Revenue

$903.00M

2024

Valuation

$10.70B

2024

Growth Rate (y/y)

29%

2024

Funding

$778.50M

2021

Revenue

Sacra estimates Klaviyo will achieve $903M in annual recurring revenue (ARR) by the end of 2024, growing approximately 29% year-over-year.

The company demonstrates strong customer retention metrics and serves over 130,000 paying customers across diverse business segments, including notable enterprise clients in the e-commerce space.

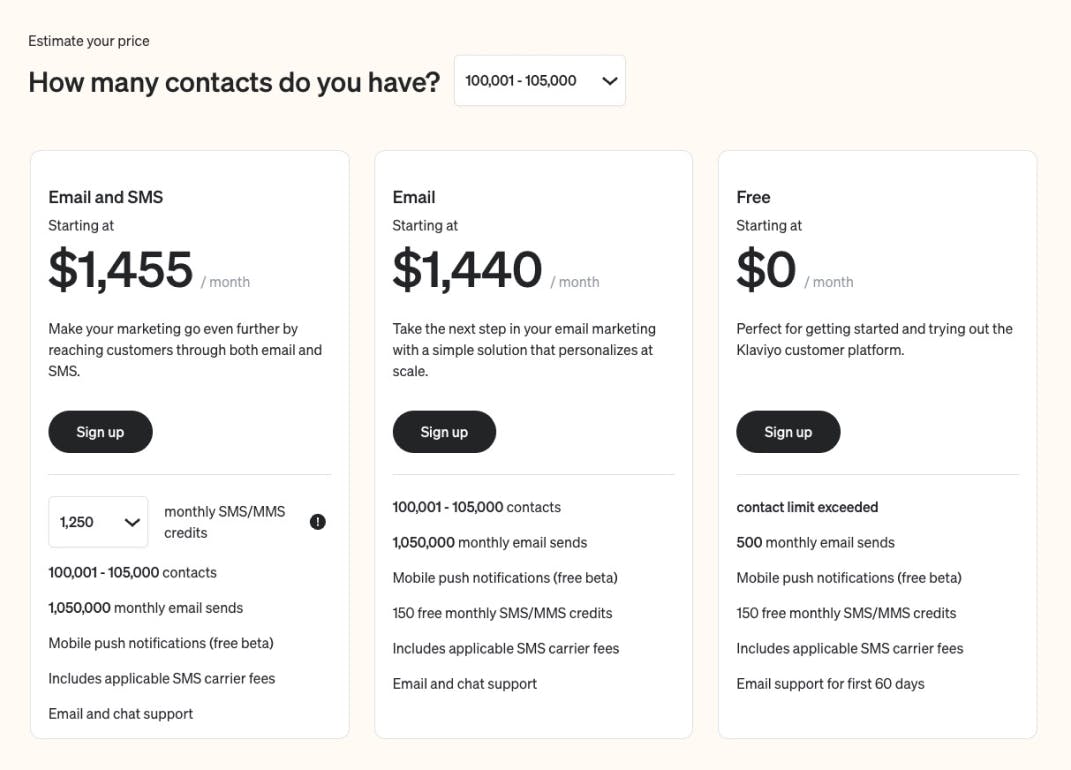

Klaviyo's revenue model is built on a tiered pricing structure based on email and SMS contact volume. The platform starts with a freemium tier for up to 250 contacts, then scales through various pricing tiers ranging from $45 monthly for up to 500 contacts to enterprise-level custom pricing for large-scale deployments.

The company averages approximately $5,400 in annual revenue per paying customer, significantly higher than traditional email marketing platforms, reflecting their advanced feature set and integrated marketing automation capabilities.

