Valuation

$4.40B

2025

Funding

$850.00M

2025

Valuation & Funding

Lightmatter reached a $4.4 billion valuation in October 2024 following a $400 million Series D round led by T. Rowe Price. This represented a nearly 4x increase from its $1.2 billion valuation in December 2023.

The company has raised a total of $850 million since its 2017 founding through multiple funding rounds. Key investors include GV (Google Ventures), which led the company's $154 million Series C round in 2023.

Product

Lightmatter was founded in 2017 by Nicholas Harris, Darius Bunandar, and Thomas Graham as a spinout from MIT, aiming to revolutionize computing through photonic technology.

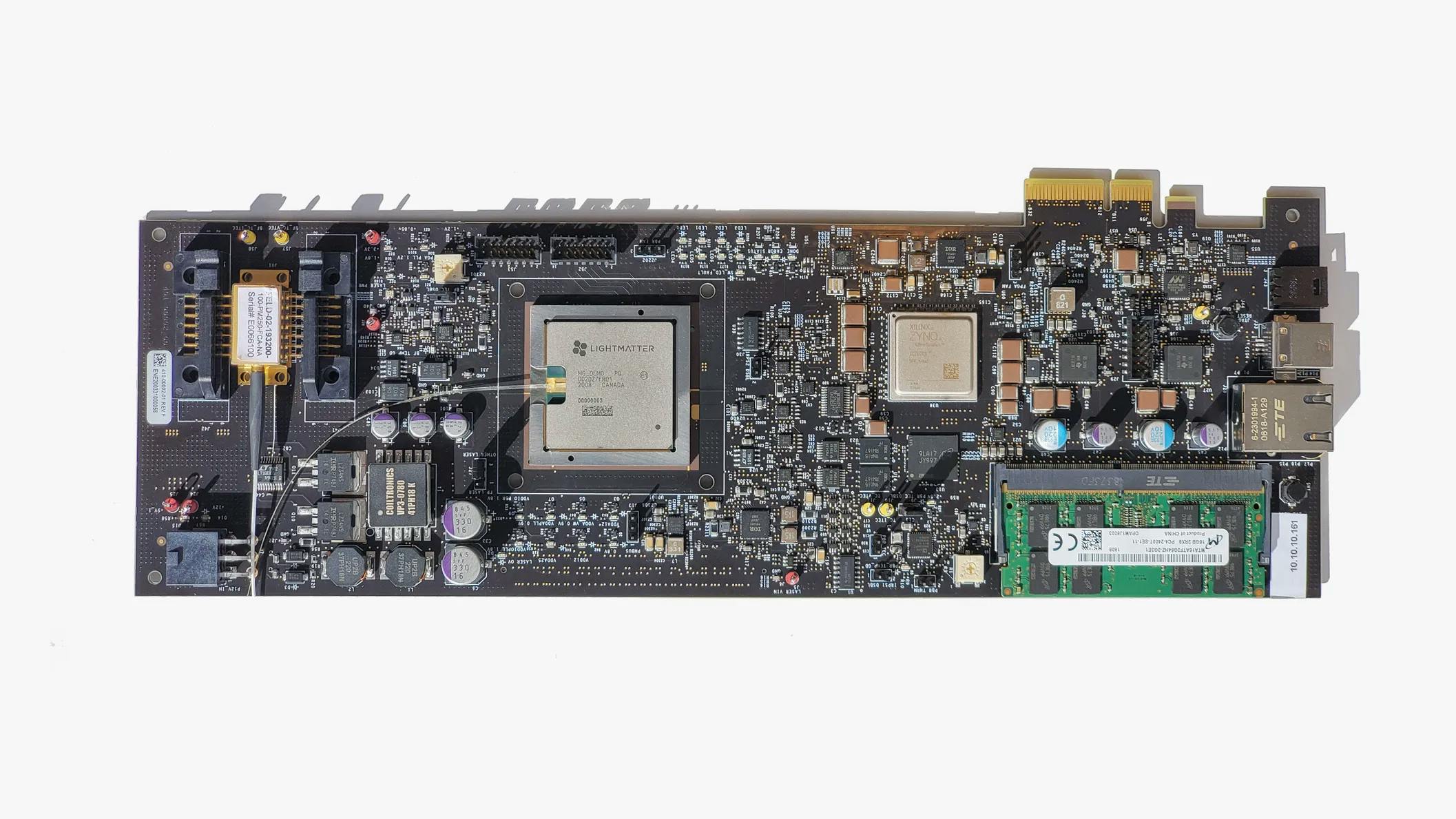

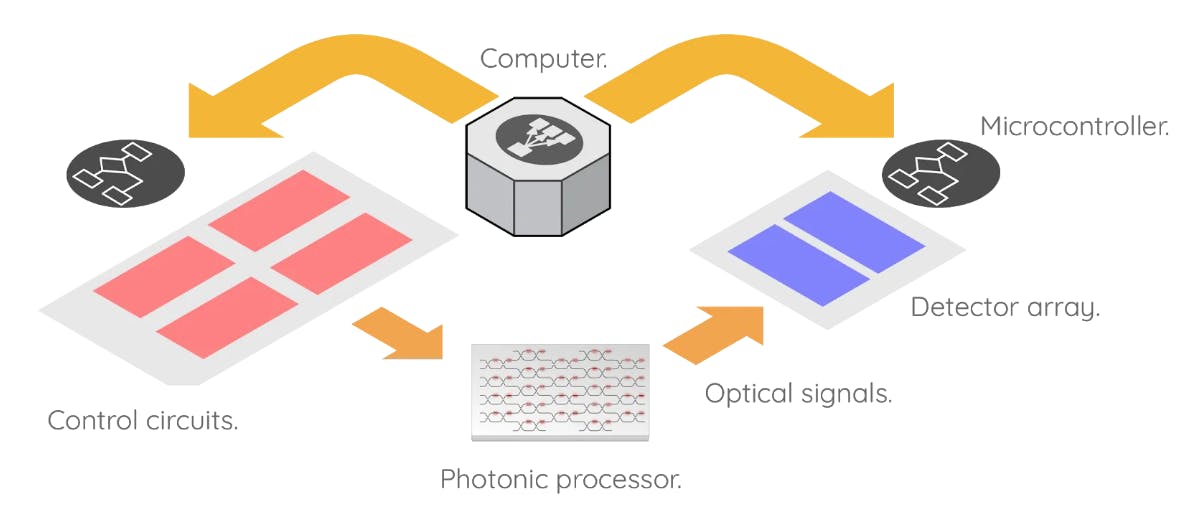

The company's flagship product, Envise, is a photonic processor that uses light instead of electricity to perform AI computations, enabling faster processing speeds while consuming significantly less power than traditional chips. Data center operators integrate these processors into their AI computing clusters to accelerate machine learning workloads.

Their second key product, Passage, is a photonic interconnect system that uses light to transfer data between processors in large computing clusters. This enables data centers to build massive AI systems with over 100,000 processors while maintaining high speeds and energy efficiency.

The technology works by converting electrical signals into light, processing or transmitting the data using photons, then converting the results back to electrical signals. This approach eliminates the heat and energy constraints that typically limit traditional electronic chips, allowing for dramatic improvements in AI system performance and scale.

Business Model

Lightmatter is a deep-tech hardware company that develops and sells photonic chips and systems for AI computing and data center interconnects.

The company monetizes through direct sales of high-value capital equipment to cloud providers and AI companies, offering two main product lines: the Envise photonic processor for AI acceleration and the Passage photonic interconnect for networking.

Their full-stack solution includes both the photonic chips and the necessary laser systems that power them, creating multiple revenue streams from each customer deployment.

Lightmatter's go-to-market strategy focuses on securing large deals with major cloud and AI data center operators, rather than pursuing smaller end-users. This approach allows them to achieve meaningful scale through fewer, higher-value partnerships. The company is positioning itself as a strategic infrastructure provider, similar to NVIDIA but with photonics-based technology.

Competition

Lightmatter operates in the emerging photonic computing and interconnect market, competing against both traditional semiconductor companies and specialized photonics startups.

Photonic computing specialists

Luminous Computing, having raised $105M in Series A funding, is developing photonic AI accelerator chips similar to Lightmatter's Envise product. However, Luminous remains at an earlier stage with less mature technology and smaller funding base. Celestial AI secured $175M in Series C funding and focuses on optical interconnect technology, though with a narrower product scope than Lightmatter's full-stack approach.

Optical interconnect providers

Ayar Labs leads this segment with $155M in funding and a $1B valuation, focusing exclusively on optical I/O solutions. Unlike Lightmatter, Ayar Labs doesn't offer computing capabilities but has secured strategic partnerships with Intel, AMD, and NVIDIA. This positions them as both a potential competitor and partner for data center deployments.

