout 2024.

Enterprise AI coding platforms

Dev.new and GitHub Copilot Enterprise dominate the enterprise segment, focusing on large development teams and offering deep IDE integrations. These platforms emphasize security, compliance, and team collaboration features while charging premium enterprise pricing.

AI-first development environments

Bolt.new and Cursor position themselves as complete development environments with AI at their core. These tools focus on speed and customization, targeting individual developers who want granular control over their development process. They typically charge per-seat licensing fees and emphasize direct code manipulation.

No-code AI builders

Wix ADI, Framer AI, and Unbounce represent the template-driven approach to AI website building. These platforms focus on simple website creation through templating and basic customization, primarily serving non-technical users and charging monthly subscription fees.

The market shows clear segmentation between tools focused on enterprise development (requiring deep technical expertise) and those aimed at democratizing software creation. While enterprise platforms compete on security and compliance features, newer entrants differentiate through speed of development and accessibility to non-technical users.

A key trend emerging in late 2024 is the shift toward full-stack capability, with platforms expanding beyond frontend-only solutions to include database management, authentication, and API integration. This expansion has led to increased competition with traditional development platforms while creating new opportunities for specialized tools focused on specific aspects of the development process.

TAM Expansion

Lovable has tailwinds from the democratization of software development and increasing demand for custom applications, with opportunities to expand into adjacent markets like enterprise development platforms and specialized industry solutions.

Developer productivity transformation

The software development market exceeds $500B annually, but only 1% of the population can code. Lovable's AI-powered platform has already demonstrated the ability to reduce development time by 90% while maintaining production-quality output. Their proprietary scaling law technology enables reliable handling of complex development tasks where other AI tools typically fail.

Enterprise and team collaboration

While currently focused on individual developers and small teams, Lovable can expand into enterprise-grade development platforms. Their GitHub integration and VS Code compatibility position them to capture large organizations seeking to accelerate development cycles. The enterprise development tools market represents a $100B+ opportunity.

Industry-specific solutions

Lovable's architecture enables expansion into specialized development platforms for specific industries. Healthcare software development alone represents a $15B market growing at 11% annually. Financial services, manufacturing, and retail each present similar opportunities for vertical expansion.

Geographic expansion

With a strong European presence and proven product-market fit, Lovable can expand globally. Their platform's ability to generate code from natural language removes traditional barriers to entry in non-English speaking markets. The Asia-Pacific region, with its rapid digital transformation, represents a particularly promising expansion opportunity.

Full-stack infrastructure

Risks

Dependency on proprietary LLM providers: Lovable's core functionality relies heavily on proprietary LLM providers like OpenAI and Anthropic, making them vulnerable to pricing changes, service disruptions, or API modifications. Their current strategy of using multiple providers helps mitigate some risk, but their business model could face significant pressure if these providers substantially increase prices or restrict access. The company's attempts to optimize and reduce LLM usage show awareness of this risk, but their inability to switch to open-source alternatives due to quality requirements leaves them exposed.

Technical debt from rapid scaling: The company's explosive growth to $4M ARR in 4 weeks has led to infrastructure challenges, evidenced by their rushed migration from Python to Go and reported stability issues. While they're actively addressing these challenges, the technical complexity of maintaining reliable AI-powered code generation at scale could impact user trust and retention.

Market positioning tension: Lovable's attempt to serve both technical users (engineers) and non-technical users (designers, PMs) with the same product creates inherent product design tensions. While this broad approach has driven initial growth, it risks creating a product that excels for neither audience, potentially leaving them vulnerable to more focused competitors targeting specific user segments.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.