Product

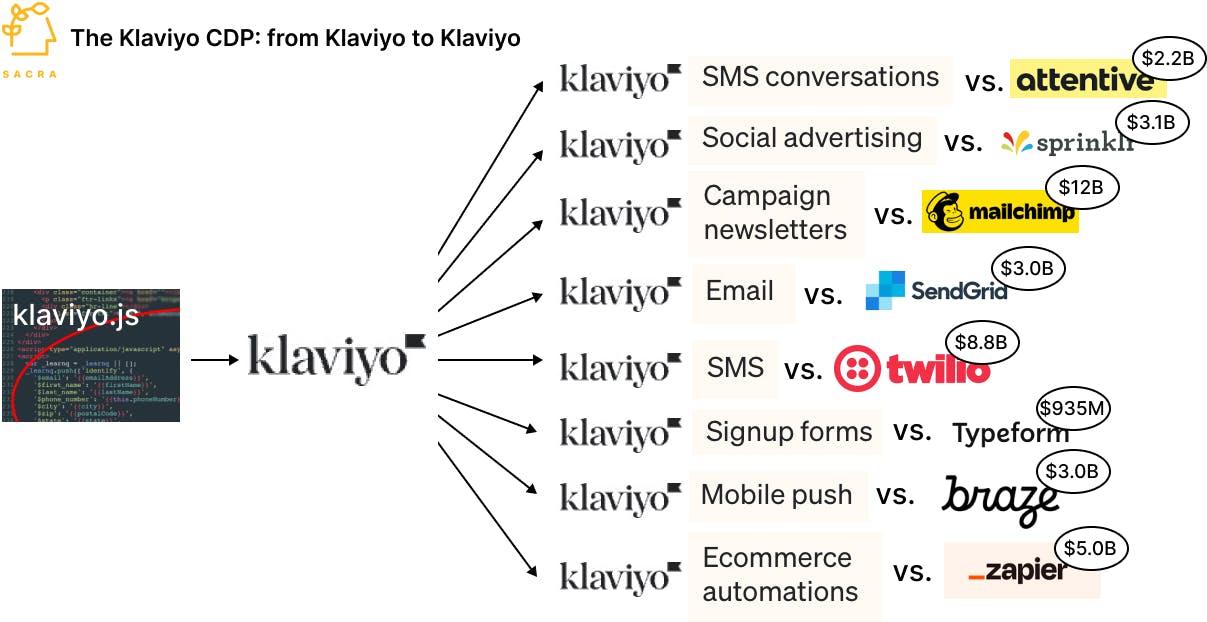

Klaviyo launched in 2012 as a vertically integrated analytics and events tracking product with a CRM and marketing automation, with rich user profiles automatically populated via a Javascript snippet (“klaviyo.js”) embedded on the site.

Amid the rise of D2C and subscription-based commerce, Klaviyo played a key role in the ecosystem providing new merchants with distribution and a way to layer MRR into their business—Klaviyo was a major early Shopify app store partner as the platform grew nearly 10x between 2012 and 2015—from $23M to $205M in revenue.

Today, Klaviyo's platform provides email marketing, SMS marketing, in-app push notifications and a CDP to ecommerce businesses, allowing them to effectively engage with their customers and drive sales.

These services are designed to be easy to use and integrate with a wide range of ecommerce platforms and other software tools, reducing the technical barriers for businesses that want to leverage sophisticated marketing techniques.

Business Model

Klaviyo operates under a SaaS subscription model, providing a cloud-based platform for businesses to manage their email marketing, SMS marketing, in-app notifications, and more recently, customer data via a customer data platform (“CDP”).

Klaviyo's services are specifically targeted at e-commerce businesses, helping them collect and analyze customer data, automate targeted email and SMS campaigns, and manage customer communication at scale. The platform integrates with a range of e-commerce platforms, such as Shopify, Magento, and WooCommerce, among others.

Klaviyo's primary source of revenue is subscription fees for its platform. The pricing scales with the number of contacts a business has, which makes it suitable for businesses of all sizes - from small startups to large corporations. The more contacts a business has, the more they pay to use Klaviyo's services.