Traditional semiconductor incumbents

Major chip manufacturers like NVIDIA and Intel represent both competitive threats and potential strategic partners. These companies have massive resources and established customer relationships but currently lack mature photonic computing capabilities. Intel has made strategic investments in the space through its backing of Ayar Labs.

TAM Expansion

Lightmatter has tailwinds from the explosive growth in AI computing demands and increasing data center power constraints, with opportunities to expand into adjacent markets beyond its current focus on AI acceleration and interconnects.

AI infrastructure expansion

The immediate growth opportunity lies in scaling deployments of Lightmatter's photonic technology across major cloud providers' AI infrastructure. With AI training clusters now reaching over 100,000 processors, the company's Passage interconnect technology could capture a significant portion of the multi-billion dollar AI networking market. The company's initial focus on AI inference chips provides a foundation to expand into training acceleration, potentially multiplying their serviceable market.

Data center transformation

Beyond AI, Lightmatter can target the broader data center interconnect market, estimated at tens of billions annually. Their photonic technology's superior energy efficiency positions them to capture share as data centers face increasing power constraints and sustainability mandates. The company's full-stack approach, including both chips and lasers, enables them to offer complete solutions for data center retrofits.

Adjacent market opportunities

Lightmatter's photonic computing platform has natural expansion opportunities into high-frequency trading, telecommunications switching, and eventually consumer devices. The technology's inherent advantages in latency and power efficiency make it particularly compelling for financial services applications. As manufacturing scales and costs decrease, integration into mainstream computing and networking equipment through OEM partnerships could open up a market opportunity orders of magnitude larger than their current focus.

Risks

Photonic technology commercialization risk: Lightmatter's success hinges on proving their photonic chips can deliver promised performance improvements at scale in real-world data centers.

If early deployments face integration challenges or fail to demonstrate the claimed 10% performance gains, major cloud providers may hesitate to commit to wider adoption, severely impacting revenue potential and the $4.4B valuation.

Customer concentration and deployment timing: The company's high valuation and capital raise are predicated on securing and executing large deals with major cloud/AI providers in 2025.

Delays in customer deployment timelines or the failure to land multiple anchor customers could create a cash burn challenge, especially given the capital-intensive nature of chip manufacturing.

Competitive response from incumbents: NVIDIA and other major chip companies could acquire competing photonics startups or develop their own optical solutions.

With their established relationships, manufacturing scale, and distribution channels, incumbents could quickly catch up to Lightmatter's technical lead and squeeze margins through aggressive pricing.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.