Competition

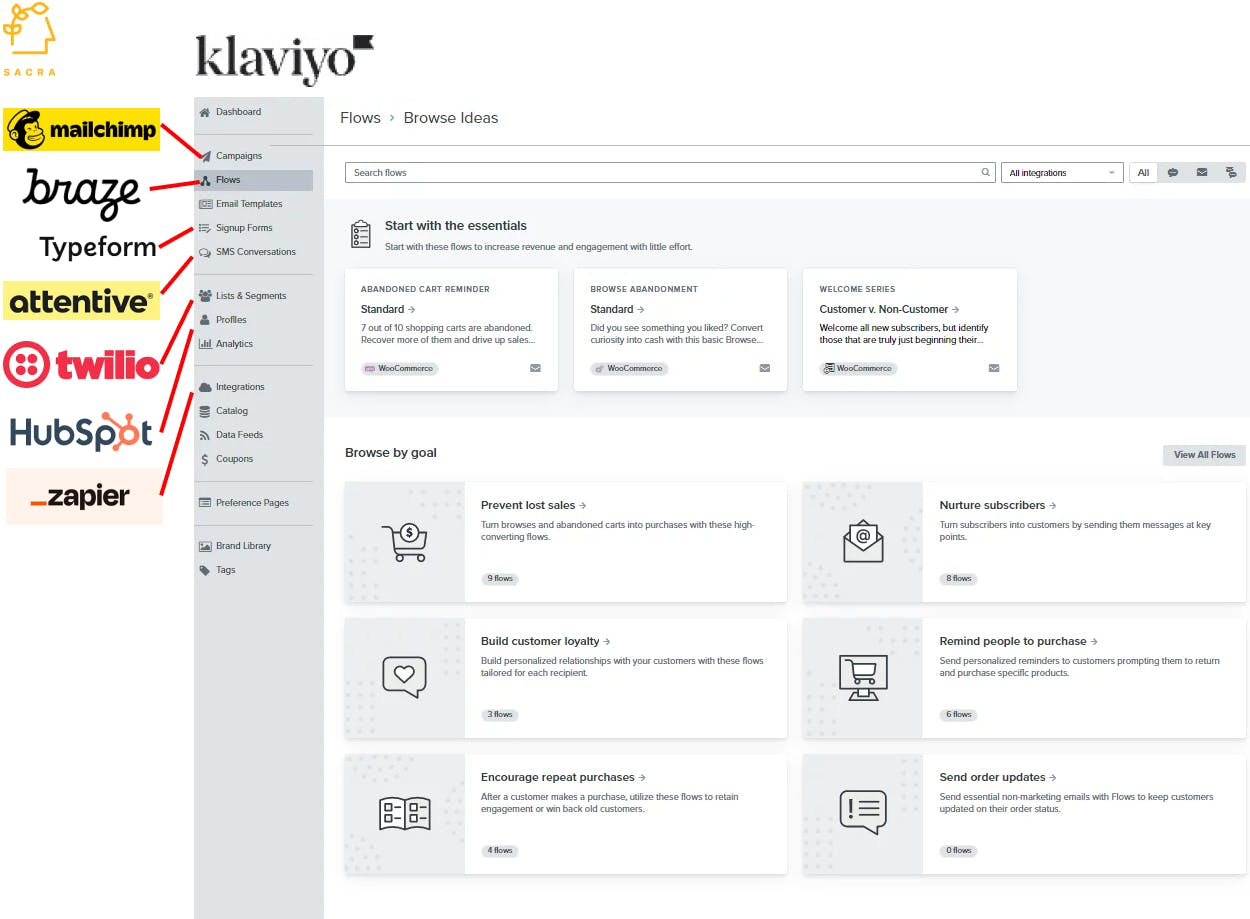

Klaviyo competes directly both with email and customer engagement platforms like Braze, Iterable and HubSpot as well as more standalone email marketing tools like Mailchimp and ConvertKit.

Klaviyo’s major differentiator early on was that it offered advanced automation and segmentation features that were not available to the average marketer without expensive enterprise software.

CDPs

Klaviyo has recently launched its own CDP to counter companies like Twilio Segment and mParticle, which became a central router for customer data in the 2010s.

The rise of universal CDPs like Segment threatened Klaviyo's position as it decreased switching costs and intensified competition between Klaviyo and tools like Iterable, Braze, Intercom, Customer.io and incumbents like HubSpot and Mailchimp.

By introducing its own CDP, Klaviyo aims to provide its customers an end-to-end experience and keep all the customer data within its ecosystem, enhancing retention and expansion opportunities.

SMS

As SMS emerged as the new inbox of choice for marketers—showing marketers a 45% response rate to their messages vs. the typical 6% for email—companies like Attentive ($200M ARR in 2022) and Postscript ($39M ARR in 2022) built big businesses helping merchants manage the new flood of texts and write automated, contextual responses to customer queries.

TAM Expansion

The big upside case for Klaviyo lies in being Shopify’s (NYSE: SHOP, $5.6B) preferred email provider in a world where ecommerce—at $1T+ in sales—still represents just 15% of the total commerce market in the United States.

Ecommerce was growing before COVID, but the pandemic rapidly accelerated the adoption of online shopping as a normal part of everyday life.

Ecommerce sales went from about $570B in 2019 to $815B in 2020 as consumers went to online shopping for convenience and safety reasons—creating a surge in demand for ecommerce marketing tools like Klaviyo that could let merchants find and engage with their customers.

Shopify, on the other hand, hit $5.6B in total revenue in 2022 with over 2 million merchants, revenue growing 21% from the year before. Despite a slowdown in growth in 2022 due to the overall slowdown in the economy and especially among SMBs, Shopify is still growing and represents just about 0.5% of the total ecommerce market.

By integrating with Shopify as their recommended email partner but staying 3rd-party, Klaviyo can be indexed both on the continued growth of Shopify’s model as well as on the growth of ecommerce more generally.

Risks

Key risks for Klaviyo from our research:

Shopify dependence: Klaviyo’s growth is substantially tied to Shopify's expansion. Most of their 100,000+ customers are Shopify merchants. While their partnership with Shopify has been a significant growth driver, it also exposes Klaviyo to the risk of slowdowns in Shopify's growth or changes in Shopify's policies.

As of 2023 and ahead of their IPO, Klaviyo has been tailoring its outbound sales to bringing on larger retailers working on their own ecommerce stacks, rather than smaller Shopify retailers struggling with a slowdown in SMB ecommerce post-COVID.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.